Opinion

The Romance Between the Art Market and Cryptocurrencies Is Getting Weirder Every Day. It Won’t End Well.

A look at some of the more outlandish news from the rapidly mutating world of art-and-cryptocurrency.

A look at some of the more outlandish news from the rapidly mutating world of art-and-cryptocurrency.

Ben Davis

It’s worth marking this cultural moment. I, for one, have never seen anything like it. I refer to the utter flood of art-and-cryptocurrency schemes, multiplying like some kind of demonic computer virus.

There have been weeks when I’ve received a new pitch for some new project every day. It’s as if some other-dimensional portal opened up at exactly the point on the Venn diagram where the art bubble meets the tech bubble.

A frenzy that intense means something, so you should pay attention—though also don’t take your eyes off of your wallet. (My colleague Tim Schneider has done yeoman’s work tracking the market implications of this hyperkinetic vogue.)

I don’t deny that there is potential good along with the bad amid this Cambrian explosion of activity. I’m not going to argue that there cannot be worthy applications.

Last year, Bail Bloc, an artist-led scheme to get users to install a program that mines Monero, a digital currency, and funnel the earnings to help bail out low-income people in the Bronx who have been accused of misdemeanors, got some attention.

I have to admit, I remain skeptical of yoking social justice to anything so speculative and opaque. But if all Bail Bloc did was leverage the hype around cryptocurrency to raise attention for the Bronx Freedom Fund, it did something good.

Logo for Bail Bloc.

Thus far Bail Bloc has raised a little more than $6,000. Which means that the investment it has generated is not even a rounding error amid the thunderous shockwave of hot money pouring into the crypto-art space. If you want to see the typical effects the craze is having on art, you have to look elsewhere.

And there, the credulous boosterism alarms me. Art is certainly not the only field, faced with shaky or crumbling infrastructure, looking to tap society’s latest speculative tech bubble as a Hail Mary to save itself—but given that it is already characterized by desperately asymmetric odds, endemic secrecy, allergy to regulation, money-for-nothing fantasies, obsession with novelty, and pretentious naiveté, it is one particularly suited to letting cryptocurrency mania run amok.

Most tellingly to me, art’s sudden infatuation has exploded exactly amid an epic cryptocurrency meltdown. It’s hard not to imagine that the art world is, on some level, serving this market as a supplier of Greater Fools.

There are too many outlandish stories out there to count. Here, I’ll only catalogue for posterity a few items that cropped up in just the last weeks that strike me as important for marking a moment that is weird and getting weirder.

What, you ask, are CryptoKitties? Well, if you want to find out, you can now fly to Karlsruhle, where the ZKM Center for Art and Media is including them in “Open Codes: Living in Digital Worlds,” alongside the likes of tech-art hotshots like Cerith Wyn Evans and Simon Denny.

ZKM Center for Art and Media. Image courtesy ZKM.

In a nutshell, they are part of an emerging genre of digital object known as “cryptocollectibles,” built atop the Ethereum network—unique, tradable digital objects (or, in the hideous jargon of the space, “nonfungible tokens”).

Essentially, you purchase, with your hard-earned Ether, a unique image of a cartoon cat that you can then either sell or “breed” with other unique cat images to create new cat images that you can also sell. It’s an application whose main virtue is that it is a) wacky enough to get media attention, and b) a thing you can buy with Ether, which is otherwise hard to spend.

The Kitties themselves, as one crypto-investing professional told Planet Money recently, likely have the long-term value of investing in “Beanie Babies, or your friend’s art.” Interest in the novelty spiked last year, to such a point that CryptoKitty trading actually slowed the Ethereum network—and then quickly tanked, down 90-plus percent from its December high last year, where it remains, to the woe of anyone who took them too seriously.

And so, the brains behind CryptoKitties have been trying to reanimate interest. This campaign includes the glorious “In A KittyVerse Far, Far Away…,” a sponsored-content teaser for the cutesy cryptocollectibles seemingly aimed at children, posted to the blockchain-focused art site the Creative Crypto (“Mama Meow and Papa Paw cuddled around a little Kitty Crib, admiring the newly minted egg that the Ethereum Blockchain had blessed them with…”)

Image from Bringing Blockchain to Life. Image courtesy ZKM Center for Art and Media.

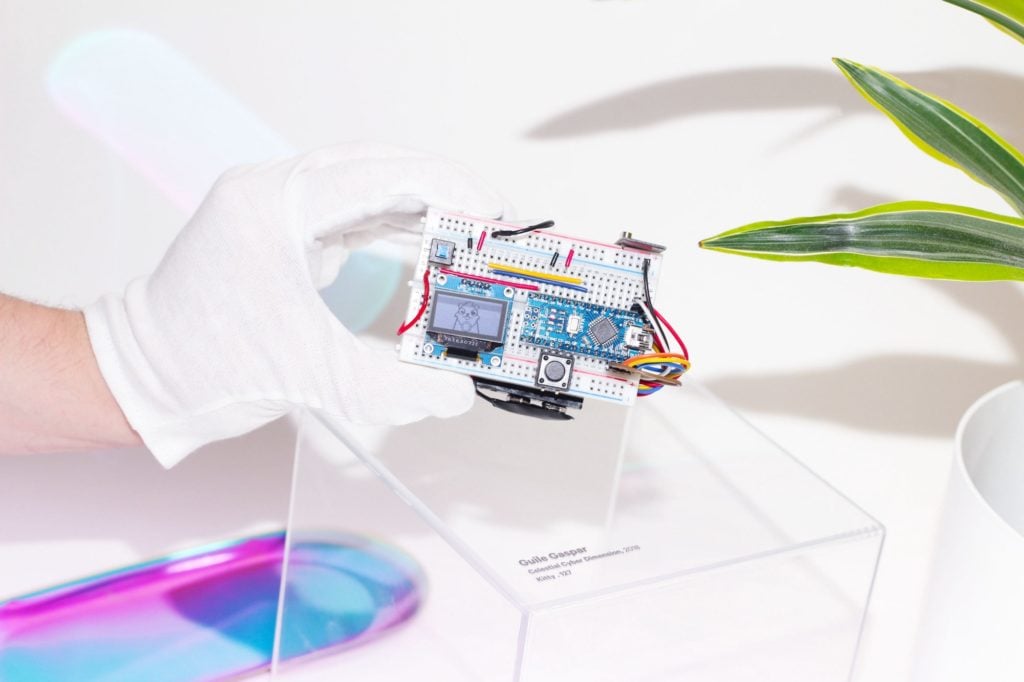

The Kitties’ celebration at a German museum—billed as coming “from the mind of Guile Gaspar,” CryptoKitties art director—must be viewed as another way of sustaining the hype as well, using art’s apparatus of prestige.

As should its highly promoted participation in a charity auction in May, where a CryptoKitty-encrusted artwork, also by Gaspar (aka Guilherme Twardowski), sold for $140,000 via LiveAuctioneers to one Igor Barinov, an Ethereum developer himself.

Press image of Guilherme Twardowski, Celestial Cyber Dimension, Kitty 127,

Creation date: May 1, 2018. Image courtesy CryptoKitties.

Art industry people have been wondering what art could do to entice the elusive “tech collector” for a long time. It turns out the answer may be something that combines the pleasures of Pokemon with the joys of throwing your money in the trash.

You’d be just about tempted to sigh and say, “Let them lose their money,” except…

This press release comes across my desk: “SF art collective Will Brown’s experiment with cryptocurrency.” For the show, titled “Will Brown: Ether,” the collective (composed of Lindsey White, Jordan Stein, and David Kasprzak) is staging an installation at the San Francisco Art Institute’s galleries that consists of taking the exhibition budget for their show and investing it in Ethereum, chosen “based on the poetic character of its disembodied and atmospheric name.”

A photo illustration of the ethereum cryptocurrency. Photo by Jack Taylor/Getty Images.

This is meant as a kind of social-practice gesture—or even as a rallying cry: “Will Brown will withdraw profits above the initial investment and direct them into a student or faculty project,” the press release says. “This gesture reflects Will Brown’s conviction that collective, creative action affords the greatest odds for art education to adapt and endure.”

This assumes that there will be profits. Ethereum has been on the opposite of a tear lately. It could well be that, instead of helping the good students and faculty of SFAI, Will Brown will have effectively torched a pile of money in front of their faces.

“This gesture reflects our concern for the management and stability of an iconic institution at a particularly challenging moment in its history,” Will Brown writes. They compare the gesture to SFAI’s 1986 sale of Eadweard Muybridge works in order to fund itself—but that comparison is way, way too flattering.

Muybridge’s works were 100 years old at the time of their sale and firmly ensconced as foundational works in photo history. Ethereum, on the other hand… well, I don’t see much difference between framing the act of investing in Ethereum as a “collective action” and feeding your money into a slot machine, pulling the lever, and calling it the return of May ’68.

The slot machine idea might actually be better. At least there the rules are relatively simple to grasp.

A gambler plays a slot machine near a Robocoin ATM that accepts Bitcoin at the D Las Vegas on May 24, 2014 in Las Vegas, Nevada. Robocoin shut down operations two years later, in 2016. Photo by Ethan Miller/Getty Images.

True, the money at stake here is small change—but that’s also why I’m bringing it up. It reflects how the hype is penetrating to places where not just the stupid-rich are going to get hurt. My question is: Is it really a good idea to explicitly present crypto-investing as a solution for cash-strapped art-school denizens?

Because students actually are being lured by crypto’s get-rich hype. Here’s what one student told Vice last year in an article called “I Invested All My Spending Money in Ethereum (And So Did My Friends),” almost exactly mirroring the pitch for the Will Brown project:

Young Americans live in a society that fosters endless ambition, but student debt, rising rent costs, and wages that haven’t significantly grown in decades all make for a relatively bleak financial outlook. Who knows what my ethereum investment will look like in five years. It might balloon into the seed money I need for a brazen startup venture. Or it could be just another one of my stupid ideas. I’m not sure, but I guess we’ll see.

I can’t think of a more despairing symbol of the warped incentives and broken state of the society we live in than that statement. Or rather, I couldn’t, until I read…

Here’s @officialmcafee’s Tweet:

This incredible opportunity is open to artists working in all media, though it will focus thematically on “revealing the Crypto Space through art.”

I mean, what to say here? You can’t make this stuff up. McAfee, if you do not know, may be synonymous with anti-virus software, but lately he has reinvented himself as a hyperbolic champion of all things crypto.

And if you wonder why he had to “reinvent” himself, well, go ahead and check out Nanette Burstein’s documentary Gringo: The Dangerous Life of John McAfee on Showtime (or Netflix) before you apply for that “Crypto Art Program.”

Burstein digs into allegations that, while building his own Colonel Kurtz-esque empire in Belize after the financial crisis, McAfee degenerated into paranoia, hiring gang members, terrorizing (and possibly worse) a biologist who worked for him, and allegedly having a neighbor tortured and assassinated.

Now, who knows what really happened. McAfee has engaged in some vigorous attempts to debunk the film. A number of the witnesses from Belize have recanted their statements. Burstein, in turn, claims that McAfee has paid them to do so. Showtime stands behind the film. So you be the judge.

John McAfee talks to the media in Miami Beach after arriving from Guatemala on December 13, 2012. McAfee was a ‘person of interest’ in the fatal shooting of his neighbor in Belize and turned up in Guatemala after a month on the run. Photo by Joe Raedle/Getty Images.

As for me, you couldn’t pay me to spent a month at the McAfee Crypto Art Program. Which is funny, because he is not even paying.

Reporting on the residency, Glasstire flags a follow-up communique, in which, challenged that he should provide a stipend for his artist-in-residence, McAfee replies with characteristic übermensch brio:

You are wrong, my friend. History proves that the reverse is true in all of the arts. Art created for free is, universally, superior to paid commissions. The statue of David, every painting of Van Gogh, the entire body of work from heironimous [sic] Bosch, M.C. Escher et. al. All free.

For the record, Florence’s Guild of Wool Merchants paid Michelangelo 400 florins to create the David—but that’s probably overthinking things.

If some conceptual artist were to concoct a satirical media stunt whose lesson was supposed to be “the crypto-art space is for dupes or scoundrels—so watch out,” it would be less perfectly illustrative than this real-life bit of news.

Look, the underlying technology, whatever cryptocurrency’s fluctuations, is probably here to stay. Interesting art or art-ish things will spring from it. Maybe. It’s just that our particular society is set up so that no progress is ever made without inflicting the maximum amount of waste and damage.

The promise of cryptocurrency is supposed to be some kind of libertarian decentralization and a new level of error-proof accuracy in online transactions. Ironic, then, that in practice its scene has proven a haven for fast-talking megalomaniacs to build kingdoms and for wild post-truth hype to flourish.

Given everything you know about art, which of the two halves of this equation do you think really explain the particular fascination for cryptocurrency, beneath it all? You can’t be critical enough.