Auctions

Vintage Cars Overtake Art on Luxury Asset Racetrack

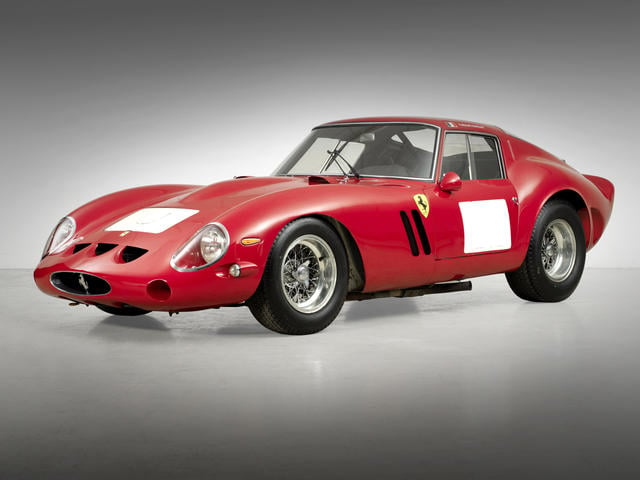

Rare car market revs up as $38 million Ferrari 250 GTO breaks record.

Photo: Courtesy Bonhams.

Rare car market revs up as $38 million Ferrari 250 GTO breaks record.

Rozalia Jovanovic

When it sold for $38.1 million at Bonhams, a classic red 1962 Ferrari 250 GTO set the record for the highest price ever paid at auction for a car. The sale on August 14 was among the yearly round-up of automobile auctions hosted by auction houses including RM Auctions, Gooding & Co., and Bonhams to coincide with the Pebble Beach Concours d’Elegance in Monterey, California. Auction sales for the week, which did not include private sales, totaled $400 million, setting a new record for Monterey week auctions.

The automobile auctions underscore a larger recent trend that has seen investments in luxury goods like cars and art outperforming those of more conventional asset classes. Recognizing this new-found interest, last year the Wealth Report published by real estate consultancy Knight Frank launched the Knight Frank Luxury Investment Index (KFLII), which tracks luxury spending across various classes of collectibles, or what Knight Frank calls “investments of passion.” It includes stamps, coins, wine, jewels, watches, furniture, and Chinese ceramics.

Over a 10-year period ending in the third quarter of 2012, several categories exceeded the incredible 400 percent increase of gold, with classic cars far outpacing all other categories, including art. This year, the KFLII has grown by nine percent, while gold (generally sought for its stability during tumultuous financial times) has dropped in value by a quarter. The market for classic cars is at an all-time high.

The Ex-Jo Schlesser/Henri Oreiller, Paolo Colombo, Ernesto Prinoth, Fabrizio Violati 1962-63 FERRARI 250 GTO BERLINETTA; Coachwork by Carrozzeria Scaglietti; Chassis no. 3851GT; Engine no. 3851GT.

Photo: Courtesy Bonhams.

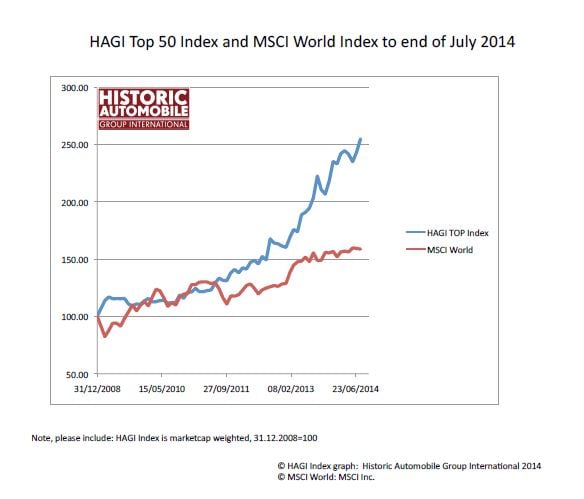

The Top 50 index by Historic Automobile Group International (HAGI), an independent investment research firm specializing in rare classic automobiles, shows that the market for collectible cars has risen steadily to over two-and-a-half times its 2008 level, motoring upward even through the recession, and surpassing the MSCI World Index (which tracks global equity).

Graph courtesy Historic Automobile Group International (HAGI).

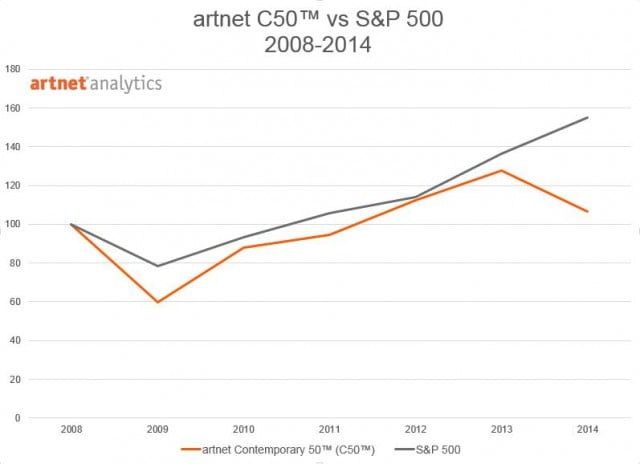

In comparison, the market for art, as per the artnet Contemporary 50 (artnet C50), has been less steady, experiencing a major dip in 2009. Only in 2011 did it recover to its 2008 level. Though it peaked in 2013, once again, it is on the decline and currently hovering at just above its 2008 level.

Classic Ferraris accounted for nine of the top 10 sales at the Monterey auctions, with a Ford GT40 breaking the run by the Italian car maker. In the past year the price of high-end vintage Ferraris has risen by 33.6 percent.

While he maintains that the causes of the rise of the vintage car market are varied and complex, HAGI founder Deitrich Hatlapa told artnet News over email that the main reasons are the “central bank’s policies of low interest rates and ‘easy money’ wealth growth across the globe and the fact that classic cars have become a lifestyle choice for many people with a myriad of events especially in Europe and the US.” Hatlapa is the author of Better Than Gold, Investing in Historic Cars.

Over a 10-year period, the rise in the market for rare cars is even more amazing, with value up by over 500 percent since 2004, according to Knight Frank’s report. According to Wealth Report editor Andrew Shirley, art is historically more volatile than stocks and shares.

Perhaps this means that the art flippers of the world should drop their hunt for the next Jacob Kassay and Oscar Murillo, and join the vintage car show circuit.