Analysis

Sotheby’s Follows Christie’s and Hikes Buyer’s Premium

The change kicks in just in time for the major fall sales in New York.

The change kicks in just in time for the major fall sales in New York.

Eileen Kinsella

Just a month after rival auction house Christie’s announced a change to its buyer’s premium, Sotheby’s has also adjusted its pricing structure.

The change kicks in just in time for its major fall sales in New York in November. Sotheby’s described the changes as “modest” on its website, and that it would affect only about five to 10 percent of lots sold. It is the first change of its kind since February 2015.

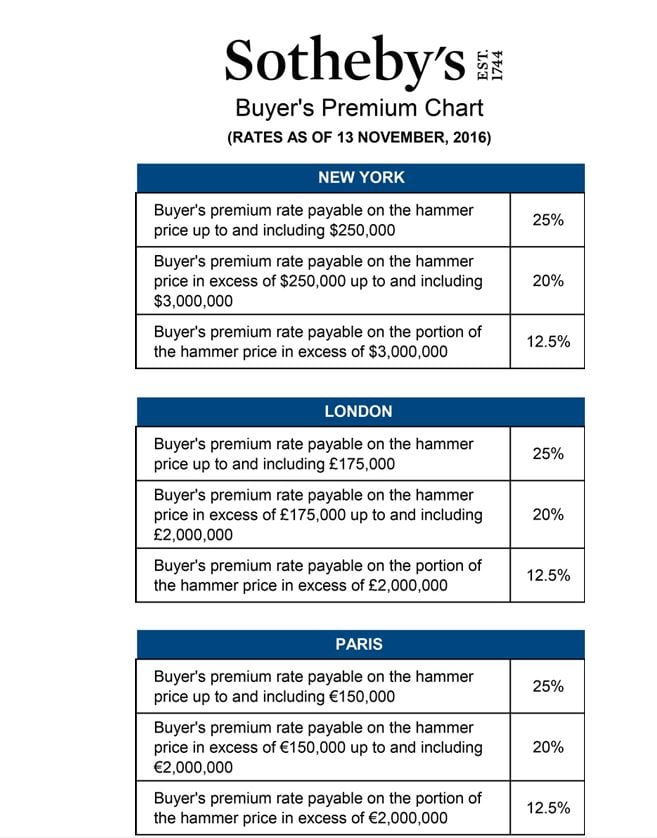

However, one category is safe: wine. Also, they won’t affect sales held in Beijing. The auction house outlines the changes in a table on its website as they apply to different locations and currencies, including in London, Paris, Milan, Switzerland, and Hong Kong.

Courtesy of Sotheby’s.com

Auction houses typically stagger or grade the fees charged on lots sold at auction, with the highest percentage charged on the first $100,000 or $200,000, and dropping off after $3 million.

The house is now charging more than what Christie’s does, taking 25 percent on the first $250,000, as opposed to Christie’s rate of 25 percent on the first $150,000. Under the current structure, for example, a buyer of a $3 million painting at Sotheby’s would pay fees of $117,500, whereas the same hammer price at Christie’s would incur a premium of $94,500.

Shares of Sotheby’s were trading slightly higher on the New York Stock Exchange this morning, at around $36.28, after having closed trading at $35.97 yesterday.

The stock has been overall performing much better in recent months, particularly as compared with earlier this year, when a flood of top specialists exited the company amid buyouts and ongoing leadership changes.

Related: Exodus at Sotheby’s Plunges Auctioneer Into Murky Waters

This past March, Sotheby’s stock had fallen roughly 40 percent over the last year, from $42.40 to $25.15 per share. It dipped as low as $19.14 in February.

“We made this decision for two principal reasons,” Mike Goss, CFO of Sotheby’s, wrote in an email to artnet News. “First, to offset margin pressure, particularly at the high end of our business where these changes are focused; and second, to continue to invest in improving our client experience in all aspects of our business.”