Even people who profess to know nothing about finance know it’s wise to diversify their investments. But should contemporary art be considered one of the assets in a well-balanced portfolio?

For most of history, this has been a question almost exclusively for high-net-worth individuals. Recently, however, a new breed of investment platforms has begun offering fractional shares of fine artworks, design objects, and other aspirational collectibles for prices as affordable as a hardcover novel.

None of these platforms poses a more direct alternative to the establishment art market than Masterworks. Opened in 2017, Masterworks, which is based in New York, acquires blue-chip Modern and contemporary artworks, then reconfigures them into Securities and Exchange Commission-approved investment opportunities aimed at the mass public. The result: everyday people can own, say, one half-millionth of a certified original Jean-Michel Basquiat painting for a mere $20.

According to Masterworks founder Scott Lynn, the platform has attracted more than 140,000 users since its inception, and its “nearest competitor is one-twentieth our size.” He said the company has already purchased more than 40 works for over $150 million to date, with expectations to surpass $300 million in purchases in 2021—an outcome “likely making us the largest buyer in the art market.”

Shareholders can visit Masterworks’s gallery space in SoHo to view select pieces, but this appears to be an ancillary benefit in almost all cases. As Lynn put it on a finance podcast in April 2020: “Our investors are really not art-world people. They’re really just looking for returns.”

The company aims to resell each artwork for a gain between three and 10 years later, at which point all net profits are redistributed to the work’s shareholders. Investors can either hold their shares in anticipation that the exit will pay off, or offer them to peers in the interim on the platform’s online secondary market.

In short, the platform’s value proposition is to convert physical artworks into intangible investment vehicles. Shareholders outsource the care, promotion, and resale to Masterworks in exchange for an annual administrative fee. It’s a way to allocate part of an investment portfolio to fine art while avoiding both the logistical downsides—and the psychic upsides—of actually living with art.

But whether Masterworks offers a wise investment opportunity is a more complex matter. Some experts in art and financial markets have expressed serious misgivings about the business model.

Their concerns primarily distill into three issues: the size and structure of Masterworks’s fees; the accuracy of the proprietary market analytics it uses in its advertising campaigns; and whether the niche blue-chip art market can support a Silicon Valley-style strategy of relentlessly scaling up.

Masterworks founder Scott Lynn. Courtesy of Masterworks.

1. Are the Fees Worth the Upside?

Masterworks’s fee structure is as follows: a 10 percent fee built into the initial offering of any work (meaning that a piece acquired for $1 million would be collectively offered to investors at $1.1 million); a 1.5 percent annual fee for every year a work is held by Masterworks (to cover administrative services and incidentals, including storage and insurance); and a 20 percent fee on the profit—not the resale price—when Masterworks finally sells the work to a buyer (at which point the profit, minus all fees, is distributed to shareholders).

Lynn described this as a “standard fee structure used by hedge funds or private equity (often referred to as a two-and-20 structure).” He also stressed that Masterworks acts as “much more an ‘asset manager’” than either of those comparison points, playing the role of issuer (by acquiring a painting and processing it into an investable entity) and investment bank (by sourcing distribution of the offering and raising capital from investors), then arranging for the proper care and, ultimately, the best time and place to sell. “In that context, our fees are very compelling,” he said.

So far, investors seem to agree. Lynn said the company’s $1 million paintings “tend to sell out in one to two days,” and $10 million paintings “tend to take around a month.” Masterworks sells the entirety of each offering to third-party investors and retains no ownership stake in the work.

After conducting his own research into Masterworks over the past several months, however, the outspoken Belgium-based collector and investment consultant Alain Servais concluded the company’s fee structure puts its investors at a substantial disadvantage. He agreed that Masterworks provides a convenient way to allocate investment dollars to fine art, but he believes the costs are simply too high to deliver a profit in most cases.

His primary issues are the annual fee and the fee on resale profit. An artwork generates no revenue until it is resold, even though administrative fees still accumulate. So if a work sells after a five-year holding period, fees would total 27.5 percent of the upside amount—a significant bite out of investors’ returns.

Megan Fox Kelly, a veteran New York-based art consultant now serving as president of the Association of Professional Art Advisors (APAA), shares only some of Servais’s concerns. Although she confirmed that a 10 percent acquisition fee is “common” among advisors, she said that Masterworks’s 1.5 percent annual fee “seems high” based on her own experiences facilitating incidentals for clients.

But Kelly was more accepting of the company’s 20 percent fee on resale profits than Servais. Because it is taken as a percentage of the upside amount, she said, it acts as a de facto tiered structure, just as auction-house fees descend proportionally based on the hammer price. (At Christie’s New York, for example, fees step down from 25 percent to 14.5 percent. But these premiums are paid by the buyer, not the seller, whose separate fee usually totals only a few percentage points off the hammer price at most, and often zero.)

Lastly, Masterworks can exit a painting by either selling directly to a client or to an intermediary (whether at public auction or privately). Both Servais and Kelly questioned how much more shareholders could sacrifice in profits when the company transacts with a middleman that would charge their own (perhaps substantial) commission. Lynn dismissed these concerns, saying his company pays “nominal fees to intermediaries when compared to most collectors because of our buying power.”

Masterworks’s proprietary data raises red flags for some experts. Courtesy of Masterworks.

2. How Reliable Are Masterworks’s Market Data and Analytics?

Masterworks promotes a wide range of enticing figures about the art market as a whole—and its paintings specifically.

The vast majority of these come courtesy of its own auction database (purportedly comprising 3 million data points stretching to 1960) as well as proprietary indices developed to chart Wall Street-indebted metrics, such as value-weighted performance and momentum. Lynn called Masterworks’s quants “the leading research team in the art market” and said they have “worked or partnered with almost every major private bank” including Goldman Sachs, Morgan Stanley, and Citi “to help ramp them up on characteristics of the asset class (returns, loss rates, correlation, etc.).”

A November 2020 document on Masterworks’s website says the company’s artwork indices focus on 60,000 “matched sales” of pieces traded twice or more at auction—an approach based on “established approaches used for real estate.” (Lynn said the specific model is the Case-Shiller Index, which tracks the prices of single-family detached homes in the U.S., primarily through repeat sales free of conflicts of interest.)

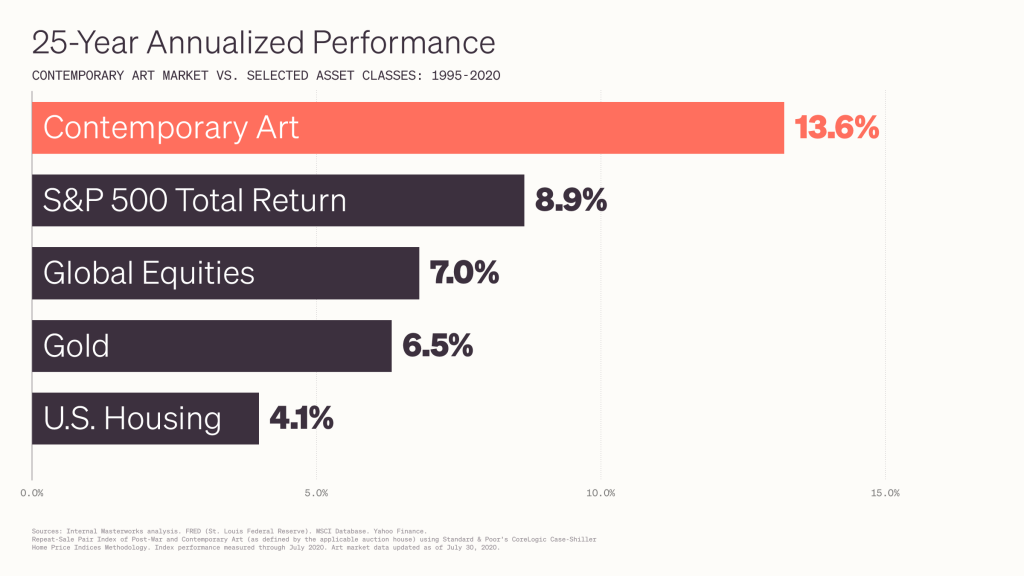

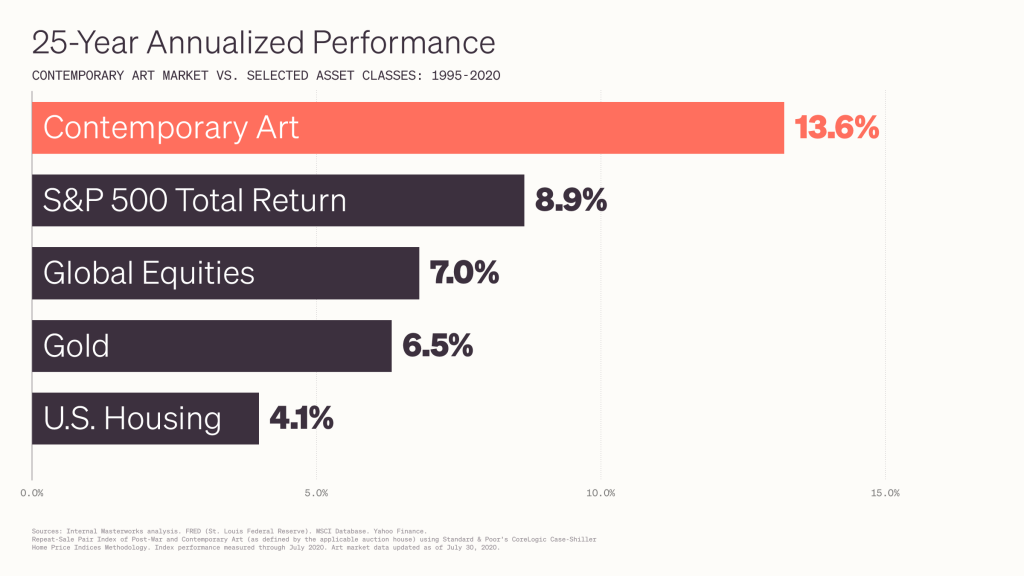

Among the marketwide conclusions drawn from this data, Masterworks claims contemporary art, which Lynn defined as all artwork made after the Second World War, delivered an annualized return of 13.6 percent from 1995 through 2020, far outstripping the S&P 500 (8.9 percent), global equities (7 percent), gold (6.5 percent), and U.S. housing (4.1 percent). The company also contends that contemporary art has absorbed dramatically lower losses than these asset classes over three-year investment horizons during the same period.

However, a note of caution came from Jeffrey Deitch, the innovative dealer whose Harvard MBA helped him co-found an art advisory group at Citi in 1979. “You can make generalizations, but each sector of the market is a whole different story. There are superstar artists who are household names where the market is completely stagnant, and you can hardly sell.”

Servais was much tougher on Masterworks’s historical market data, saying that “if you even scratch the surface of” its proprietary indices, what emerges is “extreme bullshit.”

In his view, the Case-Shiller index is a poor match for the art market. Compared to paintings sold at auction, the resale frequency of homes is much higher, while the number of unsold lots and the size of the sales commissions are both much lower. These factors make it “acceptable to forget about the unsold properties” in residential real estate, whereas “if you apply the same rules to art, you get into trouble,” Servais said.

A promotional image for Masterworks’s offering of shares in Andy Warhol’s 1 Colored Marilyn (Reversal Series) (1979). Courtesy of Masterworks.

Of these faults, Servais thinks the worst distortion arises from Masterworks’s omission of unsold lots from its auction data. (He has consistently criticized auction houses and a slew of art-market analytics firms, including Artnet, for the same practice over the years.) If the many works bought in and withdrawn prior to the sale were counted as selling for zero dollars, he contends, we would have a much more accurate picture of art’s performance in the resale market. But only showing successful lots creates a so-called survivorship bias in the figures: all of the good outcomes remain, all of the worst outcomes vanish.

Especially galling to Servais are the company’s promotional emails touting available shares in newly acquired works. Tantalizingly, they tend to lead with what Masterworks calls a “historical price appreciation” figure of 15 percent or more for “similar” works by the same artist, as well as embedding a ticking clock showing the time remaining for potential shareholders to buy in. While Servais concedes these price appreciation are not wrong per se, he feels they are so subjectively determined that they exceed even the considerable hype allowable in typical marketing.

Lynn vigorously defended Masterworks’s methodology, saying Servais’s criticism of its index construction “does not have merit (mathematically and otherwise),” adding: “Our research team (and the research teams at larger banks we partner with) believe our indices to be statistically significant (irrespective of whether the art market has more or less data than the housing market).”

“The survivorship bias argument only makes sense if you’re trying to measure the returns of the art market overall, including primary artists who never sell at auction,” he continued. “But if you buy at auction and sell at auction (or buy and sell artists who trade at auction), the returns are representative of the [secondary] market.”

He also stressed the compliance measures built into his company’s investment products. “We have a broker-dealer on every offering and all of our salespeople are licensed by FINRA,” meaning any malfeasance could result in fines, jail time, or other penalties.

“Additionally, every offering is a qualified public offering by the SEC. There is no higher standard of investment product (complete with risk disclosures, transparency, etc.) than the structure we are using. You essentially get all of the legal benefits of investing in a public company… but for a painting.”

KAWS, Far Away Friends (2009). Courtesy of Masterworks.

3. Could Masterworks’s Growth Prove Too Aggressive for the Market to Bear?

Lynn said that, on average, Masterworks’s actual costs tend to exceed the cash generated by the 10 percent fee built into its initial offerings. This is because these costs include not just artwork-related incidentals but also legal and compliance, marketing and distribution, market research, inventory-sourcing, and more.

But he said the company is profitable once the revenues from its up-front fees are combined with the revenues generated from its 1.5 percent annual fee and 20 percent fee on resale profit. (The latter two are taken in equity upon the reselling of an artwork.) This structure aligns the company’s incentives with those of its investors.

In other words, Masterworks only makes money when shareholders do.

This information is especially noteworthy since, in the fifth year since its founding, the company has sold only one artwork to date: a Banksy painting titled Mona Lisa, whose shares it collectively offered to members for $1,039,000 in October 2019. Masterworks dealt the painting in October 2020 for $1.5 million.

Its other 40 paintings (by artists ranging from Claude Monet and Andy Warhol to Adrian Ghenie and KAWS) remain available to collectors as of publication time. Their fractional shares, however, are sold out. (Lynn claimed that the average Masterworks investor buys about $30,000 worth of shares.)

That said, bundles of shares in most of these paintings are now being offered online via the company’s investor-to-investor secondary market. There, current owners can post shares with an asking price of their choosing; potential buyers can either accept that price or counteroffer. The platform provides shareholders a way to regain liquidity prior to the actual artwork’s changing hands.

As of May 2, the overwhelming majority of shares on Masterworks’s secondary market appeared to be priced from roughly $19 to $24. Assuming a $20 initial share price, this range would return something roughly between a five percent loss and a 20 percent gain.

Some higher hopes were evident—for example, 10 shares of Monet’s Coup de Vent were available for $100 each—but in these cases, several shares in lower price ranges were usually being offered simultaneously by other sellers. (Eighty shares of the same Monet painting were posted for $22 or less.)

Masterworks’s 40-to-one ratio of artwork holdings to artwork sales returns us to its emphasis on rapid growth. Lynn said the company spends “millions of dollars in online advertising,” generally targeting a demographic of non-accredited investors he labeled “mass affluent.” He described these marketing efforts as “mainly educational—if people believe that they should have an allocation to art, they almost always wind-up investing with us.”

Counter to the strategy relied on by most blue-chip collectors, dealers, and advisors, Masterworks’s website states the company “typically acquires new artwork every week.” Not even last year’s generational upheaval seemed to slow the pace much; Lynn confirmed Masterworks purchased more than $100 million worth of paintings during 2020 alone.

Claude Monet, Coup de Vent (1881). Photo by Guy Bell/REX (9717208as). Courtesy of Masterworks.

That last data point gave Kelly pause. To her and many others in the industry, last year’s market was defined by “a scarcity of great works” publicly and privately. “Auction houses were knocking themselves out to get good pictures. I didn’t have any clients coming to me desperate to sell. If you spent $100 million in 2020, were you getting the best opportunities?”

This thought led her to wonder about the appraised value Masterworks circulates on what it calls the the “deal sheet” for each new painting it acquires. According to Lynn, his company’s initial offering price to members is lower than the appraisals (which always come from independent third-parties) “in almost all cases.” He also claimed that “galleries or auction houses would never provide this to a collector.”

But Kelly, a certified member of the Appraisers Association of America, feels strongly that “one third-party appraisal is not sufficient” to determine any artwork’s value.

Instead, she believes the task demands a consortium of experts including scholars and conservators versed in the specific movement, artist, and even body of work in question, as well as market specialists who understand how aggressively an individual piece has already been shopped, and where its optimal sales channel should be based on the history of public and private resales. None of this is evident in a painting’s auction results, she stressed.

Asked whether Masterworks’s appraised values derive from a single independent third-party appraisal or multiple opinions from experts in targeted specialties, Lynn replied: “We only use large appraisal firms such as Pall Mall or Winston who have lots of specialists internally.” (Kelly wondered how frequently these firms’ most qualified specialists on, say, a 1979 Warhol Marilyn canvas are among the entire art ecosystem’s most qualified specialists for that artwork.)

Beyond appraisals, much of Masterworks’s buying strategy is driven by director of acquisitions Masha Golovina, who previously worked as an associate vice president at Christie’s (where, her company bio states, “she oversaw risk and profitability over a broad spectrum of accounts and markets”) and as a portfolio strategist at Citi. Lynn said Golovina manages a four-person team that has been offered more than 2,400 works by the roughly 45 artists Masterworks focuses on, only about one to two percent of which they have chosen to purchase.

Yayoi Kusama, Pumpkin (1993). Photo by Justin Tallis/AFP via Getty Images. Courtesy of Masterworks.

Competing Visions

Ultimately, then, what emerges from the debate about Masterworks are two clashing worldviews about the limits of the blue-chip art market. Lynn and his company believe that they can grow their staff of specialists, their inventory of high-quality paintings, and their investor base at an unprecedented rate without sacrificing sustainability or judiciousness.

By expressly seeking to become the “largest buyer in the market,” he believes, economies of scale will empower them to consistently buy low and sell high on legitimately great works—a campaign enabled by their modernizing an antiquated business model with innovative analytics and SEC-approved safeguards. The combination will make art investment accessible (and profitable) to more people than ever, while the traditional art market will benefit from their patronage.

The opposing perspective sees Masterworks’s strategy as inherently incompatible with the highly specific niche market for apex-level art. The skeptics argue it is impossible to even source, let alone secure, one or more truly top-quality works 52 weeks a year, every year—especially if you are interested in fewer than 50 artists. The supply is too low, and the current owners too willing to hold on because of too many external factors (from volatile economic conditions to a belief the work’s value is still rising).

In this view, a plan premised on weekly buys and/or lofty spending targets will inevitably result in an inventory of grade-B paintings by grade-A artists, making them difficult to resell for significant gains even 10 years on. These strategic missteps will be driven in part by flawed statistical models that fail to sufficiently account for unresolvable differences between the art market and other markets, dooming the venture with its own ambitions.

For his part, Deitch, who said he “certainly believes in art as an asset,” understands both sides. Personally, he offers the same advice he gave Citi many years ago when the bank was discussing establishing an art fund in partnership with Sotheby’s: “Why not just buy a great work of art and take it home? If you want to participate in art, there’s great art at every price range.”

But he also understands that “there are people who want to buy shares in a fund. If that’s what they want, why not? Just make sure it’s a well-managed fund and they know what they’re doing.”