Auctions

Meet the Sellers of $407 Million Worth of Art Hitting the Block in London

A $25 million Francis Bacon painting and a $500,000 Alex Katz are just a few of the trophies on offer this week.

A $25 million Francis Bacon painting and a $500,000 Alex Katz are just a few of the trophies on offer this week.

Colin Gleadell

On Wednesday in London, the marquee March auctions of Impressionist, modern and contemporary art will kick off at the big three auction houses. Their total presale estimates are down 9.5 percent from last year, to £321 million ($407 million), but that is a modest dip compared to the 26-percent drop registered in last year’s estimates versus 2022. Back in 2022, some £461 million ($652 million) was on offer.

In 2023, Christie’s registered the sharpest year-on-year decline in estimates of the big three London salerooms, but it has come out on top this time, notching a 20-percent increase, from £159 million ($202 million million) to £191 million ($242 million). Sotheby’s, in contrast, is reporting a 32-percent drop in estimated value, from £162 million ($206 million) to £110.2 million ($140 million), and it has scrapped its standalone Now sale, where it previously placed it most contemporary works. (Last year, the Now sale offered only half the value of the year before; those ultra-contemporary works have simply been wrapped up with the Impressionist, modern, and postwar categories this time.)

Finally, to complete this tale of reversed fortunes: This go-round, Phillips experienced the largest drop, by percentage, in pre-sale estimates year-over-year—they are down 40.4 percent, to £20.2 million ($26 million). Last year, it was the only house to log an increase.

Now, on to the consignors: Perusing the auction catalogues and conferring with sources, Artnet News can reveal many of the consignors of the most valuable lots. Read on.

Francis Bacon, Landscape near Malabata, Tangier, 1963. Property from a Distinguished International Collection. Estimate £15 million–£20 million ($18.8 million–$25 million). Third-party guarantee. Photo courtesy Christie’s.

Formerly in the collection of the author Roald Dahl, this Bacon was sold at Sotheby’s New York in May 1985 for a record $517,000. It later passed through the hands of London dealer Ivor Braka, from whom it was acquired around 2000 by the financier Pierre Lagrange, who is the anonymous seller. In 2000, as it happens, the investment firm that Lagrange co-founded, GLG Partners, obtained independence from Lehman Brothers. In 2010 he triggered a £160 million divorce from his wife, Catherine, announcing he was in a relationship with the designer Roubi L’Roubi. In 2012, he sued the Knoedler Gallery for selling him a $17 million fake Jackson Pollock. (The gallery later settled.)

The Bacon painting is clearly visible hanging in a photograph taken by Architectural Digest in 2016 of a London penthouse shared by Lagrange and Roubi L’Roubi.

Lagrange’s son, Bernard Lagrange, is also involved with art; he’s worked at Sotheby’s and is part of the Gagosian Gallery advisory team.

Francis Bacon. Painting March, 1985. Estimate £4.2 million–£6 million ($5.3 million–$7.6 million). Property of a Distinguished Collector. Photo courtesy Christie’s.

This late Bacon painting was bought at Christie’s in Paris in June 2013, below its €4 million–€6 million estimate, for about €3.7 million (or $4.8 million) by British collector David Ross. Born into a humble fishing family, Ross co-founded the successful mobile phone company Carphone Warehouse, and he is this week’s seller. He has loaned the painting to numerous exhibitions, notably “Pop Art to Britart: Modern Masters from the David Ross Collection,” which was staged at the Djanogly Art Gallery in Nottingham, England, in 2013. (Ross has attributed his interest in art to the influence of the Djanogly Gallery.) The owner since 2000 of Neville Holt Hall in neighboring Leicestershire (which boasts a 400-seat opera house), Ross has been cited on the Nottinghamshire county “Rich List” with a net worth of £850 million ($1.08 billion). The painting subsequently appeared in a show of late Bacon at Gagosian in New York in 2015 and a 2019 Centre Pompidou exhibition, “Francis Bacon en Toutes Lettres,” which focused on Bacon’s literary influences.

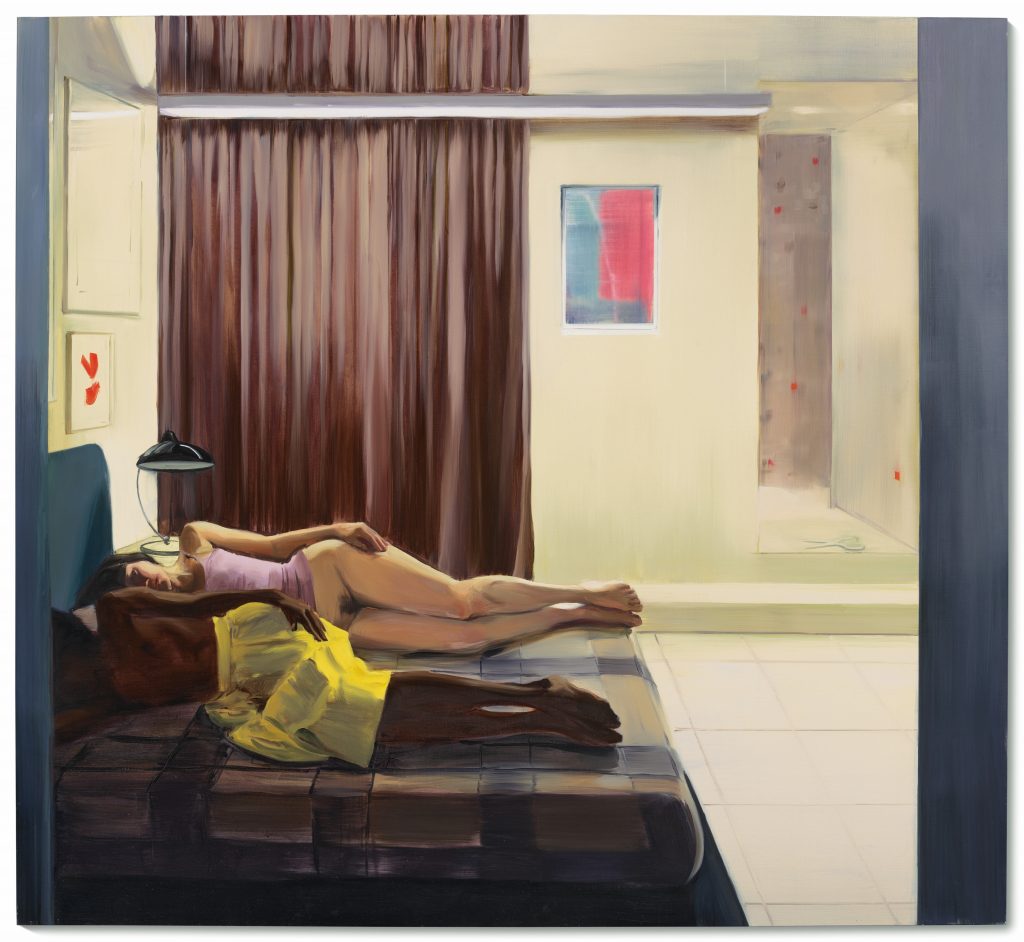

Caroline Walker, Ward Round 1, 2012. Estimate £150,000–£200,000 ($190,000–$254,000). Photo courtesy Christie’s.

Christie’s catalogues the provenance of this painting as “From a Prestigious European Collection,” which Artnet can reveal is that of Czechoslovakian collector Robert Runtak. He acquired the painting directly from the artist in 2015 and lent it to the Gallery of Fine Arts in Ostrava for a 2017 exhibition of works from his collection, “Making Windows Where There Were Once Walls.”

Runtak began collecting in 2007 and now owns over 1,000 works by 400 artists, covering a spread of Czech figures from the 1900s on, with a focus on contemporary international figurative painters from Leipzig, Cluj, Berlin, and Great Britain.

The Scottish-born Walker has had a presence in Eastern Europe since taking part in the Fifth Czech Biennale in 2011. In 2013, when she was included in “Nightfall, New Tendencies in Figurative Painting” at the Rudolfinium Gallery in Prague, her first work appeared at auction—not in Europe, but in a charity sale in Budapest.

Since then, her prices have risen in the big three salerooms in London, New York, and Hong Kong, reaching a record of £927,180 at Phillips last year. That price was achieved against the same low estimate as this week’s: £150,000, which is the highest figure yet applied to her work. Walker’s main gallery representatives are Stephen Friedman (in the U.K.), Grimm (Amsterdam and New York), and Richard Ingleby (Edinburgh).

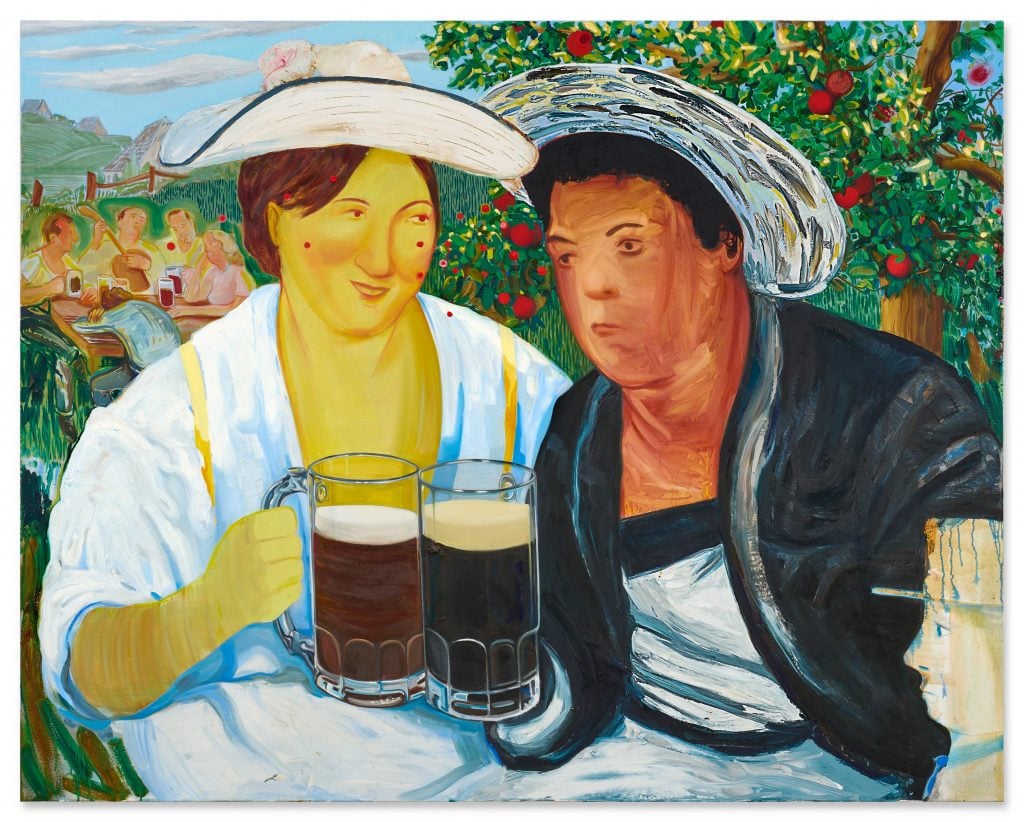

Nicole Eisenman, Biergarten, 2007, £500,000–£700,000 ($635,000–$888,000). Designated as Property from a Distinguished Private Collection Europe. Photo courtesy Sotheby’s.

According to a Facebook posting by the Berlin gallery Barbara Weiss in 2007, this painting was acquired by its current owners, art and fashion advisors Joshua Gessel and Yoel Kremin, from Eisenman’s 2007 solo show at the Vielmetter gallery in Los Angeles. They subsequently loaned it to S.M.A.K., in Ghent, Belgium, for an exhibition entitled “These Strangers: Painting and People” in 2016.

Eisenman’s market took off in 2019, when Hauser & Wirth became her representative alongside Anton Kern and Vielmetter. That year, an estimate-tripling new record of £639,000 ($791,919) was set for the artist with her painting Close to the Edge (2015). It has since climbed to $2.4 million, which was achieved last year for Night Studio, also from the collection of Gessel and Kremin.

Georg Baselitz, Zwei Streifen – Werktätiger (Two Stripes – Workman), 1967. £500,000–£700,000 ($635,000–$888,000). Designated as Property from a Distinguished American Collection. Photo courtesy Sotheby’s.

Bought from the Michael Werner Gallery in New York in 1997, this painting belongs to the artist’s “Fracture” series, which immediately followed his groundbreaking “Hero” paintings of the 1960s. The buyer, who is now selling, is the celebrated Dallas collector Howard Rachofsky. In 2022, he included it in a show at his Warehouse space in the city.

Alex Katz, Black Hat No. 3, £300,000–£400,000 ($381,000–$508,000). Designated as Property of a Distinguished Private Collector. Photo courtesy Sotheby’s.

This work was acquired by the current owner from dealer Timothy Taylor in 2010, and exhibited in the 2017 exhibition “ISelf Collection: The End of Love” at Whitechapel Gallery in London.

The ISelf collection was formed in 2009 by the Lebanese couple Maria and Malek Sukkar, who are based in London, where they have been advised by former gallerist Prue O’Day (of the Andeson O’Day gallery), who founded the Wonderful Fund with businesswoman Vanessa Branson, the sister of Virgin founder Richard Branson.

As outlined in Lee Carter’s coverage of the ISelf collection for Artnet, it is largely curated by Maria Sukkar with a focus on women artists, though men are by no means excluded. Katz is one of her favorite artists, and one of her first acquisitions was a piece by the artist that she received as a gift from her husband.

According to her website, O’Day is no longer taking on work with private collectors but is actively involved in mentoring and advising artists, gallery colleagues, and public institutions, including the advisory acquisitions committee for the Hepworth Wakefield.