The Back Room

The Back Room: Corporate Temptation

This week: Art Basel's golden boy joins an enemy encampment, Banksy’s extraordinary auction rise, NFT scammers target the art world, and much more.

This week: Art Basel's golden boy joins an enemy encampment, Banksy’s extraordinary auction rise, NFT scammers target the art world, and much more.

Naomi Rea

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy. This week, Artnet News London editor Naomi Rea steps in for your usual scribe, Tim Schneider.

This week in the Back Room: Art Basel’s golden boy joins an enemy encampment, Banksy’s extraordinary auction rise, NFT scammers target the art world, and much more—all in a 7-minute read (2,033 words).

_______________________________________________________________________________________

Noah Horowitz. Photo by John Sciulli/Getty Images for Art Los Angeles Contemporary.

Art-world denizens were shaken by the revelation last month that Noah Horowitz, Art Basel’s director of Americas, who had been a favorite to succeed the fair’s global director Marc Spiegler, was resigning “to pursue other opportunities.” This week, Sotheby’s confirmed that it had welcomed him into the fold. Here’s why this bit of professional news has big implications.

First, the basics.

Now, the context.

Finally, the challenges.

O.K.—it doesn’t not make sense.

_______________________________________________________________________________________

Horowitz could well persuade dealers that a collaboration is a win-win opportunity. Galleries—especially those that cannot afford to build out their own digital infrastructures or follow the money to the Hamptons—can reach a broad audience and secure fast sales while the house earns a flat commission.

Still, you probably don’t need me to tell you that there’s no such thing as a free lunch. Regardless of how the commission works, client data is the currency that matters in the long game, and without demanding transparency, participating galleries will end up locking themselves out of the system. (Sotheby’s is far from the only business that recognizes the value in data: the David Zwirner-backed Platform also keeps this information close to the vest, citing privacy laws.)

This dynamic could play out like Amazon or the Apple App Store: a large company offers itself up to smaller ones as a funnel for business, which seems like a great idea—but the power differential is so vast that the junior vendor ultimately becomes reliant on the corporation as a middleman. (Fairs, of course, serve a similar role—but at least they don’t keep visitors from signing your contact book.)

It seems to me that the future of the art market will be less about distinguishing between the type of seller—auction house, fair, gallery—and much more about big, multi-faceted art businesses crunching on the bones of their smaller counterparts. The question is whether it’s feasible for the little guy to give up a short-term boost in exchange for the potential for bigger profits down the road. And that’s a decision I’m very glad I don’t have to make myself.

_______________________________________________________________________________________

Wet Paint will arrive later today, but here’s what made a mark across the industry in the meantime…

Art Fairs

Art and design fair PAD London pulled the plug on its fall edition.

Auction Houses

TR Lab, the Hong Kong company founded by Christie’s exec Xin Li-Cohen and Wendi Murdoch, will hold an NFT art auction in September (Cai Guo-Qiang will drop his second NFT project with the company on September 3).

Galleries

Adam Sheffer has left his job as vice president of Pace Gallery.

Art dealer Ernst Jockels will appeal his jail sentence for allegedly selling fake works by Zero artist Günther Uecker and neo-expressionist A.R. Penck.

Von Bartha will open a new gallery in Copenhagen this winter.

Antwerp galleries DMW and Base-Alpha have joined forces to open a new joint venture, Ballroom Gallery, in Brussels in September.

Also in September, Nathalie Obadia is opening a new gallery in Paris‘s eighth district.

Institutions

Vivian Crockett will join the New Museum in New York as curator in January.

Tracey Emin said she wants her new Margate studio to become a museum after she dies.

The Smithsonian has named members of its new advisory council for planning the forthcoming American Women’s History Museum in Washington, D.C.

Brooklyn Museum workers have voted to unionize.

NFTs and More

Beeple bought one of Urs Fischer’s “Chaos” NFTs from digital marketplace MakersPlace for around $144,000, more than the original sold for on former Christie’s rainmaker Loïc Gouzer’s Fair Warning app.

Financial services firm Visa snapped up a $150,000 Crypto Punk and the vote of confidence sparked an NFT market rush.

_______________________________________________________________________________________

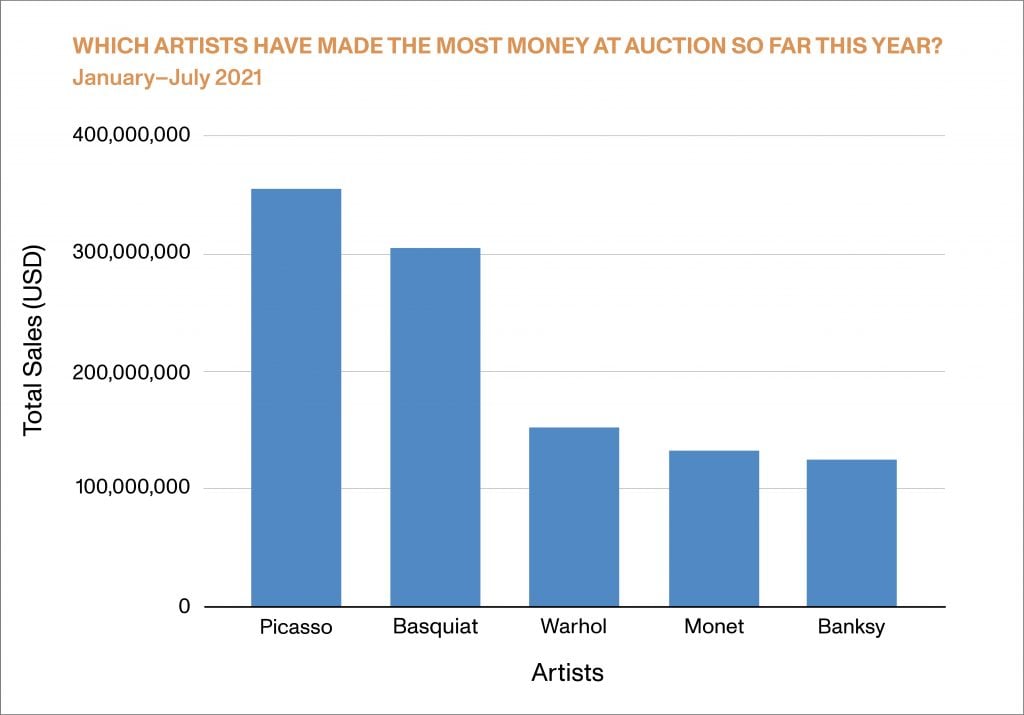

© Artnet Price Database and Artnet Analytics 2021.

Julia Halperin broke out who’s up and who’s down on the list of top-selling artists at auction so far this year.

Buoyed by the return of heavy-hitting trophy works to the block, a lineup of usual suspects—Picasso, Basquiat, Warhol, and Monet—occupies the top four spots.

More unusual, although not, strictly speaking, surprising, is that the art market’s most anonymous darling, Banksy, has cracked the top five for the first time, generating a whopping $125.5 million in the first seven months of 2021. It’s been a banner year for the street artist’s market, with sales ballooning 80 percent to drive him up from 42nd position at this point last year, knocking the late Chinese-French painter Zao Wou-Ki out of the inning.

Julia is resigned to a Banksy-laden art-market future, but a case study of 2019’s most hyped street-artist-turned-market-darling, KAWS, shows just how much the wheels of fortune can turn on a dime. At the peak of his market two years ago, fans and fashion flippers were literally stampeding (no really, literally stampeding) to get their hands on limited-edition merch while bidders pushed one KAWS painting from its $1 million estimate to a shocking $14.8 million. Since then, the artist’s total sales at auction have fallen 76.6 percent.

_______________________________________________________________________________________

“I’m like a sucker for ’90s hip hop. He was referencing Jay-Z and Drake, and he was referencing the hood. That’s real to me.”

—Art dealer Adam Shopkorn, an NYU Business School graduate and Manhattan native, on why he was drawn to the work of self-taught artist Michelangelo Lovelace. The founder of Fort Gansevoort explained his instinctive, outsider approach to art dealing in an interview with Artnet News Pro.

_______________________________________________________________________________________

Scammers and hackers are taking advantage of the NFT mania sweeping the less-than-tech-savvy art world by hawking fake NFT artworks and deploying phishing schemes, viruses, and trick trading platforms to steal credit card information and drain unsuspecting users’ crypto-wallets. (Wall Street Journal)

_______________________________________________________________________________________

Art insurers are learning the hard way that just because the fine print of their policies may not have guaranteed coverage of pandemic losses, it could be wise to pay up anyway. (Artnet News Pro)

_______________________________________________________________________________________

Sought-after artists drawing feverish search activity on the Artnet Price Database in July included rising star London painter Jadé Fadojutimi, Los Angeles-based Hilary Pecis, and, perhaps more surprisingly, the French postwar artist Sam Szafran. (Artnet News Pro)

Business magnate who formerly led the Alibaba Group, Jack Ma, has taken up painting while in hiding from the Chinese government. (Wall Street Journal)

Beyoncé and Jay-Z with Jean-Michel Basquiat’s Equals pi (1982) for the Tiffany & Co. fall 2021 About Love campaign. Photo by Mason Poole.

_______________________________________________________________________________________

Date: 1982

Seller: Private Collection

Price: Between $15 million and $20 million

_______________________________________________________________________________________

Inside every art media H.Q., there’s a special siren that goes off when Jay-Z and Beyoncé are photographed within five feet of literally any work of art. So imagine the noise when the Carters appeared in front of a blue-hued Basquiat in their new Tiffany & Co. ad.

The initial spin came hard and fast. WWD erroneously reported that the “never-before-seen” work had been in the same private collection since the early 1980s. LVMH scion Alexandre Arnault said that while there is no evidence Basquiat painted the picture for Tiffany, “the blue shade is so specific that it had to be some kind of homage” to the jeweler. (Perhaps, some commentators wondered, Damien Hirst’s formaldehyde shark and Botticelli’s Birth of Venus were similarly inspired by the brand?)

The painting, in fact, did not come out of nowhere. It was published in a splashy W magazine spread hanging above the sofa of its previous owners, Italy’s Sabbadani family, in 2018. It last sold publicly in 1996 for £155,500 ($253,000) at Sotheby’s London, after having been bought six years earlier, according to the Artnet Price Database.

While the story of a newly surfaced Basquiat is good for headlines, the truth is actually a better look for the painting. If it really had appeared out of nowhere, its authenticity would have immediately been thrown into question. And the Arnault family, which our sources say recently purchased the work for $15 million to $20 million, would have come off less blue than green.

_______________________________________________________________________________________