The Intelligence Report

Introducing: The Artnet Intelligence Report, Fall 2022 Edition

The new edition of the Artnet News Pro Intelligence Report explores how artists are gaining the upper hand in the fight against flippers.

The new edition of the Artnet News Pro Intelligence Report explores how artists are gaining the upper hand in the fight against flippers.

Artnet News

“You are not your work.” It’s a phrase you’ve probably heard from your therapist at least a dozen times.

But if you are an artist (and especially if you’re a good one), the line between you and your work is necessarily thin. So what happens when you sell a piece of yourself to a collector who promises to nurture and care for it, only to find out that they’ve sold it off to the highest bidder six months later? And, to add insult to injury, they ended up making seven times what you, the creator, were paid for it.

In most industries, investors are praised for this kind of canny arbitrage. But the art market is not most industries. Here’s one key difference: the creators of assets do not benefit directly when their work is resold for a much higher price. Now, as demand for ultra-contemporary art reaches new heights, artists, their galleries, and a few savvy entrepreneurs are trying to tip the scales and help artists profit from the rampant speculation in their work on the secondary market. This shift is all the more urgent as storm clouds gather on the horizon of the economy at large.

In this issue, we explore the many different mechanisms by which artists are working to fight flippers—and even beat them at their own game. Some of these measures are technological: tools like smart contracts can automate the distribution of royalties and empower artists to customize the terms of a resale. Other initiatives, like Artist’s Choice at Sotheby’s and a new sale series from Simon de Pury, allow artists to do an end run around flippers and put their work up for auction directly.

Then, of course, there is the age-old tactic of social pressure, like galleries’ blacklisting and outing of bad actors. In her authoritative cover story, Katya Kazakina explores the rise of flipping, the worst offenders, and where we go from here. She also interviews the patron saint of the practice, Stefan Simchowitz, about how artists have seized the upper hand.

The phenomenon of art flipping encapsulates what makes the art market distinct: it’s a big business that is built on the back of real people’s creativity, vulnerability, and personal expression. As one of the artists interviewed for this issue put it, giving creators a percentage of the upside from resales would, at the very least, help pay for therapy.

– Julia Halperin

– Marketplace

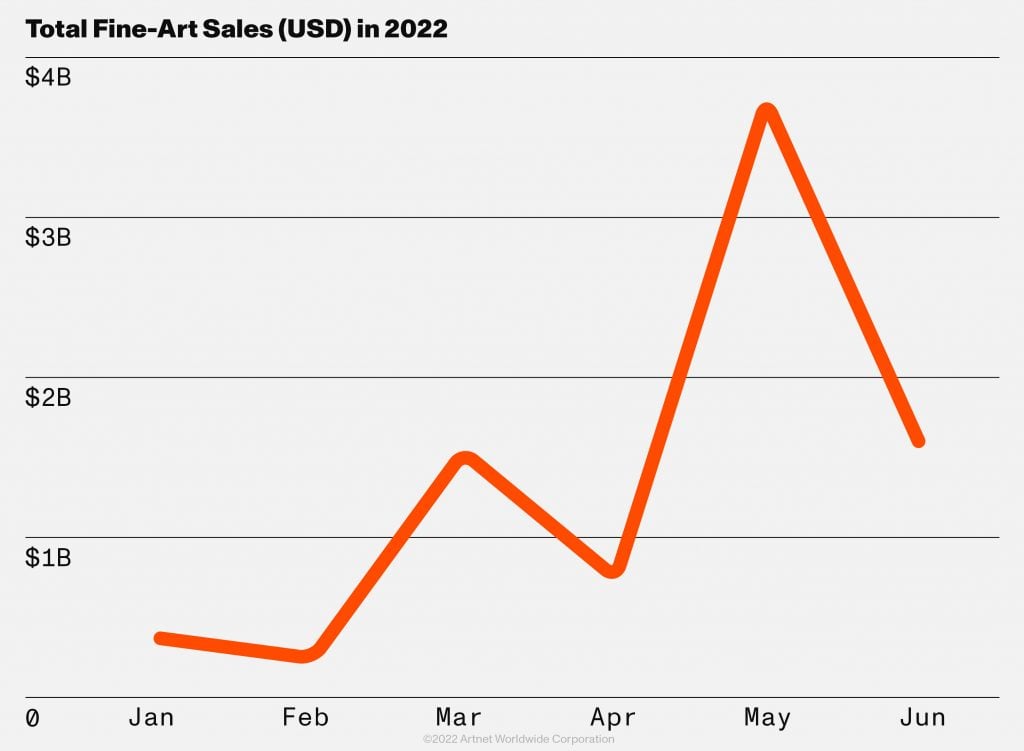

• Why auction sales climbed as the rest of the economy faltered

• Which young artists are gaining the most traction

• The top 10 lots in every major category in the first half of 2022

– Revenge of the Fed-Up Artists

by Katya Kazakina

Rampant speculation has turned the market for emerging art upside down. Now, artists are determined to wrest back control—and cash in along the way.

– A Q&A With the Original Flipper

by Katya Kazakina

Stefan Simchowitz, the wheeler-dealer who brought flipping to the fore in the mid-2010s, tells us how the practice has changed.

– The Resale Reckoning

by Katya Kazakina and Eileen Kinsella

We break down the spread between the primary and secondary prices for work by 11 darlings of the auction circuit.

– Can Smart Contracts Save the Day?

by Tim Schneider

Smart contracts are artists’ best weapon in the fight against flippers. So why aren’t they more widespread?

– Data Dive

by Naomi Rea

• How many masterpieces can the market absorb?

• Which auction house is leading the pack?

• The top 10 lots in every major category in the first half of 2022

– From the Studio to the Auction Block

by Artnet News and Morgan Stanley

The path from the studio to the auction block has shortened considerably over the past decade. Here’s what that means for the art market.

© Artnet Price Database and Artnet Analytics 2022.