Every Wednesday morning, Artnet News brings you The Gray Market. The column decodes important stories from the previous week—and offers unparalleled insight into the inner workings of the art industry in the process.

This week, how the art business does D.C.…

CLIMBING THE HILL

When it comes to creating federal laws around commerce, it’s possible that the only thing tougher than writing good ones is living with the consequences of bad ones. New bills can be blunt instruments for coercing change across entire industries, or finely calibrated tools for tweaking conditions, resulting in varying impacts on different individual players in the same market sector. In every case, the operative question becomes whether legislators understand the industry well enough to help matters more than hurt them.

For any given set of regulations in the U.S., perhaps the single most important activity in answering that high-stakes question has become lobbying. Inaugurated as a practice near the turn of the 19th century, the term describes the hiring of professional advocates to advance a client’s interests among lawmakers. Although lobbying has always been legal here to varying degrees, it has in recent decades become synonymous in the American imagination with the perversion of politics by billionaires, corporations, and other big spenders, whose outsize profits translate into an outsize voice in the ears of public servants. In short, it’s a tactic that many lovers of art and culture would see as anathema to the art world, both in spirit and in practice.

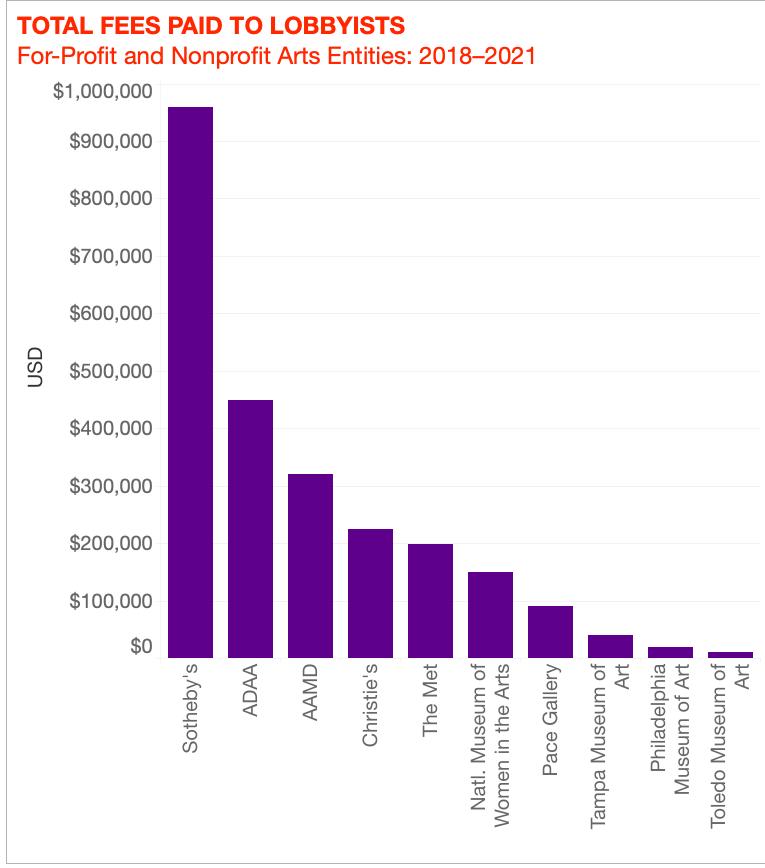

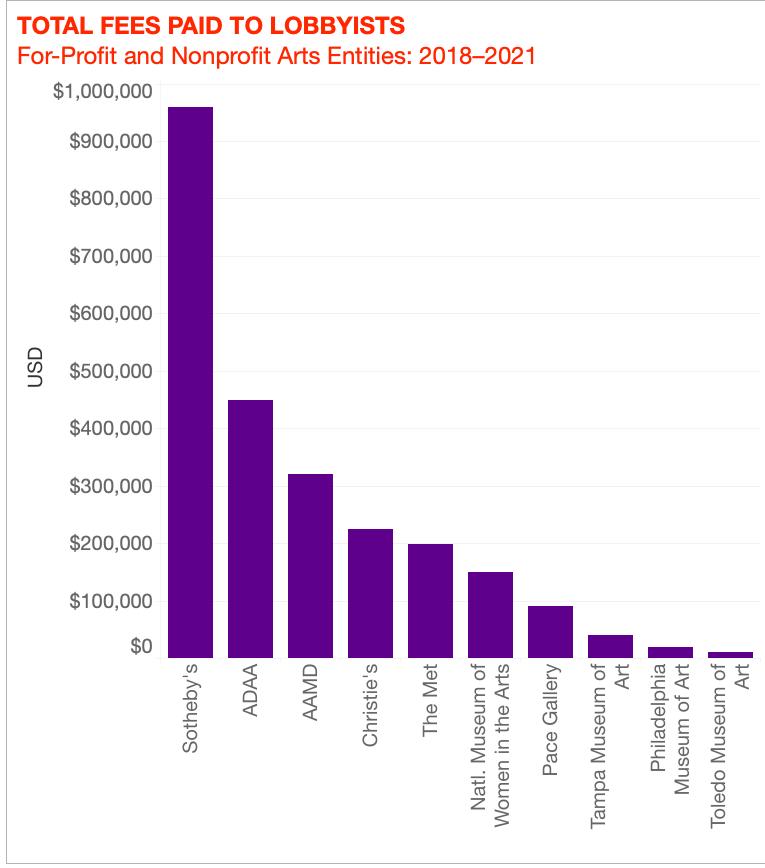

Despite its unique quirks, however, the U.S. art industry is also a business sector like any other, including in regard to paid political advocacy. Art businesses cumulatively funneled nearly $2.5 million into lobbying Capitol Hill from 2018 through 2021, based on my review of federal disclosure documents. The details of this activity further complicate the narrative of behemoth corporate interests greasing Washington’s wheels with sweaty envelopes in dark rooms.

Instead, the past four years of lobbying records demonstrate that the practice has become a fact of life for art entities ranging from small museums, to for-profit professional associations with diverse memberships, to global auction houses. Examining the policy goals these actors have pursued through lobbying, as well as of the mechanics of the process, will broaden almost any culture enthusiast’s understanding of how and why the U.S. art world evolves as it does over time—or does not.

© 2022 Artnet Worldwide Corporation.

CROSS-SECTIONING THE LANDSCAPE

Before we continue, one caveat is in order. Since the art-and-culture sectors contain multitudes, I focused my inquiry on businesses primarily concerned with fine art and antiquities. Otherwise, the results would have been skewed by the actions of organizations that champion natural history, science and industry, religious tolerance, and other admirable subjects that are nevertheless tangential to the Gray Market’s longstanding mandate.

With that context in mind, the top spender on arts lobbying from January 2018 through December 2021 was an unsurprising one: Sotheby’s. Public documents show the auction giant paid roughly $960,000 in fees to Cogent Strategies LLC, which bills itself on its website as a “a bipartisan, woman-owned, fully integrated team of government relations, communications, and digital strategists.” (Senate disclosure forms require registered lobbyists to round their quarterly income from each client to the nearest $10,000.)

Chief among the “specific lobbying issues” cited on Cogent Strategies’s quarterly paperwork for Sotheby’s were potential reforms to the Bank Secrecy Act (BSA). Introduced into the House of Representatives in 2018, the changes under discussion would have obligated art dealers to implement rigorous new “know your client” and anti-money-laundering procedures, as well as to report all cash transactions above $10,000 and to flag other types of suspicious activity. Congress voted to apply these regulations to the antiquities trade in January 2021, and many in the art market feared they would be next.

Earlier this month, however, a report from the U.S. Treasury concluded that the fine-art trade required no urgent action from federal lawmakers. Yet the effort to preserve the regulatory status quo for sales of art and antiquities didn’t just swell Sotheby’s lobbying budget over the past four years; it did the same for multiple players across sectors of the art industry.

Public records reflect that, since 2018, three of the trade’s four highest spenders on lobbying all directed their D.C. liaisons toward revisions of the BSA and/or their umbrella bill, the Anti-Money Laundering Act (AMLA) of 2020. Aside from Sotheby’s, the Art Dealers Association of America (ADAA) paid the Washington-headquartered law firm WilmerHale an estimated $450,000 to advocate on its constituents’ behalf regarding the proposed legislation, as well as other issues. Christie’s, Sotheby’s chief rival, spent roughly $225,000 during this stretch, with “BSA reform” and AMLA “as it relates to antiquities and art” being two of the four specific priorities disclosed by its various lobbyists from 2018 through 2021.

Deborah Azzopardi, Secretive (2004). Courtesy of Cynthia Corbett Gallery.

And yet, that the auction houses and ADAA paid Washington intermediaries to work on more than these two related pieces of legislation also offers a useful segue into the wider scope of art-industry lobbying overall. For example, disclosure forms during the four years in question show that some of Cogent Strategies’s priorities on Sotheby’s behalf concerned the American Royalties Too Act. The proposed legislation would award a nationwide U.S. resale royalty to artists for all works resold at auction—a policy shift all but guaranteed to hurt business in the sector. (A Sotheby’s spokesperson declined to answer questions about the house’s lobbying activity.)

Additional call-outs provided both auction houses’ paid political advocates with more room to maneuver. Cogent also cited “corporate tax reform” and “general trade policy issues affecting art” as specific lobbying issues on its quarterly reports. Christie’s lobbyists listed the similarly broad “issues related to trade and tariffs” throughout 2021, and simply “enforcement” in the first quarter of 2019. Although there is no reason to think these entries are anything but aboveboard, the vague phrasing doesn’t exactly do wonders to dispel notions of lobbyists engaging in veiled discussions to advance amorphous corporate interests.

Commercial players aside, however, one of the key takeaways from my sojourn into the Senate’s lobbying disclosure database was that nonprofit entities reigned over the art industry’s spending in Washington—and that their policy goals indicate how much more nuanced this space is than we might think.

The National Museum of Women in the Arts in Washington, D.C. Photo: Thomas H. Field.

THE OTHER SIDE OF THE COIN

Apart from Sotheby’s and Christie’s, the only other for-profit art business in the top 10 in lobbying spending since 2018 was Pace Gallery, which funneled a modest $90,000 toward pleading the case for “tax relief to [the] art industry in COVID relief bills.” The remaining seven entries were all either museums or nonprofit professional associations (including the ADAA).

The Association of Art Museum Directors (AAMD) led the pack, committing an estimated $320,000 to lobbying efforts. The AAMD was followed by the Metropolitan Museum of Art, with $198,000, and Washington, D.C.’s National Museum of Women in the Arts (NMWA), with $150,000. The rest of the names were all museums that spent $40,000 or less in the past four years, mostly from regional homes outside the usual headline-makers: the Tampa Museum of Art in Florida, the Philadelphia Museum of Art (PMA), and Ohio’s Toledo Museum of Art.

Now that you know these results, you might expect COVID relief funding to dwarf all other lobbying priorities for the nonprofit spenders. But disclosure records once again tell a more complex tale.

Yes, documents show that some of the nonprofits I just mentioned paid to advocate specifically for art institutions to be prioritized in pandemic-era stimulus and recovery bills. These issues dominated filings by the Met’s Washington representative, Park and K Public Affairs, in 2020 and 2021. The Toledo Museum of Art also worked with a lobbyist to push for actions concerning funding of institutions in Congress’s main relief package, the forgivable federal loans offered in the Paycheck Protection Program, and the Shuttered Venue Operator Grant.

Yet these focal points were only a part of the story. The National Museum of Women in the Arts devoted its entire lobbying budget to securing funding for a capital campaign linked to its first full renovation since 1987. In 2018 and 2019, aside from general arts-and-culture funding, the Met directed its advocate on the Hill to help lawmakers see the wisdom in approving a commemorative postage stamp honoring the museum’s 150th anniversary.

I suspect that, in a vacuum, the average art and culture enthusiast would locate each of these policy goals somewhere on a spectrum between “harmless” and “admirable.” At the same time, I also anticipate that some people’s opinions might darken once they learn the institutions in question paid a registered liaison to try to achieve those same goals. Should it make a difference, though, if everyone involved is just following the long-established rules of the American game?

This Ganesha statue purchased by the Toledo Museum of Art from Subhash Kapoor in 2006 was looted, and was returned to India. Photo courtesy of the Toledo Museum of Art.

The Toledo Museum of Art is an especially noteworthy case. When Columbus-based lobbyists Shumaker Advisors registered the institution as a client, the firm memorialized six “current and anticipated” lobbying issues that extended beyond pandemic-related concerns. They included promoting equitable arts education, pushing for updates to sustainable-energy infrastructure, and even implementation of… the Bank Secrecy Act’s expansion to cover the trade of antiquities!

Let’s unspool this last twist a bit. In 2014, the Toledo Museum of Art announced it would return four works in its permanent collection to India after determining that their provenance records were either falsified or incomplete. The quartet was among a group of objects donated to the institution by the disgraced antiquities dealer Subhash Kapoor, who was arrested in 2011 on suspicion of masterminding a smuggling ring now estimated to have generated more than $140 million in illicit sales. Kapoor donated pieces to numerous art institutions in the U.S. and abroad, and he was still awaiting trial in India (or possible extradition) as of late last year.

There are no indications in the disclosure forms that the Kapoor restitution directly impacted the Toledo Museum’s thinking about implementation of the expanded Bank Secrecy Act, or even what, precisely, they hoped to impart to the federal officials shepherding it to completion. But the episode acts as a reminder that galleries and auction houses aren’t the only art businesses with a vested interest in ensuring that new regulations imposed by Congress solve actual problems in the complex web of a niche trade. Several of those businesses have proven willing to pay to have their voices heard a little more clearly.

Granted, the millions spent by our industry are still small stakes in comparison to the fees paid by other industries. Consider that Meta (formerly known as Facebook) shelled out north of $20 million to lobbyists in 2021, according to political watchdog Open Secrets. That figure is almost 10 times more than the total spending by the top 10 art businesses combined over four years. Adding in the lobbying budgets of nine other tech behemoths makes the art business’s political spending look like playground activity.

Still, these public records demonstrate that art-industry lobbying activity covers a vast expanse of concerns, many of which exist beyond the bounds of the buying and selling that monopolizes the average citizen’s thinking about what makes up art business. The more I’ve learned, the more hiring liaisons to Capitol Hill has started to feel like both a savvy investment and standard operating procedure in a nation where getting anything done politically all but requires relationships, money, and the ability to manage a media narrative.

What does art-world lobbying look like from the inside, though? I’ll guide you through that labyrinth next week.

That’s all for this edition. ‘Til next time, remember: sometimes, you get what you pay for; other times, you just pay for what you get.