Market

Thomas Galbraith’s TEFAF Presentation on Top Performing Artists: Part Four of Four

An artist’s exhibition history does correlate with his or her market performance.

An artist’s exhibition history does correlate with his or her market performance.

Thomas Galbraith

In part one and part two of my presentation, I explained the artnet Index methodology and spoke about sales volume and sales value for top performing artists. In part three, I discussed how the markets for specific artists can be manipulated. This week, in the final part of my presentation, I will speak about the correlation between an artist’s exhibition history and his or her market performance.

Identifying high reward investments early on, while mitigating the high risk associated with them, is a difficult task. One such indicator of reward investments can be exhibitions. We can track our chosen top performers against their exhibition history, and look at some of their contemporaries who saw mixed success in comparison, in an attempt to identify the early stages of a trend.

This is by no means revolutionary, and as with any model, there remain risks. Though as previously discussed, there are many forms of information that can be gathered to aid the decision making process. One may argue that there is a fundamental relationship between increases in exhibitions and sale prices or performance.

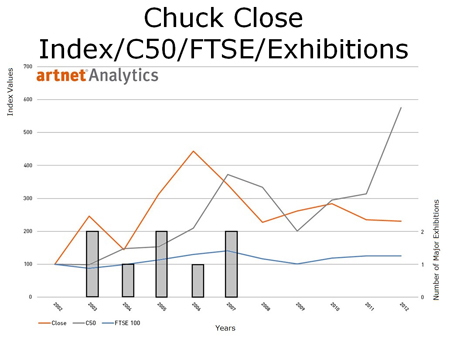

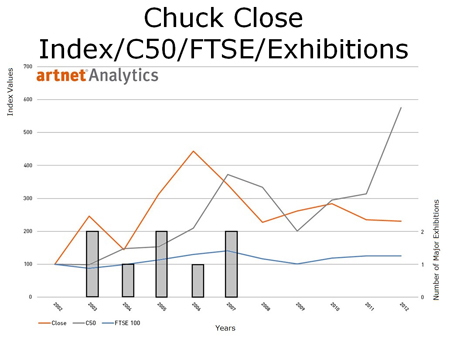

When looking at the same artists I discussed earlier in my presentation, Chuck Close (American, b.1940), Gerhard Richter (German, b.1932), and Andy Warhol (American, 1928–1987), there are the beginnings of a discernible correlation between exhibitions and sale prices or performance. For the purposes of this presentation, I only included major exhibitions, single artist retrospectives, and prominent group shows with a primary focus on our selected artists. My analysis consisted of exhibitions that were held at museums or galleries and achieved international attention.

The results indicate a lagged correlation between exhibitions and sales, best demonstrated by Close and Richter. Warhol is somewhat beyond this as his market was already well internationally established by 2002; he was no longer an emerging artist at this time.

Throughout this presentation, we’ve analyzed what makes a top performer. But, as has been shown, though there might be patterns, there is no secret algorithm or formula to predict an artist’s market performance. It takes due diligence and hard work to determine which artists are worth investing in.

By taking into consideration all of the metrics we have examined, it is possible to begin identifying a list of top performers, and to start to extracting trends for which artist may be next ordained. However, despite the best efforts of some, there will always be an element of risk.

To learn more about the artnet Index generation system and the calculation involved, read the complete artnet Indices White Paper.

Create your own Analytics Report.