The Appraisal

Can Anselm Kiefer’s Auction Market Ever Catch Up to His Work’s Monumental Ambitions?

We took to Artnet's Price Database to find out.

We took to Artnet's Price Database to find out.

Naomi Rea

No one has ever accused Anselm Kiefer of having too light a touch. He’s one of few painters whose bravado can truly meet the setting of one of Venice’s grandest buildings, and Kiefer’s monumental charred canvases in the cavernous Sala dello Scrutinio at the Palazzo Ducale were a talking point during the Venice Biennale.

The desolate painting-cum-sculptural assemblages incorporate inspirations from the Italian masters who filled the space before him. Drawing on other histories, from ancient mythologies to the traumas of the Holocaust, the works become metaphors for more recent horrors, such as the refugee crisis and the war unfolding in Ukraine.

Even though the this year’s biennale aimed to interrupt the idea of the white man as the center of the artistic universe, a Financial Times critic dubbed Kiefer “the man of the moment” in Venice.

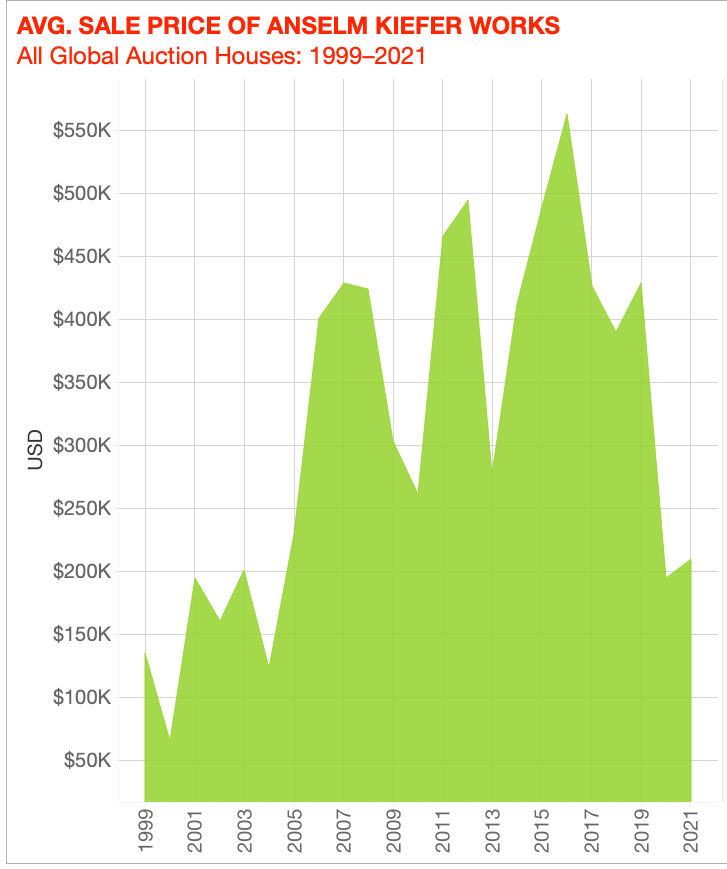

All this is to say that the art world is abuzz about Kiefer. But can his share of the market ever match the monumental scale of his canvases? We dug into the Artnet Price Database to find out.

Auction Record: $4 million, achieved at China Guardian Auctions Co. in June 2019.

Kiefer’s Performance in 2021

Lots sold: 32

Bought in: 8

Sell-through rate: 80 percent

Average sale price: $209,558

Mean estimate: $184,975

Total sales: $6.7 million

Top painting price: $1.1 million

Lowest painting price: $69,300

Lowest overall price: $10,478, for a collage of ashes and lead on digital photographs, from an edition of 150

© 2022 Artnet Worldwide Corporation.

The lack of supply of top examples of Kiefer’s work to the secondary market means that auction data can only tell us so much. The scale of much of the work—the artist resists making what he calls “sofa paintings”—means that it is most at home in museums, which are unlikely to deaccession. Meanwhile, his galleries have done a good job of controlling supply to the auction market, and having works that are resold come back through the galleries privately, and consequently keeping the secondary market relatively illiquid.

Kiefer’s market story is not unlike that of Robert Rauschenberg, whose market we looked at a few weeks back. While Rauschenberg was undoubtedly a key American artist and one of the 20th-century greats, for decades his marked lagged behind peers like Warhol, Lichtenstein, Rosenquist, and Johns. The reason being that while important works were being sold privately, the auction market was slow to come up with a real masterpiece. All it takes is a single quality painting offered at auction—for Rauschenberg that was an $89 million silkscreen from a prime year that hit the block in 2019—to change that market story.

For Kiefer’s auction market, that moment might still be a ways off. While there is some good stuff coming up—a Kiefer woodcut being offered as part of the Macklowe collection sale in New York could set a record for a woodcut, and there is a monumental 1982 landscape coming up in a Sotheby’s evening sale—anything of the caliber that would upend the public narrative has yet to appear on the auction horizon.