Galleries

This Gallery Believes Cryptocurrency Is the Future—and It Just Sold a Piece Worth Nearly $1.3 Million in Bitcoin to Prove It

The sale was made via Instagram, Signal, and Postmates. The buyer remains unknown.

The sale was made via Instagram, Signal, and Postmates. The buyer remains unknown.

Sarah Cascone

As the art world continues to adapt to the rise of cryptocurrencies, one gallery just may be ahead of the curve. Āto Gallery, an online venture founded by Carrie Eldridge in 2016, has announced the sale of a painting by New York mixed media artist Benjamin Katz for 150 Bitcoin—the equivalent of more than $1.25 million at the time of sale, and a record price in cryptocurrency for a work of art.

The new record-breaking sale came as something of a surprise to Eldridge, who had only just uploaded an image of Katz’s painting Chasing Hearts/Northern Lights to the Āto Gallery website when an interested party reached out on Instagram. After having spoken with both Eldridge and Katz on social media, the collector suggested moving the conversation to Signal, an encrypted messaging service, where he promptly asked how much the piece cost.

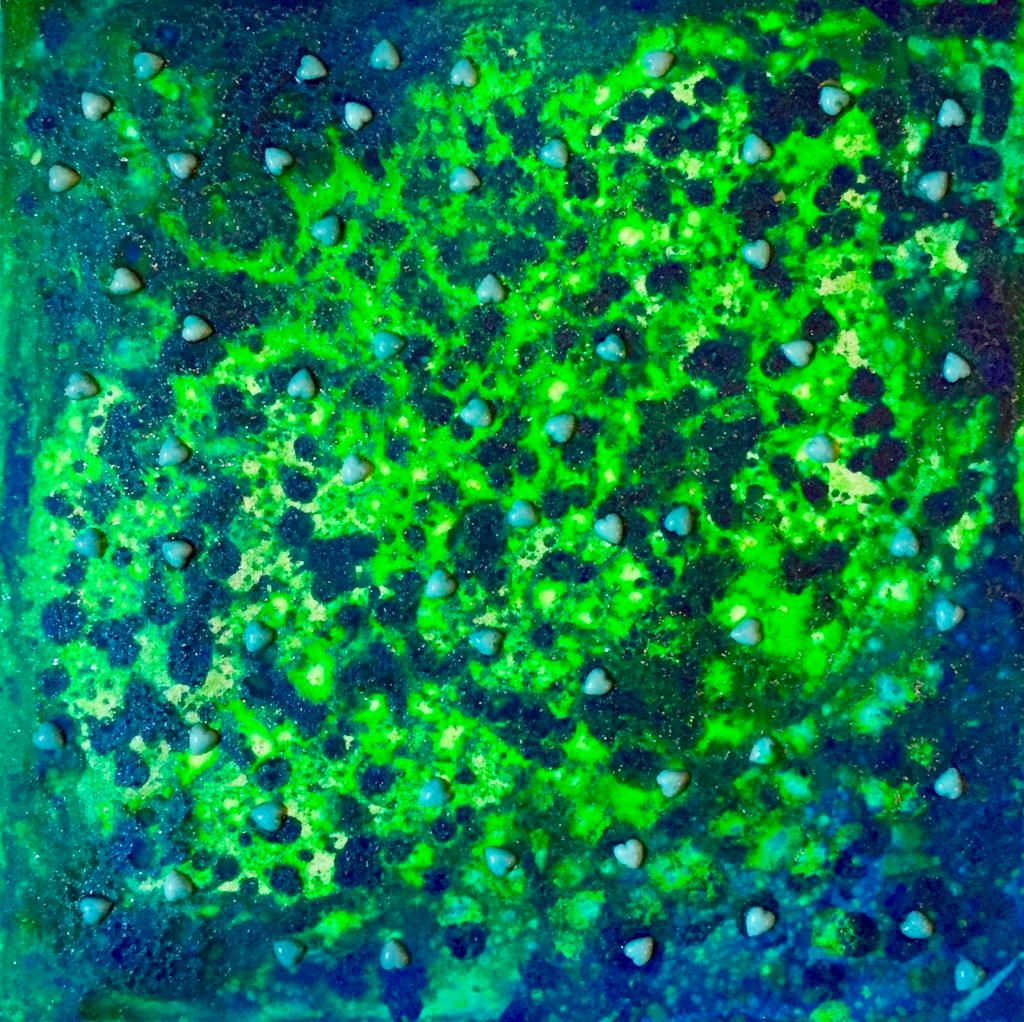

Eldridge hadn’t decided yet but knew the work was more costly than the artist’s other offerings, which currently range from $5,000 to $100,000 on the gallery website. “It took Ben three months to make that piece,” she told artnet News. “It’s very complex, mixed media using wax and paint and melting them together in his oven. He had to wear a gas mask; it was a whole ordeal he went through.”

“The colors clearly represent the auroras over Iceland, and I added the hearts as symbolism for people looking for love; moving in all directions caught up in this powerful magnetic field,” the artist explained in a statement. “I chose the northern lights because of my connections to Iceland, and love for the beauty of that country.”

Benjamin Katz, Chasing Hearts/Northern Lights (2018). Courtesy of Āto Gallery.

But while Eldridge was still checking in with her art advisors to determine an appropriate price point, the collector got back to her with the record-breaking offer of 150 Bitcoin.

“I had this ethical dilemma!” she admitted. “I asked my team of art directors and they said ‘Carrie, the price is the market price, if they offered that, and they feel that they want to pay that’—so we asked ‘are you sure?’ and they said ‘yes, absolutely.'”

The anonymous buyer’s identity is unknown even to the gallery. In addition to communicating via encrypted channels, the collector sent a Postmates courier to the gallery to pick up the painting.

“I couldn’t even tell you who bought it even if we wanted to,” Eldridge admitted. “That’s something that we want to address because we don’t want there to be a pattern of anonymous buyers of art. Our whole motive to bring transparency to the art market and not to allow people to be shrouded in mystery or to launder money!” (Āto Gallery is working to add to its platform a buyer verification system, similar to Twitter’s blue check.)

Eldridge has her own theory about why the anonymous buyer wanted the artwork: the artist’s brother, Jason Scott Katz, fled the US for Iceland after being investigated in connection to Wikileaks. He then became a founding member of that country’s Pirate Party, which advocates for direct democracy and civil rights. “We can’t say with certainty that is the motivation for the large offer, but we’re speculating that perhaps one his brother’s fans made this purchase as a statement,” she said. “It’s kind of a crazy story, right?”

The Katz sale tops the previous record for the world’s most expensive crypto-artwork, set in February with the $1 million Valentine’s Day sale of Forever Rose by Kevin Absosch (who previously claims to have sold a photo of a potato for $1.5 million). But unlike Katz’s painting, Forever Rose is not a physical artwork, but a digital version of Absosch’s rose image, a token called ROSE on the Ethereum blockchain. That work was purchased by a group of 10 investment funds, advisory firms, and other tech-savvy collectors—any of whom can separately sell their stake in the work—with the proceeds going to charity.

Kevin Abosch, Forever Rose. Photo courtesy of the artist.

Currently, Āto Gallery represents 35 artists, most of whom make work in the $20,000 to $40,000 range. She is looking to expand the stable, and to offer more work priced between $1,000 and $8,000. “More people are purchasing in dollars right now, but our bigger transactions are in crypto,” Eldridge said.

Beyond selling work online and carrying out digital transactions, Eldridge wants her gallery to harness the power of cryptocurrency to help artists build their careers. Because each Bitcoin or Ethereum transaction is recorded in a blockchain ledger, it’s an ideal way of tracking an artwork’s value over time—and can help ensure that artists get a cut of the profits each time their work is resold.

“I’ve had artists tell me, ‘I had a piece resold at Julien’s four years after I sold it. It went up 800 percent and I had no idea. I was still selling the screen prints at almost the same price,'” Eldridge said. She hopes cryptocurrency can eliminate such nightmare scenarios.

To that end, Āto Gallery is launching its own currency. The gallery hopes to raise $10 million with an Initial Coin Offering or ICO this fall or winter. Would-be investors will be able to purchase one of a billion āto tokens—Āto is Japanese for “art”—which they can then use to buy tokens for the gallery’s artists. Each artist is analyzed by a custom-built algorithm, based on the input of almost 200 curators, appraisers, and art experts, as well as the artists’ resume and past sales history. Then they are assigned a value.

At launch, the tokens will be priced at between 10 cents and 50 cents each, but as more people invest, the price will rise. The individual artists’ token value will also increase based on market interest, much like a stock. The platform will also help guide users to artists they may like, taking into account their stated preferences but with an eye toward broadening their horizons and offering added visibility to artists of color and women.

“This gives us the opportunity to expose customers to someone who they wouldn’t normally be exposed to in a brick-and-mortar gallery,” Eldridge said. “It’s about patronizing the artists, and making a very opaque market more transparent.”