The Back Room

The Back Room: Paris Goes Boom

This week: Paris+ gets in the game, Gilbert and George get anti-woke, a trustee gets auction-y, and much more.

This week: Paris+ gets in the game, Gilbert and George get anti-woke, a trustee gets auction-y, and much more.

Tim Schneider &

Naomi Rea

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: Paris+ gets in the game, Gilbert and George get anti-woke, a trustee gets auction-y, and much more—all in a 7-minute read (1,908 words).

__________________________________________________________________________

The view of the Eiffel Tower from the Grand Palais Ephèmére, Paris+’s temporary venue. Courtesy of Paris+ par Art Basel.

After an early dose of controversy, months of anticipation, and more than a little head-scratching over the name, Paris+ by Art Basel completed its whirlwind journey from inception to opening this week. Early returns suggest that the fair is proving to be a sizable upgrade over FIAC, the homegrown expo ousted from its October slot at the same venue to clear the way.

The consensus among attendees was that Paris+ brought a different crowd, a different energy, and a (mostly) different mindset to the Grand Palais Ephèmére, the temporary structure on the Champ de Mars hosting events until renovations on the main building are completed in 2024.

What does “different” mean, exactly? Three shifts stood out…

It’s no surprise that high-end dealers were able to anchor their stands with artists on show at some of Paris’s premier institutions right now. At the apex, David Zwirner’s booth included works by Alice Neel and Joan Mitchell, who are the subjects of major exhibitions at the Centre Pompidou and Fondation Louis Vuitton, respectively.

A half-step down the ladder, Galerie Templon offered works by Kehinde Wiley, who has three monumental pieces on view in the nave of the Musée d’Orsay; Gérard Garouste, currently enjoying a retrospective at the Pompidou; and Michael Ray Charles, whose work is included in the Quai Branly exhibition “Black Indian.”

But the greatest contrast to FIAC arguably came from the vivacity of the “Emerging Galleries” section—likely an effect of Paris+ director Clément Delépine (who used to run FIAC’s edgier sister fair, Paris Internationale).

The 16 up-and-coming solo booths there drew rave reviews and some swift sales on opening day. Most notable: American mega-collectors (and private museum cofounders) Don and Mera Rubell bought out Seventeen gallery’s booth of satirical, Surreal works by Patrick Goddard (priced from €10,000 to €17,000).

A hot topic around London last week was how many museums, foundations, and private buyers were (or weren’t) skipping Frieze for Paris+. Although the latter’s refusal to provide a full list of institutional attendees precludes a firm answer, the sampling that the fair did provide featured several names absent from Frieze’s list, including the…

Private foundations were well represented, too. The Bangladeshi co-founders of the Dhaka-based Samdani Art Foundation acquired two works from Mendes Wood DM. Former Stedelijk director Beatrix Ruf made the rounds on behalf of her new(ish) gig at a Dutch private foundation (see Paint Drippings for details). Again, the Rubells did their thing.

Even Louvre director Laurence des Cars “really came to look, and not to be seen,” according to dealer Jocelyn Wolff. That may be the ultimate sign of respect for a new commercial event in the institutionally reverent Parisian art world.

Almost everyone seemed to agree that an October expo in Paris had never brought in so many collectors from abroad, especially from the U.S., Asia, and the Arab world. But while there were plenty of six-figure and five-figure sales reported in the opening days, multimillion-dollar deals were relatively scarce.

Zwirner was quick to report $11 million in sales by Wednesday’s end, with the gallery’s namesake adding that those were “certainly numbers that we weren’t able to achieve here in Paris in the past.” The haul was led by a $4.5 million Joan Mitchell and a $3 million Robert Ryman.

True, both of those deals blew past Zwirner’s top reported sale at FIAC last year (a $400,000 Josef Albers painting). Yet they both paled in comparison to the $6 million Kerry James Marshall painting that the gallery placed early at Frieze London last week, as well as the $12.5 million list price for a Felix González-Torres work it dealt at Art Basel this June.

The story was similar at rival Hauser and Wirth. The mega-gallery’s loftiest reported sale on the first day of Paris+, a $2.65 million George Condo, fell far short of the $4.8 million price tag for a Philip Guston that it sold early on at Frieze. Both deals look like chump change next to the mammoth $40 million Louise Bourgeois spider it placed in Basel.

Big-ticket sales were even slower at stalwart art-fair powerhouse Thaddaeus Ropac: Paris+ was the first major fair this year where the gallery publicized no transactions above $1 million by the end of day one.

Yet slower sales, especially at the high end, have always been a theme in Paris (including at FIAC); some collectors pointed out just how gauche it is to buy work on the stand without talking about it at length first. As some fair attendees pointed out, replacing a fair won’t change the approach of a city’s buyer base overnight.

__________________________________________________________________________

Similar to this year’s other A-level addition to the international fair circuit, Frieze Seoul, market watchers should be cautious not to read too much into the seeming health of the inaugural Paris+. Stakeholders move heaven and earth (and pre-sell plenty of work) to ensure a strong first showing of any expo, and novelty value in a world-class city is a powerful magnet for collectors.

Still, Paris+ may deserve more credit than average here. Art Basel had only nine months to put together a fair, staff, and exhibitor list worthy of a prime-time crowd. Mission accomplished, it appears. Now, the real questions snap into place.

Will promises of an even bigger, better, more collaborative event next year be enough to replicate the success of the fair’s pilot edition? Will there be any blowback onto Art Basel Miami Beach, which opens only five weeks after Paris+ closes? And will the latter’s proximity to Frieze London actually force buyers and sellers to choose between the two long-term? Stay tuned, mes amies…

The latest Wet Paint was still being mixed at newsletter time, but here’s what else made a mark around the industry since last Friday morning…

Art Fairs

We rounded up the sales reported at Frieze London and Frieze Masters, from a $10 million painting by Jan Brueghel the Elder at Johnny Van Haeften to a $43,856 Zineb Sedira collage at Goodman Gallery. (Artnet News Pro)

Auction Houses

Galleries

Institutions

NFTs and More

____________________________________________________________________________

“Because at the moment it’s all Black art, all women art, all this art and that art. Just go and have a look at Tate Modern, I’m sure they don’t have a [Francis] Bacon up.”

—artist Gilbert Prousch of Gilbert & George, on what the pair perceives as reverse-racism and reverse-sexism keeping their work off view in public institutions, and leading them to build their own private museum in London’s East End. (Financial Times)

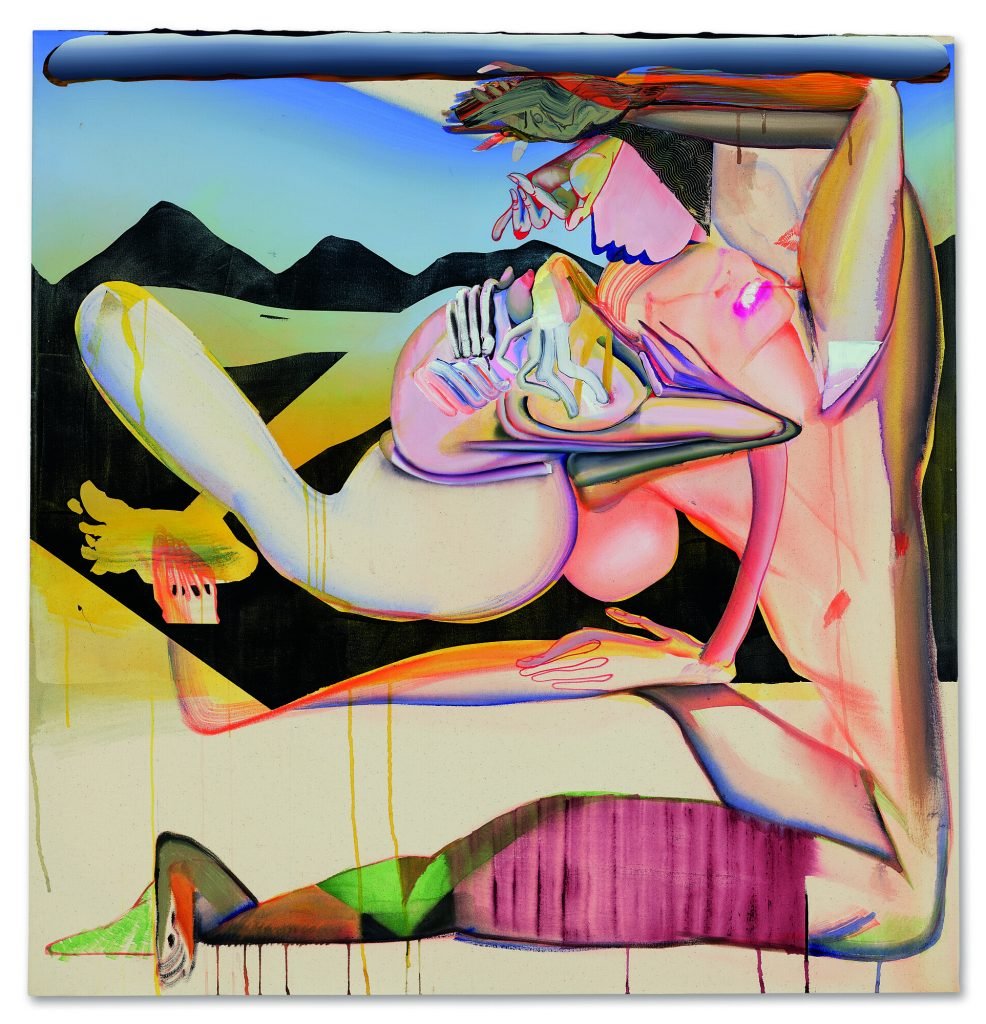

Christina Quarles, Even in tha Evenin’ (2019). Courtesy of Christie’s.

____________________________________________________________________________

Estimate: £400,000 to £600,000 ($452,250 to $678,350)

Sale Price : £856,800 ($968,900)

Sold at: Christie’s London

Whitney Museum trustee Jonathan Sobel consigned this work by the red-hot Quarles and four other in-demand artists to Christie’s Frieze Week sales under the anonymizing label of a “distinguished American collection.” Guaranteed by the auction house, the group also included paintings by Shara Hughes, Rashid Johnson, Dana Schutz, and Mickalene Thomas.

Sobel firmly rejects the idea that such a sale is equivalent to flipping. Through an attorney, he said that he acquired all but the Thomas piece from the galleries representing the artists at the time, and he only took the quartet under the hammer after the original dealers declined his attempt to honor the right of first refusal.

“Mr. Sobel understands the importance of trying to ensure that artists are properly compensated for their work, even when that work is resold later at auction,” Josh Schiller of Boies Schiller Flexner LLP told Katya last week. “While one of the works was purchased at auction, for those that were not, before listing those pieces, Mr. Sobel approached the galleries where he had purchased the works initially to see if they would like to buy them back. When none did, he chose to sell the works at auction.”

The choice paid off more in some cases than others. The premium-inclusive price of nearly $970,000 for the Quarles painting (acquired from Regen Projects in Los Angeles) put it toward the upper reaches of her current $400,000 to $1.2 million primary-market price range. In contrast, the Hughes (acquired from Rachel Uffner Gallery in New York) needed the buyer’s premium to eke above its low estimate of £250,000 ($280,900); it sold for £252,000 ($283,100) all-in.

____________________________________________________________________________