Artnet News Pro

A No-Nonsense Accounting Shows That Last Week’s $1.6 Billion New York Fall Auctions Were… Kind of a Dud

It's fair to say a correction to the speculative bonanza has arrived.

It's fair to say a correction to the speculative bonanza has arrived.

Tim Schneider

This post is adapted from Artnet News Pro’s members-only newsletter, the Back Room. If you don’t yet subscribe, you can do so here.

The state of the auction trade only lends itself to consensus opinions when everything seems to be selling at high prices, and when nothing seems to be selling at all. The rest of the time, it’s an eye-of-the-beholder market, and this past week planted us firmly in an in-between place.

The Allen Collection, which hit the block on November 9 and 10, was a clear runaway success—at $1.6 billion, it was the priciest collection of art ever sold. But the last week brought a cluster of regular-programming sales at the Big Three houses. And that’s where things became a bit harder to evaluate.

Were the overall results a sign of resilience, or of trouble ahead? Have tastes changed definitively, or has the youth frenzy just cooled a bit? Did top lots fail to ignite bidding wars more because of waning desire among buyers, or because of canny risk management by the houses?

You could credibly argue either side of any of these binaries. The one point on which all positions converge, however, is that the market has come off the highest speculative highs of the past year.

Below are three key takeaways to add dimension to this blunt truth.

Our favorite way to judge any auction’s overall health is to compare its total hammer price to its total presale estimate. It’s the most “apples to apples” method, since presale estimates exclude premiums. (And no, we don’t revise the estimate downward based on last-minute withdrawals, because those are essentially passed lots.)

So, how did Sotheby’s, Christie’s, and Phillips do this week? Of the seven evening sales, the hammer totals in five missed their aggregate low estimates.

The two success stories both belonged to Sotheby’s:

The two wobbliest results both came at Christie’s on Wednesday:

If you’re wondering, Phillips’s 20th century and contemporary evening sale missed its low estimate by just $2.8 million; Sotheby’s contemporary evening sale missed by $13.8 million; and Sotheby’s Modern evening sale missed by $17.2 million.

So, how did this happen?

Andy Warhol, White Disaster (White Car Crash 19 Times) (1963). Courtesy of Sotheby’s.

The good news is that the vast majority of works estimated to sell for $10 million or more found buyers. The mediocre news is that only a few of them soared above expectations. The bad news is that some others were withdrawn or bought in.

Case in point, here’s a roundup of the performance of five lots with the highest presale expectations.

There’s more where those came from, but you get the idea.

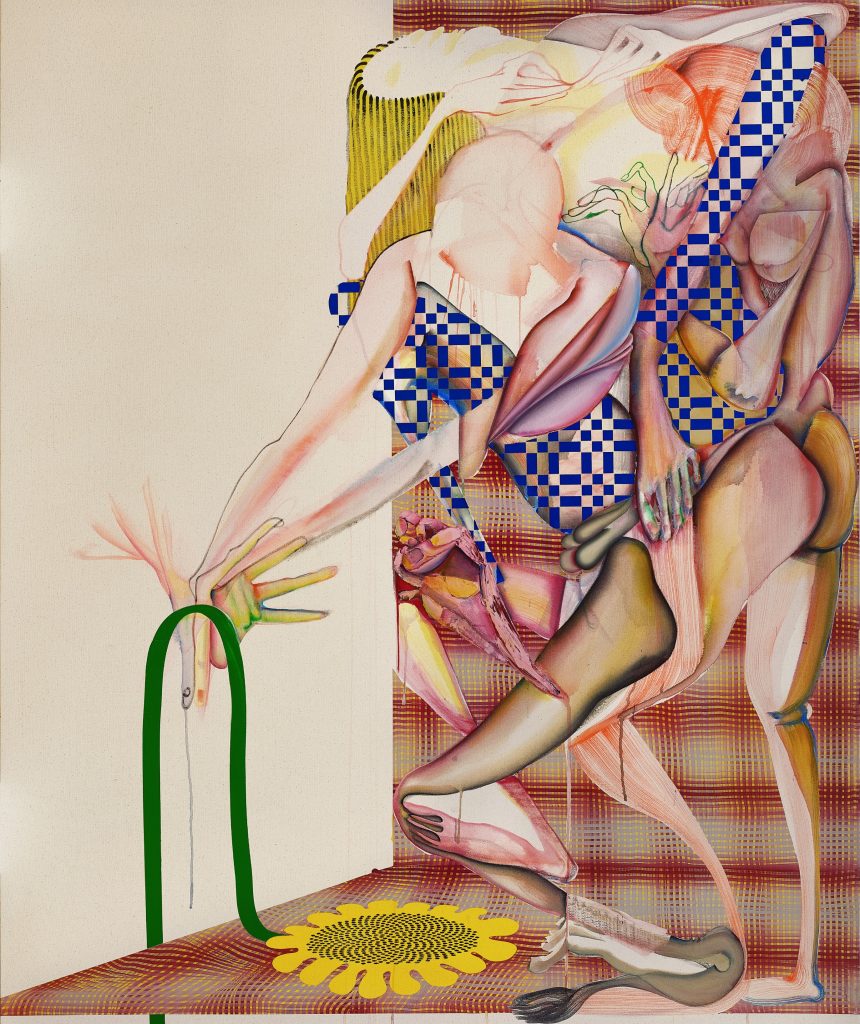

Christine Quarles, Bits n’ Pieces (2019). Courtesy of Sotheby’s.

It would be going too far to say that every hot ultra-contemporary artist saw a major decline in their auction prices this season, as a few examples prove.

Both Salman Toor works on offer hammered at more than three times their high estimates; both María Berrío lots crossed $1.2 million after fees; and both paintings by Lucy Bull hammered for more than double their high expectations, landing near or above $500,000.

But several other rising stars leveled off or lost altitude to an extent worth noting.

Two of the week’s three Anna Weyant lots landed within her rumored primary price range of $350,000 to $600,000. One of two lots by Christina Quarles hammered at $480,000, on the lower side of its estimates (and considerably lower than primary prices for her most recent show at Hauser & Wirth, which crested at $1.2 million). Paintings by market darlings Amoako Boafo, Nicolas Party, and Avery Singer were won on bids beneath their low expectations. One of two Amy Sherald canvases at Phillips failed to sell.

Maybe that doesn’t sound like much. But remember, eight artists aged 40 or younger cracked $1 million in the May auction cycle, including Quarles ($4.5 million) and Singer ($5.3 million). Toor was the only new artist from that group to join the seven-figure club this time out.

Say hello to gravity.

It’s surprisingly easy to forget that this week’s auctions had the unenviable task of trying to woo buyers only a few days after Christie’s sold $1.6 billion worth of Paul Allen’s art. Pretending that historic bonanza would have no ripple effects on the rest of the auction cycle would be naive at best.

Even so, is there evidence that the art market is tailing off amid wider economic turmoil? Yes, but it’s important not to overreact, too.

Many veterans of generation-defining economic crises are instinctively (and understandably) bracing themselves for calamity. Yet contractions in the trade vary in severity. So far, it looks a lot more like we’re entering a correction, not tipping into a death spiral.

Things could feel different by the close of Art Basel Miami Beach in 12 days. Until or unless they do, though, keep in mind that no high lasts forever—and not all downturns mean across-the-board doom.