Analysis

From the Studio to the Auction Block: How the Path Between These Two Poles Shrank in the 21st Century—and What It Means for the Art Market

A primer on how the sales cycle sped up in the 21st century.

A primer on how the sales cycle sped up in the 21st century.

Artnet News and Morgan Stanley

A version of this article originally appeared in the Artnet News Pro fall 2022 Intelligence Report.

This article examines how early interest affects artists’ long-term prospects in the 21st century through data. In particular, we focus on the genres of “Ultra-Contemporary” art, which for purposes of this article is defined as work made by artists born in or after 1975 through the present (“1975–present”) and “Postwar and Contemporary” art, which is defined herein as work made by artists born in or after 1900 through 1974 (“1900–74”). These categories of art have attracted a growing share of attention and dollars in recent years. What can the numbers tell us about how the auction market has transformed over the past several decades to serve as a platform for new art—and what effect can this have on the market for young artists?

The analysis takes two related approaches: in the first, we examine macro data to identify significant shifts in artists’ presence and results at auction in the past 20 years; in the second, we present five case studies of individual living artists whose auction sales have peaked at different points in the past two decades, as windows into how the speculative market has evolved during this century.

Methodology notes: Both samples of artists born 1900–74 and those born in or after 1975–present include only artists alive in the year their first work was included in a day auction at Sotheby’s, Christie’s, or Phillips. The samples also include living artists whose first appearance at Sotheby’s, Christie’s, or Phillips was in an evening sale—a phenomenon of recent vintage.

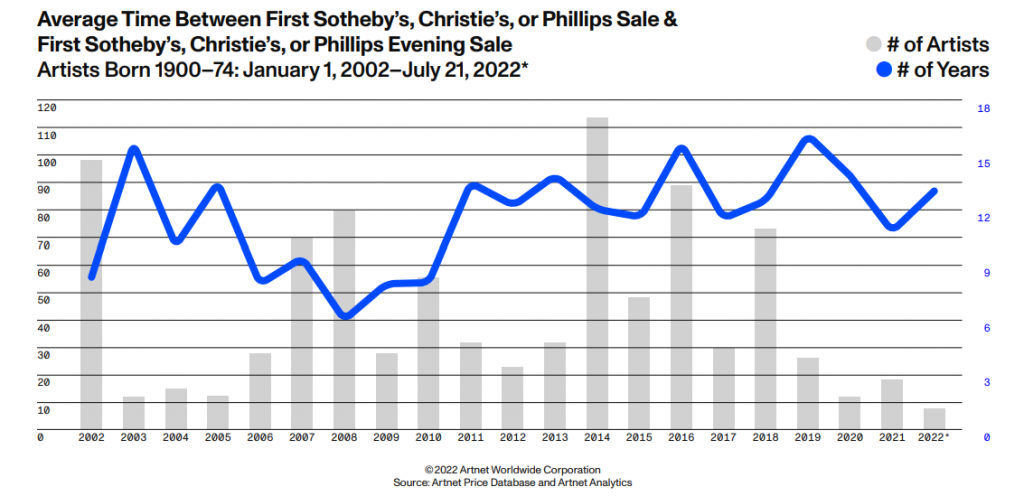

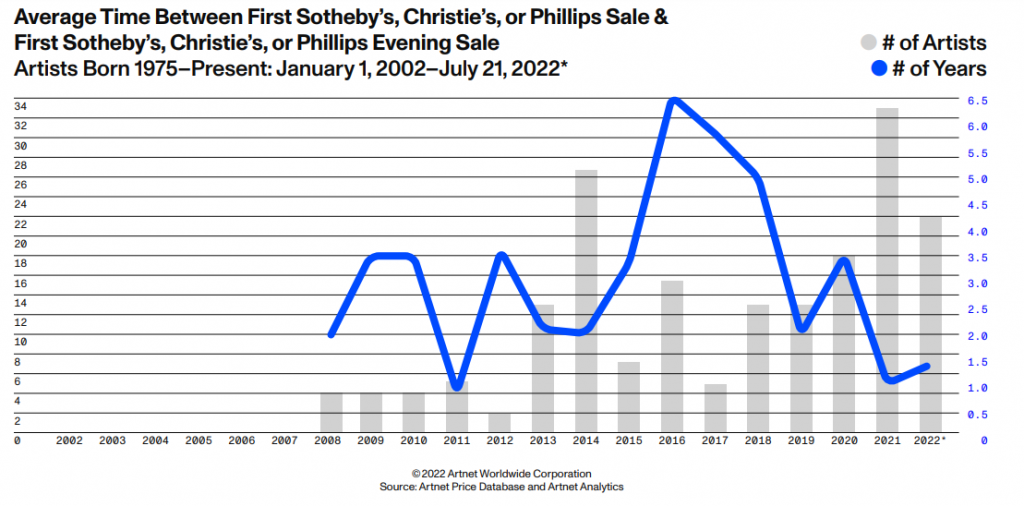

To best determine the average length of time between artists’ debuts in the two categories of sales (day and the more prestigious evening) at Sotheby’s, Christie’s, or Phillips, we began by identifying the artists who saw their first work included in one of the three houses’ evening sales in each year of the sample period. We then looked back to measure the time between that appearance and when the same artists’ works were offered in any day sale held by Sotheby’s, Christie’s, or Phillips. Finally, we averaged the results for all qualifying artists in each year. (For artists whose first work in any Sotheby’s, Christie’s, or Phillips sale was in an evening auction, their time to progress to an evening was counted as 0.0 years.)

Based on the data above, from 2013 through mid-July 2022, the growth in auction sales of Ultra-Contemporary art by artists born 1975–present has far surpassed that of work by artists born 1900–74, whether the annual sales growth is measured in dollar value or in the number of lots sold.

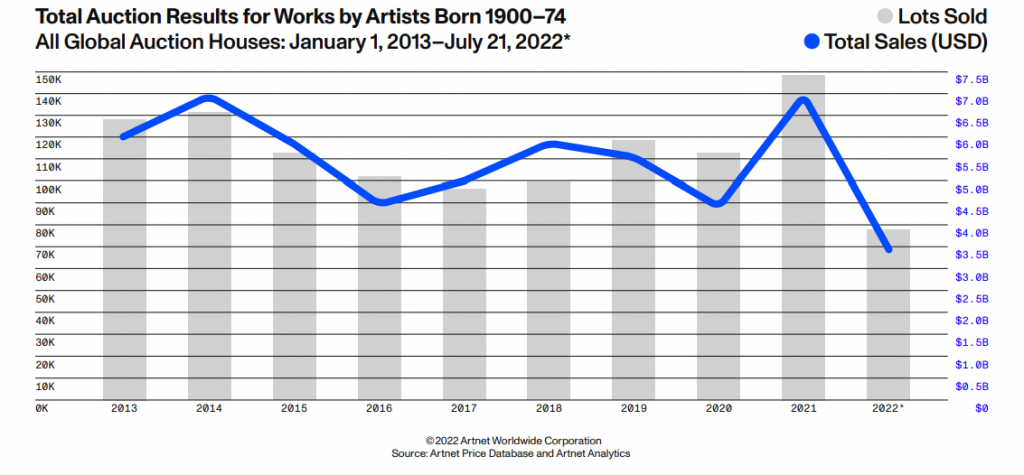

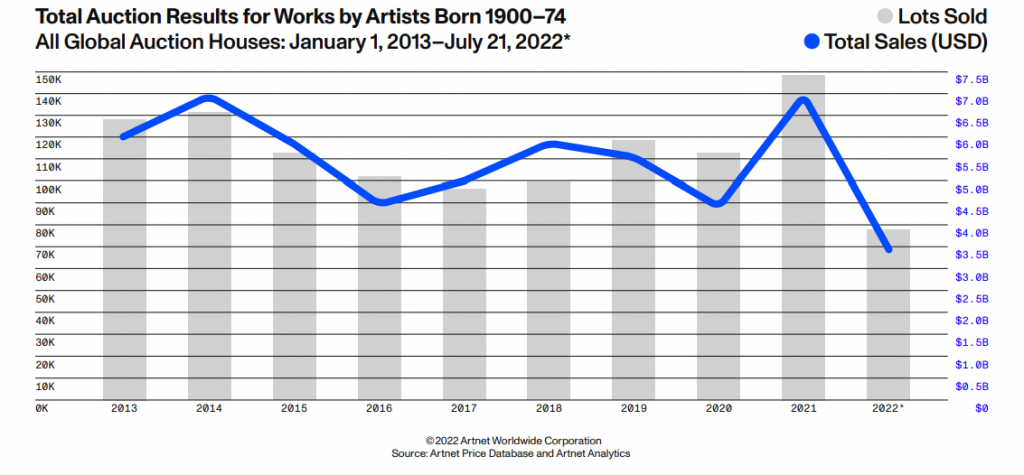

Total auction sales of Ultra-Contemporary art by artists born 1975–present have increased by more than 700 percent during this stretch, rising from $91.4 million in 2013 to $739.3 million in 2021. (Sales achieved this year through July 21, 2022, reached $396.5 million, compared with $359 million through the equivalent period in 2021.) In comparison, the apex by sales value for the older cohort of artists was achieved in 2014: $6.95 billion, an increase of roughly 16 percent over the 2013 total. (Sales achieved this year through July 21, 2022, reached $3.4 billion, close to the $3.5 billion sold during the equivalent period of 2021.)

The number of Ultra-Contemporary lots made by artists born 1975–present sold at auction rose by roughly 250 percent over the sample period, from 3,487 lots in 2013 to 12,216 lots last year. (Through July 21, 2022, the volume of lots sold this year was 7,132, compared with the 6,386 lots sold during the equivalent period in 2021.) In contrast, while 2021 did see an all-time high number of lots sold by artists born 1900–74, this total (nearly 148,000 lots) was only about 16 percent higher than the equivalent total in 2013 (about 127,400). (As with total sales by value, the number of lots sold through mid-July 2022 fell from the equivalent period last year, to 76,053 from 80,230.)

Also of note, the yearly sell-through rate for artists born 1900–74 has been, at best, only a few percentage points greater than for artists born 1975–present. On average, both groups of artists have found buyers for roughly two-thirds of the lots offered annually. The largest gap arose in 2018, when 69 percent of the lots by the older group found buyers, versus 63.8 percent for the younger group. While we cannot state for certain, the 5.2 percent advantage for artists born 1900–74 that year could be the result of the major auction houses offering multiple significant estates with especially strong holdings of works from the first half of the 20th century, including the collections of David and Peggy Rockefeller¹ and Barney A. Ebsworth (both at Christie’s).²

In summary, the data shows that buyers have grown the size of the auction market for Ultra-Contemporary art made by artists born 1975–present much larger—by two statistical metrics—than for artists born 1900–74 in recent years. Lots by the younger age group have also remained nearly as likely to find buyers at auction as lots by their more established predecessors, which could potentially suggest that both auction houses and bidders have come to view the majority of these works as worthy secondary-market acquisitions.

One indicator of the art market’s pronounced push toward youth is the accelerating speed at which artists progress through the tiers of prestige and price at auction houses. Three of the leaders in the Western auction sector are Sotheby’s, Christie’s, and Phillips.³ The offering of an artist’s work for sale at one of these “Big Three” auction houses implies greater market demand than would its appearance at any other house in the sector. Among all art auctions held by the Big Three houses, the most prestigious are their evening sales, where (generally) the most coveted and highest-priced lots are offered.4

As another way to quantify whether bidders’ interest in works by Ultra-Contemporary artists born 1975–present has been growing faster than for artists born 1900–74, we performed another analysis for both groups: a year-by-year measure of the average length of time separating the first offering of qualifying artists’ work in any Sotheby’s, Christie’s, or Phillips sale and the first offering of the same qualifying artists’ work at one of Sotheby’s, Christie’s, or Phillips’ evening sales.

Ultra-Contemporary artists born 1975–present have consistently graduated to the Big Three houses’ evening sales faster on average than artists born 1900–74. From 2008 through mid-July 2022, qualifying Ultra-Contemporary artists born 1975–present made the leap to a Big Three evening sale in between 1.2 years and 6.3 years on average. In contrast, qualifying artists born 1900–74 needed between 7 years and 16.6 years on average.

Period Between 2007 and 2010

Both groups’ average time to reach an evening sale also increased or decreased in tandem with macro fluctuations in art auction sales. For example, the qualifying cohort of older artists progressed to the Big Three’s evening sales fastest from 2007 through 2010, the years generally considered to have been most strongly impacted by the Great Recession; during this period, the number of such artists who were elevated to an evening sale ranged from 28 to 80 per year, in an average time of between seven and nine years.

This outcome meshes with the notion of a retreat to proven quality as market anxiety heightened.5 It’s plausible that the major houses would have responded to this tension by taking more established artists who had been consistently profitable in their day sales and elevating them to their evening auctions. The comparatively low number of Ultra-Contemporary artists born 1975–present debuting at Sotheby’s, Christie’s, or Philips’ evening sales during this stretch—just four per year from 2008 through 2010—represents the other side of this strategic coin.

Period Between 2016 and 2018

A similar dynamic played out from 2016 through 2018. Of all the Ultra-Contemporary artists born 1975–present who have graduated to Sotheby’s, Christie’s, or Phillips evening sales from the day sales since 2008, those who did so between 2016 and 2018 took between 5 and 6.3 years, on average, longer than their peers in the other years on record. This makes sense against the backdrop of a downturn that took place in the fine-art auction market during these years; total sales plummeted from roughly $15 billion to less than $12 billion from 2015 to 2016, a year-over-year drop of more than 20 percent, and still had not fully bounced back to 2015 levels by the end of 2018.6 In this context, 2016 may be a cautionary tale for auction house specialists, who may have tried to balance a slowly growing appetite for younger artists in the preceding years’ evening sales against steadily worsening market conditions in 2016 itself—opposing forces that could have led to elevating Ultra Contemporary artists born 1975–present who were deemed even surer sellers than the few who debuted in their evening sales during the Great Recession.

Period Between 2019 and the Present

The two groups’ progress has inverted since 2019. As auction sales of Ultra-Contemporary works made by artists born 1975–present posted three consecutive years of record-high results, the number of Ultra-Contemporary artists born 1975–present graduating to a Big Three evening sale climbed to a new high (33 artists in 2021) while the time required to do so shortened to an all-time low of 1.2 years on average. (Through mid-July, 22 new Ultra-Contemporary artists born 1975–present had entered a Big Three evening sale, in an average time of 1.6 years from their initial Big Three appearance.) Meanwhile, the number of artists born 1900–74 who made their evening sale debut dropped by nearly 30 percent from 2019 through 2021, and the time required to do so expanded to a new average length of 16.6 years in 2019 before contracting slightly to 11.4 years in 2021.

These figures could represent a new “flight to quality” during and after the onset of COVID-19. More-conservative buyers may have been most interested in canonical artists who had long been fixtures at the Sotheby’s, Christie’s, and Phillips evening sales; more risk-friendly buyers (whose investment portfolios likely produced tremendous returns from the second half of 2020 through the end of 2021) may have been most interested in the Ultra-Contemporary artists born 1975–present, whose works were seen as the highest-upside “growth” opportunities in the art auction market. In short, if the auction houses were going to promote artists untested in their evening sales, they had greater incentive to do so for the very youngest than for any other group.

The data complements an organizational push toward Ultra-Contemporary art made by artists born 1975–present at the Big Three auction houses, primarily Sotheby’s. In fall 2021, Sotheby’s reorganized its Contemporary art evening sales into two more specific auctions: “The Contemporary,” which generally encompasses artworks made from the Postwar era through the late 20th century; and “The Now,” which generally encompasses works completed in the 21st century—a designation that puts Ultra-Contemporary art made by artists born 1975–present at the forefront.7 Meanwhile, the focus on young female Ultra-Contemporary artists born 1975–present in “The Now” auctions represents a pivot away from past practice among the major auction houses in an era when gender equity has come to the fore.8

Sotheby’s also hired Noah Horowitz, the former director of the Americas for Art Basel, to try to build bridges to primary market galleries across price tiers.9 Horowitz unveiled Artist’s Choice, a recurring initiative that allows artists and their galleries to consign works directly to auction, with a small portion of Sotheby’s fees and the hammer price going to a charity selected by the artist.10 Auctioneer Simon de Pury launched a similar model in August 2022 with the sale “Women: Art in Times of Chaos,” which generated more than $800,000 for artists and their galleries.11

Two decades ago, it took an average of around eight years for an artist to ascend from the day sales to the more prominent evening sales at Sotheby’s, Christie’s, or Phillips.12 That time shrinks in moments of frenzied spending on young artists—as during the “Zombie Formalism” craze for young abstract art in 2013–14 and, more recently, from 2020 to the present. The increased glare of prominent auction trading can have a big impact on the trajectory of an artist’s market.

Just as the art market is made up of many individual genres, each genre is made up of markets for specific artists. There is much that may be learned from these individual cases. We selected five living artists from and across different decades who had dramatic spikes on the secondary market early in their careers to explore how each of their markets unfolded in the years after. We examine how a complex web of factors—including timing, gallery representation, supply, and broader market conditions—can shape the arc of an artist’s market after early auction success.

There are limits to what these case studies demonstrate. We cannot get a full picture of each artist’s private (i.e., primary) markets or insight into the personal decisions directing their careers. However, an analysis of auction results and other publicly available information does illustrate the different paths an artist’s career can take after an early splash on the auction (i.e., secondary) markets.

Disclaimer: The following case studies are presented only for individual analysis of changing auction-market demand for living artists during specific periods since 2002. The artists chosen are not necessarily representative of auction results for all living artists in the same genre, nor are their past auction results indicative of future performance. Since there is scant publicly verifiable data about sales in the private art market (i.e., the gallery/dealer sector), we have included the date of each artist’s first solo gallery exhibition (sourced from their curriculum vitae) only as an approximate reference point to suggest when collectors saw them as viable propositions in the private market, not just the auction market.

First solo gallery exhibition: 1987

First appearance at a Sotheby’s, Christie’s, or Phillips day sale: June 1995

First appearance at a Sotheby’s, Christie’s, or Phillips evening sale: May 2000

Auction record set: June 2007*

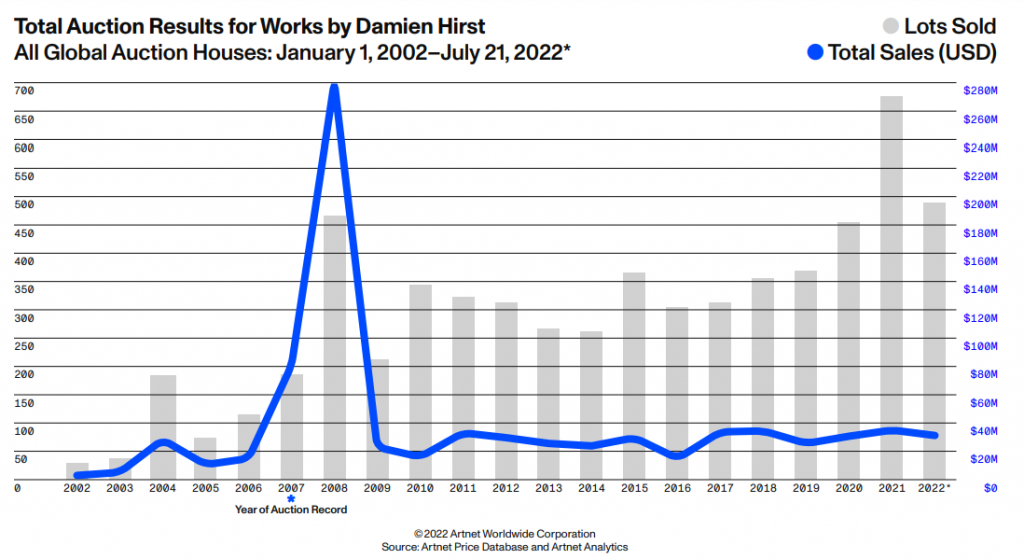

Damien Hirst (b. 1965), who became famous in the 1990s after graduating from Goldsmiths as a member of the Young British Artists, a generation of boundary-breaking painters and sculptors in the U.K., made his auction debut in 1995—seven years before the earliest sample period in the rest of our analysis and eight years after his first gallery show.13 Unlike the other artists we are examining, Hirst himself was the engine behind his most prominent turn at auction.

In 2008, the artist consigned 218 works directly from his studio to Sotheby’s for the notorious “Beautiful Inside My Head Forever” sale. The auction—a then-radical market gesture that cut out his galleries—surpassed expectations, bringing in around $200 million.14 That same night, Lehman Brothers collapsed and financial markets plunged.15 The dramatically timed sale saw the artist’s total 2008 auction sales propelled to a record $268.8 million.

The following year, as the art market began to feel the effects of the financial crash, Hirst’s annual sales value plummeted 92 percent, to $20.3 million.16 Ever since 2008, his auction market has been characterized by abundant supply, which may have constrained his prices: the number of works on offer each year has not fallen below 200.17 (In the first half of 2022, 429 Hirst lots sold, the most for any name among the top 15 contemporary artists at auction.18)

With some renewed success on the private market from his “Cherry Blossom” series, Hirst saw his best year at auction since 2008 last year, with his works generating some $37.9 million.19 Still, the market remains far below its pre-recession peak. Last year, 820 Hirst works were on offer—almost 30 percent more than in 2008—and the total sales figure was still 85.9 percent below the record-setting sum.

First solo gallery exhibition: 2000

First appearance at a Sotheby’s, Christie’s, or Phillips day sale: October 2006

First appearance at a Sotheby’s, Christie’s, or Phillips evening sale: October 2006

Auction record set: October 2007*

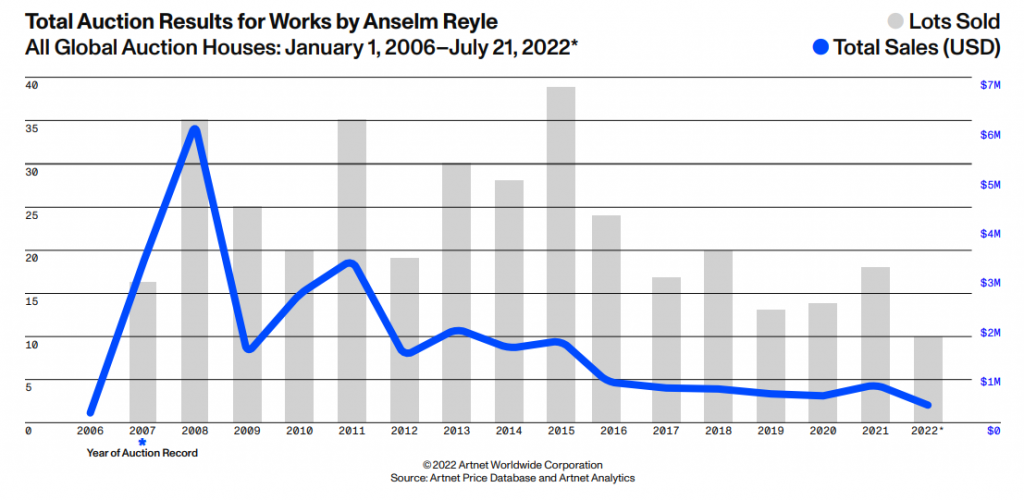

The German artist Anselm Reyle (b. 1970) burst onto the art scene after attending Staatliche Akademie der Bildenden Künste Karlsruhe with his first gallery show in Berlin in 2000. Within four years, he had a solo exhibition at the prominent New York gallery Gavin Brown’s enterprise.20 He became known for his “crinkle” pieces, in which he bunched up colored foil, mounted it on canvas, and placed it behind glass.

Reyle’s first work sold at auction in 2006 for just under $58,000, comfortably within estimate.21 No other works by the artist appeared at auction that year. As his star rose, transactions began to pick up speed. The following year, Reyle joined megadealer Gagosian gallery, and 16 of his works hit the auction block.22 As interest in Ultra-Contemporary art rose more broadly, Reyle’s auction market peaked in 2008, with total sales of just over $6 million for 35 lots.23 His works consistently outperformed estimates as he ascended to prime evening-sale positioning. A purple acrylic and foil piece from 2006, for example, fetched $619,435 at the Sotheby’s Contemporary art evening sale in February 2008, surpassing its $496,820 high estimate.24

Then the recession hit the art market. In 2009, Reyle’s total sales value dropped by 70 percent, and more than 40 percent of his works offered at auction failed to find buyers.25 Although he matched or exceeded 35 lots sold in two subsequent years (2011 and 2015), his total annual sales did not exceed $3.3 million.

In February 2014, Reyle announced his retirement from art production; he had what he stated was his last show at Gagosian that same year.26 But the retirement didn’t last long. By 2015, he was back in his studio (with considerably fewer assistants)27, and by 2016, he had returned to the gallery world with a solo exhibition at Contemporary Fine Arts Berlin.28 He has shown regularly at galleries and museums since, but his prices on the secondary market remain considerably below where they were in 2008. In 2021, auction houses sold 18 of his works for nearly $805,000; in the first half of 2022, the corresponding figures were 10 lots sold for roughly $457,000.

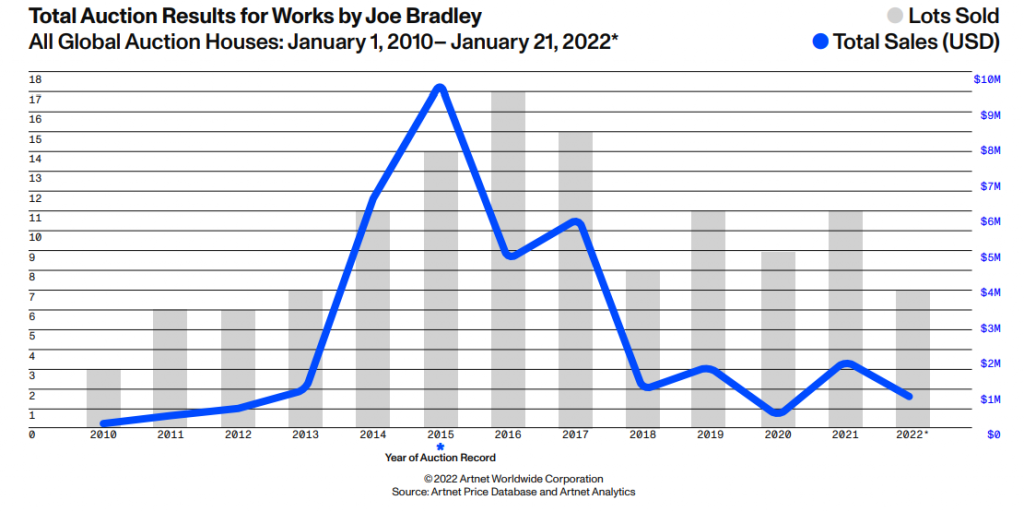

First solo gallery exhibition: 2000

First appearance at a Sotheby’s, Christie’s, or Phillips day sale: May 2010

First appearance at a Sotheby’s, Christie’s, or Phillips evening sale: October 2011

Auction record set: November 2015*

Shortly after graduating from the Rhode Island School of Design, Joe Bradley (b. 1975) had his first solo gallery show in Boston.29 He made his name creating what New York Times art critic Roberta Smith called “ironic, anti-painting paintings,”characterized by motifs outlined in black oil crayon that looked like overblown doodles.30 He left his New York gallery, Canada, in 2011 to join Gavin Brown’s enterprise, where he stayed for four years. Between Bradley’s first solo show at Canada, in 2006, and his first exhibition at Gavin Brown, in 2011, his prices on the primary market increased 1,100 percent.31 In 2015, he joined Gagosian.32

These gallery shifts coincided with a sharp ascent on the auction market. Often, when an artist joins a new gallery (especially one of the largest), the new dealer increases the works’ prices and also tamps down supply, which can push collectors to compete more fiercely for that artist’s work when it does come up for auction.33

Bradley made his auction debut in 2010. Between 2011 and 2015, his annual auction sales shot up 2,604 percent, from $368,108 to just under $10 million. The average price for one of his works at auction also rose, by a factor of more than 10. His total sales peaked in 2015, at a strong moment for the contemporary art market; the following year, the number of Bradley’s lots sold peaked at 17, but the dollar value of his annual sales had already decreased by more than half, to $4.8 million.

Over the next six years, the American artist continued to show at his galleries—Gagosian and Eva Presenhuber—and his style evolved from “anti-painting” to Abstract Expressionism-inspired brushy compositions on dirty canvases. He remained a consistent draw for bidders, albeit at a considerably lower level. The only full year in which his auction market has failed to generate at least $1 million was 2020.

In 2021, Bradley left Gagosian to join Petzel and Xavier Hufkens. His first New York solo show in six years presented more conventional works that balance representation and abstraction—and drew strong reviews.34

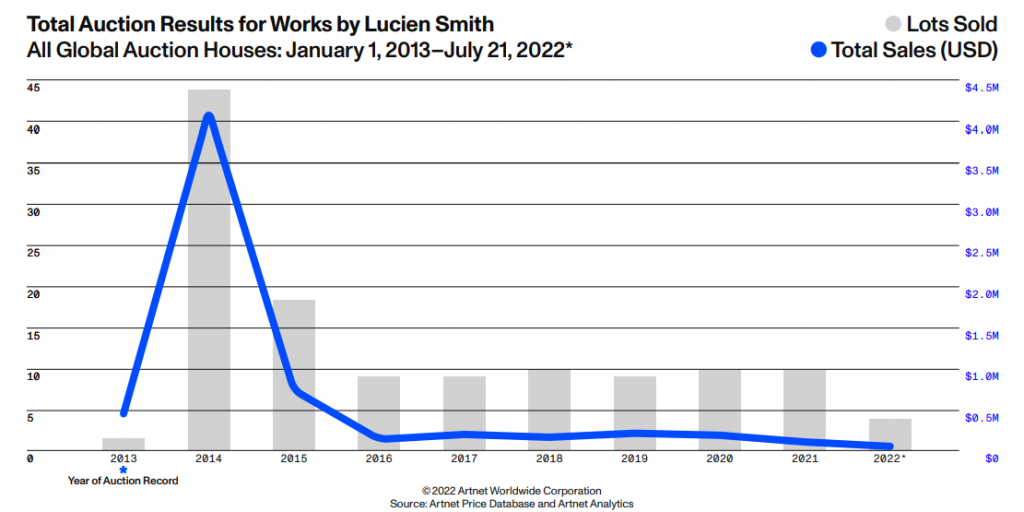

First solo gallery exhibition: 2011

First appearance at a Sotheby’s, Christie’s, or Phillips day sale: November 2013

First appearance at a Sotheby’s, Christie’s, or Phillips evening sale: November 2013

Auction record set: November 2013*

A graduate of Cooper Union, the American painter Lucien Smith (b. 1989) rose to prominence as a member of the “Zombie Formalists.” 35 The term, coined by critic Walter Robinson, referred to a cohort of young artists who became popular in 2013 and 2014 for a particular brand of process-based abstraction—they created good-looking canvases with theatrical processes like applying paint with a fire extinguisher. Smith was considered among the group’s most high-profile members; in 2013, at the age of 24, T magazine called him an “art-world wunderkind.”36

That year, he made his auction debut at Phillips, where the painting he created for his senior thesis was placed prominently as the first lot of the house’s fall New York evening sale. Hobbes, The Rain Man, and My Friend Barney / Under the Sycamore Tree (2011), a scene from Winnie the Pooh with the characters missing, carried a high estimate of $150,000 and ended up selling for $389,000 to an established dealer-collector.37 Just two years earlier, it had sold at Smith’s thesis exhibition for $10,000.38

No work by Smith has ever surpassed that price at auction. In 2014, 44 of his works hit the auction block, delivering a total of just over $4 million. But with the fever for young artists cooling, his auction market fell 84 percent the following year, when 18 works sold for a combined $639,000. The buyer of the record-setting Hobbes work told Bloomberg in 2015, “If you know someone who wants it, let me know.”39

Smith’s decline continued as he largely retreated from the traditional art market. His annual auction sales have not reached $200,000 since 2015, though they have also never fallen below $113,415. In recent years, he has reinvented himself as an NFT (non-fungible token) artist, the founder of a nonprofit called Serving the People, and an ambassador for a fractional-ownership platform.40

“I knew it was unsustainable,” Smith said in a 2021 interview. “Luckily I put my earnings in the right places so I would be comfortable.”41

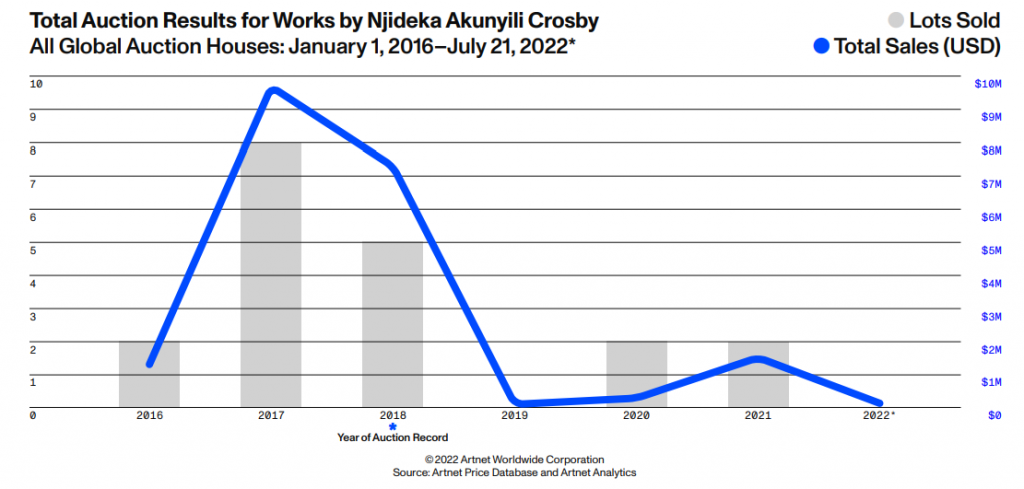

First solo gallery exhibition: 2013

First appearance at a Sotheby’s, Christie’s, or Phillips day sale: September 2016

First appearance at a Sotheby’s, Christie’s, or Phillips evening sale: November 2016

Auction record set: May 2018*

Njideka Akunyili Crosby (b. 1983) decided to become an artist only after she failed to get into her first-choice medical school.42 After graduating from the prestigious Yale School of Art in 2011, she began attracting attention with her lush, collaged depictions of her community in Nigeria, where she grew up, and New York, where she lives.

When she made her art-fair debut with Victoria Miro in December 2014 at Art Basel Miami Beach, her work stood out in contrast to the minimal, abstract “Zombie Formalist” works that were peaking in the market at the time. “We’ve never had such an immediate response to a new artist,” the gallery’s director, Glenn Scott Wright, said.43 The interior scene ultimately sold to Cape Town’s Zeitz Museum of Contemporary Art Africa for nearly $50,000.44

Before long, the number of people who wanted to buy a work by Crosby far outpaced the available supply. (In an extremely productive year, she makes around a dozen works.45) The growing demand helped push her into a Sotheby’s evening sale just two months after her first outing at one of the Big Three houses.46 She made her evening debut in November 2016 with Drown (2012). It sold for $1.1 million, shattering its $300,000 high estimate.47 As with Smith, Crosby’s auction sales peaked the year after her debut. In 2017, eight of her works hit the auction block, generating more than $9.5 million. Her auction record was set in 2018, when she donated the botanical composition Bush Babies (2017) to a benefit sale to support the Studio Museum in Harlem. It fetched $3.4 million, more than four times its $800,000 high estimate.

Crosby’s annual auction sales totals have declined considerably since then, but that has more to do with a tightening of supply than a drop in demand. Crosby and her dealers have taken deliberate steps to limit the number of her works that appear on the secondary market.48 In 2018, the artist joined mega-gallery David Zwirner, which represents her alongside Victoria Miro.49 The following year, no Crosby works were offered at auction, and only two were sold in each of the years 2020 and 2021. These efforts have continued in 2022, as none of the artist’s works have appeared at auction to date.50

To download the full fall 2022 Artnet Intelligence Report, available exclusively to Artnet News Pro members, click here.

Artnet Price Database: From Michelangelo drawings to Warhol paintings, Le Corbusier chairs to Banksy prints, you will find over 14 million color-illustrated art auction records dating back to 1985. Artnet covers more than 1,800 auction houses and 385,000 artists, and every lot is vetted by Artnet’s team of multilingual specialists. Whether you are appraising a collection, researching an artist’s market history, or pricing an artwork for sale, the Price Database will help you determine the value of art.

Disclosures: This material was published in October 2022 and has been prepared for informational purposes only. Charts and graphs were published by Artnet News in the Artnet Intelligence Report Fall 2022. The information and data in the material has been obtained from sources outside of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley makes no representations or guarantees as to the accuracy or completeness of the information or data from sources outside of Morgan Stanley.

This material is not investment advice, nor does it constitute a recommendation, offer or advice regarding the purchase and/or sale of any artwork. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. It is not a recommendation to purchase or sell artwork nor is it to be used to value any artwork. Investors must independently evaluate particular artwork, artwork investments and strategies, and should seek the advice of an appropriate third-party advisor for assistance in that regard as Morgan Stanley Smith Barney LLC, its affiliates, employees and Morgan Stanley Financial Advisors and Private Wealth Advisors (“Morgan Stanley”) do not provide advice on artwork nor provide tax or legal advice. Tax laws are complex and subject to change. Investors should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts and estate planning, charitable giving, philanthropic planning and other legal matters. Morgan Stanley does not assist with buying or selling art in any way and merely provides information to investors interested in learning more about the different types of art markets at a high level. Any investor interested in buying or selling art should consult with their own independent art advisor.

This material may contain forward-looking statements and there can be no guarantee that they will come to pass. Past performance is not a guarantee or indicative of future results.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Diversification does not guarantee a profit or protect against loss in a declining financial market.

Case studies presented in this material are provided for illustrative purposes only. Each artist’s specific situation and results will differ.

By providing links to third party websites or online publication(s) or article(s), Morgan Stanley Smith Barney LLC (“Morgan Stanley” or “we”) is not implying an affiliation, sponsorship, endorsement, approval, investigation, verification with the third parties or that any monitoring is being done by Morgan Stanley of any information contained within the articles or websites. Morgan Stanley is not responsible for the information contained on the third party websites or your use of or inability to use such site, nor do we guarantee their accuracy and completeness. The terms, conditions, and privacy policy of any third party website may be different from those applicable to your use of any Morgan Stanley website. The information and data provided by the third party websites or publications are as of the date when they were written and subject to change without notice.

This material may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm has not reviewed the linked site. Equally, except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm takes no responsibility for, and makes no representations or warranties whatsoever as to, the data and information contained therein. Such address or hyperlink (including addresses or hyperlinks to website material of Morgan Stanley Wealth Management) is provided solely for your convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through the material or the website of the firm shall be at your own risk and we shall have no liability arising out of, or in connection with, any such referenced website. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

© 2022 Morgan Stanley Smith Barney LLC. Member SIPC. CRC 4946636 10/2022