The Back Room

The Back Room: From Paris to the Pacific

This week: Art Basel takes France, Kusama wins the volume game, Christ returns (to auction), and much more.

This week: Art Basel takes France, Kusama wins the volume game, Christ returns (to auction), and much more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: Art Basel takes France, Kusama wins the volume game, Christ returns (to auction), and much more—all in a 7-minute read (1,983 words).

__________________________________________________________________________

With Paris’s Grand Palais closed for renovations until 2024, FIAC will be held at the temporary Grand Palais Éphémère and Galerie Eiffel, both designed by Jean-Michel Wilmotte to mimic their namesake monuments on the Champ-de-Mars. Photo ©Wilmotte et Associés.

After several years of adversity, Art Basel and MCH Group are once again expanding aggressively—and the global art landscape may never be the same.

On Wednesday, we learned that Basel will debut a Paris fair this October, after effectively ousting FIAC from its long-held slot at the Grand Palais. This seismic news arrived only days after Basel’s parent company announced it had reacquired a minority stake in Art SG, the long-promised expo in Singapore.

Although the former is a far bigger story than the latter, it’s important to view each move in the context of the other. Let’s sprint through what we know about them separately before charging toward the holistic picture.

Art Basel Goes to Paris

Back Story: In December, the Grand Palais “blindsided the Paris art world” (in my colleague Kate Brown’s words) by issuing an open call for events that would compete with the RX France-owned FIAC and Paris Photo. After learning the call was sparked by an offer from an unnamed rival, RX France sued the venue’s operator, the Réunion des musées nationaux–Grand Palais (RMN–GP), to try to enforce a written agreement confirming FIAC’s control of the October 2022 slot, and to freeze the solicitation of competing proposals.

Mystery Solved: Art Basel global director Marc Spiegler told Kate this week that Basel had expressed “an interest” in the Grand Palais’s October slot in November 2021. RMN–GP officials asked Basel to send a letter of intent, leading to the sudden open call.

Outcome: RMN-GP now holds seven-year contracts with Art Basel for its October dates, and with RX France for Paris Photo’s November dates. Both fairs will take place at the temporary Grand Palais Éphémère in 2022 and 2023, then shift to the renovated Grand Palais from 2024 through 2028. (Paris Photo director Florence Bourgeois said RX France was “not at the stage of having a Plan B” regarding a replacement venue for FIAC.)

What Next: An RMN-GP press release stated that Art Basel will bring “robust investment” to Paris and build out a locally based team. Art Basel signaled plans to “build bridges” with France’s fashion, music, and other cultural sectors, plus work closely with Parisian institutions to create a wider program around its fair.

Juiciest Gossip: Parisian dealer Michel Rein relayed speculation that Art Basel’s move into Paris could be a prelude to MCH Group being acquired by French luxury-goods conglomerate LVMH (which denied the rumor).

Takeaways: Art Basel will now stage fairs in four global art cities only a month after chief rival Frieze begins doing the same (via the inaugural Frieze Seoul in September). The move also beefs up the blue-chip art industry in Paris, where dealers like David Zwirner and Thaddaeus Ropac have recently expanded, and private foundations like the Bourse de Commerce, Lafayette Anticipations, and the Louis Vuitton Foundation have bloomed.

Meanwhile, Parisian dealers are torn between hope and fear over what the globalist surge will mean for the distinctive character of the local scene…

MCH Group Returns to Art SG

Back Story: In 2016, MCH Group acquired minority ownership in ART SG as part of a larger expansion into regional art fairs. But the company pulled out of the deal in 2018—one year before Art SG’s planned debut—while revealing that it would also divest its 50 percent stake in the India Art Fair and its 25 percent stake in Art Düsseldorf.

Reversal: On Monday, MCH Group announced it was buying back into Art Events Singapore, the company behind ART SG, taking a 15 percent stake.

What Next: My colleague Vivienne Chow relayed that MCH will have a “board-level presence” at Art Events Singapore and “will lend professional support to [Art SG] behind the scenes.” This should help ensure that the fair’s inaugural edition (finally) happens as (re)scheduled in January 2023. Nearly 100 galleries including Victoria Miro, White Cube, and Gagosian are already signed up.

Takeaways: After its 2018 portfolio purge, MCH Group has only gotten involved with new regional art events in one area: East Asia—and even then, only in a measured capacity. Masterpiece London (which MCH acquired in 2017, and has held onto) began a “long-term partnership” with the Hong Kong-based Fine Art Asia fair in 2019. Last year, Art Basel also became a strategic consultant for Art Week Tokyo and Singapore’s S.E.A. Focus.

Reacquiring a minority stake in Art SG is a somewhat bolder move, but still keeps MCH’s complementary interests contained to the Pacific, the art market’s primary growth engine of late. Perhaps the 2010s taught the company a lesson about overextending itself…

__________________________________________________________________________

After establishing itself as the global leader in high-culture trade fairs by 2018, MCH Group endured at least four consecutive years of strife. The turmoil included large-scale exhibitor defections and executive attrition at its primary moneymaker, the Baselworld watch fair; the aforementioned near-total retreat from regional art fairs; the quick cancellation of an experimental $15,000-per-ticket conference in Abu Dhabi; financial troubles that endangered its live-marketing business; and the event cancellations and staff layoffs caused by COVID.

This week’s moves mark an inflection point for MCH Group, Art Basel, and perhaps the fair sector overall. They aren’t just the first outward results of the up-to-$80 million investment in MCH Group made by James Murdoch’s Lupa Systems. They are also serious signs of confidence that we are once again on the cusp of live events being a consistently safe, lucrative business worldwide.

If more industry players believe the same, we could be in for more transactions that further consolidate the fair sector among the biggest winners. Even if not, the next year just got a lot more hectic.

____________________________________________________________________________

An untitled Cindy Sherman work from 2007–08. (Photo by Eric VANDEVILLE/Gamma-Rapho via Getty Images)

In the latest Wet Paint, the shape-shifting Cindy Sherman decried a bizarre scammer who has been catfishing people as “the CEO of Cindy Sherman Photography” (which does not exist!).

Plus, pop star Dua Lipa is building a legit collection, with Blum & Poe confirming that a large canvas hanging behind her desk is by New York-based painter Eddie Martinez.

Here’s what else made a mark around the industry since last Friday morning…

Art Fairs

Auction Houses

Galleries

Institutions

NFTs and More

____________________________________________________________________________

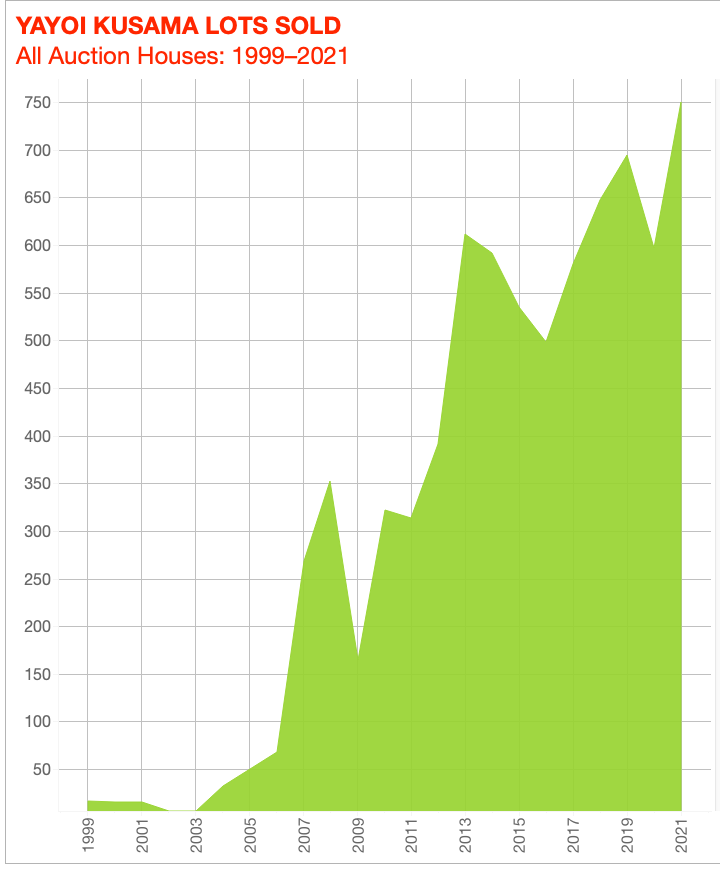

© 2022 Artnet Price Database and Artnet Analytics.

Bidders pushed works by Yayoi Kusama to an all-time high by value in 2021, mostly by buying “a large number of lower-priced works rather than a handful of trophy lots,” Naomi wrote in the latest edition of our new data-led franchise, The Appraisal.

Weirdly, Naomi noted, this means Kusama’s auction market behaves more like that of KAWS or Banksy than of peers like Brice Marden or David Hockney.

____________________________________________________________________________

“We were going to put Dick Milking Factory to work, milking yield… The joke is how much money we are making on this.”

—Crypto entrepreneur and NFT collector Ryan Zurrer, explaining his family office’s latest financial coup: borrowing and reinvesting $750,000 in U.S. dollars against the Beeple NFT Dick Milking Factory, whose central subject Katya memorably described as “an erect, rocket-size penis supported by a pair of giant testicles and catered to by testicle-tickling elephants.” (Artnet News Pro)

____________________________________________________________________________

Sandro Botticelli, The Man of Sorrows. Image courtesy Sotheby’s.

____________________________________________________________________________

Estimate: $40 million

Sold for: $45.4 million

Sold at: Sotheby’s New York

Sandro Botticelli’s The Man of Sorrows lacked the suffocating hype of Salvator Mundi, whose $450.3 million price likely makes it the Jesus artwork to beat all Jesus artworks at auction forevermore. But it’s fair to wonder whether the former was a colossally better value for the money than the latter.

Backed by a house guarantee and an irrevocable bid (and also blissfully free of controversies over its attribution and conservation), The Man of Sorrows incited a seven-minute paddle battle at Sotheby’s “Master Paintings and Sculpture” sale in New York yesterday. It hammered at $39.3 million, just below its unpublished estimate, then rose to $45.4 million with fees. That’s about half the record $92.2 million paid for Botticelli’s Young Man Holding a Roundel at Sotheby’s last January—and less than one-tenth the final price of the alleged “Last Leonardo” in 2017.

Still, the result is a gargantuan windfall for the consignor of the Botticelli, who acquired The Man of Sorrows at Sotheby’s London in 1963 for just £10,000 (about $28,000 at the time). No word yet on the new owner’s identity. But unlike Salvator Mundi, at least if this Christ portrait eventually returns to market, they won’t need a miracle to turn a profit on the investment.

____________________________________________________________________________

Additional contributions by Naomi Rea.