Analysis

Who Survived the Zombie Formalism Apocalypse? We Surveyed the Wreckage of the Last Great Art-Market Fad

Five years ago, the market experienced unprecedented speculation on young artists. Which ones got out of the bubble alive?

Five years ago, the market experienced unprecedented speculation on young artists. Which ones got out of the bubble alive?

Tim Schneider

This story originally appeared in the artnet Intelligence report, a new art market report created by artnet News and the artnet Price Database.

According to Hollywood, there are two main ways to make a zombie thriller. You can either open the story just as the outbreak hits, leaving the protagonist to escape the spreading madness, or you can begin after the undead have already gnawed most of civilization into submission, in which case the protagonist’s challenge is to find a path to long-term survival in the gruesome new world order.

For roughly four years beginning in 2011, the art market’s insatiable appetite for a particular kind of painting—immortalized by critic Walter Robinson under the rubric of Zombie Formalism—paralleled the onset-of-outbreak version of undead cinema. Foregrounding their method of creation in a way that echoed the original Abstract Expressionist principles championed by critic Clement Greenberg without advancing the ideas (that’s the “zombie” part), these artists simultaneously incorporated whoa-cool-bro theatrics (like employing fire extinguishers or fire) that often helped the paintings go viral on Instagram.

Lucien Smith, Hobbes, The Rain Man, and My Friend Barney / Under the Sycamore Tree (2011). Courtesy of Phillips.

These artworks, which appealed to those with a little art education just as much as they drew eyerolls from connoisseurs, arose at the precise moment that the global economy witnessed a level of wealth disparity and private-sector advantages unseen since the Gilded Age. A new, profit-hungry plutocracy followed the scent of money into the art market, spawning a breed of buyers I refer to as COINs: Collectors Only in Name.

These so-called collectors were often brokers who had previously funneled money into alternative investments like fine watches or nightclubs, only to turn to art in search of a new, status-enhancing get-rich-quick scheme. This COIN-operated marketplace undertook rampant speculation in favored Zombie Formalist artists, most of whom were white, male, and no older than 30. Near the height of the boom, bidding wars sent individual works to totals more than 3,000 percent beyond their prices just two years earlier. The Zombie Formalists had found their match in these Zombie Collectors, infected by the ravenous urge to mindlessly hunt money.

But by fall 2015, it seemed the Zombies had run out of fresh meat to feast on. The most infamous example of this process was the trajectory of Lucien Smith’s Hobbes, the Rain Man, and My Friend Barney/Under the Sycamore Tree (2011), an epic-scale landscape painting first sold for $10,000 after the artist’s thesis exhibition at Cooper Union, then bought at auction by über-trader Alberto Mugrabi in 2013 for $389,000, and finally, Mugrabi implied, reduced to unsellability two years later.

©2018 artnet Intelligence Report.

Today, it’s fair to say that the Zombie Formalist apocalypse has run its course. Like protagonists in that second type of zombie thriller, we are now left to sift through the chaos, identify the survivors, and try to determine why and how they made it through—lessons that will be particularly valuable when the inevitable sequel rolls into theaters—er, galleries—near you.

To do so, we created an auction price index of 13 artists who were identified by critics as major proponents of Zombie Formalism during its surge and who were also among the top 30 artists of their generation (born after 1980) by auction-sales volume. By tracking the rise and fall of their sales results as a group, we determined that demand for the aesthetic began to suffer a sustained decline in early August 2014. (To continue the zombie analogy, consider this the point when some brilliant researcher invented the serum.) We then searched the artnet Price Database for which of the artists qualified as top performers both before and after this turning point in the marketplace, as a way to find the select few who have emerged victorious from the brutality of a full market cycle.

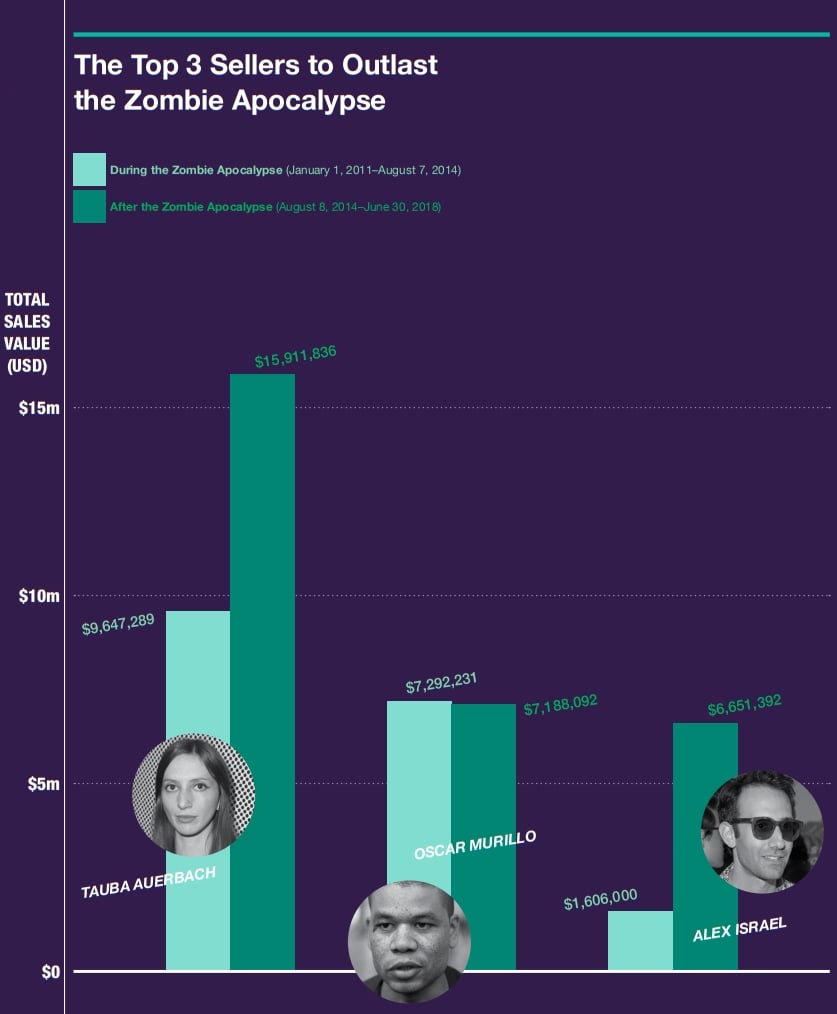

Based on their combined auction history, primary market, and institutional track record, it seems fair to say that—despite the era’s dubious excesses—at least three legitimate market stars have emerged from the Zombie Formalist apocalypse to earn a long-term seat at the art world’s table: Tauba Auerbach, Oscar Murillo, and Alex Israel.

Oscar Murillo, Untitled (Drawings off the wall) (2011). Courtesy of Phillips.

They are the only 1980s babies to amass more than $6.5 million each in total sales under the hammer since August 2014. All have shown with elite galleries for over four years—Auerbach with Paula Cooper, Murillo with David Zwirner, Israel with Gagosian—and they have each been the subject of multiple solo and group museum exhibitions.

Tauba Auerbach, Untitled (Fold) (2010). Courtesy of Phillips.

Current primary market prices for all three artists are comfortably within the six figures. Auerbach’s paintings now command $170,000 for small canvases and go up from there. Gagosian offers the most expensive of Israel’s “New Wave” paintings, on view at the gallery’s Hong Kong space this summer, for $150,000 each. And Murillo paintings now trade for $350,000 and up—remarkably, a figure nearing his current auction record of $401,000 for Untitled (Drawings off the wall) in 2013.

Is there anything in the work itself that justifies these artists’ endurance at altitude? That answer will always be subjective. But advocates of these artists would likely say that they all have managed to continuously find ways to tease fresh new work from a set of core themes, even as they spread their wings across different media, materials, and venues.

Installation view, “#AlexIsrael” at the Astrup Fearnley Museet, 2016. Photography: Christian Øen © Astrup Fearnley Museum.

Auerbach, for instance, has evolved beyond her “Fold” paintings—her best-known and most sought-after during the Zombie Formalist spree—by applying their aesthetic to everything from artist books to stainless-steel sculptures—to even the exterior of a historic New York fireship. Murillo, meanwhile, has continued branching into video, installation, and social practice while refining his signature scribble-saturated paintings. And Israel has spread his Los Angeles state of mind from his coveted shaped canvases to a host of other ironically self-reflexive projects, including a feature film.

When sifting through the gnarly rubble of the Zombie apocalypse, it’s important to remember that young artists aren’t just investments for COINs looking to flip hot commodities. They are also investments for galleries, who pump time and resources into building their profiles so that they can endure—and mature—over multiple market cycles.

For galleries, these long-term commitments entail improvising unique flight paths to help their artists navigate the turbulent airspace of a modern-day art career. Consider the more modest recent trajectories of three artists who shot to auction fame during the Zombie Formalist era and are now working to return to the art world’s good graces: Jacob Kassay, Parker Ito, and Ryan Sullivan.

Installation view of Jacob Kassay at Xavier Hufkens, Art Basel 2011. Photo: Lux & Jourik, via Creative Commons.

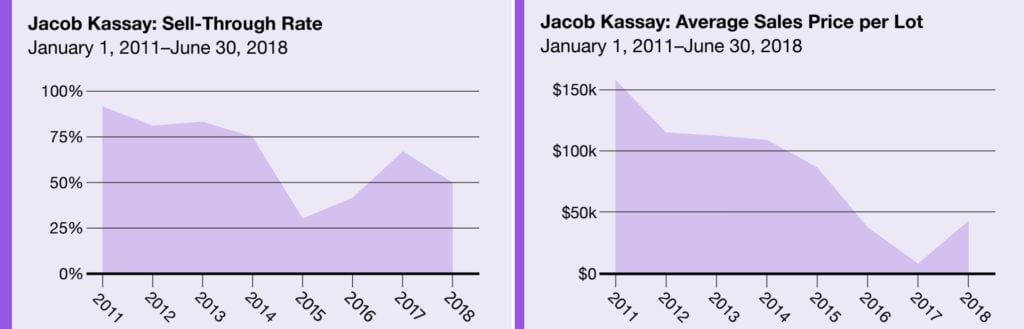

Kassay thundered onto the auction market seven years ago on the strength of a series of blurred silver canvases created through an electroplating process indebted to early photography. His auction record came courtesy of one such painting, which sold at Phillips in November 2013 for $317,000, more than 150 percent of its high estimate.

Today, he is represented by Chelsea mainstay 303 Gallery and has pivoted toward what the art advisor Benjamin Godsill calls “more radical art making”: rough-hewn paintings fashioned from scraps of other paintings, minimalist sculptures adapted from architecture, and other works that prioritize an interest in surface and space over immediate visual appeal. The prestigious Albright-Knox Art Gallery, in Buffalo, staged a solo exhibition of his work last year, proving he can still attract institutional attention.

©2018 artnet Intelligence Report.

However, his auction metrics paint a somber picture. While 53 Kassay lots sold during the Zombie surge, only 20 have found buyers since—a drop of more than 60 percent. His year-over-year sell-through rate plummeted from 92 percent to just 50 percent between 2011 and the midpoint of 2018, and the average sales price of his works at auction took a dive from nearly $154,000 to under $38,000 during the same stretch. This last figure is in line with a reported sale of Kassay’s Untitled (2018), a shaped-canvas monochrome in flat acrylic, for $45,000 at Art Basel this June—a sterling context in which to place a piece, but also an indication of a modest pricing strategy by the gallery.

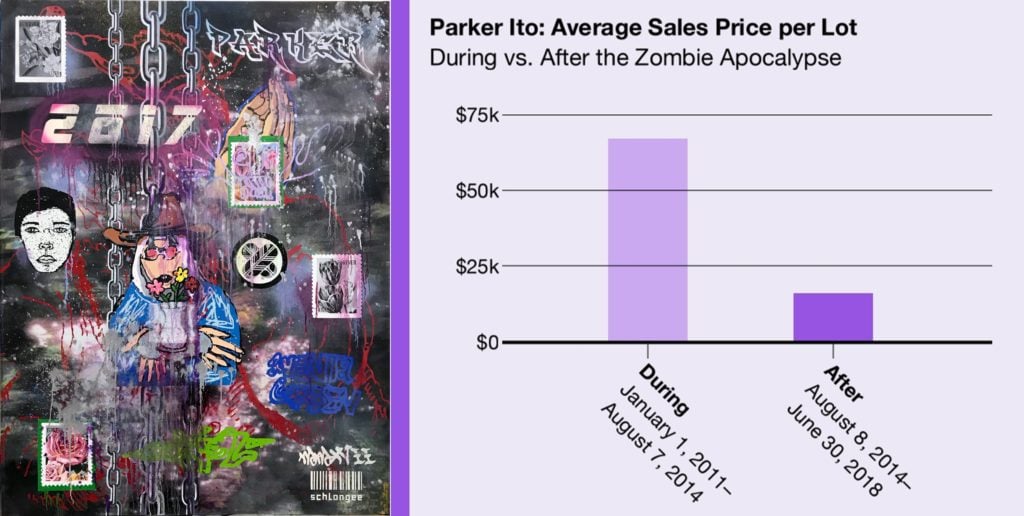

Like Kassay, Ito too has moved sharply away from the process-based abstractions that pushed him into the market spotlight. (He told Bloomberg in 2014 that the presence of his work at auction was “a sign of how ridiculous the art market has become.”) Today, his work consists of naturalistic still lifes and cartoon-inspired landscapes filled with riotous, acid-trip amalgamations of hybrid creatures.

Left, Parker Ito, #2 (miami) (2017). Graphics ©2018 artnet Intelligence Report.

Although he has been included in the occasional group exhibition in Europe, Ito has yet to be granted his first solo museum show. And in terms of auction results, he has dropped from an average sales price per lot of $62,000 before early August 2014 to an average price of about $16,000 since.

But it’s not as if he’s fallen off the face of the Earth, either. Ito is currently represented by a consortium of dealers led by respected, bicoastal Team Gallery, which mounted a solo presentation of his work at Art Basel Miami Beach last year—the first time in 17 years that the gallery had devoted an art-fair booth to a single artist.

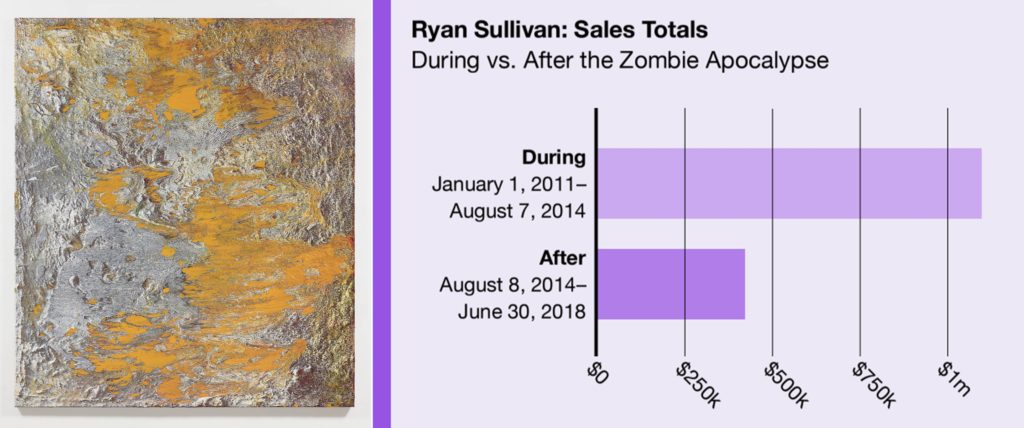

Then there is Sullivan, whose abstractions evoking extreme close-ups of swirling desert sands or shimmering iridescent oil puddles earned him a solo exhibition at the Institute of Contemporary Art, Miami, in 2015. Since that time, he has also had solo shows at both Maccarone and Sadie Coles HQ, which began working with him in 2012 and 2013, respectively. A Sadie Coles representative confirmed that Sullivan’s new paintings range from $40,000 to $90,000.

Left, Ryan Sullivan, March 8, 2014-April 15 2014 (2014). Courtesy of the artist and Maccarone Gallery.

Independent sources say that his work continues to sell well on the primary market. But there’s no question that his earliest auction results have vastly outshone his latest outings. By August 2014, collectors had spent a total of $1 million on the 12 Sullivan works consigned to auction, all of which found buyers. Since then, eight of 17 lots have been bought in, and the roughly $411,000 achieved by the other nine no longer ranks him among the top 30 artists of his generation at auction.

Does that decline under the gavel make Sullivan an undervalued opportunity or a Zombie casualty? What about Kassay, Ito, and the others? From a collecting standpoint, any 30-something (or older) artist with decent (but up-and-down) auction results, reputable (but not mega-) gallery representation, and a modest (but not illustrious) institutional presence becomes a mixture of signal and noise. What one collector might see as a career on life support, another might see as an undervalued opportunity poised for a big comeback.

Ultimately, collectors’ perspectives may depend on what they think of the dealers behind the artists. Good galleries and artists have successfully navigated the speculator-torn rift between primary and resale markets in the past. According to the London dealer Inigo Philbrick, who traded in work by Auerbach and David Ostrowski during the Zombie craze, the challenge “was to bring people who had been invested early back to the table and say, ‘Hey look, this thing got crazy. But actually we really like this artist, and we think he has something important to say.’”

The question is, which galleries are truly game for this unenviable slog? Stefan Simchowitz, the collector, advisor, and entrepreneur who became a fixture of the art-market conversation during the Zombie Formalist boom—specifically, as the most transparent of the so-called flippers—thinks that artists like Auerbach, Murillo, and Israel are the exceptions that prove the rule. “Young, emerging artists want to be with these big, fancy dealers with big net worths because it’s more prestigious for them,” he says. “But [big galleries] don’t build a market for them because they’re not fucking interested.”

Installation view, “#AlexIsrael” at the Astrup Fearnley Museet, 2016. Photography: Christian Øen © Astrup Fearnley Museum.

In his view, the increasingly limited auction inventory we see for almost all former stars of the Zombie wave is a product of backward strategic thinking. What one art advisor, Candace Worth, calls “controlling supply in a more positive way,” Simchowitz calls “[taking] all the air out of the market.” He further argues that galleries that represent major estates rely on the dead to keep themselves flush, which disincentivizes them to do the hard work of slowly but steadily building up young artists at prices welcoming to a diverse group of collectors.

To Simchowitz, all that leading galleries are doing for emerging artists’ markets is “creating a fake facade, like a Western town. And then you open the door of the facade and you walk out the back, and you go, ‘Oh, my God, I’m on the set of Warner Brothers. This ain’t real!’”

Oscar Murillo, 7+ (2013–14). Courtesy the artist and David Zwirner, New York/London and Carlos/Ishikawa, London. Photo: Matthew Hollow.

Everyone I spoke to for this story agreed on one point: The Zombie apocalypse may have transformed the buyer population, but it didn’t end speculation in the art market. It merely shifted the relationships in play.

Simchowitz says “a lot” of the speculative buyers he worked with early on have exited the art market entirely. “They’re either dissatisfied” with the profit acceleration of their artwork, “or they’re satisfied that they made money, and they moved [their investment dollars] on to cryptocurrency…or Facebook.”

Philbrick, too, estimates that as much as 50 percent of the pre-2014 buyer demographic has bid collecting farewell. He suspects the former COINs who stuck around “got an education, gained expertise, and moved from there to collecting in a different way.”

The institutional sector, too, has adopted a new focus. In response to an inquiry about the fate of the movement he branded four years ago, critic Walter Robinson wrote: “Seems to me that the Zombie Formalism tag marked the sudden end of a movement of process-based abstraction, which opened the door for the current triumph of art with sociopolitical backstories.”

Occupy Museums (founded 2011), Debtfair, 2017. Courtesy of the artists. Photo: Bill Orcutt.

He pointed to the thematic split between two major museum exhibitions bookending the past four years: the Museum of Modern Art’s process-based abstraction haven “The Forever Now: Contemporary Painting in an Atemporal World” and the sociopolitically engaged 2017 Whitney Biennial.

Today, buyers appear to be either following museums’ lead or, in some cases, steering the path with their art donations. It is no coincidence that, of the 12 first-time artists who doubled their high estimates at Sotheby’s postwar and contemporary evening sale this past May, none was a white man. Similarly, in the post-serum years, at least three of the fastest-rising auction stars have focused on sociocultural themes: Adam Pendleton, Korakrit Arunanondchai, and Njideka Akunyili Crosby.

Still, despite the feel-good vibes around this apparent win for diversity and the establishment bona fides of the buyers, a cloud may lurk overhead. “These artists who deal with narrative, figurative identity are not dealing with a more serious collector base” than the Zombies did, Simchowitz contends. “Galleries have very happily welcomed them as serious collectors because they’re now interested in more serious subjects. But they’re speculators. They’ve simply migrated like a herd to another category.”

©2018 artnet Intelligence Report.

History, it would seem, is destined to repeat itself, despite any chastening lessons of the Zombie era. “I think we’ll be having this conversation roughly every 10 years,” Philbrick predicts. “It’s the same thing we see in all sorts of asset classes, where people get enthusiastic and carried away, and then things overheat.”

But whether the market niche is emerging talent, overlooked older artists, socioculturally engaged works, or something entirely new, one question persists: If we ignore the lessons of the last art-market boom and let our appetites drive us mindlessly back into another frenzy—whether as buyers feeding on hype, as artists hunting the cool, or as sellers blinded by money hunger—who are the real zombies?

This story originally appeared in the artnet Intelligence report, a new kind of art market report created by artnet News and the artnet Price Database. The full report has even more juicy details on the most bankable artists, the biggest myths in the Chinese art market, and a detailed breakdown of the market’s performance in 2018.