Every Wednesday morning, Artnet News brings you The Gray Market. The column decodes important stories from the previous week—and offers unparalleled insight into the inner workings of the art industry in the process.

This week, taking a second look at first principles…

THE ALIGNMENT PROBLEM

Regardless of their chosen medium, most ambitious artists envision their flight to success being co-piloted by a savvy art dealer for one reason above all. Securing representation means the artist can devote maximum time and energy to their creative work, while their dealer handles the murky realm of commerce on their behalf. Most importantly, the artist can have the peace of mind because they know their dealer’s business incentives fit hand-in-glove with their own. There’s little reason to second-guess the dealer’s decisions (or even think much about what they’re doing at all) since what’s good for you, the artist, is good for them, too.

This is a nice story. It even happens to be true a lot of the time. But there are also cases where an artist’s interests and their dealer’s interests can fall out of alignment. In fact, I just dug into one of them last week: resale restrictions. You just wouldn’t necessarily know it because I spent the majority of the column examining how they impacted the relationship between dealers and buyers.

I’m returning to it now because understanding the artist’s relationship to resale restrictions demands that we think through some of the most urgent questions around the industry’s continuing evolution, most notably the extent to which talent’s hand at the bargaining table is growing stronger every day.

When true believers in the art world discuss the concept, you’ll almost inevitably hear dealer-implemented resale restrictions framed as a mechanism to “protect” the artist. Case in point: After recent news of the legal fracas between Paula Cooper Gallery, X Museum founder Michael Xufu Huang, and Huang’s former friend (and kinda-sorta client) Federico Castro Debernardi over an alleged breach of resale covenants, Paula Cooper director Steven Henry portrayed the out-of-court settlements that ended the dispute as evidence that resale restrictions can be “effective tools to help protect an artist’s career.”

Such rhetoric implies that all artists’ careers need “protecting” in the same ways, to the same extent, and for the same reasons. Yet this assumption caves in quickly under scrutiny. And once it does, we get a much clearer view of the market’s shifting topography.

Eniwaye Oluwaseyi, The Breakfast (2020), included in “Say It Loud (I’m Black and I’m Proud).” Courtesy the artist and Destinee Ross-Sutton 2020.

POLAR OPPOSITES

Here’s the thing: the same resale restrictions have different effects depending on whose work they apply to. The most efficient way to see this is to consider artists at opposite ends of the career spectrum.

On one side, curator Destinee Ross-Sutton attached resale covenants to works by the young Black artists featured in the 2020 Christie’s online sale “Say It Loud (I’m Black and I’m Proud).” Marianne Boesky did the same for “Winner Takes All,” a now-on-view group show of fresh voices from Africa co-curated by Amoako Boafo and Larry Ossei-Mensah. Although the exact terms in Ross-Sutton’s agreements almost undoubtedly vary from those in Boesky’s, both sets of restrictions create disincentives for buyers to rapidly resell figurative works by emerging artists of color in a market that has been gonzo for exactly such material for roughly a half-decade.

On the other end of the spectrum, consider Richard Serra. According to the New York Times in 2019, Serra’s sculptures “come accompanied by legal contracts” that prohibit owners from both “moving or altering his work without his permission” and “offer[ing] a work for sale to another collector without offering it to Mr. Serra first.” Again, we don’t know the exact parameters of Serra’s right of first refusal (or RoFR, pronounced “rowfer” among art attorneys). But for the sake of argument, let’s assume that their terms mirror those used by Ross-Sutton and Boesky.

Does Richard Serra, an 82-year-old canonical megastar whose sculptures soar into the millions of dollars on the primary market and are too physically mammoth to be sold at auction regularly, need the same “protection” from profit-hungry private resellers as the early-stage artists whose paintings were priced at $17,000 and under in “Say It Loud (I’m Black and I’m Proud)” and $30,000 and under in “Winner Takes All”?

I think it’s pretty hard to argue in good faith that the answer is yes.

Dealers at all levels of the market generally (and genuinely) want their artists’ work to go to emotionally invested buyers who plan to steward their acquisitions for the long term, and not just because that’s what the artists they represent want too. But from an economic perspective, the main goal of resale restrictions is to prevent self-interested buyers from flooding the secondary market with scarce artworks from in-demand talent and, as a result, crashing their prices.

This is not an outcome a Richard Serra-caliber artist needs to worry about. So what does the right of first refusal attached to his sculptures accomplish? The answer is pretty clearly outsize influence over the ownership and profits of his earlier output. Which is a great outcome for him, and one I would absolutely try to engineer for myself if I were in his position. It just means his resale restrictions are a sword, not a shield.

Richard Serra’s Equal at MoMA in New York. Photo by Cindy Ord/Getty Images.

DIVIDED LOYALTIES

The same principle often applies when dealers are the ones implementing and thus benefiting from resale restrictions for artists with established markets. We can debate exactly how close Cecily Brown—whose $700,000 painting Faeriefeller (2019) became the centerpiece of the Huang-Debernardi dustup (and whose large paintings reliably bring around $2 million or more at auction)—is to Serra in terms of market vulnerability. But it’s indisputable that she’s much nearer to his orbit than to the ascendant young artists I mentioned earlier.

That isn’t to say that Paula Cooper Gallery had anything but Brown’s best interests in mind when it wrote resale restrictions into its agreement with Huang for Faeriefeller. But it does suggest a different set of stakes are in play.

Law professor and artist Brian L. Frye put it to me this way: “The deeper, more profound question is, what are the artists actually getting from resale restrictions? A lot of this is just middlemen negotiating over how to maximize their own return on these transactions irrespective of the interest of the artist whose work is being sold.”

Say, for instance, that a particular resale covenant only dictates that the first buyer of a work has to grant a right of first refusal to the dealer for two years from the invoice date, under penalty of some clearly defined monetary payout. In this hypothetical case, the dealer gets either the opportunity to make a (second) profit on an artwork they’ve already sold, or substantial financial compensation for being robbed of that opportunity.

The artist, however, might get nothing more tangible than the knowledge of where their work will end up and, presumably, peace of mind that the new buyer can be expected to be a “good steward.” That’s not nothing… but it’s considerably less than what the dealer gets in dollars-and-cents terms.

Further torquing this labyrinth is the prospect of a gallery’s loyalties being split between its artist and its top clients. Relationships reign supreme in the art market. Even if a dealer has incontrovertible proof that a given buyer flipped a work by one member of their roster, they might hesitate to sue (or even threaten to sue) if that buyer was also an important, long-term patron of the gallery’s other artists.

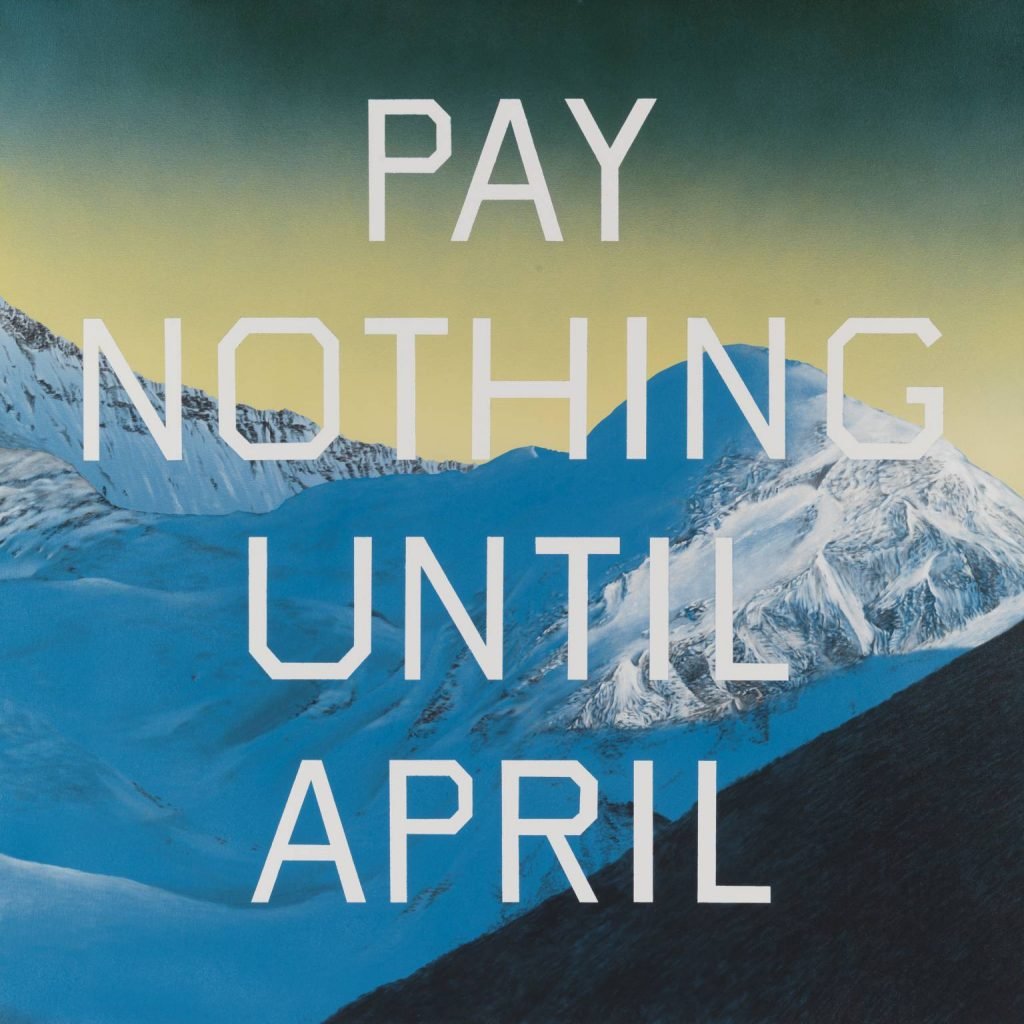

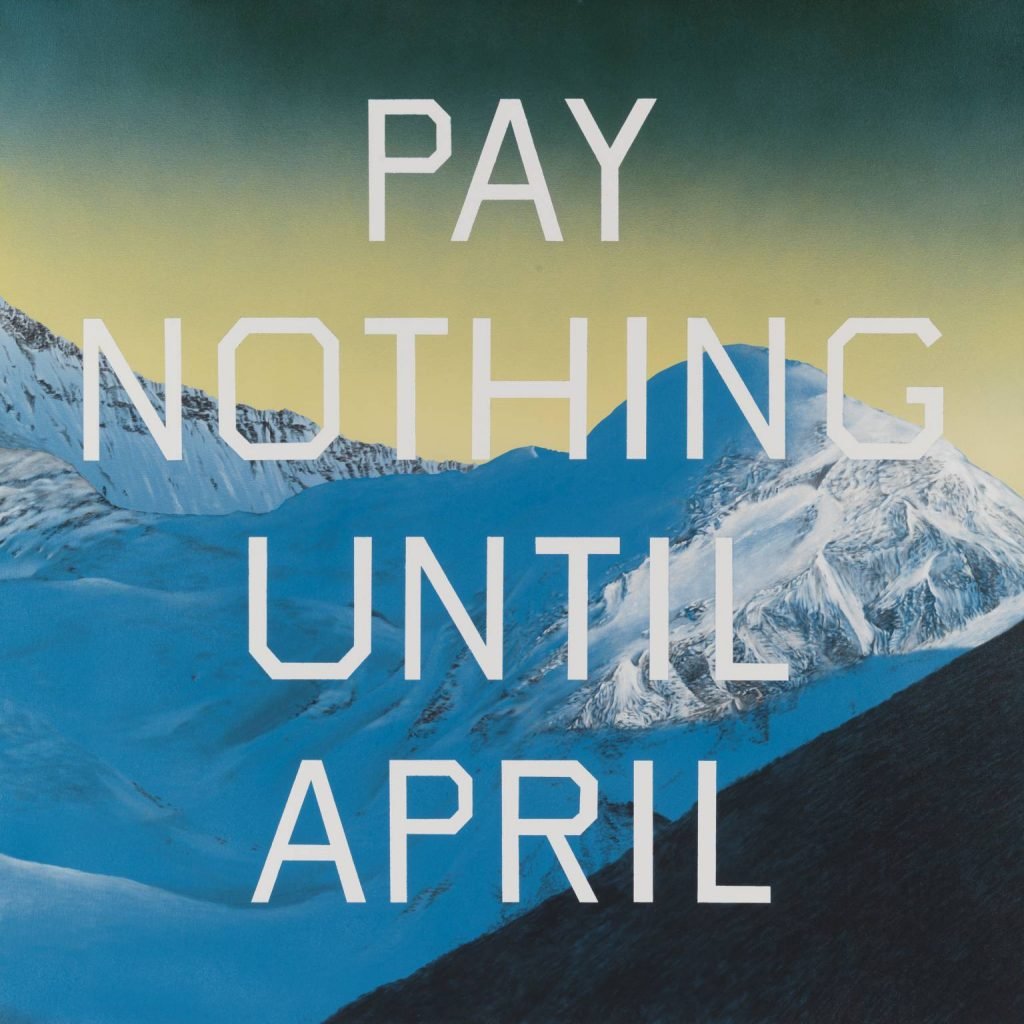

Ed Ruscha, Pay Nothing Until April (2003). © Ed Ruscha, courtesy of Tate.

Yet the agreement between the seller and the buyer is only one component here; the representation agreement between the seller and the artist can be even more important in protecting an artist’s interests (assuming one exists at all). Megan Noh, partner and co-chair of the art law group at New York firm Pryor Cashman, called an artist’s representation agreement with their dealer “a valuable tool in helping to align the incentives of an artist and their gallery as closely as possible, because they are not necessarily aligned automatically in all cases.”

Resale covenants are a perfect example. Suppose the artist has a representation agreement holding that they will be paid a percentage of the proceeds on any work their gallery gets to resell by virtue of the resale restrictions written into its invoices. Suddenly, a dealer-imposed right of first refusal becomes vastly more advantageous to the artist.

Artists can also negotiate being named a so-called third-party beneficiary in the terms of any dealer-imposed resale restrictions. This provision grants the artist, not just the gallery, the right to sue any buyer who breaches the resale agreement. This tweak can take the pressure off a gallery wary of torpedoing its relationship with a buyer, as well as strengthen the disincentives for a buyer to violate the no-flip agreement in the first place. After all, it’s riskier to act a fool if you can be sued by two parties instead of one.

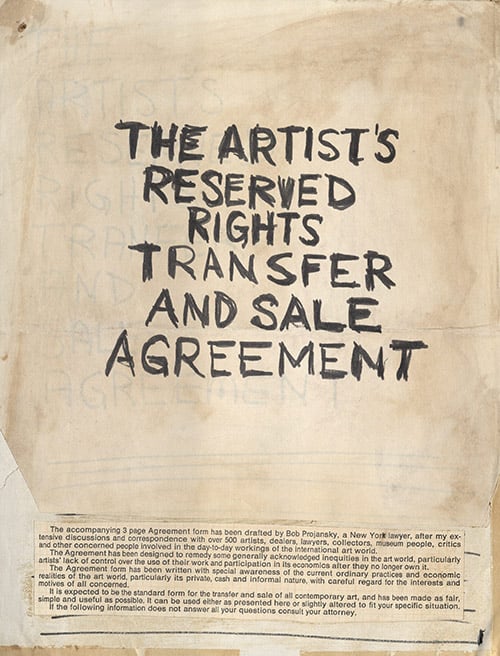

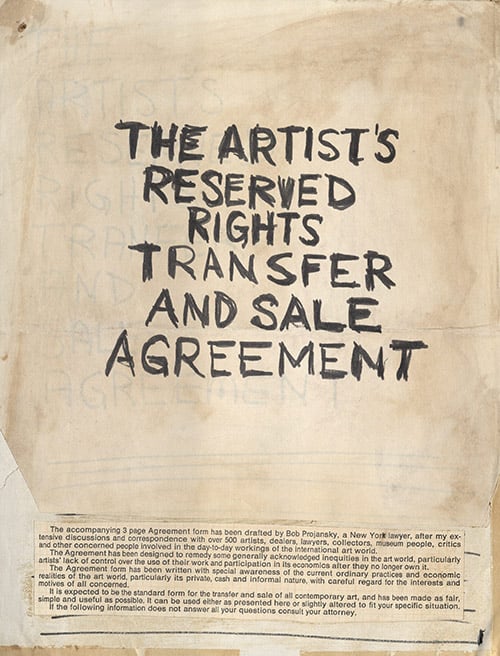

Another possibility is for artists to implement what attorneys call subsequent-purchaser restrictions: legal mechanisms to make the terms (here, the no-flip covenants) agreed to by the first buyer extend to all future purchasers. That can get complicated fast, however. The requirement to accept resale restrictions, let alone to try to impose them on a subsequent buyer, might make a prospective client balk—a problem that has haunted resale covenants ever since the original “Artist’s Contract” drafted by Seth Siegelaub and Robert Projansky in the 1970s, as Frye has written.

Still, getting bogged down in subsequent-purchaser restrictions somewhat misses the point that there are other, relatively simple ways for contracts between artists and dealers to help both parties get what they want. Yet whether and how artists and dealers take this joint step toward resale equity depends on one factor above all: bargaining power.

Mock-up draft of the Artist’s Contract in English (ca. 1971). Image courtesy Museum of Modern Art.

A SEAT AT THE TABLE

Fifty years ago, before creating the Artist’s Contract, Siegelaub told his comrades in the Art Workers Coalition, “There’s a class of human beings who make art, and a class who don’t, some of whom happen to be curators of museums, directors, or museum trustees. This is the way your leverage lies. I would think that by using that leverage you could achieve much greater goals than in any other ways.”

Incidentally, Ross-Sutton echoed this thinking in a panel discussion about resale restrictions last year. Of the requirement for buyers to agree to covenants like those used in “Say It Loud (I’m Black I’m Proud),” she said, “My main effort isn’t to say that it’s possible or impossible to do this, or to control the market from an artist’s standpoint. It’s really to motivate the artists to realize that they have more power than they think they do.”

To me, the art market is increasingly being shaped around this revelation reaching more and more artists at more and more levels of the industry. The modern process arguably began decades ago with the Art Workers Coalition and the Artist’s Contract, then progressed as star artists began commanding a greater share of primary-market sales than the standard 50 percent. (Don Thompson alleged in The $12 Million Stuffed Shark that, by the end of their relationship, Jasper Johns’s split with Leo Castelli was 90-10.)

It has accelerated in recent years with big-name artists such as Richard Prince, Anish Kapoor, and Danh Vō opting to show at certain major galleries without accepting ongoing representation. Resurgent interest in resale restrictions, especially among emerging artists of color (a group that has been exploited by market makers in every creative sector in American history, from music, to film, to visual art, and beyond), advances the concept further.

Some argue that technology is helping artists at all career stages power up to new levels. My ambivalence about NFTs is well documented, but Frye, who was one of the speakers in Tezos’s talks series at Art Basel Miami Beach and remains an active NFT artist himself, is among those making the case for its value in this context.

“NFTs have introduced a more transparent way to sell work without intermediaries and collect royalties on future transactions in a pretty easy and painless way. If that isn’t an existential crisis for galleries, I don’t know what is,” he said.

Crypto isn’t the be-all, end-all of this discussion, of course, but I agree that it is another bell helping to wake up artists to their own value in the 21st century art market. Bargaining with brick-and-mortar galleries for a fair share of resale proceeds is just one more appropriate way for them to flex. More broadly, the sooner the conversation within the industry acknowledges that artists’ and dealers’ interests are not in perpetual lockstep—and that artists can do something very real about that—the better the future can be.

That’s all for this week. ‘Til next time, remember: you never know what you can get until you ask for it.