The Gray Market

How Prices for In-Demand Living Artists Rocketed to Hair-Raising New Heights in 2021 (and Other Insights)

Our columnist unpacks why the last eight months of global demand have pushed the art market into new territory.

Our columnist unpacks why the last eight months of global demand have pushed the art market into new territory.

Tim Schneider

Every Wednesday morning, Artnet News brings you The Gray Market. The column decodes important stories from the previous week—and offers unparalleled insight into the inner workings of the art industry in the process.

This week, gasping at the radar gun’s reading…

Almost since COVID made landfall in the U.S., it seems we’ve heard the same refrain from business and cultural analysts: basically, “the pandemic dramatically accelerated the changes that were already underway.” While I think the full story is more complex, the warp-speed phenomenon has altered the markets of several ascendant contemporary artists this year—and to a degree that appears unprecedented even in the speculation-driven 21st century. The results are the clearest proof yet that the global art trade has entered a new era. But whether they also indicate a new level of stability, or just a new level of volatility, remains open to interpretation.

For perspective, it’s valuable to compare this trend to what happened during the Zombie Formalist frenzy in the first half of the 2010s. Favored artists in that movement generally shot out of the gate with jetpacks, quickly reaching prices near the half-million-dollar mark, before either crashing back to earth within a couple of years or else managing to roughly maintain that initial altitude up to the present day.

As an example of the first trajectory, Lucien Smith hit $389,000 with his first-ever piece offered at auction, Hobbes, The Rain Man, and My Friend Barney / Under the Sycamore Tree (2011) in November 2013. (Final prices include fees; presale estimates don’t. All data courtesy the Artnet Price Database.) Several other paintings by the artist sold at auction for between $150,000 and $400,000 by February 2015, but no work of Smith’s has surpassed $62,500 in that venue in the nearly seven years since. New paintings shown at Swiss gallery the Stable this summer were priced no higher than $25,000, according to my colleague Kenny Schachter, and Smith has recently pivoted into blockchain-conversant work and the role of NFT ambassador to artists at the crypto-centric startup Lobus.

To map the second trajectory, look at Oscar Murillo. His top six auction results to date all manifested from June 2013 to October 2015, with each lot selling for between $374,000 and $401,000. However, he has found price support near those levels very recently. His painting Manifestation (ca. 2017–19) fetched just south of $350,000 (£252,000) at Sotheby’s London this September, becoming Murillo’s eighth-richest gavel-driven result to date. Although he was represented by London’s Carlos/Ishikawa gallery beforehand (and continues to exhibit there today), Murillo signed on with David Zwirner in 2013. He has been a consistent subject of shows at the mega-gallery’s locations in New York, Hong Kong, London, and Paris since that time, as well as numerous institutions around the globe.

What we’ve seen happen with some of the most in-demand talent this year is meaningfully different. In multiple instances, artists in their mid-30s to early 40s suddenly high-jumped from well-established auction prices at or above the richest results of the Zombie Formalists to lofty new territory multiple times higher seemingly overnight. That could just be a feature of a market whose expanded sell-side infrastructure and buy-side reach create new safeguards… or it could be that economic exuberance has hijacked those same elements for a dangerous joyride.

Loie Hollowell, Yellow Canyon Over Red Ground (2016). Courtesy of Christie’s Images, Ltd.

Loie Hollowell already seemed to be nearing the peak of a SpaceX-like trajectory two years ago. At her inaugural solo gallery show at Feuer Mesler In October 2016, new works found buyers at prices from $8,000 to $15,000 each. Fast forward to September 2019, when the artist debuted a show at Pace Gallery’s freshly completed New York headquarters, and the nine new large paintings in the exhibition had sold out in advance for $100,000 per. Individual pieces were being scooped up at auction for upwards of $200,000. Advisors relayed that her works were fetching up to $300,000 in private resales. Then, in October 2019, a Hollowell painting sold for just over $442,000 (£359,250) at Christie’s London, a new record.

That was roughly where her prices stayed for close to two years afterward. From what I’ve heard, Pace played her private secondary market relatively conservatively, reselling works in the $250,000 to $275,000 range. Five other auction lots went for $200,000 or more as of May 2021, but none of them for more than about $256,000. Her auction record remained $442,000.

Then, between mid-May and mid-June, Hollowell’s high mark was reset three times under the hammer, with the last two gavel strikes sending her work into the multimillion-dollar arena.

First, Yellow Canyon Over Red Ground (2016) more than quintupled its high estimate to surpass $563,000 (HK$4.4 million) at Christie’s Hong Kong on May 24. On June 8, a four-foot-by-three-foot Hollowell canvas titled First Contact (2019) vaulted six times its most optimistic presale projection at Phillips Hong Kong to land at more than $1.4 million (HK$10.9 million ). Less than two weeks later, a Hollowell painting of the same size, made the same year, reset her auction ceiling 50 percent higher, at more than $2.1 million (HK$16.5 million) in a Sotheby’s Hong Kong auction with Taiwanese pop star Jay Chou.

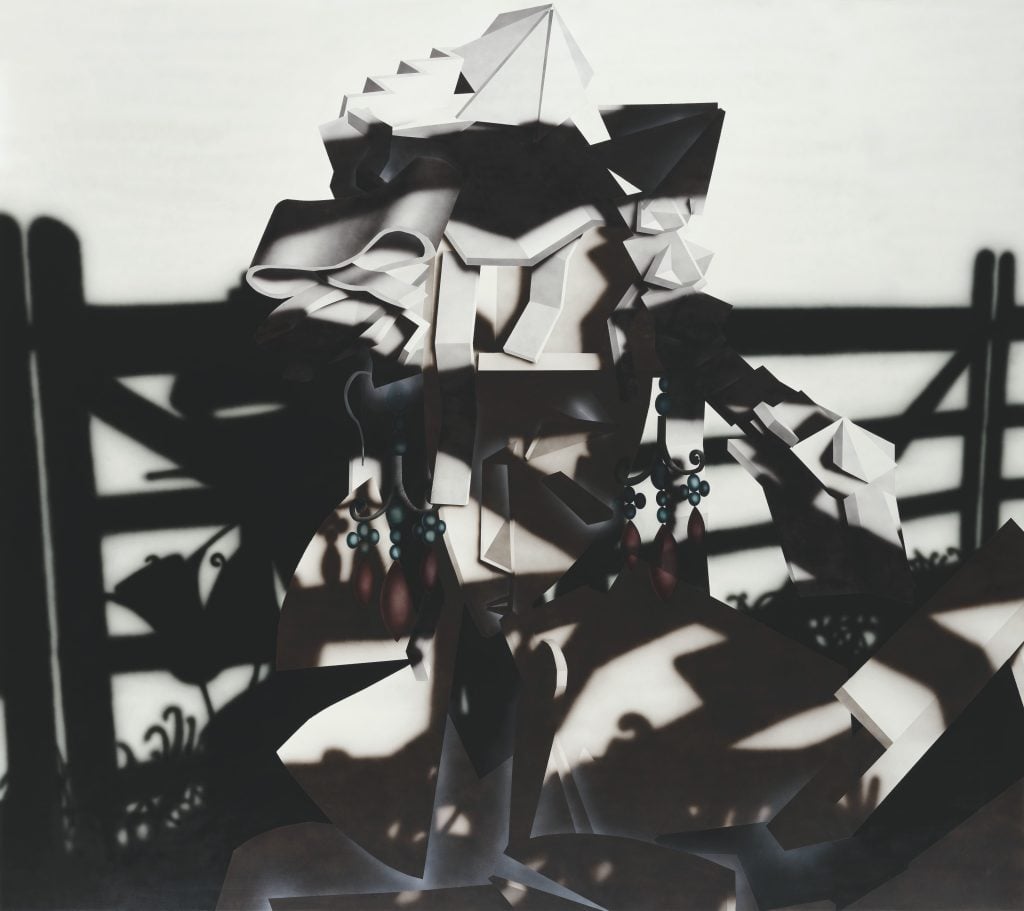

Avery Singer, Untitled (Tuesday) (2017). Courtesy of Christie’s.

Avery Singer experienced a similar nitro boost over almost the same timespan. Sotheby’s set her first substantial auction record in a New York evening sale in May 2018, selling FELLOW TRAVELERS, FLAMING CREATURES (2013) for $735,000. Despite Hauser and Wirth’s announcement that it had won representation of Singer in December 2019—and news that fresh paintings offered by the gallery at Frieze Los Angeles 2020 were priced between $420,000 and nearly $500,000—only two other lots by the artist cracked the half-million-dollar barrier by mid-April 2021. She then experienced an order-of-magnitude upswing eerily reminiscent of Hollowell’s in the remaining months of this year.

First, Singer’s auction record was reset modestly, to just under $864,000 (HK$6.7 million) at a Sotheby’s Hong Kong sale on April 18. Between that date and this column’s publication, her auction apex increased three more times, at multiples of both that figure and presale estimates. Dancers Around an Effigy to Modernism (2013) started the ascent by leaping up to $3.1 million (HK$24.3 million) at Christie’s Hong Kong in May. An untitled canvas from 2018 shot to $4.1 million at Phillips New York in June. Last but not least, the 2017 painting Untitled (Tuesday) brought $4.5 million (HK$35.1 million) at Christie’s Hong Kong just two weeks ago, on December 1. (Another Singer painting surpassed $4 million at Phillips New York in November but failed to break what was then her record.)

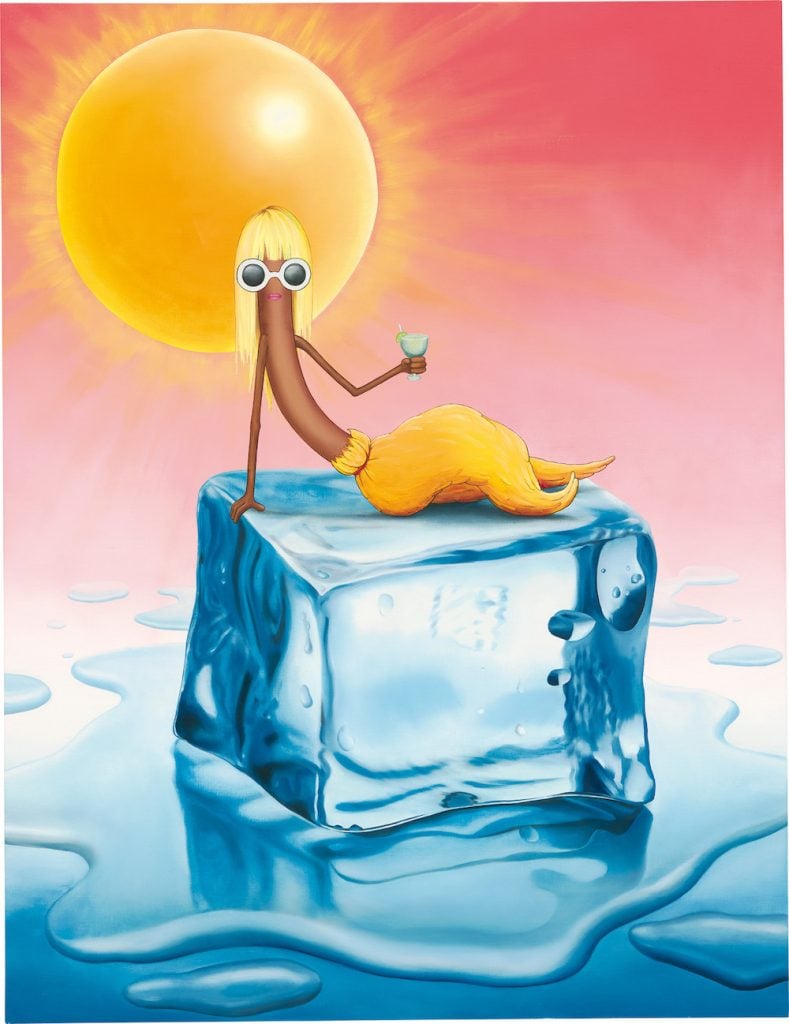

Emily Mae Smith, Broom Life.(2014) Image courtesy Phillips and Poly Auction.

Since three makes a trend, as the old adage goes, consider Emily Mae Smith, whose paintings have banked more money off broom imagery than any creative work since Disney’s Fantasia. True, she hasn’t seen her loftiest auction result recalibrated as often as Hollowell and Singer have this year. Yet she, too, made an unexpected leap into seven-figure territory midway through 2021, then found price support at that level multiple times after.

Entering this summer, Smith’s auction record stood at $359,000 (£277,200) for Alien Shores (2018), sold at Phillips London in October 2020. Seemingly out of nowhere, however, her auction record more than quadrupled when a bidding war pushed Broom Life (2014) to $1.6 million (HK$12.4 million) at a Phillips and Poly Auction sale in Hong Kong this June, more than 21 times its $76,000 high estimate. (Sources pegged the buyer as Shanghai-based collector YiXiao “Xiao” Ding.) Two more EMS paintings sold for more than $1.25 million in the next five months, this time at Phillips auctions in London (against a high estimate south of $83,000) and New York (still well above an optimistic presale expectation of $300,000).

There’s no telling how many more artists I could find to fit this general curve if I had more time. None of the above even fall into the most widely speculated-upon category in the market since the fade-out of Zombie Formalism: young figurative artists of color depicting subjects of color. (Whether that distinction qualifies as an anomaly or a contributing factor is a subject for another column.)

Are Hollowell, Singer, and Smith’s superhuman price leaps explainable? Definitely. I just think the explanations are less noteworthy than the implications about what comes next, especially in light of the primary-market spending spree that just recently overwhelmed the return of Miami Art Week.

Phillips auctioneer Jonathan Crokett selling Gerhard Richter’s Kerzenschein (Candle-light) at the Phillips and Poly Auction evening sale in Hong Kong in November 2021. Courtesy of Phillips.

Most readers of this column are already familiar with the variables driving art sales since the start of the pandemic. The investor class increased its net worth dramatically. Young money, particularly in East Asia, charged into the art market with new confidence, vigor, and international taste. Many high-net-worth individuals bought new homes with bare walls in places like Aspen, the Hamptons, and Palm Beach as a (temporary?) escape from population-dense metro areas. Income saved on lavish vacations and luxe nights out found its way into other forms of discretionary spending. Art sellers finally embraced online and hybrid selling en masse.

None of these is news anymore in mid-December 2021, nor is their general cumulative effect on the art trade. But the scale and the speed of the outcomes are. Even outside of the auction supernovas highlighted in the previous section, it’s much harder to miss the acceleration than it is to determine where, exactly, it leads.

“At Art Basel Miami Beach earlier this month, a gallery director informed me that one of the young artists in his booth was ‘the most famous artist in the world right now.’ Not ‘in X city’ or ‘within Y group of artists,’ but, apparently, in the world,” New York-based advisor Liz Parks told me. “Histrionics aside, I felt the comment was indicative of the pace at which young artists—in this case, an artist with zero solo museum exhibitions and limited gallery ones—are ‘brought to market,’ and whether this apparent approach of ‘manifesting’ success… will help or hurt in the long run.”

Still, I can understand why some galleries might be tempted to believe their own marketing. After 20 years as an art advisor, Candace Worth heard from some dealers whose businesses concentrate below the high-end secondary-market echelon that they had their “best fair ever” during Miami Art Week 2021. In particular, she referenced two galleries that came loaded with physical and on-the-iPad inventory—one prepared to offer around 40 works and the other around 60 works, respectively, with some prices potentially creeping into the six figures—that “sold everything, everything, everything,” she said.

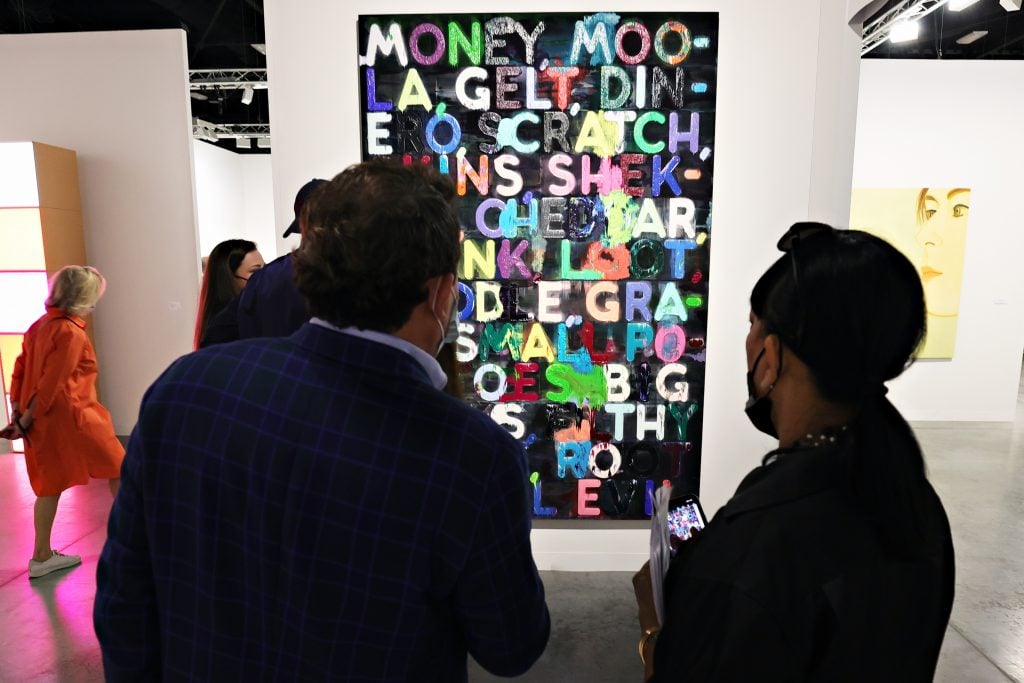

Mel Bochner, Money (2015) at Art Basel in Miami Beach. (Photo by Cindy Ord/Getty Images)

It’s little wonder in this environment that more and more dealers are leaning into what Parks called “the current BOGO trend” (short for “buy one, gift one”), in which clients can only acquire their first piece by a scorching-hot artist if they also agree to acquire a second on behalf of a museum in the same transaction. (As a reminder, though, the plan doesn’t always go as the client promises.) Regardless, there have never been this many people in this many places ready and willing to spend this much money this confidently in the art market before. We aren’t just in a seller’s market; we’re in a seller’s paradise, at least if you have the right names on your available-works list.

“It’s not that there’s no risk, but people are seeing art as a real place to put money, and that’s not how it used to be,” Worth said.

That’s great news for some dealers, major auction houses, and art-fair organizers (as well as plenty of wily opportunists). We just shouldn’t kid ourselves about how the money train can permanently plow through the decision-making process of even the most earnest art lovers, let alone the artists they pursue. Worth cited the example of one client who saw a few once-modest acquisitions turn into potentially handsome returns on investment after the artist’s market went nuclear: “Now he asks different questions when we’re looking at things. He’s still willing to take chances, but it’s definitely changed the conversation.”

The same can be said for the last eight months in an art market surging like never before. Supply, demand, and the arc of history have already accelerated the careers of coveted living artists further beyond the speedometer’s red line than any of their predecessors. Now the question becomes who in the business can keep control of the wheel once this unprecedented straightaway leads into the next hairpin turn.

That’s all for this edition. The column will be on hiatus for the holidays next Wednesday, but I’ll return the week afterward to grade my 2021 predictions. ‘Til then, remember: rules were made to be broken, for better and for worse.