The blaring headlines are hard to miss. From Bloomberg (“NFT Price Crash Stirs Debate on Whether Stimulus-Led Fad Is Over“) to CNN (“NFT prices are plummeting. What could this mean for the art world?”) to the Art Newspaper (“The cost of a single tulip bulb surged to the same price as a mansion 400 years ago: are NFTs the ‘tulipmania’ of the 21st century?”), it’s all but with relish that the press gleefully notes that the sky is falling on the ubiquitous NFT market, citing a drop in average prices from around $4,000 in mid-February to $1,500 now.

Yet this shrill outcry fails to acknowledge that even the markedly lower numbers still represent a 10-fold increase from six month ago. And though trading volume has drifted down from 40,000 to 20,000 transactions per week in the same period, it still stands well above levels only a short time ago.

Will prices vacillate? Of course they will! To paraphrase Oscar Wilde, the value of good art, digital or otherwise, will never drop—but in the interim, the prices just might. Regarding the overall crypto market, what is indubitable is the wildly volatile price gyrations so vast, erratic, and swift that peaks and troughs are conflated into cycles lasting a single afternoon before the violent whipsaws happen all over again.

Crypto Beuys: “Yes, I said everyone is an artist. BUT THAT WAS BEFORE NFTs.”

But this NFT shit (I employ that term endearingly) isn’t going away anytime soon. Adrian (my 24-year-old) is continuing to sell his latest digitally derived works via the OpenSea platform—with better results of late than me, I might add, but that’s how it should be (which doesn’t make it any easier to stomach).

Mainstream artists such as Murakami—who also minted artworks on OpenSea, accompanied by an unprecedented set of unwieldy restrictive covenants (such as a prohibition against displaying the works in the metaverse), before withdrawing his work altogether (I think in search of a more tech-savvy contract lawyer)—are entering the fray at a rapid pace.

Murakami got off to a shaky NFT start with a slew of ill-informed restrictive covenants that accompanied his works, and then he withdrew them just as quickly.

What hasn’t changed is the vehemence of the trolls, with attacks ranging from plain nasty to downright personal. Fun. What is it about NFTs that elicit such denunciations as “enjoy your 5-minute nifty wank”? Besides the fact that it’s more often than not an attempt at a 3-minute money grab (plus gas fees), this space still raises the hackles of both art world traditionalists and the original digital players that view art-world folk as interlopers.

When I was in a lousy mood and let one of my videos sell on SuperRare for a price less than that of a previous work, the initial collector (who paid more) got in touch, took me to the digital woodshed, and in no uncertain terms chided me like my dad when I stole his car and crashed it into a pole. The digillector (I just coined that one and should register it on the Ethereum Name Service) told me I was minting too many artworks in too short a period of time! He might consider calling George Condo while he’s at it, and telling him to ease off on the oils.

Ouch, lesson learned—buyers hiding behind a cloak of anonymity, as many in NFT-dom do, will feel emboldened to communicate in a direct fashion, to an extent unlike that in the art world. I found it refreshing, even though it was at my expense.

Nevertheless, there are also an unlikely number of likenesses between the digital marketplace and brick-and-mortar art landscape. (I prefer the digerati term for it: the meatspace, which seems in contravention to the decentralized, libertarian, freewheeling spirit of NFTism.) Firstly, the collector who contacted me (on Twitter of course, that’s the communication tool of this set) told me he only buys on curated platforms like SuperRare and NiftyGateway, not dissimilar from buyers that only trade with Gagosian (who recently celebrated his 76th, happy birthday Larry G!), and it’s near impossible to gain admittance past the curators of these platforms unless you are famous or a social media phenom (i.e. with vast audience). The world ineluctably changes and manages to remain the same.

To be clear, NFTism doesn’t necessarily disrupt anything but rather presents a market alternative to the traditional gallery system. In the process, it ushered in a unexpected audience of crypto collectors, empowered a whole new generation of artists with easy access to that audience, and instilled the (potential) windfall of a 10 percent resale residual to NFT artists in perpetuity. On another note, make no mistake, this is not just the domain of the youngins. There are a slew of artists well into their 70s and 80s, which brings me to the next topic of discussion….

I penned a feature for British GQ in December 2016 titled: “Why Jerry Saltz is the provocative art critic you need to follow.” (The subtitle is “From failed artist to Facebook fetishist, Jerry Saltz has used his online persona to rail against the wild excesses of the market and claim his place as art’s social media poster boy.)

In the beginning of March 2021, at the height of NFTism, the man himself contacted me via email about possibly dipping his toes into the market and asked me what I thought of the notion. I replied: “I love you! I would do anything you are behind. But, YOU WOULD NEVER GET INVOLVED IN A COMMERCIAL ENDEAVOR! As for me, I have been doing digital art since the mid-’90s, this is [the] first time in my life I ever capitalized on it. Most importantly, the money took me by surprise, I absolutely didn’t/don’t care and never paid it the least bit of thought. It just happened. and may not happen again.”

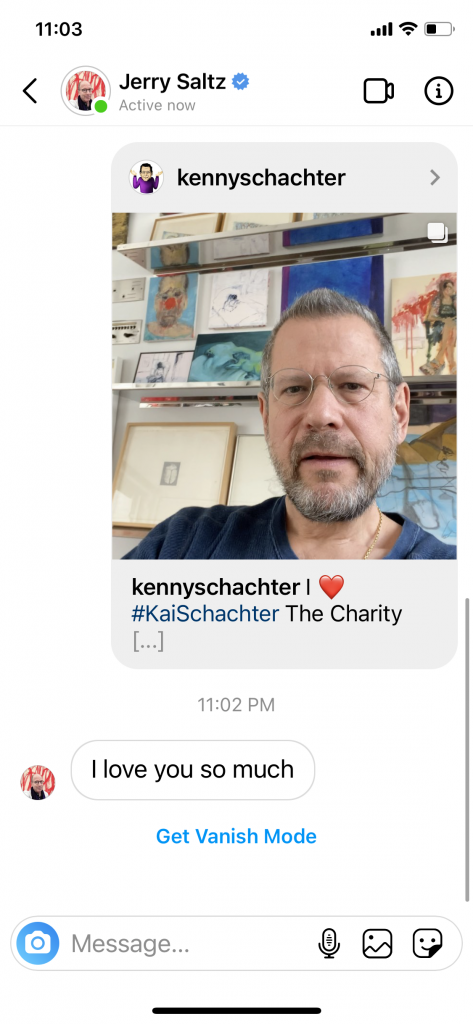

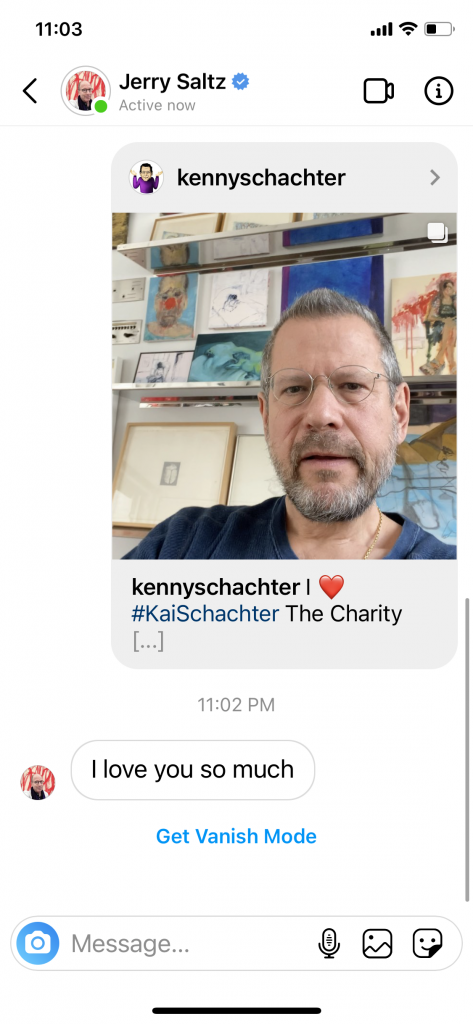

I truly love Jerry (and Roberta) more than direct messages can tell.

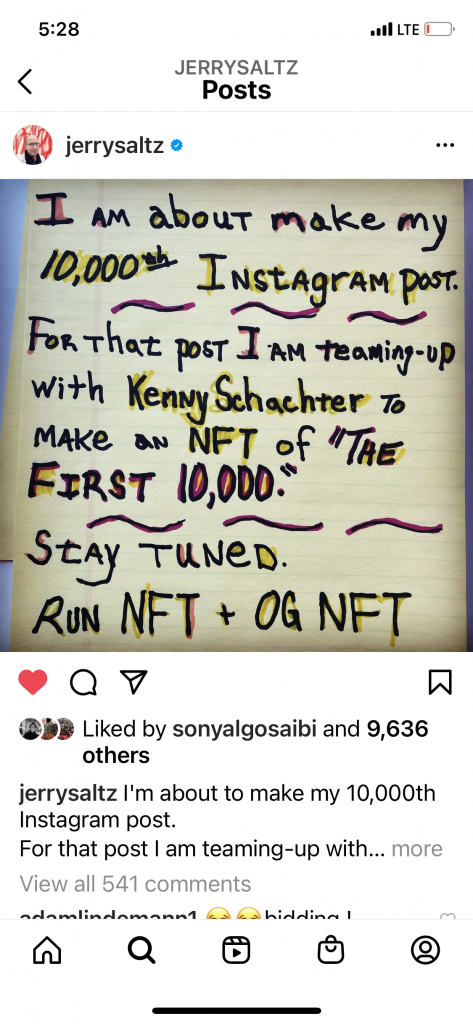

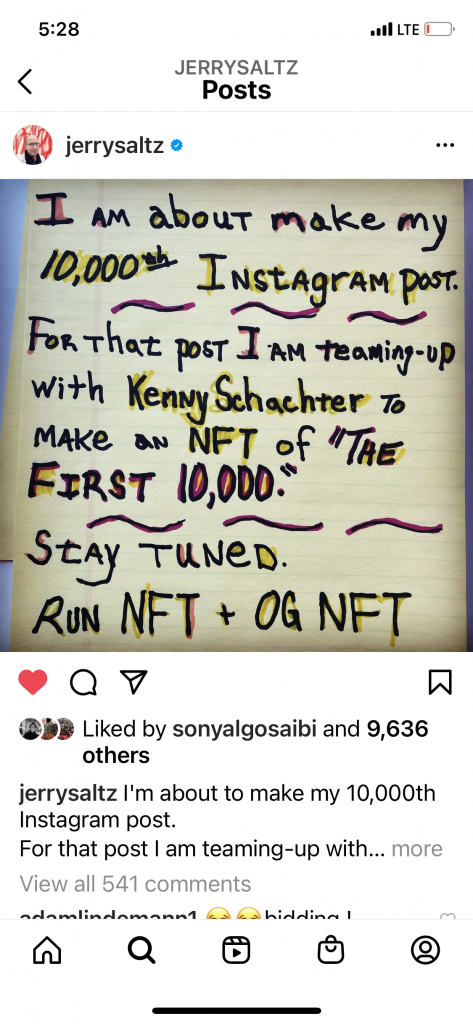

I was under the impression that was the end of Jerry’s NFT dreams of untold dosh, and then came another missive: “I am coming to my 10,000 Instagram post. Should we make a NFT Beeple thing out of my 10,000 pics and sell it and split the dough? Exactly like his – collage thing – but ours. I assume it takes like two-seconds to make one. If not, whatever. Just thinking about what to do with the 10,000th.”

The digital crowd has a name for that too (and everything else for that matter—that tech lot exist in a parallel realm with their own language to boot): “low effort NFT.” Against this backdrop was born the idea to help midwife Jerry’s first market adventure, a headlong dollar dash into the uncharted, choppy waters of NFTism. Call it the Old Man in the Sea.

Trust me, it’s no easy feat to rise above din of Paris Hilton, Kate Moss, and Tom Brady, who have all recently (everything is recent in this world) jumped into the game to the tune of millions. And, in the face of an overall NFT market pullback, our timing wasn’t exactly propitious. I thought it would be wise to work with top-tier platform SuperRare (where I already had a relationship) and affiliate with charities for the majority of our take on the enterprise. Jerry chose Memorial Sloan Kettering, where his illustrious wife (now cancer free), New York Times writer Roberta Smith, received treatment, and I settled on the American Foundation for the Prevention of Suicide after losing my beautiful, gifted artist son, Kai.

My beloved son Kai, lost to suicide two years ago.

Admittedly, Jerry caught me unawares when he shared with his 504,000 Instagram followers that we were together teaming up to NFT his first 10,000 posts—I thought my role would be as a behind-the-scenes shepherd, as the content was his. Like a true artist, Jerry used me for compost to facilitate and promote his work. Respect.

Surprise! This caught me a bit unawares when Jerry posted it to his 504,000 followers regarding my midwife role in helping him shepherd his NFT project.

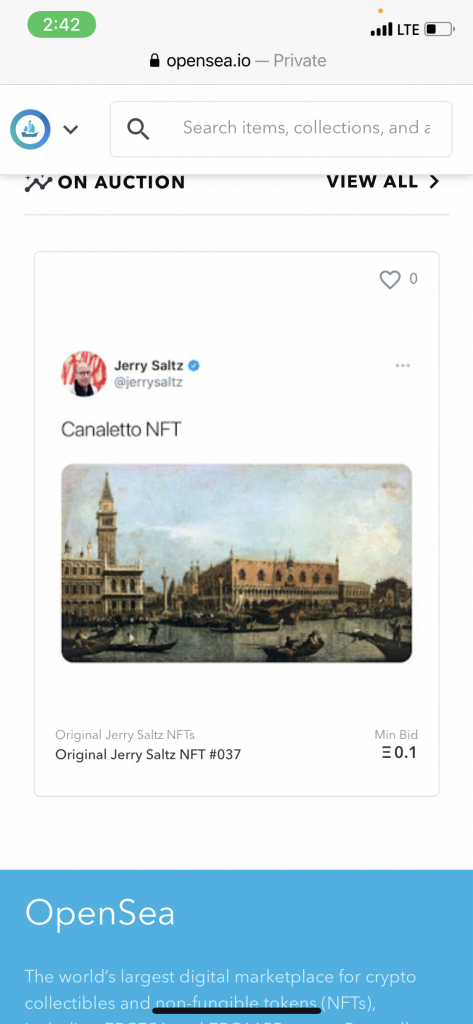

When our social media campaign launched, two nasty things immediately came to light that neither of us had given much thought too. First, Jerry didn’t own the majority of the copyrights for his NFT. It was comprised mostly of other artist’s artworks (including mine). Plus, there was already an “Official Jerry Saltz” account on OpenSea hawking a wonderful array of masters from Canaletto to Daumier, all in the form of NFTs, and in the name of Jerry. In other words, a case of blatant identity theft.

All that remains of the original Jerry Saltz rogue identity theft NFT account.

That’s when I quickly found out about the Digital Millennium Copyright Act takedown law, a U.S. law that criminalizes dissemination of technology and services intended to circumvent copyrighted material in the form of intellectual property. I got the rogue Jerry NFT site removed by contacting OpenSea, and we decided to donate 100 percent of the proceeds of our project to evade any issues of our own. An hour later, the platform removed a work of my own: a mash-up of a Richard Prince Instagram painting featuring Kim Gordon that is the subject of major litigation at present against Mr. Prince (of Thieves) by the photographer Eric McNatt, who I take it wasn’t a fan of my piece either.

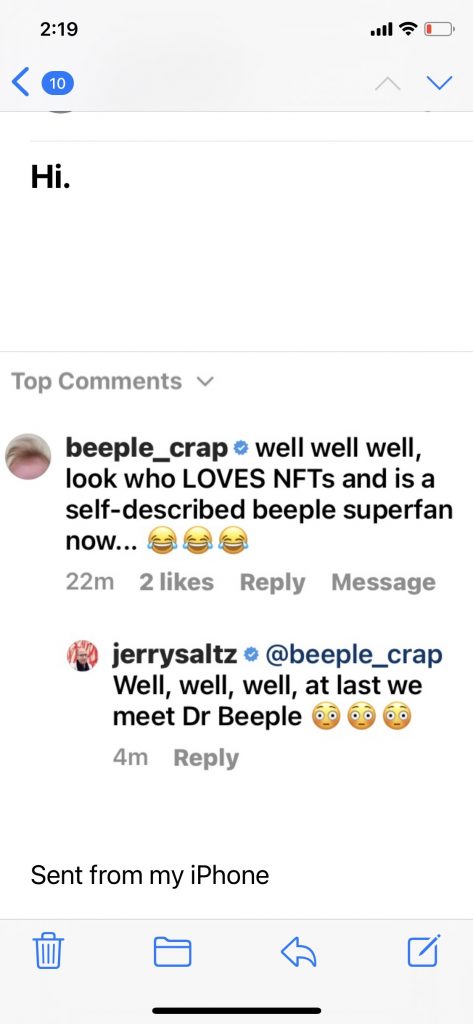

Leading up to the three-day auction, Mike Winkelmann weighed in and tweeted to Beeple-bashing Jerry: “well, well, well, look who LOVES NFTs and is a self-described beeple superfan now…???”

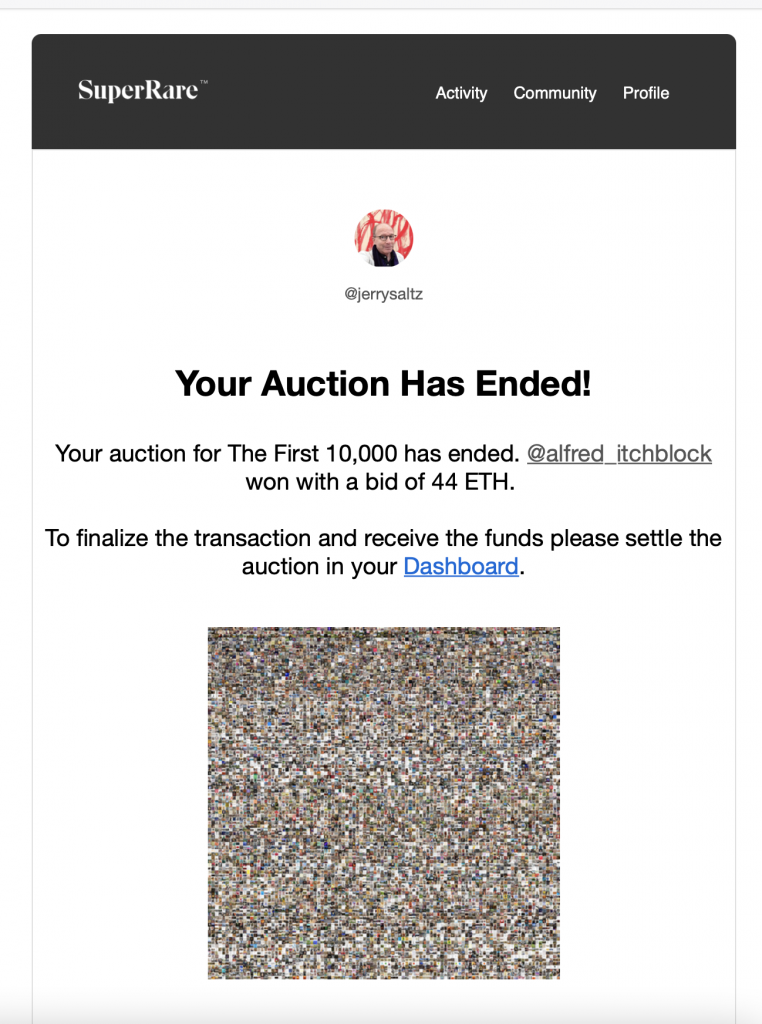

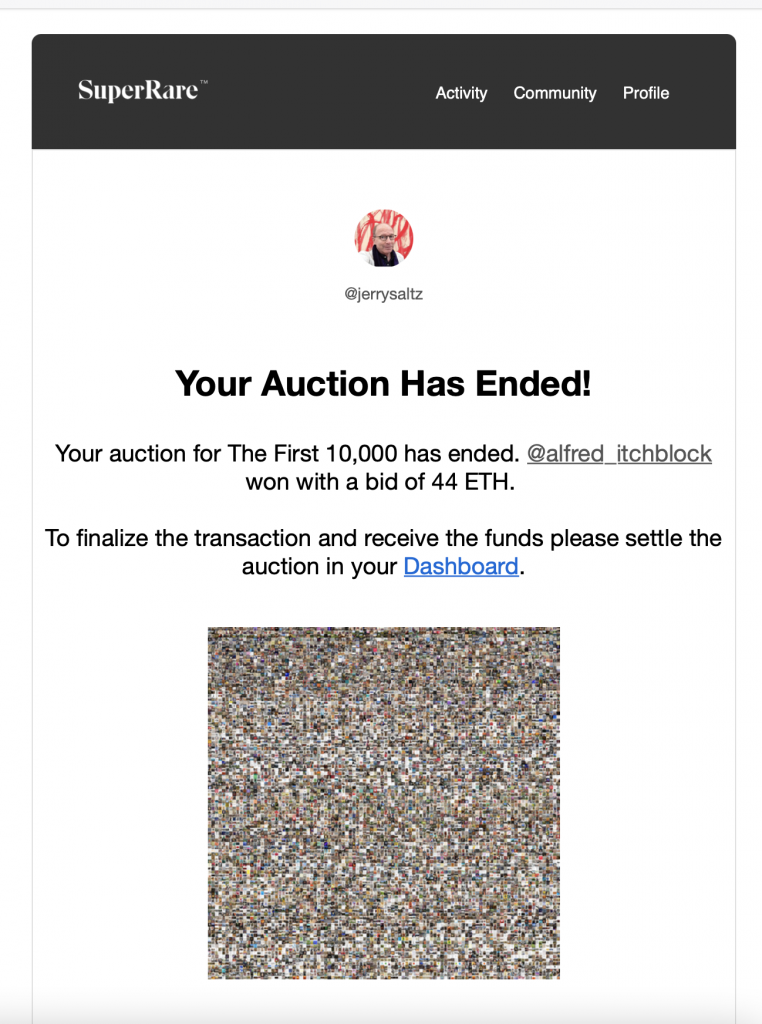

Self-proclaimed beeple_crap. I couldn’t have named him better myself.

Once things got underway, two bids came in fast and furious totaling 20 ETH (about $48,000), which just as fast tanked to $42,000, then silence ensued till the last few minutes of the sale. Jerry grew concerned. I reassured him that in pretty much all online sales, potential buyers have it down to a science waiting for the clock to tick till the final few seconds, which then trigger additional bonus time to bid. In the end, we hit 44 ETH from “Alfred Itchblock”, which amounted to $95,000 yesterday (and, as of this writing, $102,000—god knows what that will be before the proceeds are wired to the respective charities). SuperRare are admirably donating all of their fees as well.

Going, going gone! Jerry has complained about art disappearing into free port art storages, now they just go into invisible digital wallets.

We live in a society increasingly dictated by numbers—from the hegemony of money discourse in art, to the recording of every bit of data related to our phone and computer usage. Whether writing for New York magazine, Artnet, working for a gallery, art institution, or a nonprofit, we are all part of an art economy. The foibles of the market are a nuisance artists must contend with each time they offer a work for sale, publicly or privately. When I first released digital art in the form of NFTs last December, my expectations remained as they always have been: less than zero. I most assuredly did not do it solely for money in the same fashion Jerry does not write exclusively for a salary. Jerry’s Instagram NFT was more an intellectual exercise in order to feel a feeling, have an experience he’s written about, judged, and thought about forever. Entering an art-related marketplace is something to be scrutinized, processed, and analyzed. The hypocrisy of the art world is silly and stifling, as much of the reaction to the NFT phenomenon has been.

Afterwards, Jerry and I met for a coffee combing over the emotions related to our NFT experience. Though it could have been worse, it was also an anti-climax, which it always is when you are reduced to a number fetched on an auction block.

We were both a little tussled and adrenalized. My guess? Jerry won’t be the same for decades to come having experienced the rawness and vulnerability of being market exposed instead of just writing about it. As we parted ways, Andres Serrano passed by on the street and congratulated us on our project, and mentioned he was reprising his 1987 infamous Piss Christ photo in the form of 15 NFT variations on the platform Async.art. He then, without missing a beat, unceremoniously shoved his business card in my hand and told me to call, as he wanted some publicity for it. What an a… oh never mind.

Artist’s mock-up (mine!) of the not-very-well-mannered Andres Serrano’s upcoming Piss Christ NFTs for Async.art