Analysis

SEC Filings Show Sotheby’s Gave Taubman Estate a Massive $500M Guarantee

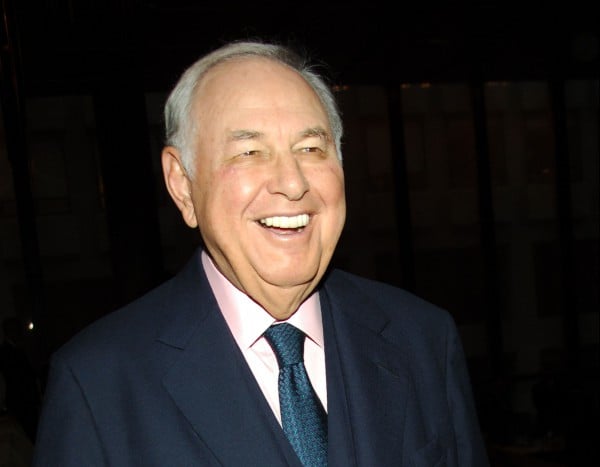

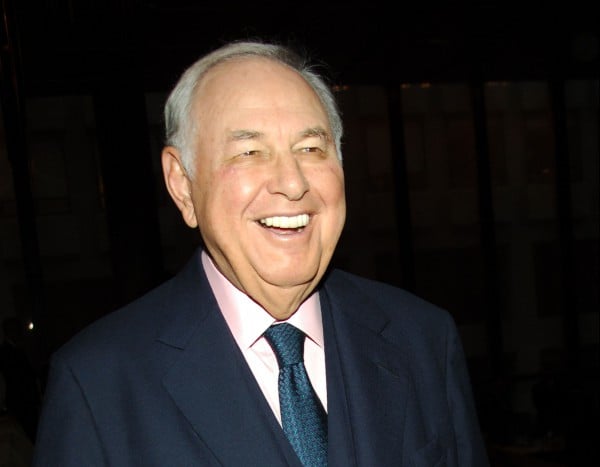

Image: via Patrick McMullan

Eileen Kinsella

Christie’s and Sotheby’s jump-started the fall season last week with announcements of respective blockbuster consignments including a $100 million Modigliani nude and the roughly $500 million collection of illustrious former Sotheby’s chairman A. Alfred Taubman’s estate.

According to the 8-K SEC filing Sotheby’s made on September 9, the publicly traded auction house is betting big on the $500 million Taubman collection, having given estate overseer and Taubman’s son Robert a financial guarantee “for the collection at approximately that level.” The SEC Filing was first flagged by the Art Market Monitor’s Marion Maneker in a post this morning.

Further, Sotheby’s may enter into third-party guarantees in order to reduce some of the risk. According to the filing: “Sotheby’s may reduce its exposure under the auction guarantee by entering into risk and reward sharing arrangements prior to the auctions at which the Estate’s collection is offered.”

As artnet News reported last week, the wide ranging collection comprises about 500 items and including objects ranging from antiquities to Impressionist and contemporary paintings. It is said to be the most expensive private collection ever offered at auction. Some of the most valuable highlights are paintings by Amedeo Modigliani, Pablo Picasso, Willem de Kooning, and Mark Rothko.

It’s safe to assume everyone will be carefully parsing the catalogue symbols denoting third party guarantees on related Taubman lots to see how Sotheby’s makes out on this deal this November.

When the art market endured a sharp correction during the 2008-2009 economic crisis, Christie’s and Sotheby’s sustained heavy losses on guarantees secured in the heated market atmosphere of the year prior, and subsequently curtailed the activity. Now, with the resurgence of the art market in recent years, the practice is obviously back in a big way.

As the filing notes: “Sotheby’s is generally entitled to a share of the excess proceeds if the property under the auction guarantee sells above the guaranteed price.”

Another interesting piece of information noted in the filing is Robert Taubman’s connection to Sotheby’s “in his capacity as a director,” noting that Taubman “played no role in the Board of Director’s consideration or approval of the transaction and the associated Guarantee. As a result of this transaction with the Estate, the Board of Directors has determined that Robert S. Taubman is no longer independent under New York Stock Exchange rules and standards.”

The filing ends with the statement, “The Board of Directors will continue to have ten independent directors (out of a total of thirteen).”

Related Coverage:

Sotheby’s To Offer $500 Million Collection of Former Chairman A. Alfred Taubman

What Will Happen to Billionaire A. Alfred Taubman’s Astonishing Art Collection?

Christie’s To Offer $100 Million Modigliani. Is It Worth It?