Auctions

Picasso Tops Sotheby’s $127 Million Modern and Contemporary Sale

Signs that the middle market may still be a bit sticky were evident in the 10 lots withdrawn before the sale.

Signs that the middle market may still be a bit sticky were evident in the 10 lots withdrawn before the sale.

Colin Gleadell

London’s spring sales of Impressionist, Modern, and Contemporary art opened at Sotheby’s on March 6 with a 60-lot sale that made £100 million ($127 million) against a presale estimate of £74.8 million to £106.5 million ($95.2 million to $135 million). (All final sales totals given include auction house fees unless otherwise noted; presale estimates do not.)

As the first marquee sales of the year, many are looking to the London auctions for an indicator of whether the softer market of 2023 has improved. Signs that the middle market may still be a bit sticky were evident in the 10 lots withdrawn before the Sotheby’s sale.

Days before the auction, a private collector who had bought a strongly colored work on paper by Paul Klee in 2015 for £700,000 (then around $980,000) was looking down the barrel of gun with no interest shown now near the £500,000 ($700,000) low estimate and decided to withdraw the lot in advance. More significant was a fairly unremarkable but rare Blue Period Picasso portrait of Luis Vilaro bought 40 years ago for $196,000 and passed down to a grateful descendant. It was the first Blue Period Picasso painting at auction since 2010 when the portrait of Angel Fernández de Soto sold to Andrew Lloyd Webber for $51 million. The Vilaro portrait was estimated at between £5 million and £7 million ($6.3 million to $9 million), but it never made it to the block due to lack of presale interest.

In the post-war sector, a presale casualty was a marble and slate carving by the late Barbara Hepworth, Horizontal Vertical (1972), with an estimate of £900,000 to £1 million ($1.1 million to $1.27 million). A late work that looks like an early carving placed on an uncharacteristically elaborate tiered plinth, it was designated as “property from an important American collection,” which sources identified as the collection of billionaire Ron Perelman, whose problems and disposals of late have been well documented by Artnet News.

Takako Yamaguchi, Catherine and Midnight (1994). Courtesy of Sotheby’s.

After a lengthy announcement about the 10 withdrawn and 20 guaranteed lots, the sale began with the most contemporary works, effectively The Now sale, which is no longer a stand-alone event.

Placed up front was Catherine and Midnight (1994), the first work by Japanese American Takako Yamaguchi in a public auction to appear in a major sale room. Its £400,000 to £500,000 ($509,000 to $636,000) presale estimate may have come as a shock to some. Works by the West Coast artist had appeared in smaller, regional sales since 2010 but never sold for more than $10,000. That is until a well-timed sale last month on Loic Gouzer’s online auction platform, Fair Warning, in which one of her works sold for $991,875 (£781,467), which may have made less informed bidders more comfortable with the estimate. Offered with a guarantee, three phone bidders competed until it sold for a record £889,000 ($1.1 million).

Further records in this section were set by Rebecca Warren (£571,500, or $727,900) and an abstract painting by the late Etel Adnan (£444,500, or $566,000) that went for more than three times its low estimate. The winning bid came from Sotheby’s Mai Eldib from the house’s Middle Eastern Department.

The big disappointment in an otherwise triumphant evening for contemporary female artists was Nicole Eisenman’s Biergarten (2007), estimated to fetch between £500,000 and £700,000 ($636,000 and $891,000), which failed to raise a single bid. Designated as “property from a distinguished private collection in Europe,” it is owned by Israeli art and fashion advisors Joshua Gessel and Yoel Kremin.

The presale announcement also signaled Sotheby’s interest in the Impressionist market this year, which marks the 150th anniversary of the birth of Impressionism. Without any first rank examples, the sale provided a testing ground for the middle-range works where good examples were looking to attract new buyers and double up in price over a 20-year period or less.

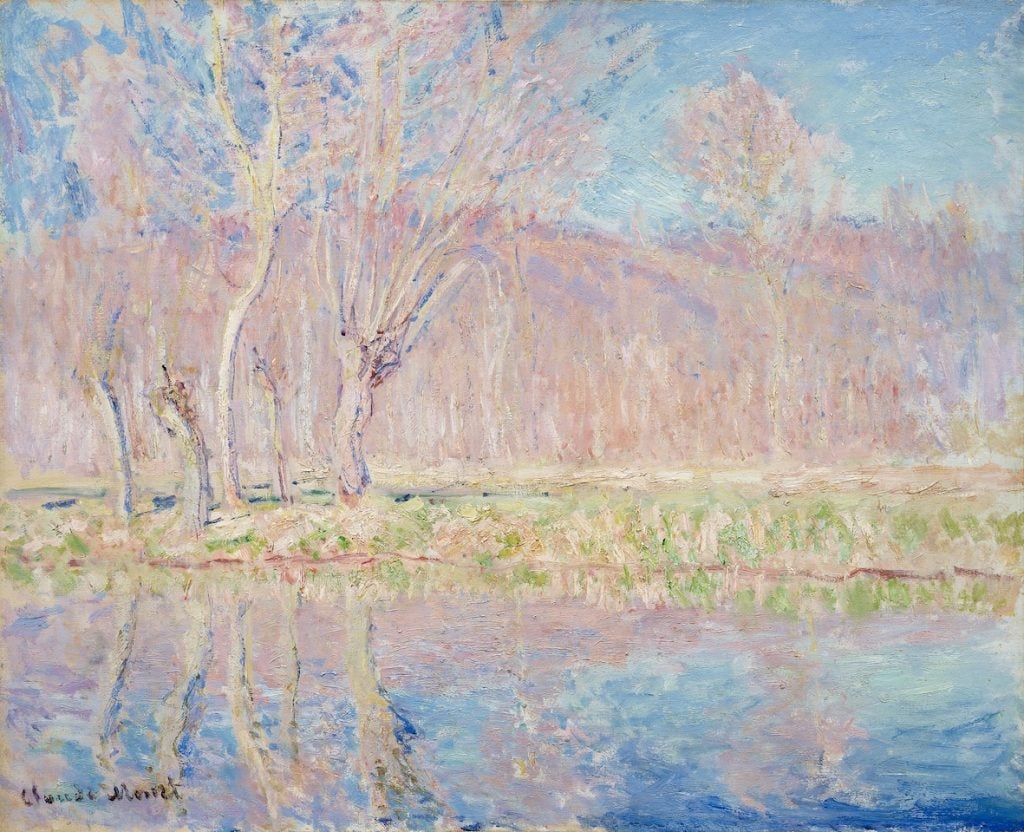

Claude Monet, Arbres au bord de l’eau, printemps à Giverny (1885). Courtesy of Sotheby’s.

In 2006, Monet’s 1893 pastel-colored view of an iced-over Seine, River Seine, Glaçons, environs de Bennecourt, sold for £1.1 million (then around $1.7 million). By 2022, the last time it was at auction, hopes had risen for it to be granted an estimate of £5 million to £7 million ($6.5 million to $9 million), but it did not sell (an event not recorded in the catalog). On its return this week, it was back with a much reduced £2.5 million to £3.5 million ($3.1 million to $4.4 million) estimate, backed by an irrevocable bid, and sold for £3.1 million ($3.9 million).

Another pastel-hued landscape by Monet, Arbres au bord de l’eau, printemps à Giverny (1885) was looking for a rather speedier return having been bought in Paris in 2002 for $2.6 million. Its £5 million ($6.3 million) low estimate more than doubled the previous price and the work easily fetched more than that, selling for £7.7 million ($9.8 million).

A cloudy 1903 view of the Pont Royale by Camille Pissarro, bought in 2018 for £1.4 million ($1.9 million), then seemed to slip by selling to the guarantor below estimate for £1.1 million ($1.4 million).

For the investment minded, Impressionism is not the multiple return market it used to be. A Degas work featuring three dancers bought in 1965 for £20,000 and sold in 1989 to Jose Mugrabi for over £800,000 found a less dramatic return of £1.6 million ($2 million) 35 years later, and the owner of a 1917 Matisse landscape, bought just over three years ago for $746,000 sold for a modest markup of £762,000 ($967,130).

Evidence of active Chinese interest in this market was hard to spot, but a Renoir flower painting, estimated at £2 million to £3 million ($2.5 million to $3.8 million), did fetch its low estimate courtesy of a Chinese buyer who bought the original vase shown in the painting into the bargain.

The best example of the long-term benefits for those who explored Impressionist and Post-Impressionist art in the mid-20th century was a pointillist view of St Tropez, Le Rayon Vert, by Paul Signac which had been bought in 1958 for £6,200 (then $17,360) and was sold by the buyer’s family for £7.7 million ($9.8 million).

The Modern section of the sale was led, predictably, by Picasso, whose musketeer painting, Homme a la Pipe (1964), was the top lot of the sale selling within estimate for £13.7 million ($17.4 million), though the best musketeer paintings have far surpassed that price.

Pablo Picasso, Homme a la pipe (1964). Courtesy of Sotheby’s.

A small Miro gouache from around 1946—Soirée snob chez la princesse, reminiscent of his sought-after constellation series—was one of the top sellers of the evening but had a more complicated provenance than indicated in the catalogue. It had previously belonged to a U.S. collector, Donald Marron, and was offered by Sotheby’s in 2008 but it did not sell as the market was in the doldrums after the Lehmann Brothers crash. It was, however, sold after the auction and appeared on the Nahmad family’s stand at Frieze Masters in 2022—but it didn’t sell there either. Finally, it appeared back at Sotheby’s again, this time with a third-party guarantee and a £5 million to £7 million ($6.3 million to $8.9 million) estimate, selling on a single bid, presumably to the guarantor, for £5.6 million ($7.1 million). It was a reasonable if not remarkable price.

A clutch of Dubuffets from the Bloch collection all sold, but mostly below estimate. Even former Christie’s president, Jussi Pylkannen, attending in his new role as independent advisor, pulled out of the bidding for an L’hourloupe painting, Le Retour du Soldat (1964), as it reached its high estimate at £2.2 million ($2.8 million).

After a string of unsold lots by Kandinsky, Jawlensky, Schlemmer and Fontana, it was only in the last two lots of the sale that Modern competition sprang to life. A 1935 Magritte, Composition on a Sea Shore, sold over estimate for £3.1 million ($3.95 million), and Dancing Balls, a sizable abstract from between 1935–8 by Rudolf Bauer, was pursued by advisor Wentworth Beaumont before selling to a phone bidder well over its £200,000 low estimate and close to a record for £520,700 ($660,872).

It was not a great night for the Dallas collector Howard Rachofsky, who was selling Georg Baselitz’s sombre Zwei Streifen–Werktätiger (Two Stripes–Workman) from 1967, which went below estimate for £482,600 ($614,680).

Alex Katz, Black Hat No. 3 (2010). Courtesy of Sotheby’s.

Overall, American art was thin on the ground but performed solidly. A small Andy Warhol Flowers (1964), which made £456,000 in 2007, managed to elicit some competition to sell on the phone for £1.1 million ($1.4 million). Also reasonably positive was a 1969 oil on card by Cy Twombly that was guaranteed with £1.8 million to £2 million ($2.2 million to $2.5 million) estimate; it sold within estimate for £2.2 million (£2.8 million). The buyer was the London dealer Anthony d’Offay.

A 2010 painting by Alex Katz, Black Hat No. 3—belonging to the London-based couple Maria and Malek Sukkar, whose much respected ISelf collection has been exhibited at the Whitechapel Art Gallery—sold comfortably for £482,500 ($614,500) to a phone bidder, just a hair over its £400,000 high estimate.

The British section saw a strong opening bid for Bridget Riley’s flashy Break (1967) before stalling within estimate at £1.1 million ($1.4 million), and bidding for a Francis Bacon portrait of his lover George Dyer petered out after the guarantor was seen off, ultimately selling for £6.8 million ($8.7 million).

The School of London section saw perhaps the best return of the sale. Frank Auerbach’s Head of EOW 11 (1964)—which is similar to the 1963 painting EOW on her Blue Eiderdown V11 that sold above estimate for £4.5 million ($5.7 million) last June—had been bought in the 1998 Robert Hiscox sale for £67,000 (then $109,000) by the London dealer Ivor Braka on behalf of a client. Estimated to fetch £3 million to £5 million ($3.8 million to $6.3 million) last night, it sold to the guarantor for £4 million ($5 million). No wonder Braka was beaming as he watched.

Leonor Fini, L-envers d’une geographie (1964). Courtesy of Sotheby’s.

Works by historically overlooked women also fared well in the sale. Untitled (Alhalker) (1993) by Emily Kam Kngwarray, an aboriginal artist who is scheduled for a major solo show at Tate Modern in 2025, sold without fireworks to a bidder in the room for £635,000 ($808,000), just below its high estimate. It was the first aboriginal dot painting to be offered in an evening sale of Western Modern art.

Also breaking that evening sale barrier was a painting by Françoise Gilot belonging to Arianna Huffington, whose book on Picasso was the first to really question the artist’s treatment of women. Portrait de Geneviève avec un Collier de Colombes (1944) attracted some heavy U.S. bidding before selling for triple its presale estimate at £723,900 ($ 918,774).

The best return among women artists, however, was for the surrealist Leonor Fini’s L’envers d’une geographie (1964), last sold in 2013 for £76,275 ($115,300) to an American collector. Fini has been long disregarded but is currently enjoying a moment in the sun and this work rose above estimates to fetch £571,500 ($727,910).