Opinion

Kenny Schachter Comes Out to Play at Frieze London

Kenny returns with tales from the obscure side of the art world.

Kenny returns with tales from the obscure side of the art world.

Kenny Schachter

Art Oktoberfest in London

It’s art Oktoberfest in London and being that I’m so lazy, I relish the opportunity to see as much in as little time as possible, especially in this town where everything is spread so far and wide. Frieze fair turned 14, the magazine 25, accompanied by a Phaidon book (surprise) as the German edition folded (when is last time you’ve read a copy, c’mon?).

Other changes afoot include a major investment, possibly up to 100 percent, by the Hollywood talent agency headed by Ari Emanuel of WME-IMG. In an elucidating article on the topic by Arnet.com’s Laura van Straaten, she quotes Emanuel on what the talent and event purveyor saw in a contemporary art outfit: “Art, media, food and compelling conversations that are leading the industry forward…a force multiplier.” A what? Leading a what? UTA, another talent agency, opened a space in LA with a Larry Clark exhibit. The show must go on, I guess.

Conducting a very unscientific, empirical report, I got the overall impression that things didn’t go exactly as planned. Yes, there was the feel good exuberance of seeing a lot of art in a flash crash (like the speed at which the Brit currency is depreciating). But I’m pretty certain it was more show-and-tell than show-and-sell. I can hardly believe large sums of money crossed hands, more likely people were sitting on them till the elections and New York auctions in November. Though, the UK sales did much better than expected (like Trump in the last debate) with a hit of irrational exuberance for old times’ sake.

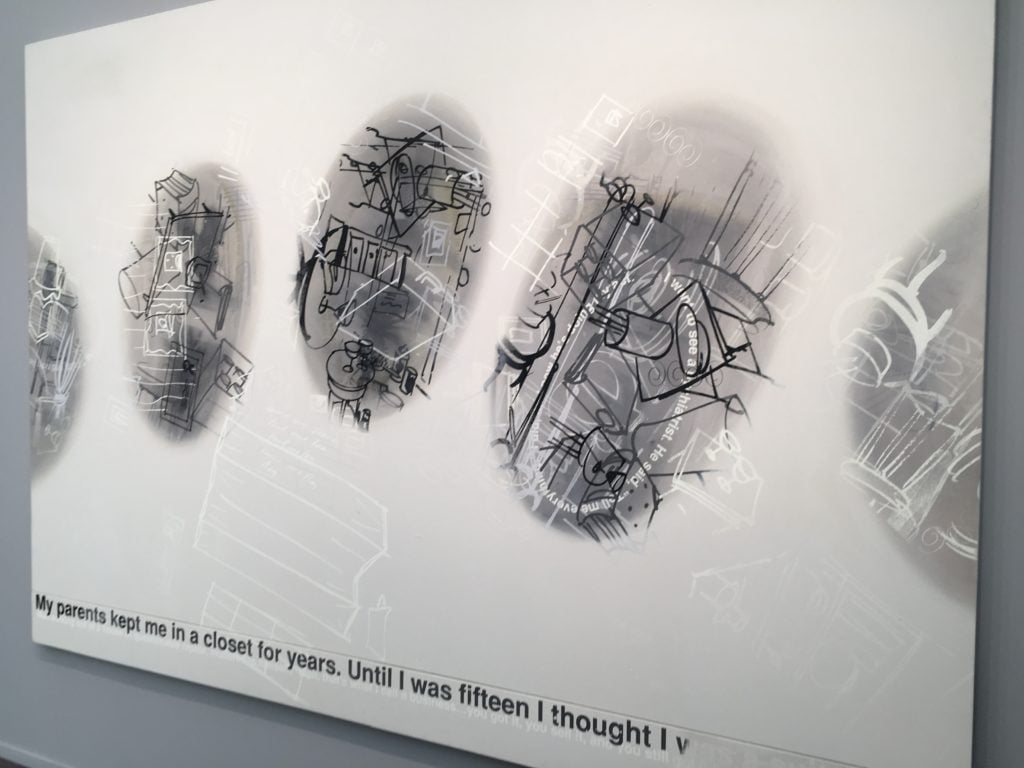

Schachter at the Jon Rafman installation at Seventeen’s booth. Courtesy Kenny Schachter.

Did you know there was a Frieze finishing school called—I kid you not—Frieze Academy? From their web site and for a fee, on offer you will find, “unparalleled insider access to the individuals and institutions that make the international contemporary art scene thrive….” For a price, they will teach you to walk, talk, and maybe get an audience with a royal. As much money as the mothership is pulling in, I detected cracks in the Frieze fortress through the buoyant vibe. Call it fair fatigue, or lethargy against the booth saturation framing our art, but maybe it will spur a back-to-gallery movement. Nah. Worse, nipping at Frieze’s heels is the Foire Internationale d’Art Contemporain (FIAC), in Paris of all places.

There has been a veritable exodus of international exhibitors flocking to FIAC amounting to a consolidation, a shakeout in the cutthroat, highly profitable contemporary fair business. These things seem to occur in cycles and Frieze is on the wane. I’ve had insiders from three separate fairs serve up scoops on the defections, and they are legion, among other tidbits—the fair trade is not very fair. Please don’t misunderstand me, a wounded Frieze is a kinder, more empathetic beast, and I liked it.

I didn’t spend much time focusing on the interim London auctions, as they never amount to more than in between sales despite growing along with the scale of the fair. But you didn’t have to be a Python (as in Monty) to look on the bright side of the auctions, including the 100 percent sold Leslie Waddington estate sale, well above the high estimate. In viewings, Leslie would direct my kids to shine a blue light over his paintings to detect for telltale signs of conservation and then ask them to refer to his notes to determine at what prices he acquired the pieces so he could in turn determine what to charge. Leslie was a rare bird in the art world: kind, honest and as transparent as his pricing.

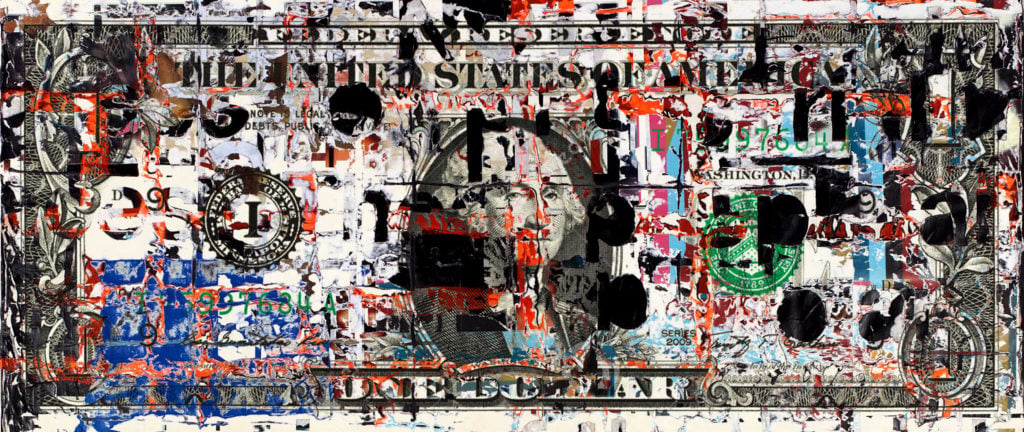

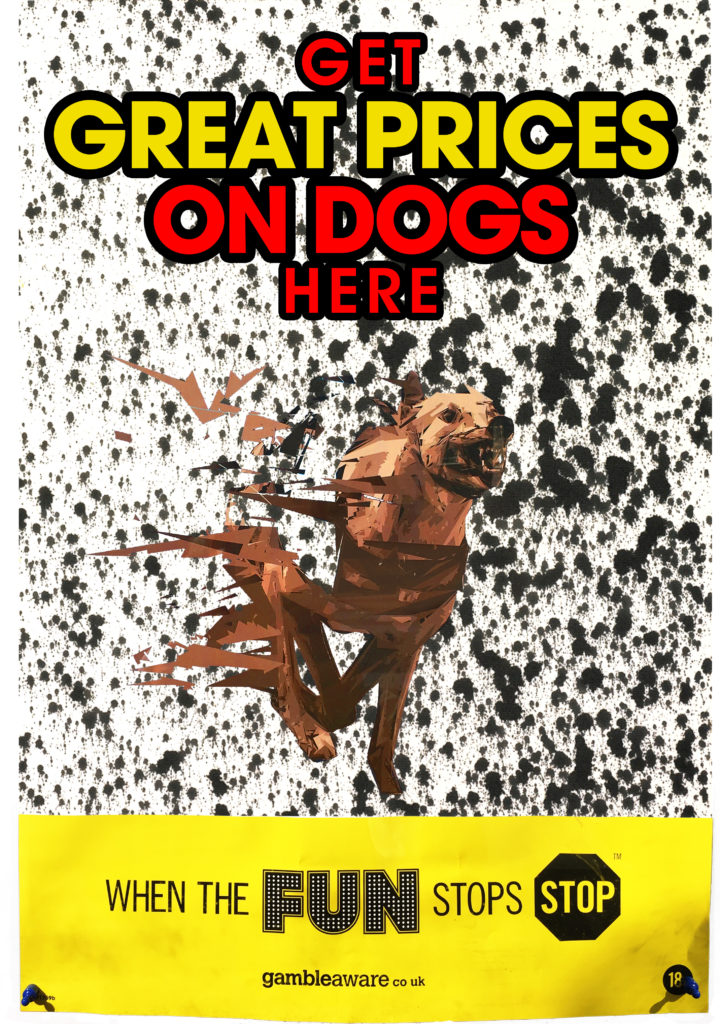

Collage by Kenny Schachter. Courtesy Kenny Schachter.

You may have heard of a not yet 40-year-old Romanian painter called Adrian Ghenie who sold a painting at Christie’s for $9 million on an estimate of $1 million to $1.5 million. We’ve seen the rapid rise and fall of generic process oriented abstraction created (effortlessly) in large series. Here, we have the representational equivalent: Zombie Figuration. Ghenie is the messiah of mediocrity giving great hope for lousy painters to succeed beyond imagination (oh relax, I’m joking).

Though when I first encountered a painting about three years ago I sheepishly admit to liking it, just not the £121,000 it fetched, more than three times the high estimate. I never thought I’d live to see the day I considered a Mark Grotjahn a safe bet at $10 million—need there be any further evidence of the erosion of paper currency?

Here’s a shout out to my pal Stefan Simchowitz (as if he needs more) whose self-styled insurgency to upend the cycle of oppression wrought by the antiquated status quo of the gallery system has culminated in buying a lot of stuff in a little auction, while chatting up the Nahmad’s in the front row of the house. Then calling Josh Baer to ensure such activities were incorporated into his Baer Faxt newsletter tracking sales. Viva la revolución! Fitting enough, while he’s chasing new clients—a few of whom are professional gamblers—his only serious client (my source Deep Pockets confirms) is Sean Parker of Facebook fame.

Collage by Kenny Schachter. Courtesy of Kenny Schachter.

Simon, the Charmer

I was asked by Simon de Pury and Whitewall Magazine to converse with the auctioneer at Blakes Hotel on the occasion of the publication of his book: The Auctioneer, Adventures in the Art Trade (with William Stadiem) published by St. Martin’s Press.

It was fun, kind of like a charity auction with no art…and no charity. The room was (too) small and the list of people turned away at the door was a who’s who of art and London life, including legendary dealer Irving Blum (and jeweler Laurence Graff’s wife); the organizers shouldn’t have looked a gift horse in the mouth. Simon, of course, was superb. He’s a raconteur and then some. I was relegated the uncharacteristic role of straight man.

The book is a romp through 50 years of art business history via the auctions, and I highly recommend it for anyone remotely interested in the market. It’s even a tad salacious, which is funny in the face of Simon’s typically unflinching Swiss decorum and exquisite manners. Following the charismatic Simon was like following Kevin Spacey, which I did once at a charity event—I don’t recommend it. Simon is a fervent believer in all things art and his sense of mission is profound; but unlike most zealots, he’s hilarious and charming. Oh, and while regaling the crowd, which he does so effortlessly, he failed to answer a single one of my questions.

Shifting Sands at Frieze

Art fairs in tents are like bouncy castles for adults. No matter how you approach, they are an assault on the mind and eyes, but there’s plenty to absorb and well worth the forced march. There were no Leo sightings—I imagine sooner or later the primary dealers will cotton on to his flipping tendencies anyway. After shutting down on Sunday, a few Friezes back, for the stated reason of keeping away the hoi polloi, the fair this time around returned to having full weekend hours. Either they are trying to cultivate children and non-art-world types as collectors or looking to post bigger attendance numbers in the press release.

Before I get to the art, I was clandestinely informed of subsidized booths in the curated section revisiting the 1990s, and a dealer or two dealt primo rooms at Claridges gratis as an inducement. Hey, I’d do it for a room (to get some peace from the family). My curatorial practice did help define the 90s in New York, wink wink.

It gets better, I was delivered a handwritten list of dealers that dropped out of Frieze or transferred to FIAC. Jessica Silverman and Vilma Gold left Frieze and are doing FIAC this year. Luhring Augustine and Cheim and Read left Frieze this year. Eva Presenhuber joined FIAC this year though the gallery wasn’t at Frieze last year. Anton Kern left Frieze this year and is doing FIAC (the gallery did FIAC last year as well). Barbara Gladstone and Konrad Fisher are new to FIAC this year though neither gallery did Frieze last year. Standard Oslo dropped Frieze this year as well.

I was also informed the alphabetization of the names of the participants on the fair map was reversed from last to first to throw off suspicions of a mutiny. Crafty! Anyway, less galleries and foot traffic make for more taxis—it’s always essential to have a good exit strategy.

What made my viewing all the more intense was being asked to lead a tour for patrons of London’s Royal Academy (which currently has an AbEx show not to be missed); after a reconnaissance tour on opening day to plan out a route for the group, I returned the following morning to throngs of art fans patiently lined up outside the venue. I was given a microphone and the members were given a radio transmitter with earphones. I was inside their heads and, poor souls, they were in mine—what a way to see an art fair! I wouldn’t wish it on an enemy, many of whom I got to speak about in their presence without so much as being heard or noticed.

Standouts in the 90s section, which was markedly different from most other sections of the fair, with it slavish emphasis on the new, were Richard Billingham at London’s Anthony Reynolds Gallery, Karen Kilimnik from New York’s venerable 303 and Wolfgang Tillmans at Berlin’s Buchholz. Though Billingham’s prices haven’t moved much since that period (£7,500 to £30,000), you’d have to be catatonic not to be impacted by the real-time drama unfolding in the photos of his wickedly dysfunctional family. Karen Kilimnik’s work ($60,000 to $100,000), represented by fey paintings and drawings amidst a kitsch formal garden installation represent the work of a criminally undervalued and underappreciated artist.

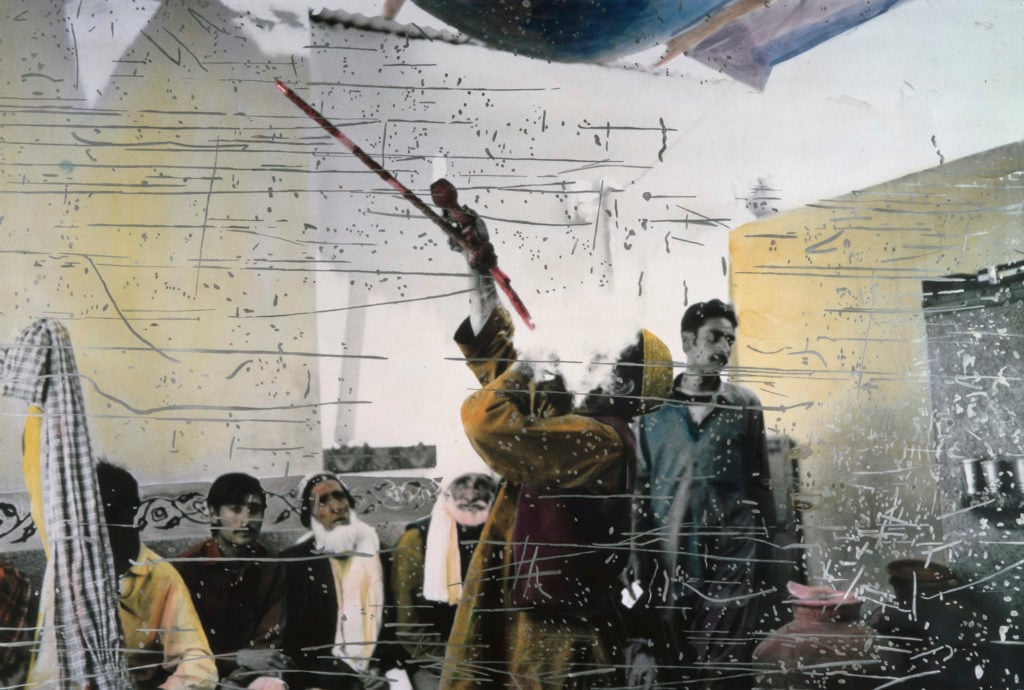

Courtesy Kenny Schachter.

Wolfgang Tillmans’s ad hoc installation, which recreated the tiny space at the gallery as it was when the work was originally shown, was being sold in its entirety ($400,000 for the room). The show interspersed his photography (of friends and abstract formal compositions) casually pinned and taped to the wall. Tillmans helped to break down resistance to photography in the contemporary art market by his casual installation methods using pins and tape and throwing into the mix appropriated printed matter.

Tillmans helped to brake down resistance to photos in the contemporary art market by his casual installation methods using pins and tape and throwing into the mix appropriated printed matter.

Then there was the bathroom installation of Julie Verhoeven, a curated project, entitled The Toilet Attendant… Now Wash Your Hands. Activating the bathroom where you can pee and have a peek simultaneously was not as bad a place to see art as it sounds. It was just less certain as a commercial enterprise—which seemed to match the experience of many exhibitors at the fair (from my informal exit polls of dealers). The only downside was that I left the loo with a tampon wrapper (part of Julie’s piece) stuck to the bottom of my shoe. A security guard kindly pointed it out.

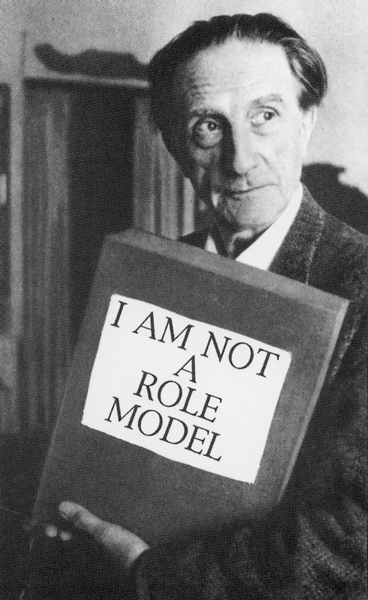

Sigmar Polke. Courtesy of Kenny Schachter.

Dealers Make the Best Clients at Frieze Masters

Dominique Lévy, Marianne Boesky Gallery, and Sprüth Magers banded together to present a (better than) museum worthy historic display of early Frank Stella paintings that might have been mistaken for late Sean Scullys. I’d suggest this was an endeavor less the spirit of ¡Three Amigos! than a marriage of convenience of three art superpowers merging for economies of scale and expense.

Per Skarstedt had the painting with the most colorful provenance (to say the least): a Richard Prince canvas that formed the basis of a legal action that landed private dealer Perry Rubinstein cooling his heels in an LA jail over a weekend—lesson learned: choose your mark a tad more carefully than pissing off famously grumpy, grudge holding Michael Ovitz. The work was disgorged from the subsequent good faith purchaser and the $2 million purchase price returned to Ovitz by his insurance company, which became co-owner with the original buyer who in turn sold the painting to Skarstedt for $1 million, suffering a 50 percent loss. The work remained unsold last time I checked at $1.5 million, a veritable bargain with a backstory.

A Richard Prince canvas at Per Skarstedt.

No Masters is complete without a usual customary Judd stack at David Zwirner, in this instance in somber black with clear sheets of Plexiglas, at the not so somber price of $8.5 million. Christophe Van de Weghe was seen haggling over a Cy Twombly work on paper in the region of $1.25 million with fellow dealer and fair mate Robert Mnuchin. It turns out $50,000 was separating them, but the sale was ultimately consummated.

I don’t suppose you sign onboard to Frieze in order to sell to another dealer located a block away in Manhattan. Though admittedly, dealers make the best clients: they need neither explication nor handholding. And the lack of ready money on hand never seems to get in way of the next deal.

Gagosian Gallery assistant handing out newspapers in Mayfair.

Gallery Girl in Mayfair and the Sunday Fair

Like the political activist Thomas Paine and missionary Johnny Appleseed, I spotted a Larry G gallery girl handing out pamphlets on Mount Street in Mayfair announcing multiple exhibitions across many a beachhead: I lost count of how many. She wasn’t making much of an effort and resembled a frozen J. Seward Johnson Jr. figure. But she was certainly dressed for the occasion—I always wanted to do a flow chart of the family histories of Gagosian employees—it would be like Hans Haacke tracking Guggenheim trustees.

Almine Rech of Paris opened behind Larry’s gallery with one of his (former, current, who can keep track?) artists Jeff Koons. We are in the age of artists’ free agency. Indentured servitude no more, if your prices are private plane high enough.

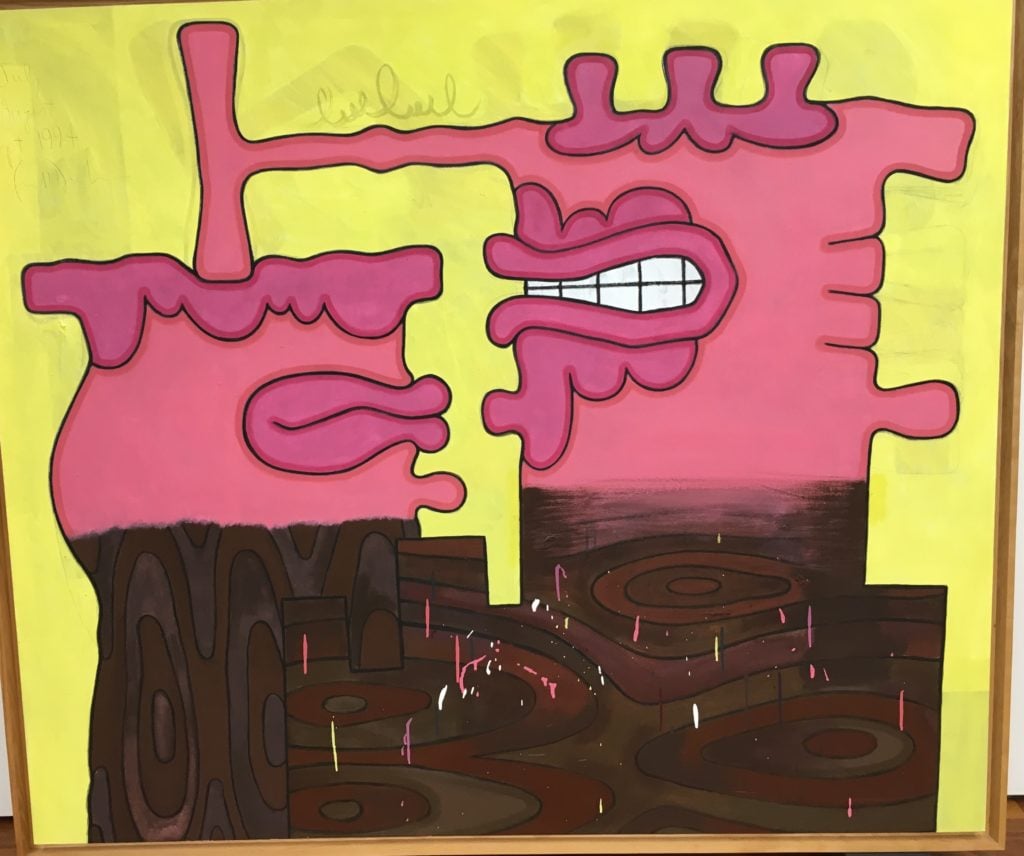

Carroll Dunham. Courtesy of Kenny Schachter.

With fabricated copies of old master paintings with shiny blue gazing balls affixed to their surface and glossy ballerina figurines writ large, all I could muster thoughtwise is that we get what we deserve. If you removed all the ready-mades and had-it-mades in galleries and fairs, you wouldn’t be left with much, Duchamp be damned. But the alarmed look of the security guard protecting the baubles when he clocked my dragging (vintage, I might add) Adidas track pants was worth it all.

From blue balls to the painted penises of Carroll Dunham, this was an eye opening standout show at Inigo Philbrick Gallery. Dunham’s characters are anguished and angry, screaming the scream of life and death silently from the painted surface. Dunham’s dick—forgive me—are asexual weapons of horror (bring to mind any candidate?) that are battering rams in a faceoff between hostile camps of faceless creatures defined by their dingdongs. One of the paintings is mine (on loan) for full disclosure; I can appreciate a Dunham dick (I did it again, sorry) as much as Ileana Sonnabend, his long time dealer and proponent.

Ed Ruscha. Courtesy of Kenny Schachter.

As interesting as Ed Ruscha’s ambitious new painting show at Gagosian is, he announced he’s going into the closet, designing a limited edition suit-lining for Savile Row bespoke tailor, Huntsman. What’s next?

The Sunday Art Fair in Marleybone is a small pleasant alternative fair with a few choice finds on view. I liked paintings depicting grids of log cabins by Neil Raitt at Anat Ebgi from LA, Claire Tabouret slightly, disturbingly distorted faces from Lyles & King in New York, and the 3D clumps of pigment on Gina Beavers’s paintings that you could bite into at Michael Benevento in LA. I hate myself for liking the text and cartoons on canvas of Josh Reames at Brand New Gallery in Milan, but they suck me in. Shhh. All the art mentioned is $5,000-$15,000—the way things should be.

I felt for some of the exhibitors. Nothing is more inspiring of sympathy than a small booth in a small fair with crummy art. You can feel the pain of the proprietors. I’ve been there before. I was amused that on the Saturday of the Sunday fair a lot of the bosses were missing in action. They are preparing for when they step up to the majors where gallery owners go…as soon as they can. And also that the Pinault Collection has replaced MoMA as a future value signifier in gallery sales speak, they learn quickly nowadays.

A class from the University of Zurich, Executive Master in Art program came calling to my house at the conclusion of the weekend. I have a hard time saying no and after a while they become like family—just what I need more of. Anyway, art is communication and I am compelled (as you know all too well). It’s no easy task, teaching (and thinking) is hard labor for me, I could feel the eyes of the head of the course, Dr. Nicolas Galley, fixate on my sweating armpits, which was worse than it felt playing Charlie Rose to Simon de Pury.

The class is a realm of study born of a prosperous art market. The lecture lasted two hours recapping the fairs and auctions and produced some great questions, including: Why were the works of Günther Uecker ubiquitous all of a sudden in the fairs, galleries, auctions, practically lining the storefronts. The answer is simple: the art world loves to discover the discovered, resurrecting the reputation of a great artist, who had been previously ignored (by the market) but embraced critically and by institutions.

Collage by Kenny Schachter. Courtesy of Kenny Schachter.

Trading Tales

When you’re hot, you’re hot—coveted new (market) art looks different enough but the same. And if you want it, you can’t have it unless you are important enough on the hierarchical food chain to leapfrog the fictitious waiting list. Even with the unprecedented free fall in the prices of recent highfliers, sought-after artists of the moment include Helen Marten, Laura Owens (both of powerhouse Sadie Coles), Camille Henrot (stick that in your prejudiced pipe Baselitz) and more established talents like Mark Bradford and Yayoi Kusama. A lowly (loaded) collector I know was actually asked by two of the artist’s dealers to unwind a purchase he previously paid for to make way for a more prestigious punter.

One way around this bottleneck of supply, where primary prices of these artists are still significantly cheaper than secondary, is to buy by proxy, on the down-low. I’ve even heard of actors real life acting the role of collectors to secure art on behalf of friends (and money) subsequently disposed of either privately or at auction. Everyone adores celebrities, ask Leo.

Shortly after writing about an artist I got a text from a dealer-friend (ha) I had facilitated an exhibit for in the recent past. Like much in the art world, nothing was reduced to a contract, my fault as an ex-lawyer (trained anyway). He had purchased an in demand painting and wanted to know if I was a buyer under the stipulation it had to be buried for eighteen months (i.e. not publically sold). That’s rich considering he hadn’t yet paid, would profit handsomely to the tune of 50% and I should agree to (an unenforceable) resale restriction. The primary/secondary shuffle is an arbitrage play that has largely closed since the shakeout in the market; but its not entirely shut. Turns out they sold work from the show I organized for their gallery and were so busy trying to sell to me they failed to inform. Nice.

Few odds and ends if you haven’t had it yet. The art world’s very own Hatfields and McCoys (Nahmad and Mugrabi families) have taken a joint Mark Grotjahn position said to amount to $30m. A rogue Nahmad was even seen at Mugrabis recent society wedding. These folks get different auction terms you couldn’t fathom, having started such practices, now commonplace, as paying for guarantees with more art, the perfect wampum circle jerk, trading up and out.

Art kite? The indeterminate period between dealers and galleries getting paid for art and in turn paying the consignor/artist is an art Twilight Zone. When/if they recompense, it’s the equivalent of paying on the honor system like airport and drug store automated checkout machines. The eternal unanswerable question: Where’s my money? The problem is that such behavior often causes a domino effect of multiple parties being told the same lies that the payment is coming! In the same vain, a spec-u-lector passed by whose wife was pleading he desist from launching more lawsuits, he didn’t earn his nickname without cause.

Lastly, the Ullens Center for Contemporary Art, I’d be remiss not to mention an historic happening: the first museum flip—it started with a few auctions of art, now they are trying to pawn off the museum itself, (what’s left of it). Wow.

When it comes to buying many are helpless (like me) and see money as a coupon redeemable in art and (cars—apologies to my family). I’m not saying art is money; rather money is art, the new old gold standard. Even though the market is generally constricting, the goalposts are still moving outwards for the best (and sometimes the worst for some reason). London if anything was good-tidings for November in New York—in the face of unanimous newspaper headlines to the contrary in the months and weeks before. Art is always in a volatile flux, financially and historically, but it’s a mature market that isn’t going to go away…ever. Forecasting is futile but I bet FIAC will be fine and the New York sales, better.