Market

The Back Room: A Macro View of the Spring Auctions

This week in the Back Room: A mad dash through the auctions, a major U.S. dealer goes bicoastal, Frank Bowling wins the long game, and more.

This week in the Back Room: A mad dash through the auctions, a major U.S. dealer goes bicoastal, Frank Bowling wins the long game, and more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy. The inaugural month’s editions are free, but you’ll have to become a member (and click the “subscribe” box during checkout) to receive it in June and beyond.

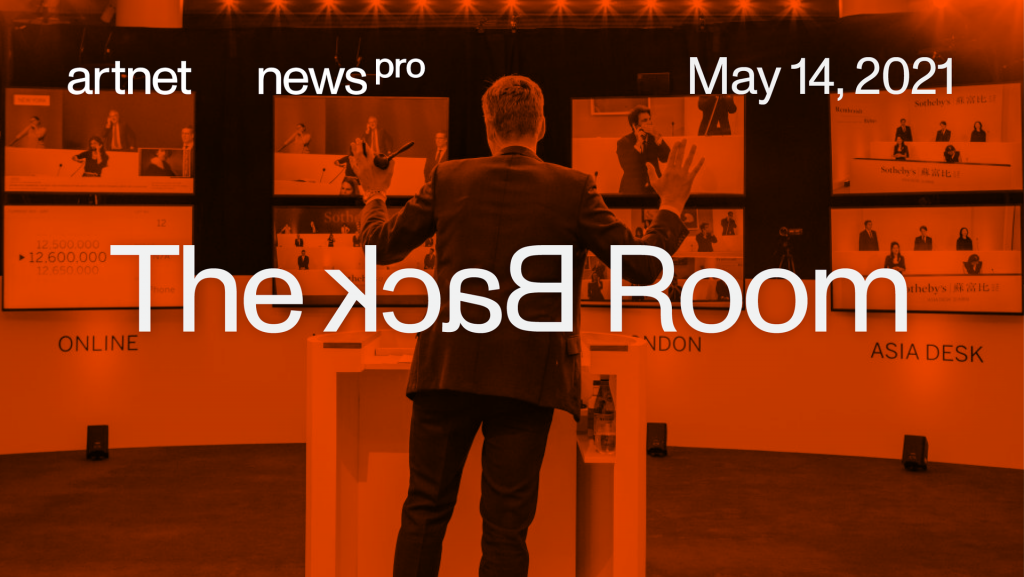

Jean-Michel Basquiat, In This Case (1983) Image courtesy Christie’s Images Ltd.

It’s mid-May, and like lush foliage, indoor dining, and the streetside aroma of sun-baked garbage, major auctions are back in New York! Even with Christie’s 20th Century evening sale still ongoing when this newsletter had to be finalized (you can time travel to Nate Freeman’s full recap of the sale here), there was already enough action to make last spring’s void feel like it happened in another lifetime.

Just shy of $780 million worth of art traded hands between Christie’s 21st Century evening sale Tuesday and Sotheby’s nearly five-hour auction triple-header Wednesday. (All sales results include fees unless otherwise indicated; presale estimates do not.) Three key themes had emerged from the bidding by Thursday morning.

Brett Gorvy, co-founder of Lévy Gorvy gallery and a former Christie’s executive, said it well: this spring, buyers wanted “fresh material, exciting names, works that haven’t been seen in a long time.”

Thanks to frenzied bidding from around the world, Christie’s 21st Century sale set new records for El Anatsui ($1.95 million), Lynette Yiadom-Boakye ($1.95 million), Nina Chanel Abney ($990,000), Jordan Casteel ($687,500), and Alex da Corte ($187,500).

Competition was also fiercest during Sotheby’s contemporary segment for three works by creators whose names meant nada to most blue-chip buyers 10 years ago:

The presale period is when the houses field third-party offers to assume the risk (and upside) of the guarantees they’ve made to consignors. Once those back-room competitions play out, there’s seldom much demand left for the salesroom anymore.

At Christie’s, solid (if not spectacular) works by Gerhard Richter, Christopher Wool, and Richard Prince sold to their guarantors with no outside resistance—often well beneath their low estimates. (Katya Kazakina’s latest column dug into these works and others consigned to Christie’s by private equity titan Thompson Dean.) In total, 16 of the 39 works in the sale were guaranteed, and most were backed by third parties.

In Sotheby’s contemporary segment, a classic Cy Twombly “blackboard” painting barely crept within presale estimate range by hammering at $36 million on one bid to its backer. Jean-Michel Basquiat’s Versus Medici hammered below its $50 million presale expectation. (Fees pushed it to $50.7 million.) Incidentally, nine of the 32 lots to reach the rostrum in this portion of the evening were guaranteed, with seven of the nine backed by third parties. (Two works were withdrawn presale, further reducing the drama.)

Sotheby’s Impressionist and Modern sale, largely defined by uneven bidding and few fireworks, counted 14 guarantees—11 of which had third-party backing.

The point: Many works seen as reliable stores of value (but not much more) are likely to be more in demand behind the scenes than in front of them anymore. This week’s sales did little to dispel that notion.

Christie’s claimed that 25 percent of works sold in its 21st Century auction went to Asian buyers, including one of its lesser-priced Basquiats and a Dana Schutz canvas.

At Sotheby’s, an Asia-based collector acquired one of its most competitive lots of the evening—Banksy’s Love Is in the Air, which went for $12.9 million, more than 2.5X its high estimate. (The house also managed to keep it out of a frame harboring a remote-activated shredder, which is nice.)

I can’t prove that bidders from the global East were responsible for some of the rocket fuel pumped into the early week’s two biggest sales: Basquiat’s In This Case ($93.1 million against a $50 million estimate), and Claude Monet’s Le Bassin aux nymphéas ($70.3 million against a roughly $40 million estimate). But I’d bet on it, as well as that we’ll see much more high-dollar demand from Asia in the future.

For more details, check out our sale-by-sale roundups:

__________________________________________________________________________________

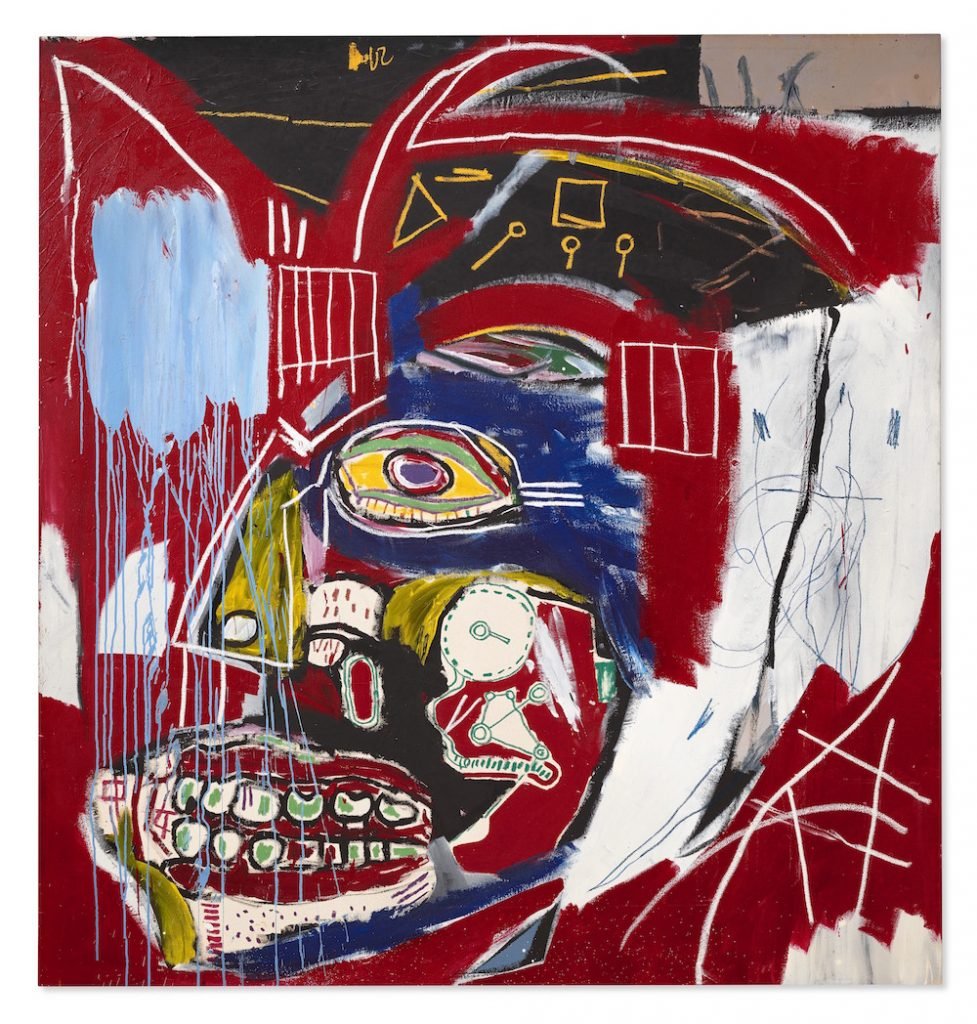

At left, the facade of David Kordansky Gallery in the Los Angeles neighborhood of Mid-City; at right, Kordansky. (Both images courtesy Getty Images.)

Sources tell our gossip guru Nate Freeman that tastemaking Los Angeles dealer David Kordansky is set to add a New York location to his evolving empire.

Remember those $16.9 million CryptoPunks at Christie’s 21st Century evening sale? Sources say they were acquired by a consortium of investors led by hall of fame NBA bettor, current Dallas Mavericks analytics maven, and crypto-enthusiast Haralabos “Bob” Voulgaris.

The 2022 edition of Frieze Seoul—first broken to the Western World by critic Andrew Russeth—will be officially announced next week. (Thaddaeus Ropac will also add a Seoul location this fall.)

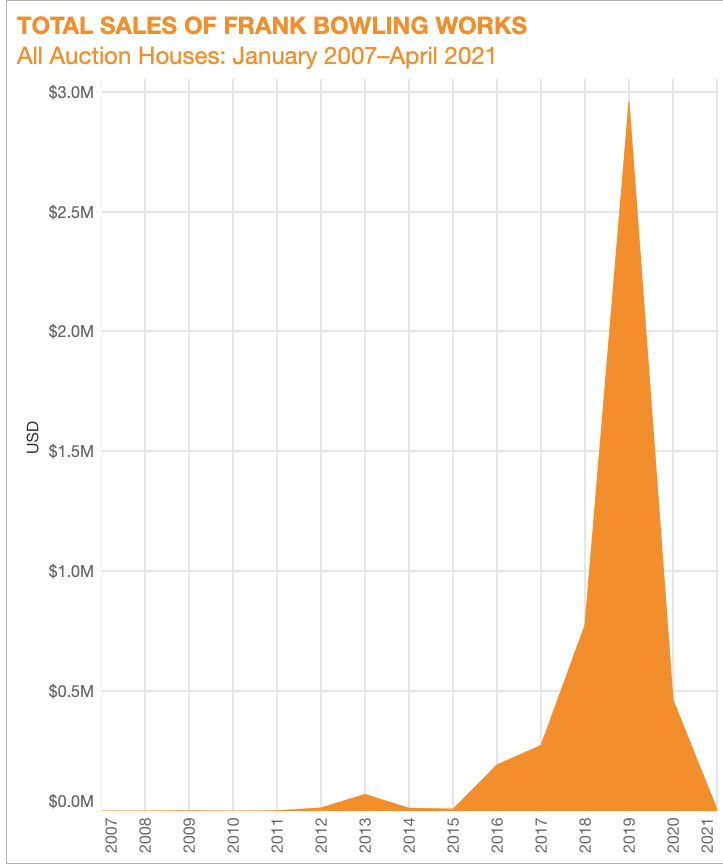

© Artnet Analytics

In the 48 years after he graduated from London’s Royal College of Art in 1962, Frank Bowling’s auction career comprised a grand total of one painting resold for under $1,200. But since 2011, his bravura works have chalked up nearly $4.8 million in sales (and counting) under the hammer.

That was the year Bowling joined Hales Gallery—a fruitful relationship that later soured into a mash of multimillion-dollar lawsuits and heated accusations from both sides.

However, the now-87-year-old painter and his former dealers recently settled out of court, freeing Bowling to concentrate on finalizing his legacy with the help of mega-gallery Hauser & Wirth and a 360-degree studio team that will one day transition into managing his estate.

Bowling’s story reads like a hybrid between novel and art-business case study: early critical success hampered by an England “not ready for a gifted artist of color,” as the Whitechapel’s then-director told him in 1964; a lone creative odyssey developing into a multigenerational family business; a market increasingly shaped by deliberate placements and auction-sector maneuvering; and more.

You can find Naomi Rea’s complete unspooling of the tale below.

“A resale royalty is just a peculiar sales tax that goes to the author of an artwork. Normally, we think tax revenue should be used for the purpose of socially beneficial redistribution. Why should a resale royalty tax be any different?”

– Legal scholar Brian L. Frye, explaining why artist resale royalty systems should funnel a percentage of proceeds to artists in need, not the already-successful makers of resold works.

The secondary market for NFTs shows the same high level of concentration as the art market during early Modernism—and data scientist Albert-Laszlo Barabasi has visualized the collector network. (The New York Times)

If you’re a completist or a masochist, drink in our final $ales roundup from Frieze New York. (Artnet News)

Sotheby’s will issue $300 million in new debt, infusing majority owner Patrick Drahi’s Bidfair USA and other stakeholders with their second major dividend in six months. (Financial Times)

While dealers look to Seoul, political uncertainties are driving global luxury brands to relocate their Asia-Pacific headquarters from Hong Kong to Shanghai and Singapore. (Business of Fashion)

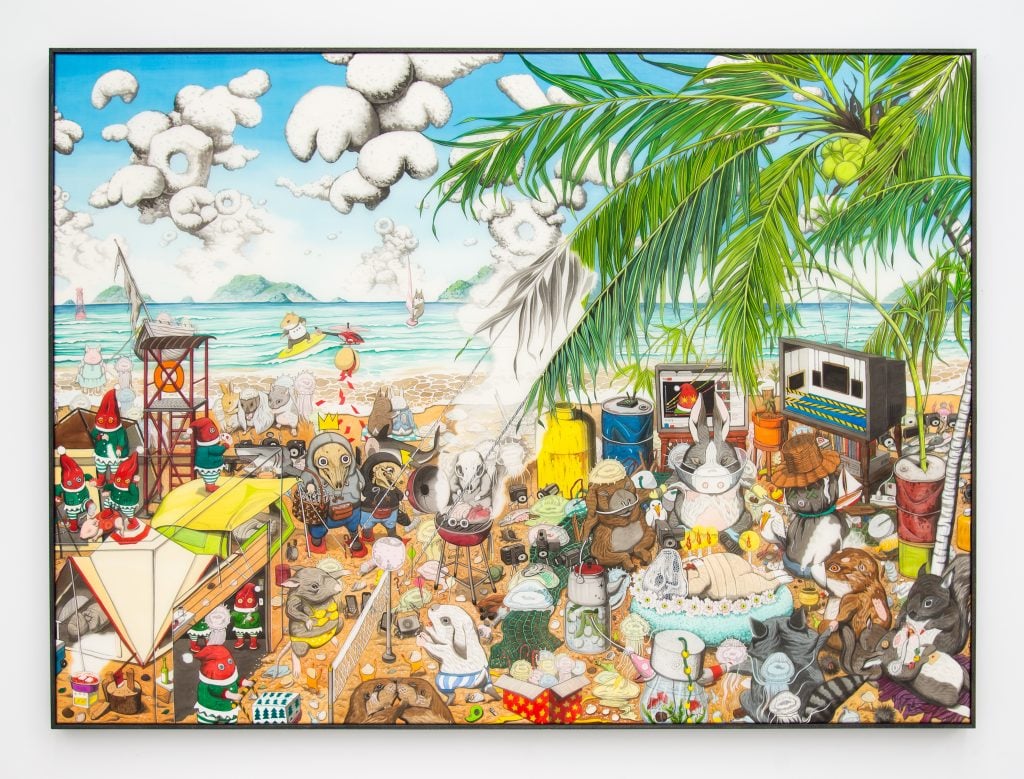

Hun Kyu Kim, Funeral on the Beach (2020). Courtesy of the artist and High Art.

Date: 2020

Seller: High Art

Price: €20,000

Selling at: Art Basel Hong Kong

Sale Date: Wednesday, May 19–Sunday, May 23

Hun Kyu Kim paints intricate, surreal take-offs on all-too-real scenes of discord and loss by placing anthropomorphized animals in the role of we humans. (Think Hieronymus Bosch meets Peter Rabbit.) He also shows how momentum can carry through disruption. High Art cofounder Jason Hwang told me that the artist “had no market” before the gallery showed his paintings at Liste in June 2019, but by the end of that fair, his works required a waiting list.

In the two years since, Kim’s work has been acquired by the Pérez Art Museum Miami and the Kadist Foundation, and “several” of the new paintings sold to waitlisted collectors shortly after the gallery sent out its ABHK booth preview. Funeral on the Beach was one of the few pieces still available from High Art’s booth as of publication time. It “attempts to depict the irreconcilable moral complexities that have emerged during this time of COVID,” Hwang said—a process many of us are still trying to work through even as the art market surges back with a vengeance.