The Back Room

The Back Room: Up, Up, and Away

This week: inflation's effects on the art market, a painting that can't stop flipping, millions spent on Washington lobbyists, and much more.

This week: inflation's effects on the art market, a painting that can't stop flipping, millions spent on Washington lobbyists, and much more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: inflation’s effects on the art market, a painting that can’t stop flipping, millions spent on Washington lobbyists, and much more—all in a 7-minute read (1,895 words).

__________________________________________________________________________

Andy Warhol’s Front and Back Dollar Bills (1962-63). Photo by Tristan Fewings/Getty Images for Sotheby’s

While the industry’s movers and shakers are out finalizing deals at Frieze, Felix, and other haunts between Malibu and the Los Angeles River, broader economic conditions continue to drive up prices for nearly everything that touches our odd little niche of commerce.

So what, exactly, does the worst bout of inflation in decades mean for the art market itself? Perception and reality are still warring over the answer, as Katya found in a recent column.

The debate hasn’t felt this urgent in my lifetime. The Consumer Price Index, a key inflation metric, just showed its biggest increase in 40 years (up 7.5 percent YOY in January).

The Federal Reserve has signaled an interest-rate hike in March, with the possibility of more to come later in the year. Meanwhile, supply-chain disruptions and a job market brimming with newly choosy laborers often mean consumers are paying more for second-choice goods and worse services.

It’s a confusing mix of inputs and outputs. Thankfully, Katya’s signature blend of research and reporting allows me to sort the inflation-based takeaways for the art economy into two easy-to-grasp categories…

__________________________________________________________________________

Although art’s reputation and (mixed) record as a hedge could continue to boost sales until inflation slows, the downsides of the current market conditions may outweigh the upsides for much of the art industry.

The sell side is bound to pass some of its cost increases along to art buyers, particularly at the lower end of the market where margins are thinnest. Nonprofits will also likely struggle to maintain the status quo, especially since government officials tend to cut funding to arts and cultural institutions during inflationary periods. (New York City mayor Eric Adams’s first proposed budget is a case in point; it would slash spending for every municipal department except the NYPD.)

No matter how the costs and benefits math out, however, one thing is certain: inflation will impact the art business more than the art business can ever impact inflation. So whatever moves you make next, make them with your eyes wide open to the bigger picture.

____________________________________________________________________________

X Museum founder and collector Michael Xufu Huang. Image courtesy X Museum.

Hold onto your bristles for the latest Wet Paint, folks!

Remember Cecily Brown’s Faeriefeller, the painting at the molten core of the red-hot flipping scandal between X Museum founder Michael Xufu Huang, his Monaco-based friend and client Federico Castro Debernardi, and Paula Cooper gallery?

Well, the painting is going back up for sale at Sotheby’s London on March 2—for a much bigger sum than Huang paid. With an estimate of £2.2 million to £2.8 million ($3 million to $3.8 million), it represents as much as a 442 percent markup (!) from its original $700,000 selling price just over two years ago. The listed provenance is a sight to behold, too.

And if you think that’s spicy, just wait until you read what other art-world personalities had to say about Huang’s Instagram apology for the incident. (Sneak peek: the reactions include expletives and the word “dickmatized.”)

Here’s what else made a mark around the industry since last Friday morning…

Art Fairs

The World Photography Organization, which runs Photofairs Shanghai, has bought a 25 percent stake in Photo London. The latter fair’s organizers said the pact would expand their footprint into Asia and offset challenges posed by Brexit and COVID. (Financial Times)

Auction Houses

Galleries

Institutions

NFTs and More

____________________________________________________________________________

© 2022 Artnet Worldwide Corporation.

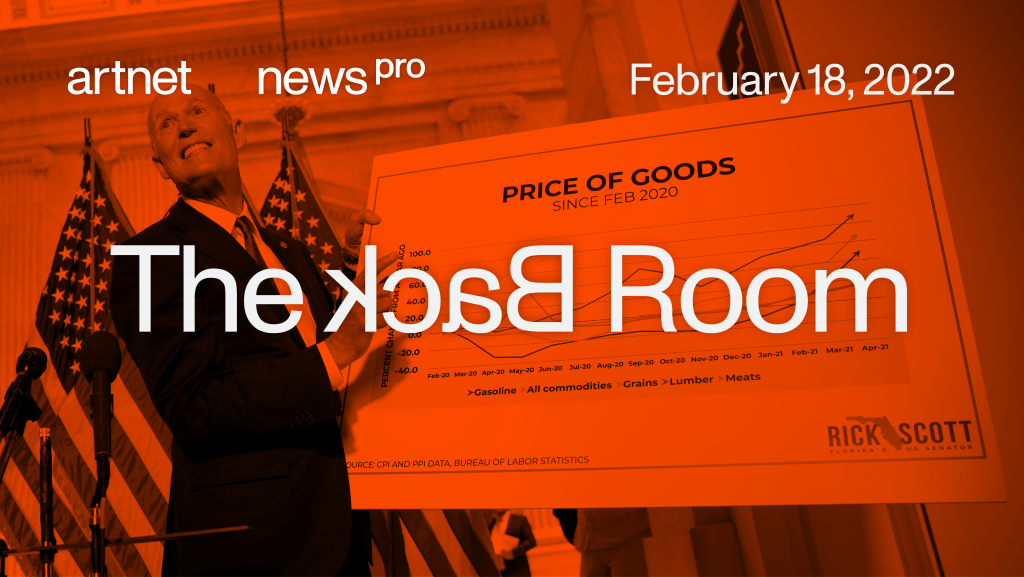

From 2018 through 2021, art businesses cumulatively funneled nearly $2.5 million into lobbying Washington lawmakers, according to my review of public disclosure documents.

For more details, click through for this week’s Gray Market.

____________________________________________________________________________

“Before the auction, he didn’t know anything about Giacometti… I tried to educate him and let him know how important the lot was and why we should have it.”

—Art advisor Sydney Xiong on how a three-hour crash course just ahead of the Macklowe evening sale convinced her crypto-billionaire client Justin Sun to shell out $78.4 million for a prized cast of Alberto Giacometti’s Le Nez (1947/1965). (The New York Times)

____________________________________________________________________________

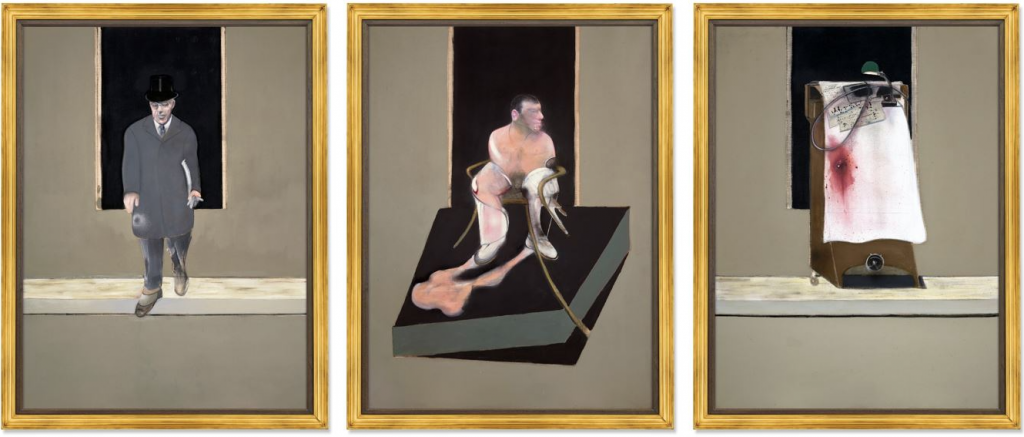

Francis Bacon, Triptych 1986-7. Courtesy Christie’s.

____________________________________________________________________________

Estimate: £35 million to £55 million ($47.3 million to $74.3 million)

Selling at: Christie’s London

Sale date: March 1

A week after Christie’s announced that this eerie Bacon triptych would headline its upcoming 20th/21st century sales cycle in London and Shanghai, Katya unmasked the work’s consignor: starchitect Norman Foster.

It’s “unclear” why Foster is bringing the work to auction now, she writes. But it has apparently been offered privately since the start of the pandemic, according to people familiar with those discussions, at an asking price ranging from $70 million to $100 million.

The triptych is loaded with cryptic political and personal references. The left panel is modeled on a 1919 photo of U.S. President Woodrow Wilson at the talks that produced the Treaty of Versailles, the pact that ended World War I; the right panel alludes to the assassination of Russian revolutionary Leon Trotsky. The central panel, however, hosts an image of Bacon’s then-partner John Edwards, as only Bacon could envision a loved one.

The artist’s triptychs have done big numbers under the hammer in recent years. The last one offered to bidders was Triptych Inspired by the Oresteia of Aeschylus, which became the top-selling work of 2020 by wringing $84.6 million out of none other than Sotheby’s owner Patrick Drahi. Seven years earlier, Christie’s New York sold Three Studies of Lucian Freud for $142.3 million, still the artist’s auction record today.

The final price for this latest triptych is anyone’s guess. But Christie’s has already secured a third-party guarantee for the lot, ensuring that Foster won’t come away empty-handed again.

(Representatives for Foster didn’t respond to emails and calls seeking comment. Christie’s declined to comment.)

____________________________________________________________________________

With contributions by Naomi Rea.