Market

The Back Room: Asia Major

This week in the Back Room: Asian collectors to the fore, “art bros” on the rise, Chinese auction sales bounce back big, and much more

This week in the Back Room: Asian collectors to the fore, “art bros” on the rise, Chinese auction sales bounce back big, and much more

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy. You’re now viewing the final free promo edition, so become a member (and click the “subscribe” box during checkout) to receive it next week and beyond.

This week in the Back Room: Asian collectors to the fore, “art bros” on the rise, Chinese auction sales bounce back big, and much more—all in a 7-minute read (1,746 words).

Visitors to an auction preview in Beijing. (Photo by In Pictures Ltd./Corbis via Getty Images)

The art market’s focus is on Hong Kong this week, thanks to a now-in-progress live edition of Art Basel’s fair in the city and a cluster of premier seasonal sales at Christie’s Hong Kong. But some experts argue that collectors in Asia increasingly pace the industry year-round.

Yuki Terase, the veteran head of contemporary art for Sotheby’s Asia, has overseen a decade of dramatic growth across the continent. Most important in her eyes is a group of “vibrant, active young people” from the region who are determining “what names are the most coveted on a global scale, not just in Asia. Asia leads the way.”

Deep reporting by Vivienne Chow revealed these youthful buyers tend to be either…

Self-made entrepreneurs collecting to broadcast their rapid rise to elite status (see: pop stars Jay Chou and Big Bang member G-Dragon, AKA Kwon Ji-Yong).

Both groups are tech-savvy, research-driven, fast-acting, and eager to build relationships with artists directly through social media. They are also equally comfortable buying online or offline.

Their tastes are influencing an older generation, too. Often at the urging of their children, veteran collectors of early 20th century works are increasingly gravitating toward millennial artists in demand around the globe, such as Amoako Boafo, Avery Singer, and Matthew Wong.

Asia-based bidders are also pushing classic contemporary artists from the West to big prices at auction. A bidder in the region just set a new high mark for a work of Western art in Asia this March, paying $41.8 million for Jean-Michel Basquiat’s Warrior at Christie’s Hong Kong.

Auction data verifies Asia’s growing interest in the contemporary genre and importance to the overall market:

Sotheby’s Hong Kong posted a new all-time sales high of $298 million (HK$2.25 billion) from its spring slate of modern and contemporary art auctions this April.

Christie’s, Sotheby’s, and Phillips all reported that buying in their Asian houses accounted for one-third of their worldwide sales revenue last year.

China reclaimed the global fine-art sales title in 2020, showing no year-over-year decline during the Year of the Shutdown while the U.S. and U.K. each plunged 35 percent.

A final contributor to these gaudy totals is a cadre of surprise artists experiencing outsized success in the East. For instance, ever heard of Javier Calleja? I definitely hadn’t! But a playful canvas by this 50-year-old Spanish painter of gonzo-eyed characters traded for $1.1 million (HK$8.89 million) in an online auction by Christie’s Hong Kong this year. As one major buyer in the region put it…

If there was any lingering doubt, Asia-based collectors—especially millennials and zoomers—have the wealth, knowledge, and confidence to engage with their Western art-market counterparts as equals, and they are in fluent dialogue with dominant global trends. But buyers in the region are also willing and able to set their own agenda… and those of us in the West should recognize that our success in the art trade will depend more and more on listening to their perspectives than dictating our own.

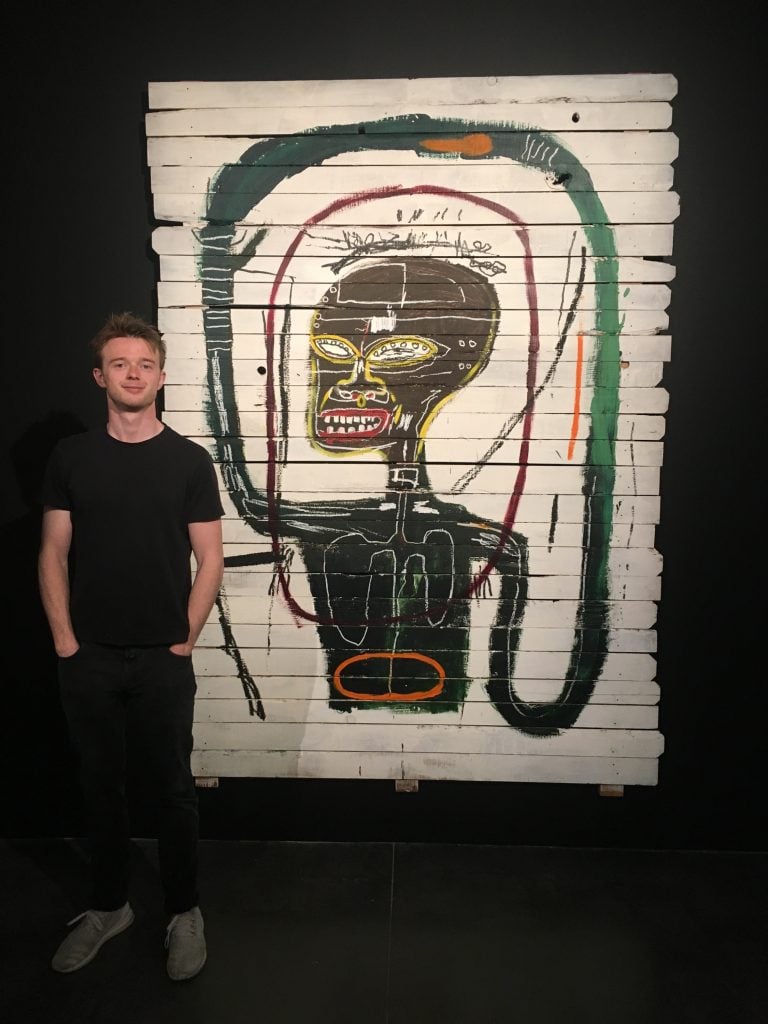

Connor Remes with a painting by Basquiat. Courtesy of Remes Advisory.

Asia may be the most important axis of change in collecting today, but it’s also just part of another crucial shift concerning age and gender.

Take it from Alex Rotter, the chairman and mastermind of Christie’s restructured 20th and 21st Century art departments, who told Katya Kazakina that he “didn’t know many of the names of buyers and bidders in” the house’s $211 million 21st Century evening auction in New York last week.

One longtime market player identified many of these fresh-faced collectors as “art bros,” which Katya summarized as “young men who’ve made millions in equities and are now moving markets for individual artists from their bedrooms—without ever setting foot in a gallery.”

The two biggest factors in the birth of the art bro? The rich-get-much-richer effect of the Great Shutdown, and a hulking intergenerational wealth transfer that some analysts have pegged as high as $30 trillion.

Turning a profit on their acquisitions is an animating force for many of these buyers. Their wealth, the size of their ranks, and their competitive approach to art is contributing to a rapid acceleration in primary-market prices—sometimes “from $50,000 to, say, $200,000… in a year or less,” per Kevie Yang of Phillips Art Advisory.

Art bros are also utterly transparent about prioritizing gains, unlike many older collectors (some of whom are privately just as obsessed with the bottom line). Several are even openly posting their costs, returns, and anecdotes online, similar to their peers plastering Wall Street Bets with tales of their meme-stock adventures.

So if you’re a dealer or advisor, it might even be time to familiarize yourself with terms like “tendies,” “diamond hands,” and the rest of Wall Street Bets’ distinctive jargon. (Just beware that if you actually click through to this Reuters guide to zoomer day-trading slang, you will instantly become the same age as Ed Ruscha.)

It’s probably fair to be disquieted by the strength and influence of the art bros most deserving of the name, but don’t assume every young male buyer is crass, stupid, or both. Take 26-year-old China-born, LA-based Harry Hu, who recently donated a Glenn Kaino painting to LACMA, sits on the Whitney Museum’s acquisition committee for painting and sculpture, and will found a residency for international artists in the City of Angels in 2022. So be open-minded, but don’t be naive.

© Artnet Analytics.

Houses in China (including Hong Kong) sold $470 million worth of fine art at auction last month, up 12,062 percent versus April 2020, and 78.6 percent higher than April 2019.

Part of the rise was logistical even outside of the absence of last year’s chaos: Sotheby’s shifted its marquee spring auctions in Hong Kong from March (where they were in 2019) to April this year.

But the rest of the story appears to be genuine growth across price brackets, especially at the apex. Compared to results in April 2019, five times (AKA 500 percent) more works sold above $10 million in China this April. Sales were also up a healthy-but-not-outrageous 35 percent alike in the price bands from $100,000 to $1 million, and from $1 million to $10 million.

For more details and backstory, click through to Julia Halperin’s analysis below.

“I wouldn’t be interested in doing something like that—it’s a little bit of a wolf in sheep’s clothing…. My advice to smaller galleries would be: preserve your own identity and brand—even if you can’t do it at the level of a large gallery, work within your means and don’t hand over your artists and client lists to somebody who might take advantage of it at some point.”

— Larry Gagosian carving up the new iteration of David Zwirner’s Platform, a click-to-buy online marketplace where Zwirner will feature $50,000-and-under works from smaller dealers in exchange for 20 percent of sales proceeds.

L to R: Max Moore, Yuki Terase. Image courtesy Sotheby’s

Yuki Terase, the Sotheby’s Asia dealmaker you may remember from the top of this post, will depart in June “to pursue independent interests,” according to the house. (Artnet News)

Terase’s departure continues a cross-continental reshuffling of Sotheby’s personnel deck. Multiple Asian execs are being replaced by Westerners relatively new to the region, and all promotions so far are coming from within.

Alex Branczik, Sotheby’s current Euro head of contemporary art, will occupy the new role of chairman, modern and contemporary art, Asia.

Max Moore, NYC VP of contemporary art (and freshly minted NFT czar), will become head of contemporary art sales, Asia.

Amy Cappellazzo, who needs no introduction here, will exit in July for adventures TBD.

To try to fill A-Cap’s void, Imp-Mod expert Brooke Lampley will be elevated to chairman and worldwide head of sales for global fine art…

To moot travel restrictions (and prove the art market has transcended parody), select foreign dealers were “beaming into” Art Basel Hong Kong as holograms. (SCMP)

TEFAF canceled the rescheduled September 2021 edition of its flagship fair in Maastricht due to “current global circumstances”… the same day the E.U. announced it would resume welcoming vaccinated travelers. (Artnet News)

Mr. Doodle, Caravan Chaos: Side 2, Panel 6 (2015). Photo by Christie’s Images Ltd. 2021.

Date: 2015

Seller: Private Collection, Europe

Presale Estimate: $9,017 to $11,600 (HK $70,000 to HK $90,000)

Selling at: Christie’s Hong Kong

Sale Date: Tuesday, May 25

Mr. Doodle (AKA Sam Cox) is another Western artist whose Asian market went bonkers first. Just 18 months ago, buyers cleaned out a solo selling exhibition of his self-described “graffiti spaghetti” works, at prices between $6,400 and $25,640 per piece, at Sotheby’s Hong Kong. Those deals, a cascade of subsequent auction successes across the East, and his expansive social media reach (he’s tallied more Instagram followers than the Guggenheim) helped make him into a regional star despite little establishment buy-in… until venerated Hong Kong dealer Pearl Lam began repping him worldwide this spring. (Two Doodle works are now in her booth at Art Basel Hong Kong.)

Next week, Christie’s hopes to hitch onto the Doodle Man’s winning streak with “Caravan Chaos,” a dedicated auction of works culled from a trailer whose exterior he covered in cartoons in 2015. The project yielded 27 lots consisting of one or more of the vehicle’s panels, some of which (like the door highlighted here) retain in-your-face evidence of their origins on the road. With presale estimates topping out around $32,200 (HK $250,000), expectations are only a short haul from where they were at Sotheby’s in 2019. But now there’s a lot more reason to believe demand could send prices into overdrive.