Auctions

Kenny Schachter Deals in Difficult Times at New York Auction Week, Part II

Kenny gets a surprising call from Sotheby's Amy Cappellazzo.

Kenny gets a surprising call from Sotheby's Amy Cappellazzo.

Kenny Schachter

Captain Cappellazzo, the Auctions and the Onward March of May

Markets like psyches have their natural, cyclical biorhythms; no one is happy 100 percent of the time and nothing goes up forever (except taxes); they also have a propensity to go down, even great ones—that’s why the term business cycle is employed. But a business art is, rock-hard and on healthy footing. Like the Dow Jones, major auction tallies are an art-abacus for keeping score, a financial report card on the state of the markets and I’d grade the overall outcome of the auctions in New York in May 2016 a solid B (especially in light of how the art press forecast it would fare).

The ostensibly for-profit auction houses have not been run as such in the recent past, recklessly chasing market share at any expense. They’ve resembled Swiss bondholders who pay for the luxury of depositing money; but it’s not your turnover that matters as much as how you turn it over. Coinciding with a broad, worldwide macro economic downturn the art world engaged in a no-win celebrity death match with whittled-away profitability, a flawed business plan (if you could call it that) where the real victim was the integrity of the auction market, the only shady grey area left in art.

For most of the last 5 years Christie’s has been roundly beating Sotheby’s in Contemporary—they are beginning to win in Impressionist/Modern (Imp/Mod) too and this spate was no different. Though overall smaller in scale by a factor of 50 percent, Christie’s still conclusively won the sales battle against Sotheby’s, and with less guaranteeing, they might have made more now than in last year’s twice-the-size record breaking gig. With the former a private company, we’ll never know—Brett, can you help me out here?—There’s no better group of contemporary specialists than the present Christie’s team; and, pardon my indiscretion, thank fucking god for that.

Ed Ruscha, Hotel. Courtesy of Sotheby’s.

Though it was billed as art giga-week (because for the first time both houses were cramming two weeks of Imp/Mod and contemporary sales into one week as opposed to two), the strategy proved neither bigger nor giga. Sotheby’s dismal Imp/Mod performance did nothing to quell the fear and they seemed better bound to fail than Christie’s. In spite of Sotheby’s stress and Christie’s finesse, the contemporary numbers fell within expectations and records managed to fall in succession over the course of the week. Though it was close in the end, the art eclipsed the back office drama (read on), but make no mistake—plain and simple—it’s still the low cost of money egging it all on.

Let me pull back the curtain on some of the latest: My trusted and reliable source, Deep Pockets, rolled back into town and informed me (as he’s always done) that Alibaba’s president Michael Evans went about building a contemporary art collection with all the obvious protagonists (Richard Prince, Christopher Wool, Jeff Koons) fostering relationships with dealers, artists, and museums alike. Then he decided to dump the lot full stop (other than his Calders) with Christie’s. Was he disillusioned, does he know something we don’t?

A portion of the recent market uptick has been the result of specialists enticing collectors to sell what they don’t want to part with to buy what they don’t know they want. Take for example Dan Sundheim of Viking Global hedge fund, the seller of Wool, Prince, Tauba Auerbach, Andy Warhol, Jean-Michel Basquiat, among others not for the dough but to pay for a mega recent Twombly purchase. Art apples traded for art oranges.

Richard Prince had a stellar week with big bucks bang, but someone who didn’t do as well was the mug that sold Runaway Nurse, despite making a record $9,685,000 at Christie’s evening sale. Word on the street was that the collector snagged the painting directly from the artist only a short time ago for a rumored $15 million, probably while wading in the sea in St. Barts, which for a fact the artist has been wont to do. That’s called a haircut, of extreme order.

Since the high octane evening auctions have been done to death, I will instead focus on the strongly performing day sales, an elucidating window into the sentiment of the mid-market, the art world’s bread and butter. In these anxious and uncertain times, taking into consideration my karmic wellbeing, I’ve determined to seek out the positive so will overlook the Phillips sale altogether and wonder if they might be better served focusing exclusively on watches and design. But before that, this…

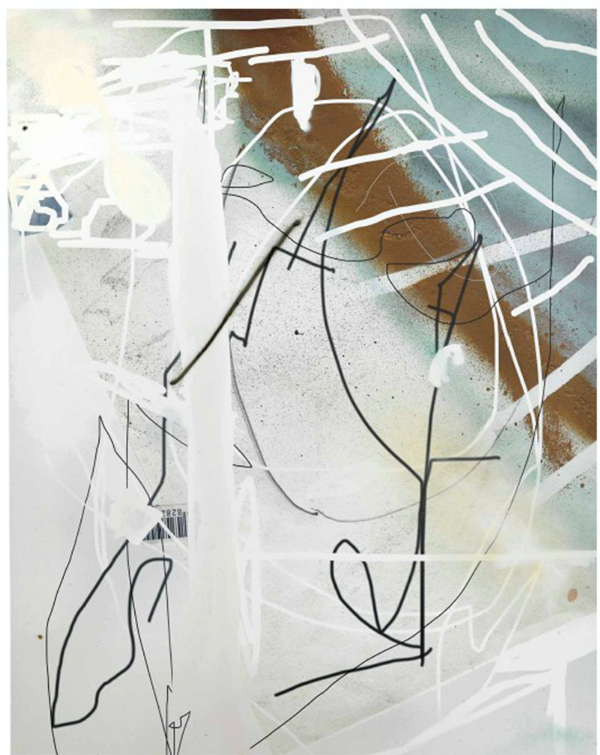

Photo collage by Kenny Schachter.

Amy’s Onslaught

No one expects incoming President Trump to retain holdovers from Obama’s administration. Massive is too small a word to accurately describe the scale of personnel turnover after Amy Cappellazzo stepped into the fold as Chairman and Executive Vice President of Sotheby’s, after the acquisition of her firm, Art Agency Partners. The cumulative years of experience of the Sotheby’s defectors exceeded the age of the Rolling Stones. It was like a neutron bomb went off and no man or woman (or specialist, even) was left standing, a scorched earth.

Amy in trouble translates into a kinder, gentler Amy and in that vein I got a surprisingly breezy, unexpected phone call last month that lasted for nearly an hour; trying to spin me no doubt. Yikes. Initially I thought I was getting pranked, not to mention I hate speaking on the phone, more so when being called an “important voice on the art market.” I didn’t realize the breadth of my writing—it felt like being in the core of nuclear reactor. With four kids and a less than tolerant wife (I am sure you can feel for her) I’m not used to being glad-handed. Admittedly, I don’t envy her (Amy or my wife).

Amy spoke of structural changes needed in a market far too unregulated, but wondered what “loser” would take the job. She also mentioned the fact Sotheby’s is in a period of ashes prior to the raising of the Phoenix that will occur over the next year and a half—institutional change would not be effectuated in a mere matter of months. Rather than bemoaning the fact, Cappellazzo stated that in fact it was better to be the steward of a public company avoiding irreparable damage to the industry wrought by dirty tactics employed by those not accountable to public scrutiny, i.e. her former company, Christie’s.

She mentioned that knowing everything from both houses now was a burden she wished she wasn’t faced with; after speaking to her for so long, I could echo the sentiment. Cappellazzo ticked off a list of artworks she turned down due to condition issues and over-shopping that were subsequently on offer from Christie’s. Over and over, she referred back to the lack of regulation and that the “there should be no pissing in the beautiful pond we all drink from—artists, critics, collectors, handlers.” What I gather she was getting at was the practice of having naïfs pushed to bid by those with undisclosed vested interests, unaware of the manipulations and shenanigans behind the scenes; who needs friends like that. As a generally idealistic chap (ok, cynically so), I can count myself among the naïve who not so long ago believed in it all.

To cut to the chase, Amy was none too pleased with Christie’s grab for market share with the unfair advantage of being a private company with no accompanying reporting obligations. She recounted an executive boasting that it wasn’t his money at stake chucking around guarantees with no sound business motive other than throwing up big numbers from a sale.

Despite the (sometimes) sanctimonious tone of Amy over the years, I admire her enormous success and forthright determination to prosper. In the end, in the face of her many detractors, Cappellazzo did just fine or should I say the irrepressible market did it for her—Amy personally didn’t wield a phone line till the evening sale was nearly complete.

Then I found out I was one of many who Amy called to placate. Her nod to me didn’t go exactly according to plan but I’m a fan; really, I am. It’s no easy feat, her new beat, and I am appreciative of the tenacity and unquestioned accomplishments of her past. Then, I figured out a solution to the conundrum of Dan Loeb’s Sotheby’s quandary (struggling share price and mass staff exodus) and Phillips’s lack of a business model: a merger!

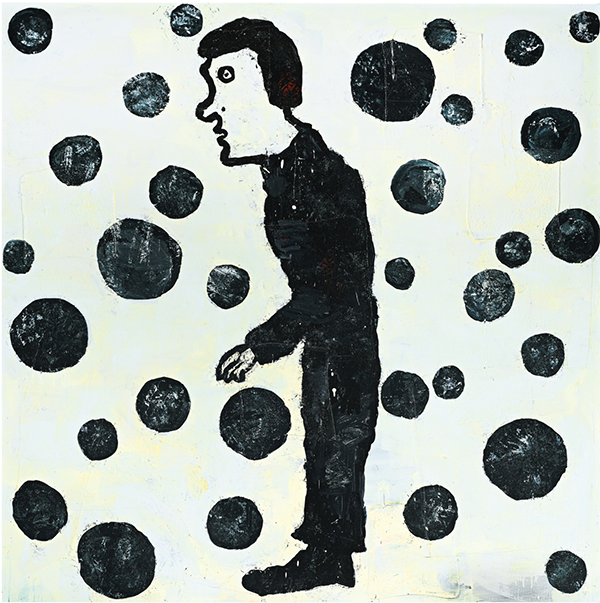

Donald Baechler, Punishment or Reward. Courtesy of Sotheby’s.

Christie’s Day Sale

A painting executed in 2013 by Jeff Elrod (b. 1966) made $161,000 on an estimate of $60,000–80,000 from Simon Lee Gallery, London where they initially sold for $60,000 only three years ago. Even though I have one, I’m still befuddled by the rise and rise of Aaron Garber-Maikovska (b. 1978). A signature ink-and-pastel drawing-on-board fetched $106,250 against expectations of $40,000–60,000—his record stands at over $116,000. Dating from 2014, this recent work didn’t remain long with the owner; originally sold from Standard, Oslo, a gallery so notoriously obnoxious it serves them right to be flipped as such.

There is a dearth of Sigmar Polke (1941–2010) works available at David Zwirner or anywhere else for that matter, one of the standout shows in the city at a time when galleries bring out the big guns. A 1990 work made $893,000 against an estimate $350,000–450,000. Painted with silver sulfate, a material that in the hands of playful Polke literally alchemically transformed the piece into the mystical and magical. This was a challenging example of painting at its most difficult, aesthetically reduced form, indicative of the growing strength the market of the artist. And rightfully so.

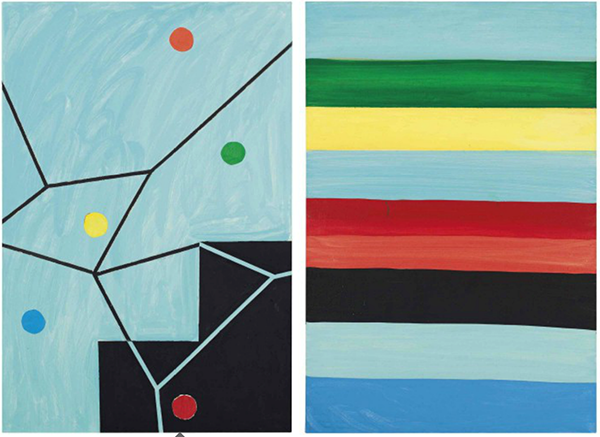

Mary Heilmann, Untitled. Courtesy of Christie’s.

A three-part table in the form of a map of China by Ai Weiwei (b. 1957) fabricated from dismantled Qing Dynasty temples sold for $2,517,000 against expectations of $800,000–1,200,000. With four previous iterations having been sold at auction alone, Ai has a creative approach when it comes to stretching the concept of the term “unique” in relation to his output. Politics pays.

Mary Heilmann (b. 1940) sold a work for $93,750 just above the estimate of $60,000–80,000. She’s the subject of an imminently opening show at London’s not for profit Whitechapel Gallery and rumored to be the subject of an upcoming Whitney Museum retrospective (if it’s not so, it should be). With an auction record of under $200,000, I find it simply wrong that such an exceptional abstractionist should sell so cheaply in relation to her peers. Aside from Joan Mitchell who performed exceptionally well, and only a few others, there is still little by way of parity in the market between the sexes.

Jeff Elrod, 13th Floor Elevator. Courtesy of Christie’s.

Sotheby’s Day Sale

The rich (artists) get richer. The Richter-esque grisaille painting, Hotel, by Ed Ruscha (b. 1937) sold for $1,930,000, nearly twice its high estimate. The esteemed collector, Alex Rodriguez, otherwise known as the steroid ingesting baseball star with Nate Lowmans installed in his batting cage located in his Miami mansion, was identified as the seller of another Elrod. Though it squeaked above expectations achieving $187,000—I guess the A-Rod provenance didn’t prove all that alluring, though it was still a solid batting average for a three-year holding period.

Whoa! Chris Burden’s (1946–2015) Warship from 1981, a mixed-media assemblage resembling a cluster of toys sold for a record $502,000 against a $60,000–80,000 estimate, 5 times his previous high. Good for him, we shared a love of 1960s and ’70s sports cars like the ugly duckling Porsche 914 he unceremoniously tethered to an industrial-scaled scale counterweighted by a meteor. Not sure what it meant but it certainly was imposing.

Trompe-l’œil painter Tauba Auerbach (b. 1981), known for her subtle depictions of folded fabric, held her own selling for $970,000 with a $600,000–$800,000 estimate; still way off her nearly $2.3 million record of two years ago. Inscribed “For Alex,” might it have been another deaccession from the slugger’s digs?

Donald Baechler’s (b. 1956) Punishment or Reward, a painting from 1986 sold at the high estimate for $30,000. But that’s more punishment than reward for such a significant early painting by an undervalued practitioner. Sure as shit, this work will appreciate over time, it must. Bought well. Another market underperformer was the $50,000 result for a Lynda Benglis (b. 1941) bronze estimated at $50,000–70,000. C’mon folks, what is wrong with you!

Lynda Benglis, KISSELL. Courtesy of artnet.

Basel and Beyond

In the elevator up or down from one of the auctions, Jeffrey Deitch marveled that Yusaku Maezawa, an unknown (and unexpected) buyer from Japan, a country off the art radar for decades, could singlehandedly move the game along spending nearly $100 million in a matter of days. And do so he did. The week would have been an utter bloodbath if Maezawa didn’t appear. But that’s exactly what I’ve been saying all along, there’s a route around any obstruction; and it’s often not the most obvious course. Sounds like a fortune cookie but it’s true.

In an historic time of tumult the art world reverts to a mentality of passion over the ability for a quick cash-in. Despite all the skulduggery, the good outweighed the tricks or the market wouldn’t countenance it. The bravado of an unfettered art arms race at the expense of profits is gone, perhaps forever. But like illicit drugs, the demand for art is inelastic, remarkably resilient beyond the understanding or belief of the myriad naysayers and doubters.

As the art world breathed a collective sigh of relief, plans are underfoot for the next month’s Basel-Basel fair and London auctions. Look for November in New York, the next bellwether sales, to make a healthy gain on what proved to be a lovely spring week in New York. And sooner or later, albeit not imminent over the next few years, auction sales will eclipse the highs of 2015, just watch.

Adrian and Kai (my kids) sat patiently, diligently throughout the sales (remarkable with their abbreviated attention spans), today’s equivalent of being dragged by your parents to your local church/synagogue/mosque. That they did so of their own volition is an inspiring testament for the future of the art business.