The Back Room

The Back Room: It’s Gogo Time

This week: Larry’s life and legacy, Zwirner on Zwirner, cultural infrastructure accounting, and much more.

This week: Larry’s life and legacy, Zwirner on Zwirner, cultural infrastructure accounting, and much more.

Artnet News

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: Larry’s life and legacy, Zwirner on Zwirner, cultural infrastructure accounting, and much more—all in a 7-minute read (2,084 words).

_____________________________

Programming Note: Today’s edition of the newsletter will be the final one overseen by Tim, who departs Artnet News next week for new endeavors.

Larry Gagosian, 2017. Photo: Harold Cunningham/Getty Images.

The talk of the art market this week has been the New Yorker’s mega-profile of mega-dealer Larry Gagosian, almost inarguably the definitive account of the 78-year-old titan’s life, career, and perspective to date.

The first notable aspect of the profile is that it exists at all. The notoriously press-averse Gagosian agreed to multiple sitdowns with writer Patrick Radden Keefe, author of the acclaimed Sackler family takedown tome Empire of Pain, as well as an incalculable amount of the New Yorker’s famously rigorous fact checking to bring his story to life. The end result runs almost 18,000 words. (The audio version clocks in at just under two hours.)

Keefe’s reporting doesn’t upend the prevailing wisdom about Gagosian. Instead, it sharpens the consensus to a more exacting edge than ever. If you want to understand what makes the man once dubbed “Gogo” so unrelenting and so singular, the profile offers at least three answers…

1. Profits Beat Purity (But Not the Law).

One of the most telling takeaways comes when Gagosian admits that ethical question marks about a client should never stand in the way of a good deal. “If the money is correct, if the transaction is correct, I’m not going to be a moral judge,’” he told Keefe.

The profile documents Gagosian’s relationships with an array of major collectors with major baggage. The rogue’s gallery stretches from the U.S. to the far corners of the world.

The stateside list includes Leon Black, the embattled financier and Jeffrey Epstein associate; Steven A. Cohen, whose hedge fund paid a $1.8 billion fine after pleading guilty to insider trading; and Sam Waksal, the pharmaceutical giant who pleaded guilty to securities and bank fraud, obstruction of justice, and perjury, to name a few.

Then there are the emirs and oligarchs. Keefe notes that Gagosian has been doing “a lot of business” with the UAE despite its “appalling record on human rights.” He also chronicles Gagosian’s decades of dealings with some of Russia’s richest collectors, including Roman Abramovich and Mikhail Fridman.

But once Abramovich was sanctioned by the E.U. after Russia’s invasion of Ukraine, a source told Keefe that Gagosian emailed his sales directors to make clear that “You cannot jeopardize the gallery to sell to these people,” not even through “their fake businesses in Liechtenstein.”

The distinction is fine but important: Gagosian has built his empire on transactions made in ethical gray areas. But the law is still a red line—at least, when buying or selling to someone who has crossed it risks bringing down the palace.

2. Personal Impropriety Has Shadowed But Never Sullied Him.

Gagosian was dogged by rumors of all kinds during his rapid rise in the 1980s, but perhaps the most persistent concerned his alleged habit of making lewd phone calls to women.

Although Gagosian refutes the accusations, Andy Warhol wrote about the calls in his diaries and even warned (or gossiped) about them to others, including photographer Paige Powell. Keefe also spoke to a woman who recounted receiving just such an obscene call after meeting Gagosian four decades ago—an account corroborated by her husband and a close friend.

“When I told Gagosian about my conversation with the woman, without sharing her identity,” Keefe writes, “he said, flatly, ‘Not true. Never happened. Never. I’m not that kind of guy.’ In any case, the consensus among people who say that Gagosian made harassing phone calls is that he stopped.”

Gagosian and his gallery have largely steered clear of personal misconduct scandals in the roughly 30 years since, with one recent exception: the 2020 allegations that Sam Orlofsky, one of Gagosian’s top directors, had exhibited sexually predatory behavior toward multiple women, including gallery staff.

An investigation led to Orlofsky’s firing and a companywide declaration from the founder that there was no place for such behavior at Gagosian. Whether his stance was more a result of personal evolution or recognition of changing social mores (and legal standards), the episode contrasts sharply with the controversy-courting Gagosian of the ‘80s.

3. Stopping for Any Reason Is Unthinkable.

One of the more vulnerable moments in Keefe’s profile details a 2020 exchange between Gagosian and in-demand British artist Issy Wood, who he had been courting for weeks in hopes of adding to the gallery’s roster. Keefe writes:

“Wood wanted to know about the gallery’s long-term future, so she asked, ‘What will happen when you die?’

‘What the fuck is wrong with you?’ Gagosian exploded. ‘Talking about my death when we’re trying to have a meeting!’ Wood now concedes that this wasn’t very diplomatic. But she wanted an answer, and she was ‘pissed at him.’”

The moment shows the mega-dealer’s reticence to admit that his 19 galleries, which rake in about $1 billion annually, will one day need to be managed by someone else. He also downplayed the idea that his recently formed board of advisors, featuring the likes of Sofia Coppola, J. Tomilson Hill, and Jenny Saville, relates to succession planning “per se” (as did the actual board members, in Keefe’s estimation).

Gagosian also told the writer that even retirement is impossible for him to consider, saying, “I enjoy what I do… I don’t know what else to do.”

This gels with numerous assessments of his genius lying in a mix of extreme ambition and extreme tunnel vision. The profile ultimately suggests that this concoction may be both a gift and a curse for Gagosian, the man, and Gagosian, the gallery.

___________________________________________________________

For now, Keefe’s profile of Gagosian may be the most comprehensive portrait we have of the dealer who has most powerfully shaped the art trade in the post-Leo Castelli era. (A forthcoming unauthorized biography by Michael Shnayerson will challenge for that honor.) Still, it leaves some of the most tantalizing questions surrounding him unanswered.

How will the already-sprawling gallery continue expanding at a pace that matches its founder’s voracious appetite? What will happen to Gagosian’s business when mortality finally does catch up to him? Will he in fact donate his expansive personal collection to a public museum, as he has suggested, or will he follow the private foundation route, like many of his wealthiest clients?

Keefe’s reporting implies that not even Gagosian himself may know the answers yet (and may never). Even so, the past 40+ years have proven that his legacy as a dealer, an innovator, and most of all, a hustler (in the most positive sense) are already secure—and like it or not, the rest of us are all living in the art market he built.

_________________________________________________________

This week’s Wet Paint was still being mixed at newsletter time, so here’s what else made a mark around the industry since last Friday morning…

Art Fairs

Auction Houses

Galleries

Institutions

Tech and Legal News

_______________________________________________________

“There must be 10 good artists, but he represents 30 or 40.”

—Ninety-year-old art-dealing veteran Rudolf Zwirner, father of David Zwirner, on the roster at his son’s mega-gallery. (FAZ)

____________________________________________________________

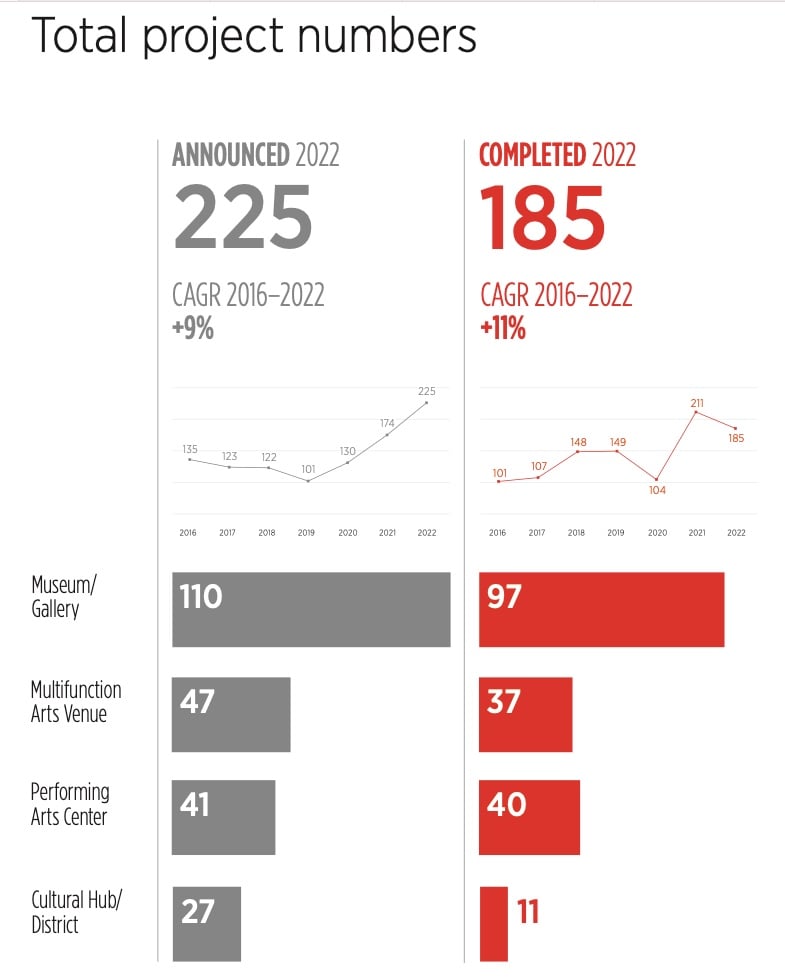

Courtesy of AEA Consulting.

Global investment in cultural projects further rebounded from pandemic lows last year, according to the latest Cultural Infrastructure Index. While the pipeline for such projects was more robust than ever, the number finished dipped modestly from 2021, which saw a glut of completions due to pandemic backlogs.

AEA Consulting crunched the numbers for its seventh annual report. Here are three key takeaways…

But, but, but… AEA notes that “while the volume of projects has increased, the value of investment remains consistent with 2016, representing a reduction in real terms.” In other words, when you adjust for inflation, the numbers leave something to be desired—for those of us invested (emotionally if not literally) in cultural venues, at least.

—Guelda Voien