Analysis

Sotheby’s to Offer $500 Million Collection of Former Chairman A. Alfred Taubman

Works by De Kooning, Picasso, and Modigliani will be offered.

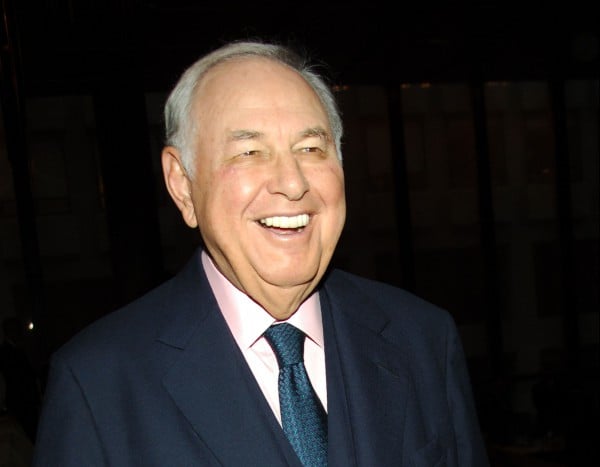

Image: via Patrick McMullan

Works by De Kooning, Picasso, and Modigliani will be offered.

Eileen Kinsella

Sotheby’s announced Thursday that it will offer the collection of its illustrious former chairman A. Alfred Taubman across several sales this fall.

The collection, which includes 500 works ranging from antiquities to Impressionist and contemporary works, is valued in excess of $500 million, making it the most expensive private collection ever offered at auction. Earlier in the day, Christie’s unveiled news of a $100 million Modigliani nude consignment. Yes, it’s going to be that kind of season.

The most valuable individual works in the collection are modern and contemporary paintings. These include: Pablo Picasso’s Femme assise sur une chaise (1938), estimated at $25–35 million; Willem de Kooning’s Untitled XXI (1976), also estimated at $25–35 million; Amedeo Modigliani’s Portrait de Paulette Jourdain (circa 1919), estimated at $25–35 million; and two Mark Rothko works, both estimated at $20–30 million including Untitled (Lavender and Green) (1952) and No.6/ Sienna, Orange on Wine (1962).

Amedeo Modigliani, Paulette Jourdain (1919).

Photo: artnet

All of the above works will be offered at the Masterworks sale (November 4), while other works will be offered at Modern & Contemporary Art (November 5), American Art (November 18), and Old Masters (January 27, 2016).

Taubman, a Detroit-based shopping mall magnate, collector, and philanthropist became both famous and infamous after he bought Sotheby’s in 1983, then a flailing brand known as Sotheby’s Parke Bernet. He was widely credited with transforming the auction business into a global powerhouse brand by applying his acumen in retailing and luxury brand management to the art world.

Taubman built Sotheby’s into a full-service art retailer, revamping it from the small business that it was to one that offered expanded options to collectors such as financing, insurance, storage, and education, while also pushing the notion that art collectors were a tasteful, intellectual, and wealthy breed of culture arbiters.

Willem de Kooning, Untitled XXI (1976).

Image: Courtesy of Sotheby’s.

“Selling art has much in common with selling root beer,” Taubman, who also owned A&W Root Beer, once said, according to the New York Times. “People don’t need root beer, and they don’t need to buy a painting, either. We provide them a sense that it will give them a happier experience.”

Taubman “solicited clients with mass mailings of glossy catalogs, gave credit to buyers and concessions to consignment sellers, threw parties for clients and guaranteed minimums to sellers regardless of sales prices. He opened branches in Hong Kong, Monte Carlo and Russia; introduced lines in Scandinavian art, Victorian paintings and rock ’n’ roll memorabilia; and spent lavishly on palatial New York headquarters,” according to the Times.

Taubman.

Image: Courtesy of Sotheby’s.

Unfortunately, Taubman, faced with cut-throat competition from rival auction house Christie’s, also became a key fixture in the price-fixing scandal that embroiled both houses in the late 1990s and early 2000s. Taubman—who was found to have met with his Christie’s counterpart Sir Anthony Tennant about a dozen times—was found guilty of collusion following a 2001 trial in Manhattan. He was sentenced to a year and a day in prison.

Despite pleas from his attorneys about his then-fragile health, the 77-year-old Taubman served time in a federal correctional center in Minnesota. During his sentence, there were media reports of a steady stream of prestigious visitors jetting in to see him on private planes, and Taubman happily reported losing over 25 pounds, the result of not being able to eat regularly at the top-notch New York restaurants he liked to frequent.

Thomas Gainsborough, The Blue Page. Image: Courtesy of Sotheby’s.

After being released from a halfway house in 2003, Taubman hopped on his Gulfstream jet and flew straight to his oceanfront estate in Southampton, New York. According to the Times, he was soon “back home in Manhattan, Palm Beach, Fla., and Bloomfield Hills, partying with Michael Eisner, Barry Diller, Henry A. Kissinger, Donald Trump and others in the arts, entertainment and business.”

“I had lost a chunk of my life, my good name and around 27 pounds,” he wrote in his 2007 memoir Threshold Resistance: The Extraordinary Career of a Luxury Retailing Pioneer. “I’m out and I’m not bitter. I believe in the system. It’s still the greatest system in the world.”

Taubman was the only person who served jail time in the price-fixing scandal. Tennant, who refused to leave London to stand trial for the collusion charges, could not be extradited under UK law.

Martin Johnson Heade, The Great Florida Sunset.

Image: Courtesy of Sotheby’s.

In exchange for immunity, Christopher Davidge, Christie’s presiding CEO during the time in question, had turned over a trove of incriminating documents to the US Justice Department. And Sotheby’s then CEO Diana Brooks alleged that Taubman had orchestrated the whole scheme and that she had just been following orders. Brooks received a lighter sentence of house arrest after she testified.

Following his prison sentence, Taubman delved back into his philanthropic activities. He was the principal benefactor of the University of Michigan’s College of Architecture and Urban Planning, Health Care Center, Health Sciences Library and Biomedical Science Research Building (each of which bears his name).

At Harvard’s Kennedy School, he established the Taubman Center for State and Local Government. He also funded the A. Alfred Taubman Wing at the Detroit Institute of Arts, which houses the museum’s European paintings collection.

Proceeds from the Sotheby’s sales will be used to settle estate tax obligations and to fund the A. Alfred Taubman Foundation, which supports the arts, education, and medical research.

Related Coverage:

What Will Happen to Billionaire A. Alfred Taubman’s Astonishing Art Collection?

Sotheby’s Names Tad Smith as New CEO

Christie’s To Offer $100 Million Modigliani. Is It Worth It?