The Back Room

The Back Room: Fighting the Flippers

This week: new resistance against rapid resales, a national shakeup at auction, Henry Taylor gets down to earth, and much more.

This week: new resistance against rapid resales, a national shakeup at auction, Henry Taylor gets down to earth, and much more.

Tim Schneider &

Naomi Rea

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: new resistance against rapid resales, a national shakeup at auction, Henry Taylor gets down to earth, and much more—all in a 6-minute read (1,599 words).

__________________________________________________________________________

Download the full report today. Illustrator: Johnny Sampson

Since the early 1970s, rapid resales of young artists’ works have transformed from an occasional scandal to a fact of life in the art market. But artists and dealers are working harder than ever to push back against the practice—and the industry is being reshaped by their efforts.

In the cover story of this fall’s Artnet News Intelligence Report, our own Katya Kazakina rounded up the latest developments in the fight over flipping. The upshot? The stakes have never been higher, and all parties involved are thinking more creatively than ever about how to partake in the profits.

For works by ultra-contemporary artists (those born in 1975 or later) resold within three years of their completion, total auction sales rose from $22.8 million in 2012 to $257.4 million in 2021. That’s an increase of more than 1,000 percent, compared to about 200 percent by the S&P 500 over the same decade.

The gains have been a boon for early buyers. But an array of new tools is giving unprecedented leverage to the original stakeholders in these in-demand artworks. Below, a summary of how artists, dealers, and intermediaries are jockeying for more control and more cash…

A growing number of initiatives is giving hot artists and dealers direct influence over what comes to auction—and who benefits from it.

The details vary slightly from intermediary to intermediary, but the general plan carries over: the house consigns new works directly from the makers and their galleries in exchange for most or all of the hammer price; the auctioneer keeps most or all of the buyer’s premium; and a charitable cause receives a preordained piece of the proceeds.

The results have been promising so far. Simon de Pury’s namesake auction platform generated more than $831,000 from 16 primary-market works by an all-star cast of women artists this summer. A few weeks later, the debut of Sotheby’s Artist’s Choice series brought just shy of $920,000 for six new works, triple their combined joint presale estimate.

De Pury also passed the galleries and artists the identities of the winner and underbidder for each lot—vital info that auction houses have generally siloed for themselves.

Dealers have compiled blacklists for as long as flipping has existed. However, the lists’ traits have changed in response to the rising stakes of the rapid-resale market.

Some galleries that now represent sought-after talent expect collectors to share a percentage of resale proceeds with them even if the work changes hands elsewhere on the secondary market (including at auction), and/or even if it was acquired while the artist was repped by a different gallery.

Dealers are no longer always content to simply restrict collectors’ access when they violate these norms, either. Galleries such as David Zwirner and Anton Kern have proven willing to leak the names of flippers to the press, adding a public shaming onto their transactional penalty.

Although the enforceability of resale covenants remains a point of contention, forward-thinking attorneys are encouraging artists and dealers to combat flipping by adding more robust protections to their sales contracts. The innovations include…

Third Party Beneficiary clauses, which grant artists, not just galleries, the right to sue if a buyer transgresses.

Right of First Refusal clauses, which require collectors to give the original dealer the opportunity to buy back a piece before it can be resold elsewhere.

Time-Limited Resale clauses, which demand that buyers wait a designated period (usually three to five years) before reselling a work.

Upside-Sharing clauses, which require buyers to pay a preordained portion of proceeds to the gallery when a work is resold through another intermediary.

A vanguard of startups believes that the blockchain can help solve the flipping dilemma, specifically by supplementing traditional contracts with crypto-native “smart contracts,” or digitally coded agreements that self-execute when objective conditions are met.

Most prominent among these companies is Fairchain, whose proponents include galleries such as 56 Henry and artists such as Carroll Dunham, Hank Willis Thomas, and rising star Ludovic Nkoth.

Its tools promise artists and dealers a guaranteed share of resale proceeds, automatic knowledge of subsequent buyers, and other longed-for assets the market has rarely provided.

__________________________________________________________________________

The effects of these new measures have been mixed. On one hand, there are recent examples of collectors voluntarily siphoning a portion of their resale proceeds (usually between three and 10 percent) to the artists or dealers critical to the original purchase. Although exceptional, such reported make-good sums have reached as high as $1 million.

On the other hand, defiant collectors have circumvented contracts and tacit expectations by, for example, privately reselling in-demand works at lower values in exchange for promises to “bury” the transactions until an unproblematic future date.

What is sure is this: as long as legislating an artist resale royalty remains a nonstarter in the U.S., and as long as the profits of rapid resales continue escalating, then all parties will keep searching for new and better ways to capture what they see as rightfully theirs.

The latest Wet Paint was still being mixed at newsletter time, but here’s what else made a mark around the industry since last Friday morning…

Art Fairs

Art Basel and UBS published a global survey of high-net-worth collectors’ activity in 2022. Key findings included increased spending across all markets and all generations in the year’s first half. (Artnet News)

Sales from Artissima‘s preview day included €75,000 for a sand machine work by David Medalla at Enrico Astuni; €42,000 for a Peter Zimmerman painting at Nagel Draxler; €32,000 for a work by Aks Misyuta at Sebastien Bertrand, and the Castello di Rivoli bought a painting by Pietro Moretti from Doris Ghetta for €8,000. (Artnet News)

Auctions

Sotheby’s will offer Andy Warhol‘s White Disaster (White Car Crash 19 Times) (1963) at an estimate “in excess of $80 million” during its November 16 contemporary evening sale in New York. (Artnet News)

Galleries

Gagosian now represents Deana Lawson in New York, Europe, and Asia; Kasmin has secured exclusive worldwide representation of Robert Motherwell; and Paula Cooper now reps the estate (and foundation) of Bay Area abstractionist Jay DeFeo on the east coast. (ARTnews / Press release / Artnet News)

Monica Bonvicini announced she has put her relationship with König Galerie on hiatus pending resolution of recent allegations of sexual misconduct against owner Johann König. (Monopol)

Institutions

Frances Morris is stepping down from her role as director of Tate Modern in April 2023. She has been at Tate since 1987 and in the director role since 2016. (Artnet News)

The Solow Art and Architecture Foundation confirmed plans to open a private museum for the collection of namesake real-estate tycoon Sheldon Solow in 2023, contradicting rumors that the chosen building at 9 West 57th Street is for sale. (Artnet News)

NFTs and More

Art Basel and the Luma Foundation launched Arcual, a blockchain-based startup offering smart contracts for artists and dealers. (Artnet News)

____________________________________________________________________________

“There are people that have big major goals, and that’s great… Me, I just want to get to a place where I can pay rent. That was my thing for a long time. It was nothing grandiose.”

—artist Henry Taylor, reflecting on the long journey to his first institutional retrospective on the west coast, which opens at the Museum of Contemporary Art Los Angeles this weekend. (New York Times)

© 2022 Artnet Worldwide Corporation.

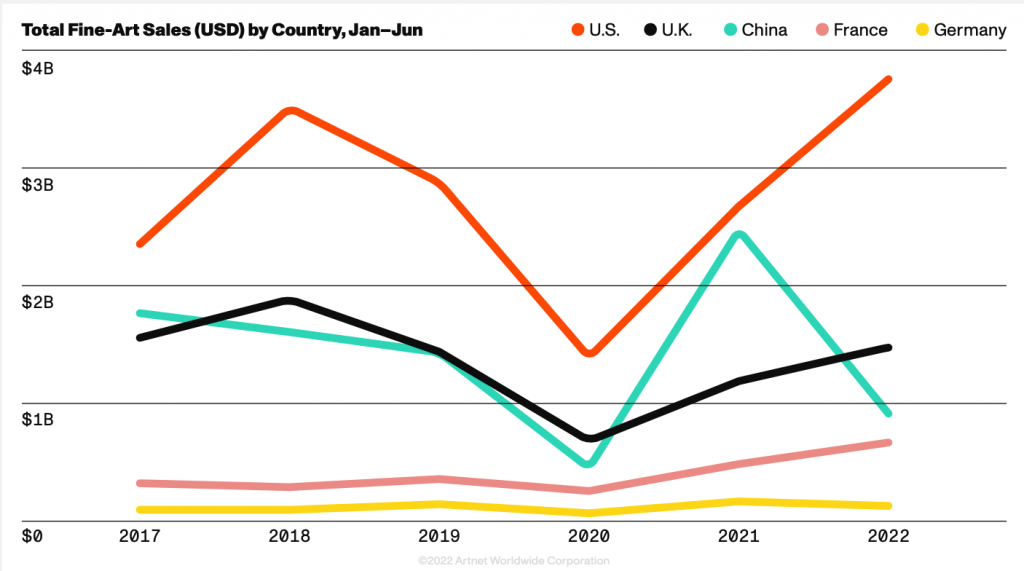

In the first half of 2021, China’s economy was still enjoying the benefit of its swift, strict COVID response, and spending by its young, wealthy collectors dramatically narrowed the U.S.’s long-held lead in fine-art auction sales. But the opening six months of 2022 have seen these fierce national competitors go in opposite directions…

With the CCP’s ongoing zero-COVID policy continuing to roil life, business, and travel in China, it will be a big surprise if the country’s results under the hammer turn around by the end of December. But given how shaky the economy feels everywhere else, the first half’s winners might be due for a downturn, too.

____________________________________________________________________________