Market

Want to Make a Killing in the Old Master Market? Here Are 5 Areas to Look for Value

Experts share their insights into the underappreciated market.

Experts share their insights into the underappreciated market.

Henri Neuendorf &

Eileen Kinsella

At a time when contemporary art has become the art market’s most coveted segment, the Old Masters—once the most desirable treasures for elite collectors—has gone under the radar in recent decades. Scarcity has played a role in this, and so has a vogue for the newest thing in an era obsessed with bleeding-edge innovation.

But while the spotlight shines elsewhere, plentiful opportunities have opened up in the Old Masters market.

“People are looking back and seeing the value that you really can get,” Wendy Goldsmith, a London-based art advisor who previously oversaw 19th-century European art at Christie’s, told artnet News.

The Old Masters, of course, are not without their challenges. Experts are quick to point out several key differences between the Old Master and contemporary markets, most notably the supply shortage. Some works are centuries old and as time has passed artworks have succumbed to natural damage, fire, flood, and theft. What’s left—particularly the works by the more celebrated artists—has disappeared into private and public collections.

Additionally the Old Masters aren’t affected by the dramatic price fluctuations that buffet the contemporary segment because the market has had centuries to assimilate, and the benefit of hindsight has facilitated the identification of key periods and artworks. Due to extremely limited supply and heightened demand, Old Masters tend to maintain their value and rise in price only gradually.

Today, the dearth of obvious buys—the Titian painting, the Rembrandt portrait—and their stratospheric prices when the do surface in the market force Old Master collectors tend to cast a wide net, targeting great works in great condition, rather than chasing individual names. “It’s about subject, it’s about date, it’s about condition, it’s about freshness to the market,” Goldsmith said. “If you get all those right, the sky’s the limit.”

As a result, Greg Rubenstien, a specialist for Old Masters drawings at Sotheby’s, says prospective buyers must be prepared to trust their eye, and be creative. “I think the nature of the Old Master market is that what you buy is driven by what comes on the market,” he told artnet News. “People are buying more on the basis of outstanding quality and less on the basis of it having to be an established, big name.”

At the same time, there are certain trends in the market that industry experts pay heed to, and certain styles that are prone to holding their value no matter who created the work. Here are several areas that specialists suggest prospective buyers focus if they want to spend smart money on the Old Masters.

According to experts, significant buying opportunities in Italian Old Masters have opened up as the country’s current economic difficulties have stimulated supply by pushing Italian collectors to sell. Several dealers pinpointed 17th-century Italian Baroque and 18th-century “view” paintings (called vedute in Italian) of cityscapes or other stirring vistas as areas that are currently undervalued in light of their art-historical significance.

“At the moment, because the whole Italian economy is down the tubes, some of the view paintings are being sold for a third of what they used to be,” New York dealer Adam Williams told artnet News. “Also, some of the less important Baroque artists have gone down [in price] enormously.”

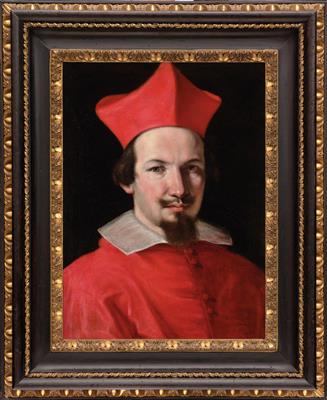

As an example, veteran New York dealer Richard Feigen cited Guercino, whose Portrait of Cardinal Bernardino Spada sold for $176,766 at Dorotheum in April. It’s not cheap, but considering that the painting is thought to have been part of the Borghese collection, its a reasonable price for a piece of art history.

Guercino’s Portrait of Cardinal Bernardino Spada. Photo: courtesy of Dorotheum.

According to Williams, the market for 17th-century Dutch painting has cooled off, resulting in lower prices and good buying opportunities “Some of the Dutch 17th-century [works] are reasonable where they used to be unbelievably expensive 10 years ago,” he said.

Salomon van Ruysdael’s River Landscape With Fishermen and Cattle, the Grote Kerk of Alkmaar Beyond (1664). Photo: courtesy of Sotheby’s.

For example, Salomon van Ruysdael’s River Landscape With Fishermen and Cattle, the Grote Kerk of Alkmaar Beyond (1664) sold at Sotheby’s in June for only $75,000. The painting boasts the illustrious provenance of coming from the distinguished collection of New York philanthropist Emile Wolf, and was exhibited at New York’s Metropolitan Museum of Art in 1922.

This is certainly not the most politically correct category these days, but Goldsmith singled out the European tradition of evocative, Romantic scenes from the Near East—painted during the colonial era—as a place where great value can be found. “To me one of the greatest fields of the 19th century is Orientalism, and that’s one that I’ve watched and followed over the last 27 years,” she said. “I’ve watched it fluctuate, but at the moment it’s really down.”

Jean-Leon Gerome’s Bethsabée (1889). Photo: courtesy of Sotheby’s.

She pointed to the arc of Jean-Leon Gerome’s Bethsabée (1889), a painting that has come up at auctions three times in the last 27 years, as an example of how much the market has dropped. In 1990 it set the record for 19th-century painting when it sold at Sotheby’s New York for $2.2 million. It reappeared in 2005 at Sotheby’s London, where it sold for £456,000 ($823,696); when Bethsabée came up at Sotheby’s London in June, it reached only £488,750 ($630,482). “It’s a staggering drop on a masterpiece,” she said. “If I had several million to just buy pictures and put them in a warehouse for a few years, I’d buy it.”

Works by “British painters from the last half of the 18th and first half of the 19th century” are also currently undervalued, according to Richard Feigen, and represent a good opportunity for buyers. The dealer named landscape artist Henry John Boddington and the Romantic painter John Constable as examples. Recently, Constable’s Portrait of Elizabeth, Lady Croft sold at Christie’s, London in December 2016 for $102,226. The painting is a desirable depiction of a member of the British aristocracy, and was owned by Florence Horatio Nelson Suckling, a descendant of the famous British admiral Horatio Nelson.

John Constable’s Portrait of Elizabeth, Lady Croft. Photo: courtesy of Christie’s, London.

Unlike the Impressionist and contemporary segments, which both have very robust competition in the middle market, London dealer Simon Dickinson told artnet News that demand in the Old Master market is almost exclusively for top-quality works—which presents fantastic opportunities for acquisitions in the mid-market spectrum. “Demand at the moment is for really great pictures, but some middle-range things at the moment are probably undervalued,” he said. “I think the middle range pictures are key at the moment. Everyone wants the very best, and I think the market is not particularly good for the middle-range pictures.”

Within the middle market, opportunities lie in portraits of significant figures that continue to resonate today. “Writers, poets, kings, queens, and monarchs who shaped the history of civilization, that’s what I would recommend,” dealer Philip Mould told artnet News. “Names [of artists] are irrelevant in the middle market—it’s all about the quality of the image and the application of the image.”