Auctions

Sotheby’s Is Selling an Eye-Popping Set of Blue-Chip NFTs From the Collection of Failed Crypto Hedge Fund Three Arrows Capital

The auction is the first in a series to sell off the company's digital assets.

The auction is the first in a series to sell off the company's digital assets.

Richard Whiddington

Aside from losing billions of dollars and arguably setting off a crypto winter, cryptocurrency hedge fund Three Arrows Capital also backed a plush portfolio of NFTs, one that founders Su Zhu and Kyle Davies thought would look pretty lit projected in the gallery of their proposed $50 million superyacht Much Wow.

Following the bankruptcy of the Singapore-based fund in July 2022, advisory firm Teneo, Three Arrows Capital’s liquidator, has been tasked with clawing back funds through the sale of NFTs owned by the company.

On April 19, Sotheby’s announced it would host the first part of the process with “Grails,” an auction of nine blue-chip generative digital works that will comprise part of the auction house’s marquee Contemporary and Modern Art sale from May 6 to 20.

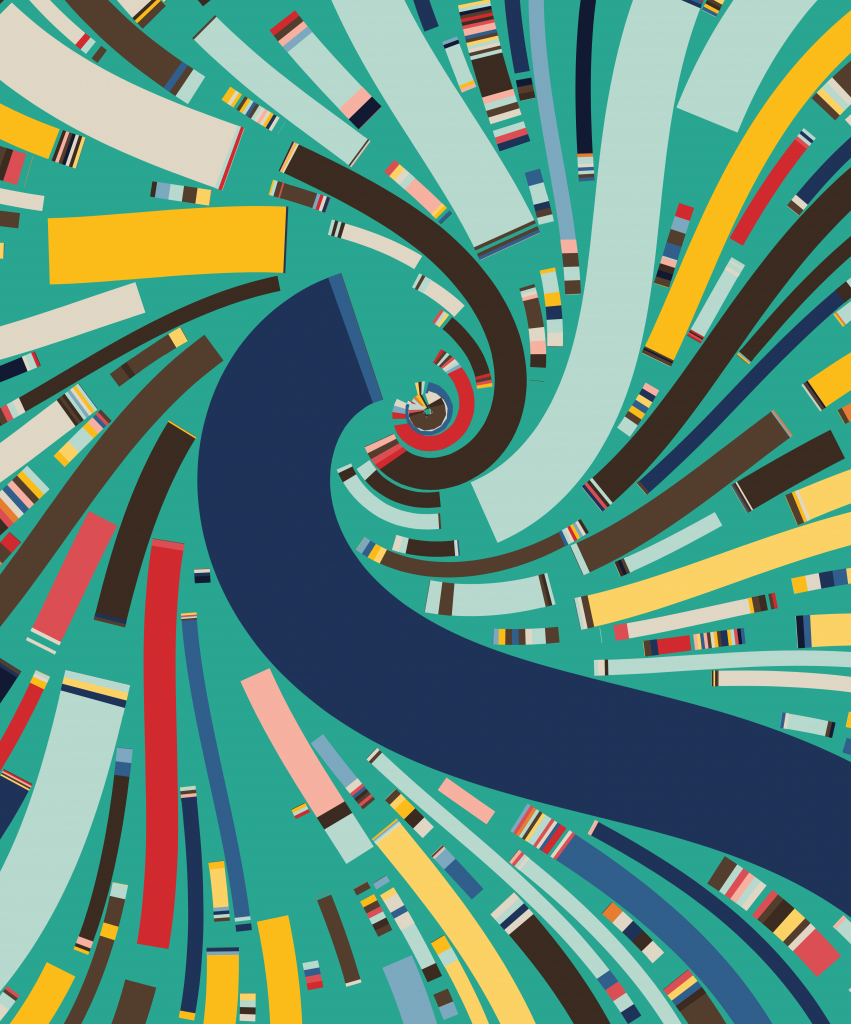

Dmitri Cherniak, Ringers #879 (2021). Photo courtesy Sotheby’s

“We chose to partner with Sotheby’s digital art team because we believe that they bring a best-in-class approach that will ultimately maximize the value of these assets on behalf of all creditors,” Teneo said in a statement to Artnet News. The collapsed crypto fund still owes creditors around $3.5 billion.

Established in 2012, Three Arrows Capital backed a number of high-profile projects including BlockFi and Polkadot, with its founders fronting as brilliant maverick investors. As Zhu and Davies became celebrities in crypto Twitter, they set about amassing an NFT collection worthy of their lofty status. Part of this endeavor involved partnering with renowned NFT collector Vincent Van Dough to launch the Starry Night Capital fund, which promised to assemble “the world’s finest collection of Crypto Art.”

Although NFTs from the so-called Starry Night portfolio will not be on the auction block given ongoing complications surrounding their ownership, the works on sale at Sotheby’s are indeed works befitting the show title “Grails,” which in NFT parlance refers works of historical significance that will hold value.

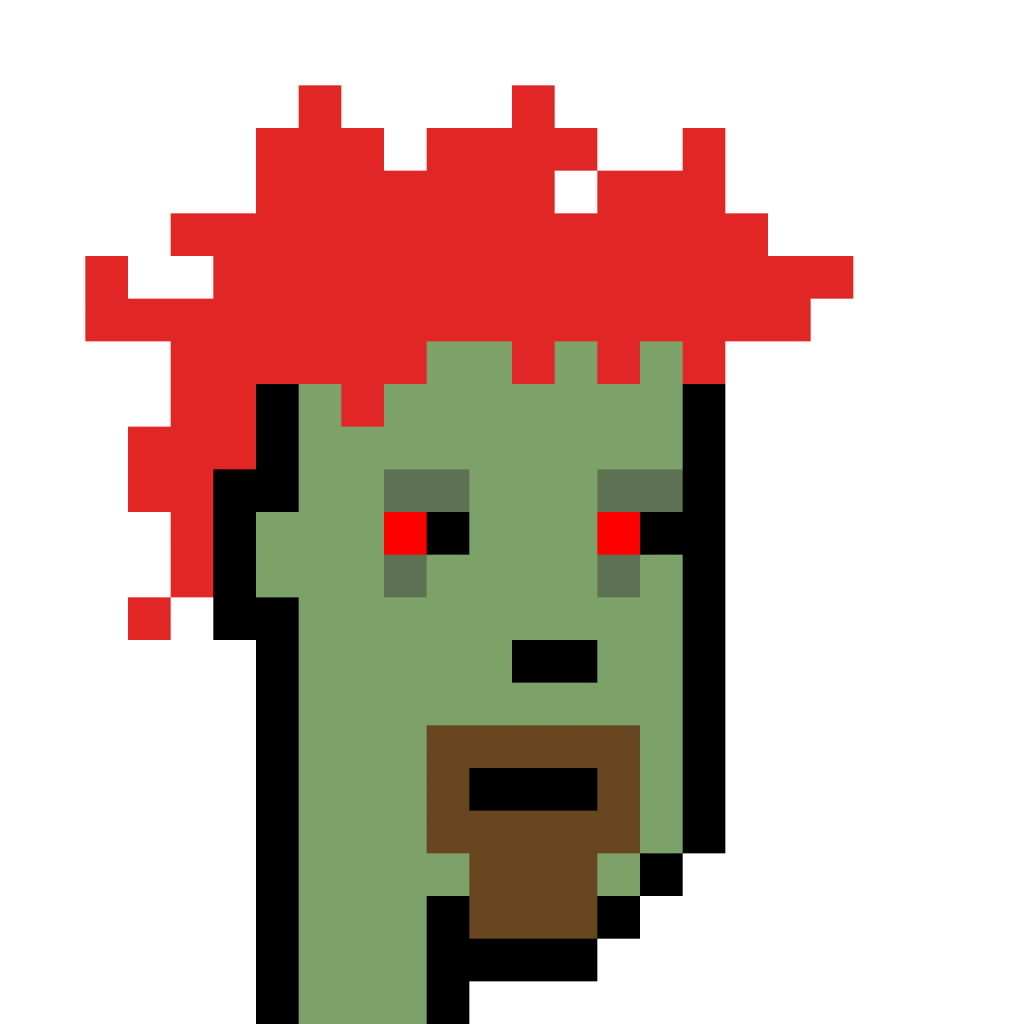

Larva Labs, CryptoPunk #6649 (2020). Photo courtesy Sotheby’s.

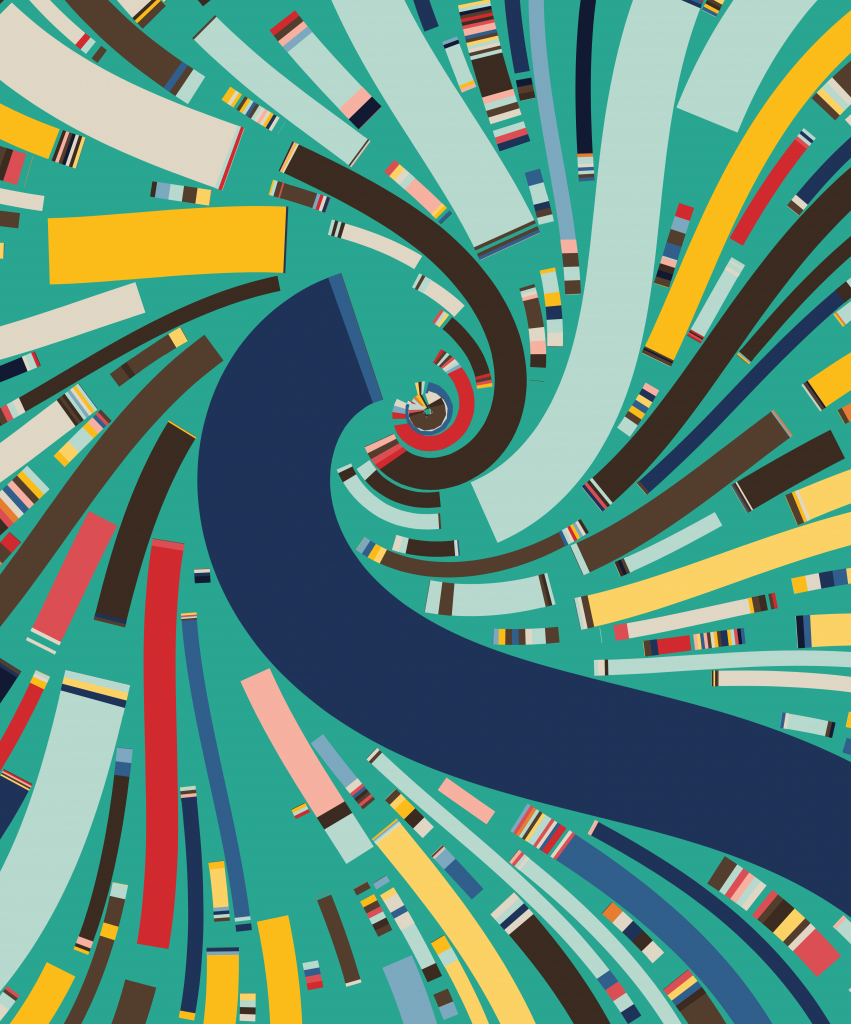

There’s Ringers #879 from Dmitri Cherniak’s series in which the artist devised 1,000 works that capture the infinite ways a string might move around pegs, varying the number of pegs, the sizing, the wrap pattern, and colors. There’s a pair of Fidenza works from Tyler Hobbs’ randomly generated flowfields that are comprised of crooked rectangles. There’s a trio of Sol LeWittt-inspired Autoglyphs works from Larva Labs, with the zombie-like CryptoPunk #6649 thrown in for good measure.

“This expansive collection marks an important moment in the rise of generative art on the blockchain in 2021,” said Michael Bouhanna, Sotheby’s Head of Digital Art and NFTs. “Since that defining moment, when digital art and NFTs became a genuine pop culture phenomenon, generative art has continued to gain attention from a growing audience”

While neither Sotheby’s nor Teneo were willing to offer a sale estimate, the timing of sale, along with the rareness of the works on offer, has the potential to raise millions of dollars.

In February 2023, Teneo published a notice listing the company’s NFTs. More than 300 NFTs were marked green and subject to sale including 30 of Hobbs’ Fidenzas, 17 of Cherniak’s Ringers, and 11 CryptoPunks. Expect a series of sales to roll through the summer.