This article is part of the Artnet Intelligence Report Year Ahead 2024. Through in-depth analysis of last year’s market performance, the new edition paints a data-driven picture of the art world today, from the latest auction results to the artists and artworks leading the conversation.

The art market’s globalization has accelerated over the past three decades in line with broader economic and cultural trends. In the early 2000s, auction houses and art dealers worked to cultivate clients beyond Europe and North America, targeting the so-called BRIC countries (Brazil, Russia, India, and China) through specialized sales and events.1 Today, the art market is thoroughly global, with participants flying from country to country for art fair openings and placing bids at auction from halfway around the world. Artists and collectors also frequently work with galleries in multiple countries. But key regional distinctions remain.

In order to explore how artists from different regions have performed at auction over time, and how their markets have developed in unique ways, in Part One, Morgan Stanley, in collaboration with Artnet, will examine auction sales and the volume of lots sold over the past decade by artists from North America, Europe, the Asia-Pacific, Africa, Latin America and the Caribbean, and the Middle East. Artnet Analytics sources nationality information from artists’ CVs and auction house records. Artists with dual nationalities in different regions are reflected in two data sets. For a more nuanced look at the performance of artists from each region, we will break down total sales by category.2 “Old Masters” covers artists born from 1250 to 1820; “Impressionist and Modern” covers artists born between 1821 and 1910; “Postwar and Contemporary” covers artists born between 1911 to 1974; and “Ultra-Contemporary” covers artists born after 1974.

Art markets do not develop in a vacuum; they require vibrant institutions, exhibitions, and other stakeholders in order to grow. In Part Two, we will explore the key developments in each aforementioned region for the rest of 2024. We will highlight important museum openings and expansions; biennials and major exhibitions; and critical art market developments to offer a global look ahead, broken down by region.

Part One: The Data

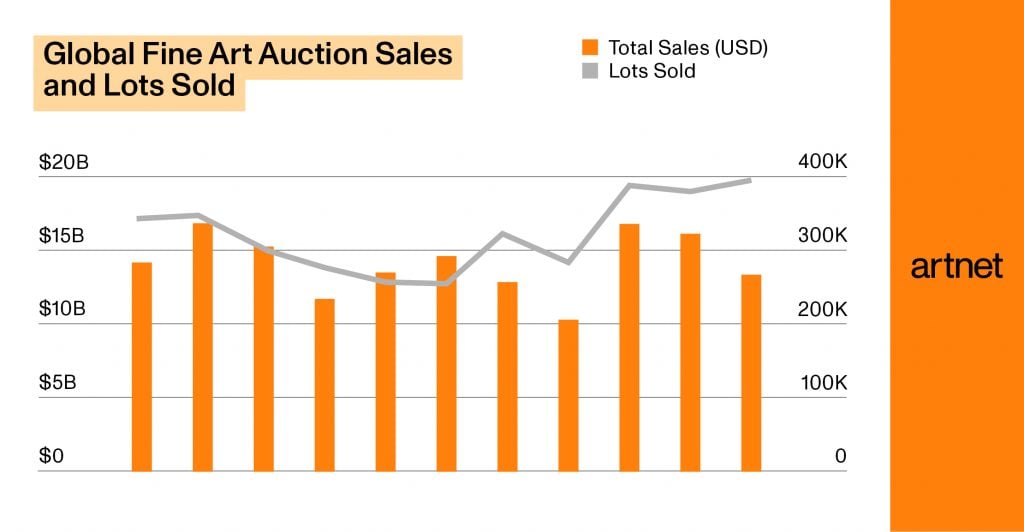

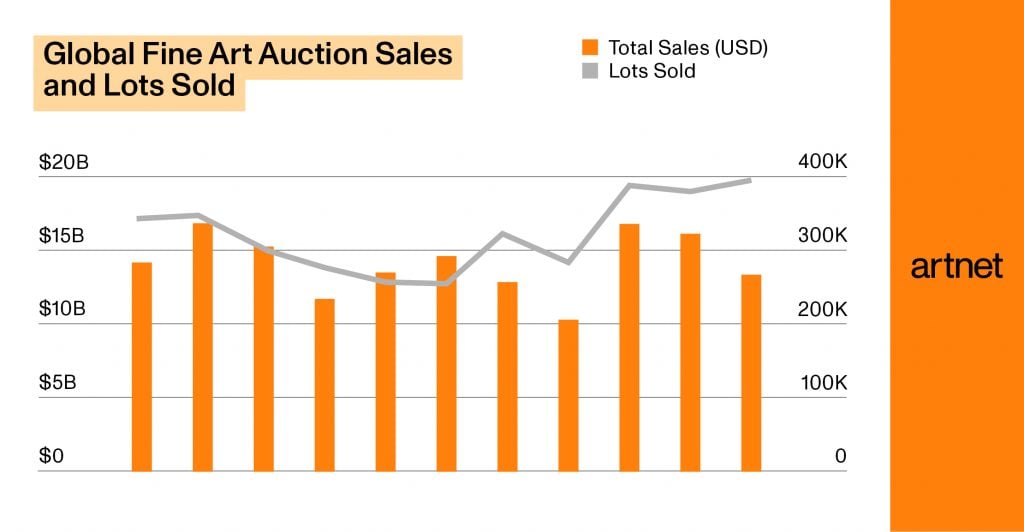

As we break down the data on fine art sales by region and genre, several themes emerge. The market for North American-born and European-born artists’ work is the largest and steadiest. The market for work by African- born artists has grown appreciably—albeit in fits and starts—over the past decade. Meanwhile, the market for work by Asia-Pacific-born artists has markedly declined over the same period. For context, a chart of global fine art auction sales—including, but not limited to, all regions discussed herein—is below.

Source: Artnet Price Database and Artnet Analytics.

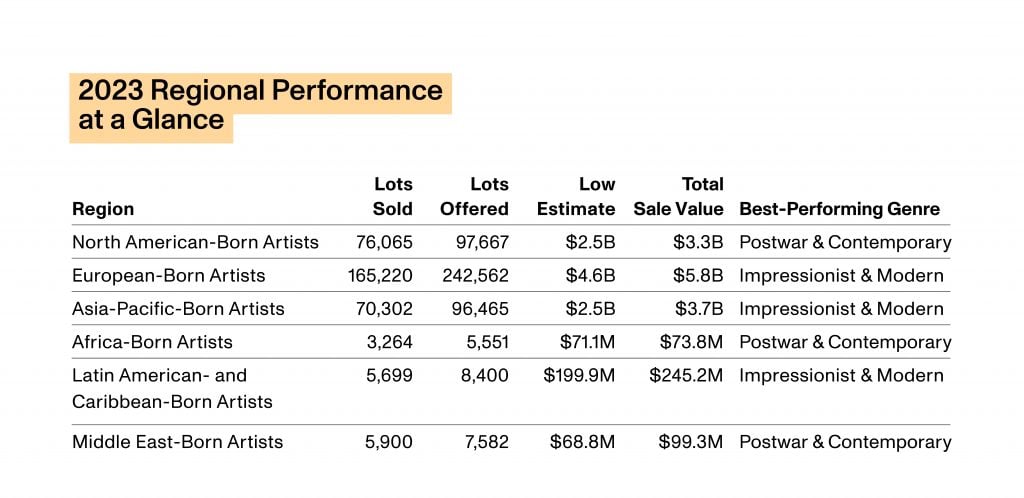

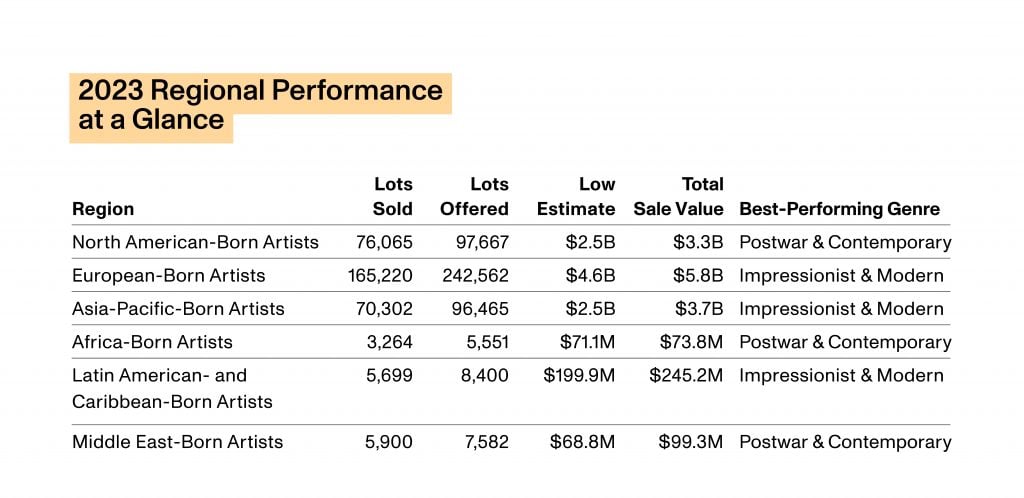

Source: Artnet Price Database and Artnet Analytics.

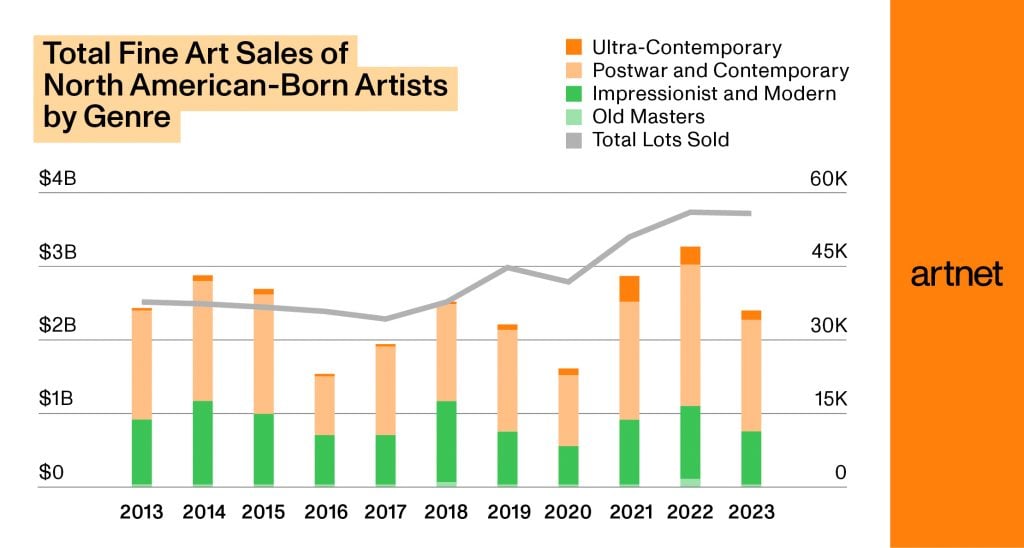

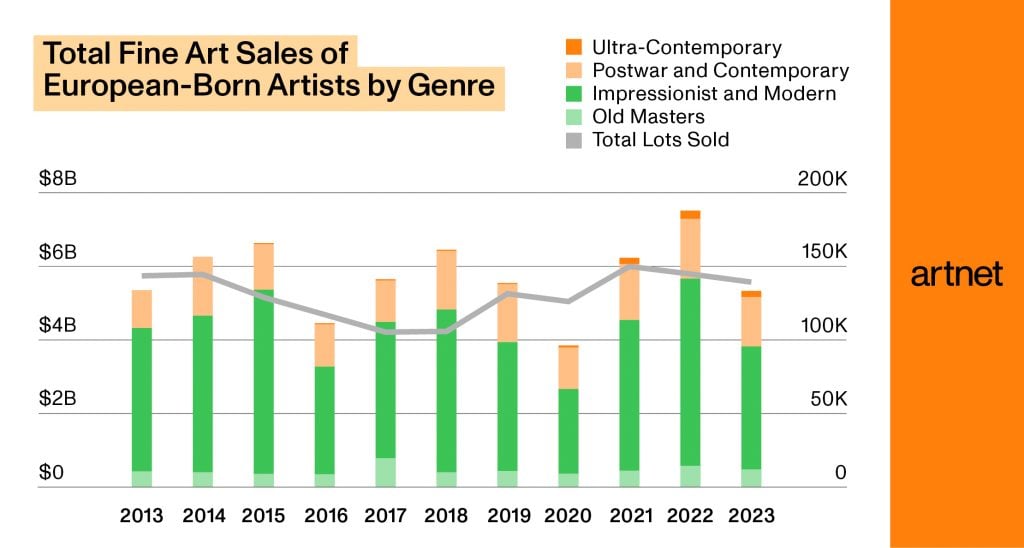

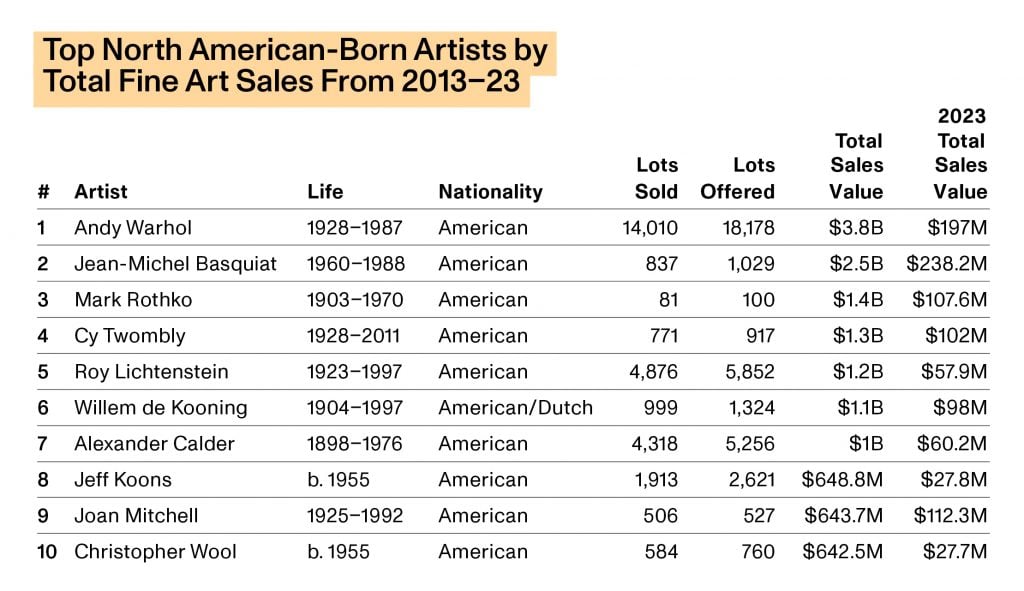

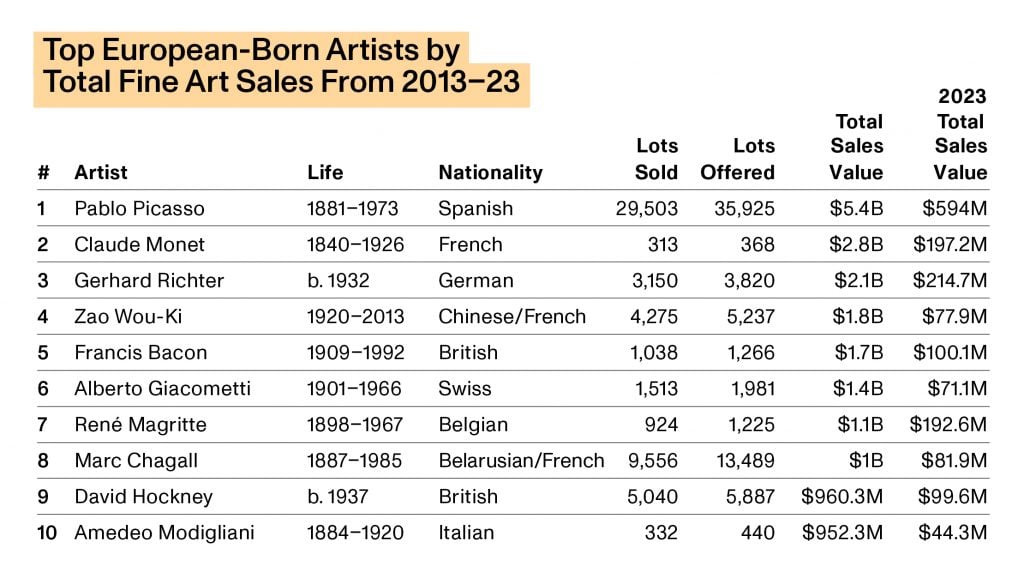

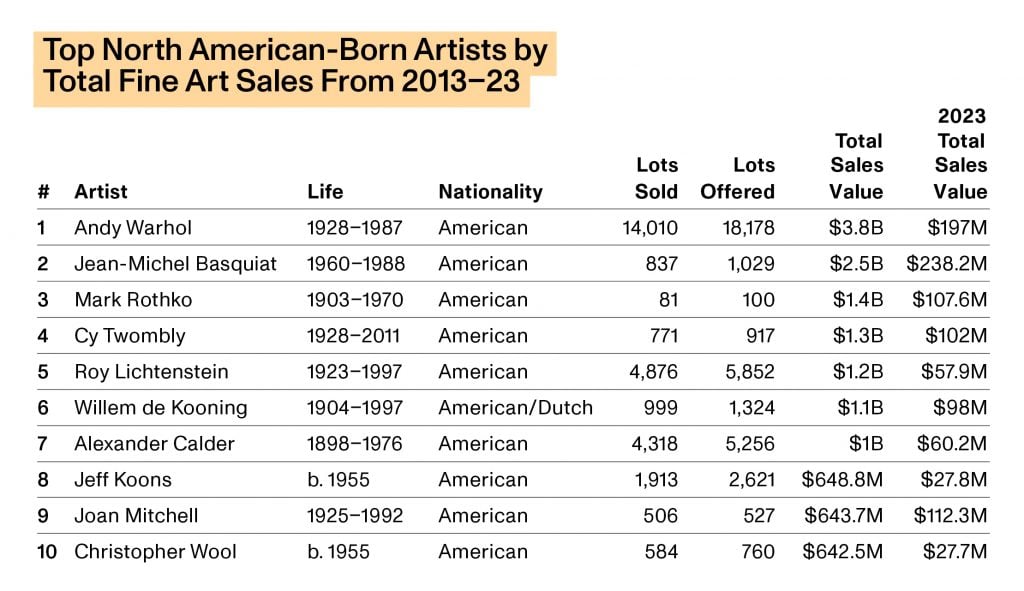

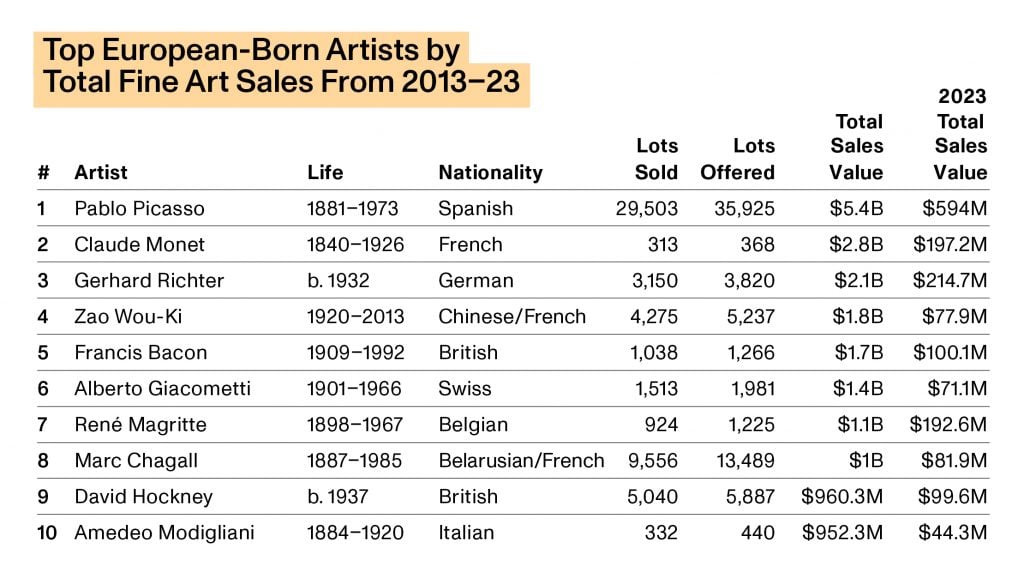

North America and Europe

Work by artists born in these two regions commands by far the largest share of global fine art sales. The just over $3 billion and nearly $6 billion in sales in 2023 for North American- and European-born artists, respectively, formed 65 percent of the $13.9 billion global fine art auction market in 2023. This share has remained relatively consistent over the past decade.

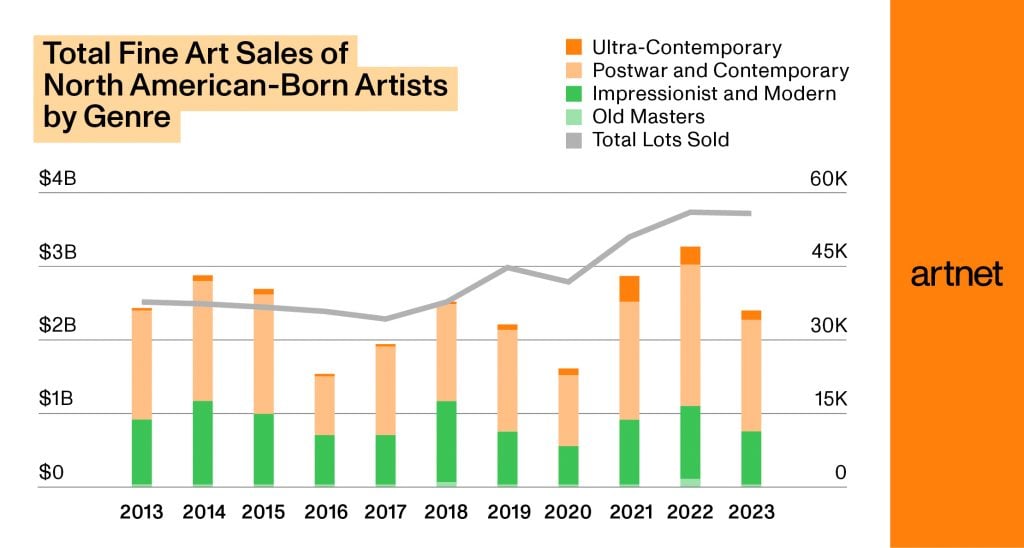

Source: Artnet Price Database and Artnet Analytics.

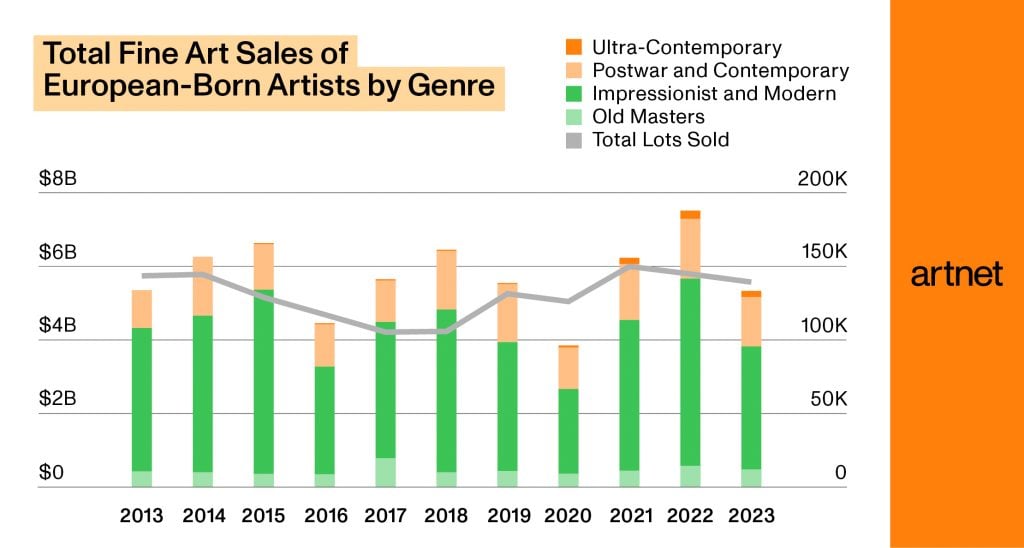

Source: Artnet Price Database and Artnet Analytics.

Of the two groups, European-born artists consistently have the larger market share by both value and volume. In 2023, the number of lots sold by North American-born artists (76,065) was less than half the number of lots sold by European-born artists (165,220). The regions, however, are on diverging trajectories. Over the past decade, the number of lots by North American-born artists offered annually has grown by 47 percent, while the number by European-born artists has decreased by 7 percent.

Source: Artnet Price Database and Artnet Analytics.

Source: Artnet Price Database and Artnet Analytics.

For North American-born artists, the most successful genre at auction is consistently Postwar and Contemporary, a trend that appears to be due to American-born artists having gained a foothold in the art market relative to their European-born peers during this era. The Postwar and Contemporary category includes Andy Warhol, Jean-Michel Basquiat, Mark Rothko, Cy Twombly, and Roy Lichtenstein, who account for the five top-performing North American-born artists by total sales. Excluding outlier years—2016 (when the global auction market contracted by 22 percent) and 2020 (during the pandemic shutdowns)—the sales totals for Postwar and Contemporary for North American-born artists landed between $1.2 billion and $1.9 billion each year.

The largest segment by far for European-born artists by genre is Impressionist and Modern. For four of the years in the past decade, the genre saw a total of more than $4 billion in sales of work by European-born artists. Twice, in 2015 and 2022, that sum came in just under $5 billion.

Those peak years can be tied to two key market moments: In 2015, Christie’s reported an upswing in sales driven by a strong market for Impressionist and Modern art, which it attributed to an increasingly global buyer base and a rise in online transactions.3 That surge, in turn, is believed to have been built on interest in the genre the previous year, when Asian buyers entered the global art market in force and began to snap up high-value Impressionist and Modern works by European-born artists.4 In 2022, the sale of the $1.6 billion Paul Allen collection included high-priced works by Van Gogh, Cézanne, Seurat, and others from Europe.5

The best-selling European-born artist is by far Pablo Picasso, with $5.4 billion worth of sales at auction in the past decade. That’s almost double the size of the market for the artist in second place, Claude Monet.

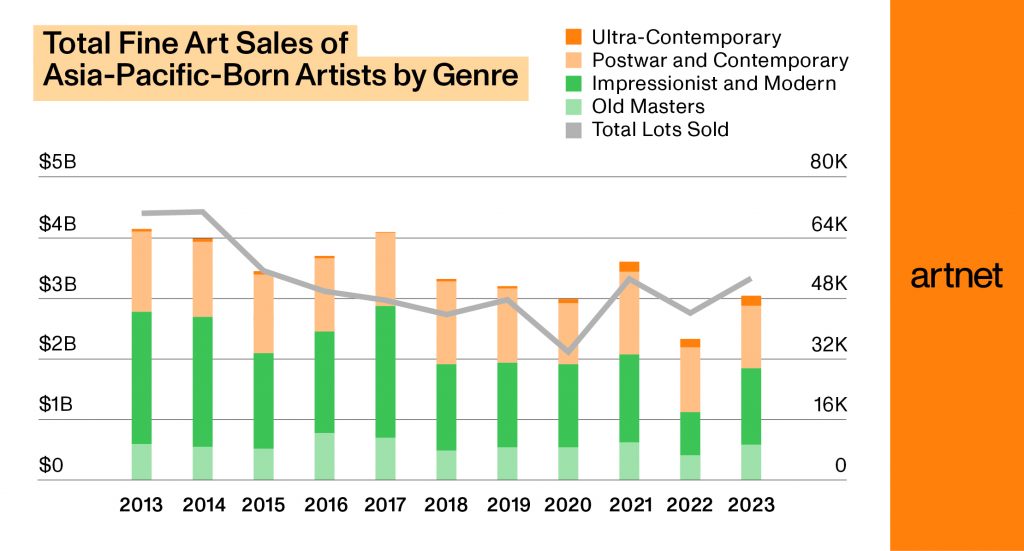

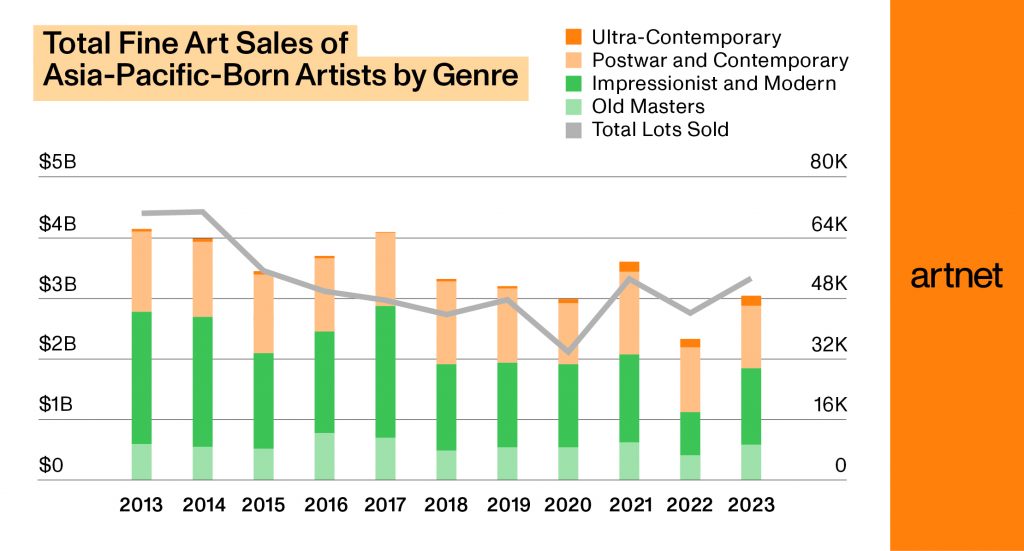

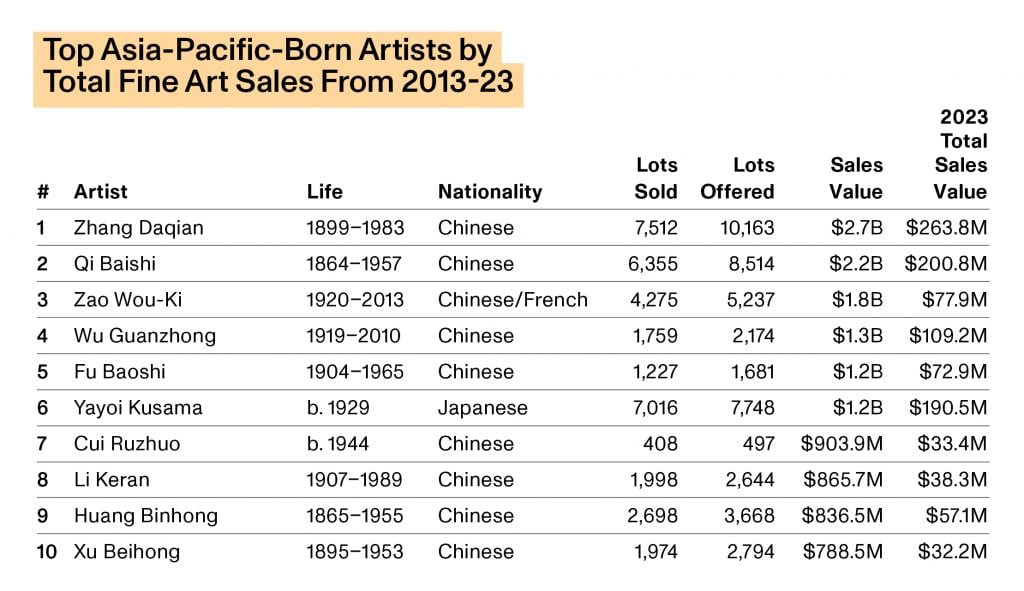

Asia-Pacific

The total sales of work by Asia-Pacific-born artists have been dropping steadily over the past 10 years, save for a small bump in sales in 2017 and a significant one in 2021 (consistent with the rise in the global art market that year). Overall, between 2013 and 2023, total sales of Asia-Pacific-born artists fell $1.5 billion, and the number of lots offered dipped by about 23 percent.

Source: Artnet Price Database and Artnet Analytics.

Source: Artnet Price Database and Artnet Analytics.

Last year, $3.7 billion worth of work by artists from the region traded hands, up from $3 billion in 2022. But the overall trend remains downward, representing a notable deviation from the decade prior, when interest in Chinese Contemporary artists flourished.6

Total sales and the number of lots offered by Asia-Pacific-born artists declined especially sharply between 2014 and 2015—a period when Asian collectors came into their own as formidable buyers of blue-chip Western art.

For a region with a strong collector base whose artists began the decade as peers of Europe’s in terms of sales, the trend is striking. The pandemic and Chinese economic turmoil doesn’t help explain the dip, since the decline begins in 2014—the year China surpassed the U.S. to become the world’s largest economy as measured by purchase power parity.7

It appears, then, that art market globalization—including an expanded palette of sales in Hong Kong by the Big Three auction houses (Sotheby’s, Christie’s, and Phillips) and Western collaborations with mainland Chinese auction houses8—correlates negatively with the market for homegrown Asian artists, perhaps because more Western art is being proffered to Asian buyers.

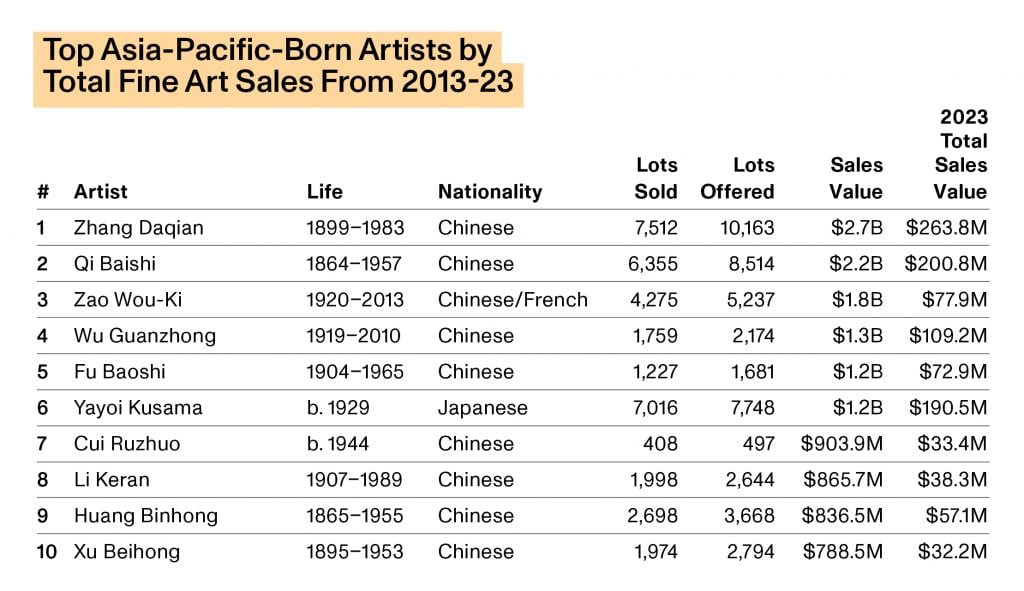

Work by Asia-Pacific-born artists in the Impressionist and Modern category has generated more money at auction than that in any other genre; its annual sales topped $2 billion thrice in the past decade.9 Those peaks were surpassed only by sales of work by European-born artists in the Impressionist and Modern category. Two Chinese painters born in the late 19th century and of note in this market are Zhang Daqian and Qi Baishi.

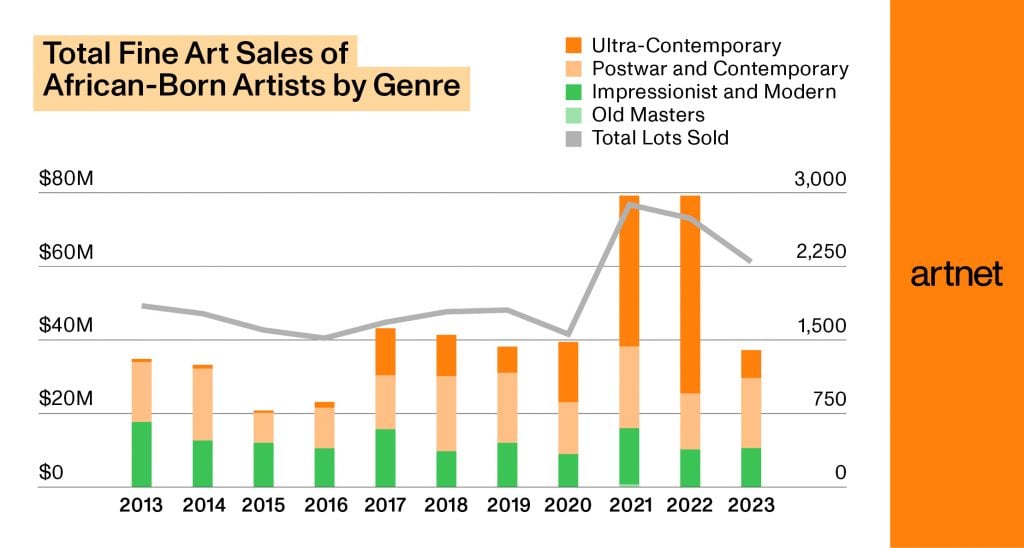

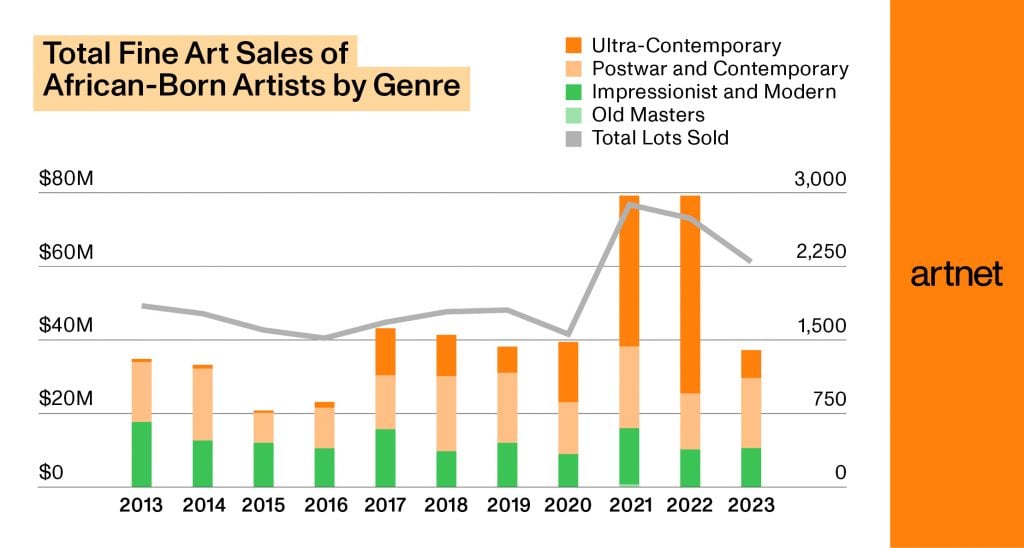

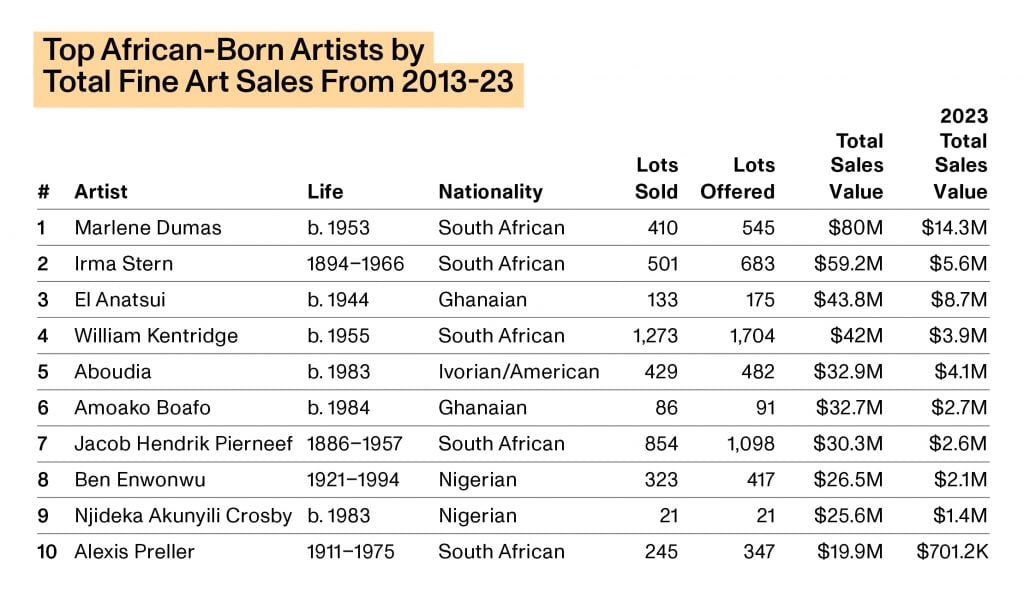

Africa

Sales of work by African-born artists are relatively small in dollar value and experience more volatility than those of any other region. Total sales of work by African-born artists were, for example, about 2.3 percent of North American-born artists’ total sales in 2023. The region’s best year, 2021, saw $101.3 million worth of work by African-born artists sold. Between 2013 and 2023, total sales increased by 46 percent.

Source: Artnet Price Database and Artnet Analytics.

The spike in sales is underpinned by a surge in the Ultra-Contemporary category for African-born artists that began in 2021, with myriad forces propelling the segment’s explosive growth.10 First, buyers stuck at home due to pandemic restrictions were transacting online more frequently,and auction houses made it easier to do so.11 Ultra-Contemporary works in particular sold quickly, likely due to a combination of price point and appeal to a younger collector audience that was more comfortable buying art online. The number of Ultra-Contemporary lots sold globally more than doubled between 2019 and 2022.12

Source: Artnet Price Database and Artnet Analytics.

Collectors were also trying to diversify their holdings in light of broader social movements such as Black Lives Matter. (The shift followed years of work by curators like Okwui Enwezor, who sought to broaden the Western canon of art history to include artists from Africa and the Global South through exhibitions he curated, such as the 2015 Venice Biennale.13) Meanwhile, figuration, a style popular among Ultra-Contemporary African-born artists, also became especially favored among collectors.14

This segment of the market has seen dramatic swings in recent years. In 2021, sales of Ultra-Contemporary works by African-born artists jumped to $40.6 million from $16.2 million year over year. However, as some of the speculative furor began to fade, the total plummeted in 2023, falling to $17.9 million from $52.1 million the year prior. (The total sales of work by African-born artists were boosted in 2023 by the record $10.7 million price achieved by Julie Mehretu’s Walkers With the Dawn and Morning (2008). However, because the artist was born in 1970, we categorize her work as Contemporary, not Ultra-Contemporary.15)

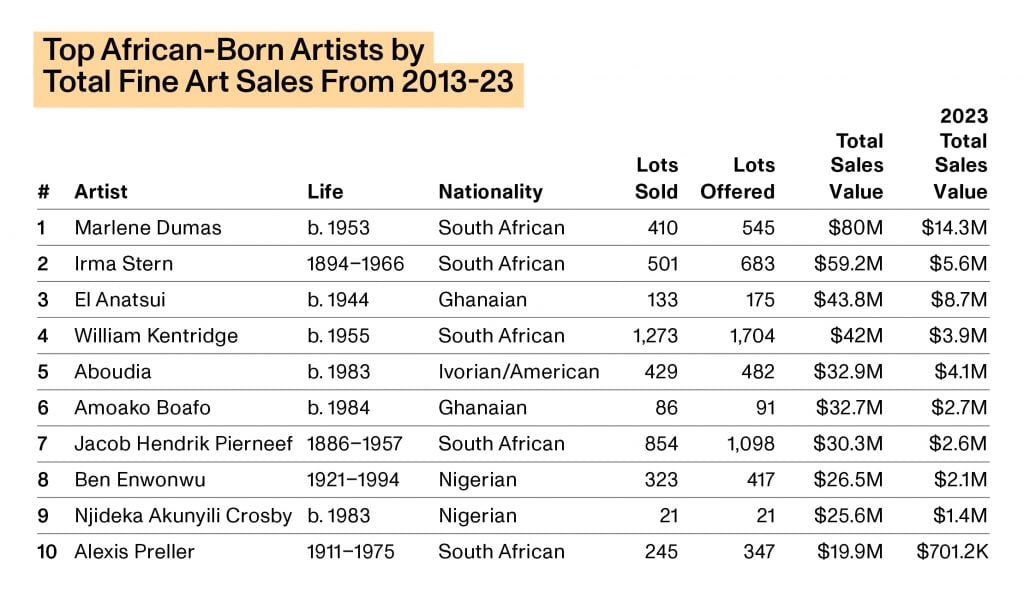

By comparison, Latin American-born artists saw no such surge in Ultra- Contemporary sales, and Middle Eastern-born artists observed a less significant rise in Ultra-Contemporary but no drop-off (see below). Africa is also the only region where Ultra-Contemporary—usually the smallest genre by sales total—ever surpassed all other genres during the decade under review. The African-born Ultra-Contemporary artists undergirding the surge include Amoako Boafo and Njideka Akunyili Crosby, while the sales volume for African-born artists overall is buoyed by the work of Marlene Dumas, Irma Stern, El Anatsui, and William Kentridge.

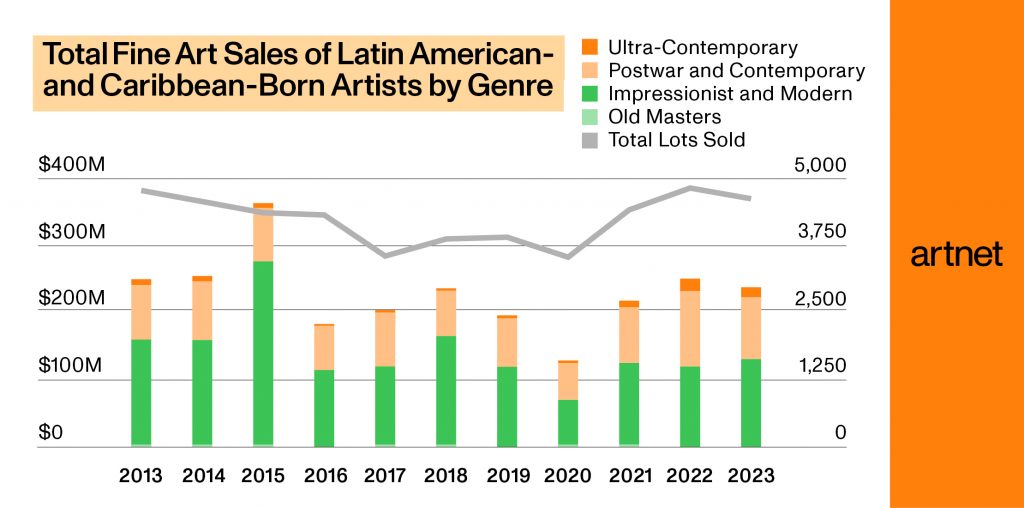

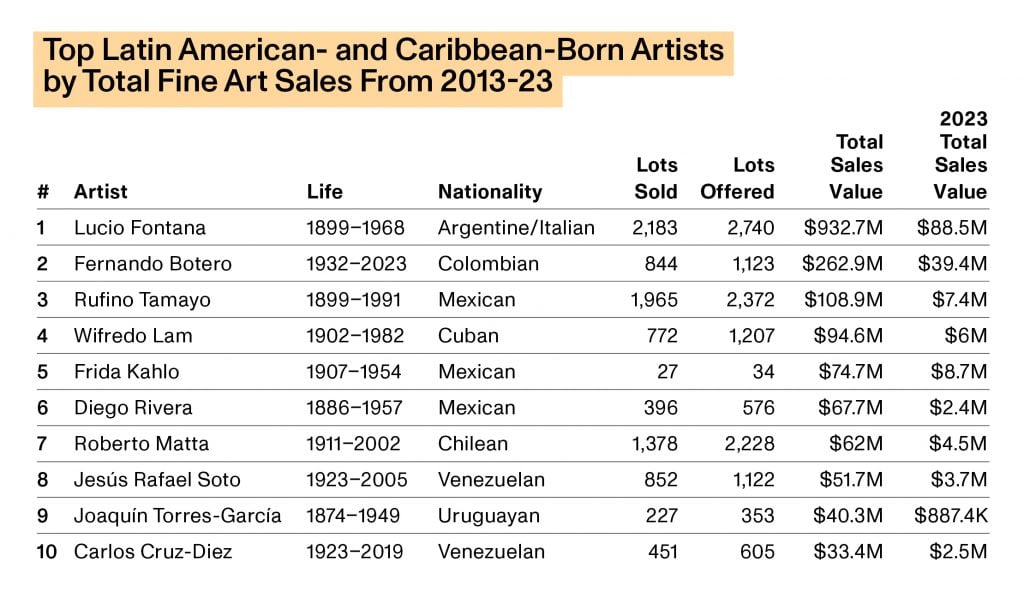

Latin America and the Caribbean

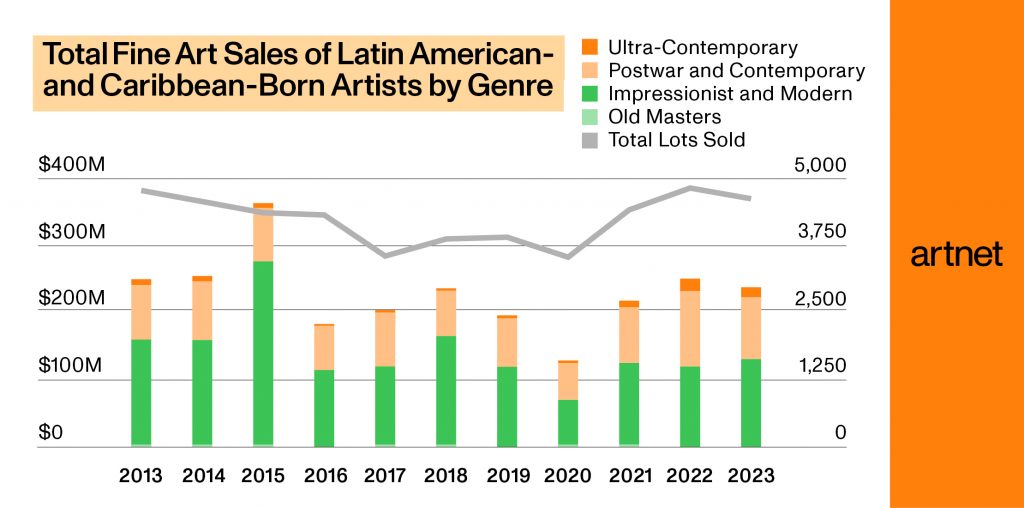

Both the total sales of work by Latin American- and Caribbean-born artists and the number of lots sold have remained essentially even over the past decade, save for the exceptional year of 2015, when sales volume for the region shot up to $388 million. The other years, excluding 2020, all landed in the $200 million-to-$280 million range.

Source: Artnet Price Database and Artnet Analytics.

Source: Artnet Price Database and Artnet Analytics.

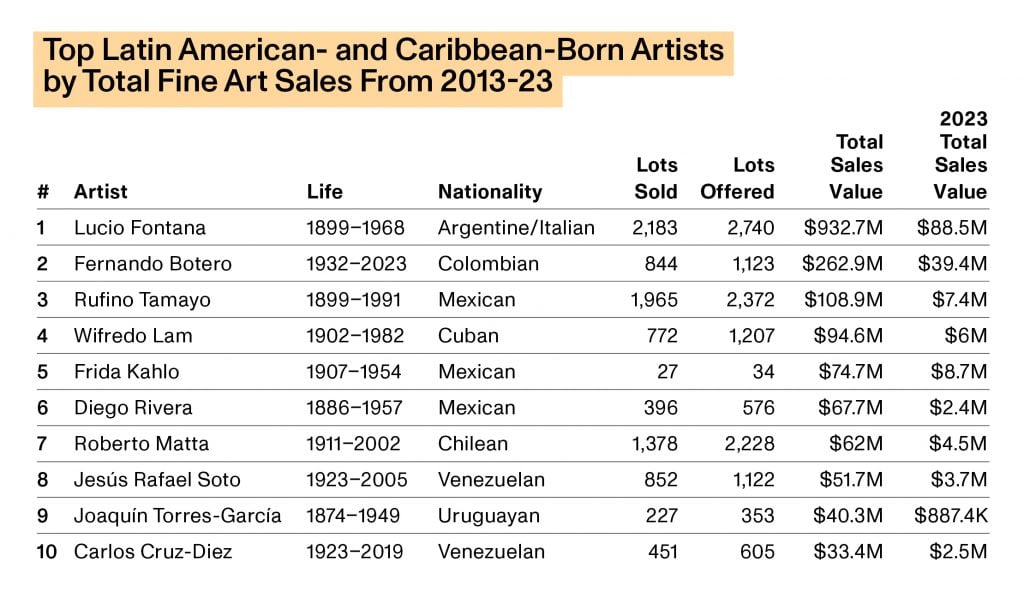

The outlier year of 2015 is partially explained by the stellar market for the Argentine-Italian painter Lucio Fontana at the time.16 Two of his priciest sales ever—including his artist record of $29 million for Concetto spaziale, La fine di Dio (1964)—sold at auction that year.

Notably, Sotheby’s announced plans to fold its specialized Latin American sales into its global fine art sales in 2017 in an effort to stimulate the market and see if placing the work of Latin American- and Caribbean-born artists alongside European-born artists would have a positive impact on the former.17 But while the average price of work by Latin American- and Caribbean-born artists at auction climbed above $50,000 in 2017 and 2018, it failed to do so again in the following years. (That held true even in 2021,when the Latin American art market was still rebounding from the pandemic shutdowns. Despite the fact that a painting by Frida Kahlo sold for a record $34.9 million, the average price for a work by a Latin American- and Caribbean-born artist was $42,313.)

The biggest chunk of the market for work by Latin American- and Caribbean- born artists by genre is Impressionist and Modern; it is also the most volatile. In 2015, the genre accounted for $273.3 million in sales. In 2016, its worst year excluding 2020, the genre generated a mere $108 million. The artists propelling the genre include Lucio Fontana as well as Fernando Botero, Rufino Tamayo, Wifredo Lam, and Frida Kahlo.

Middle East

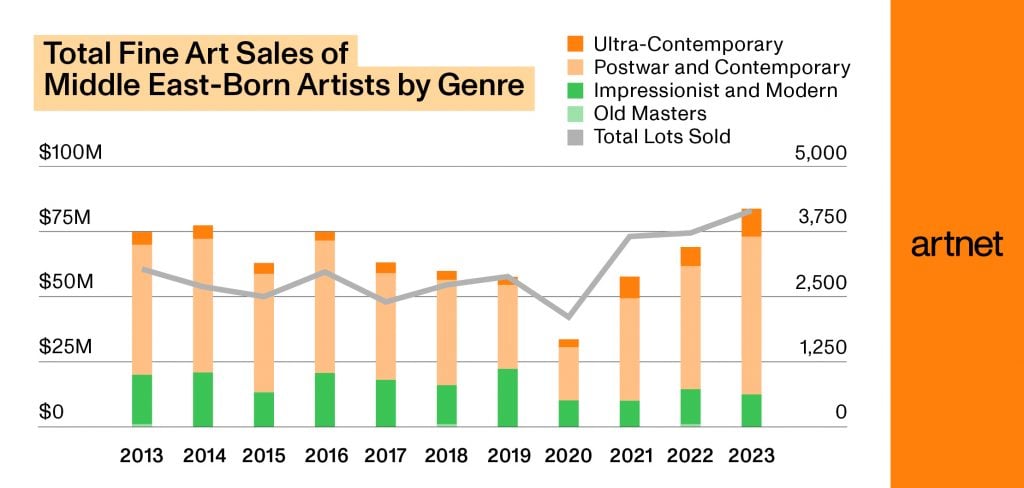

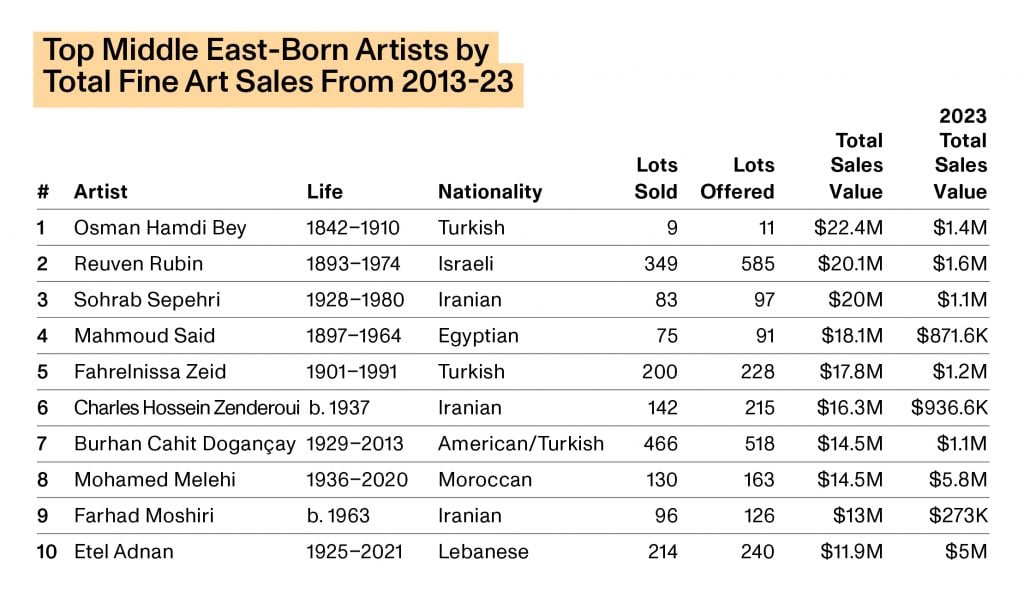

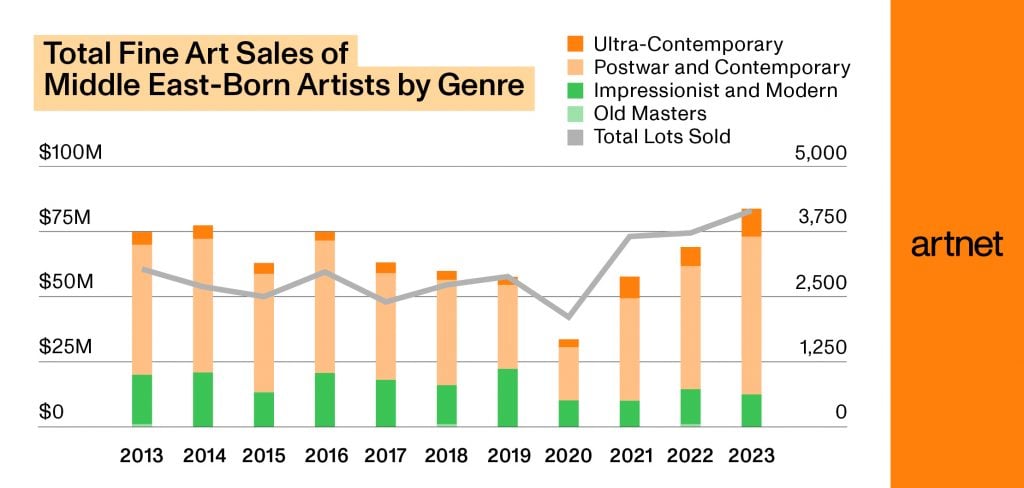

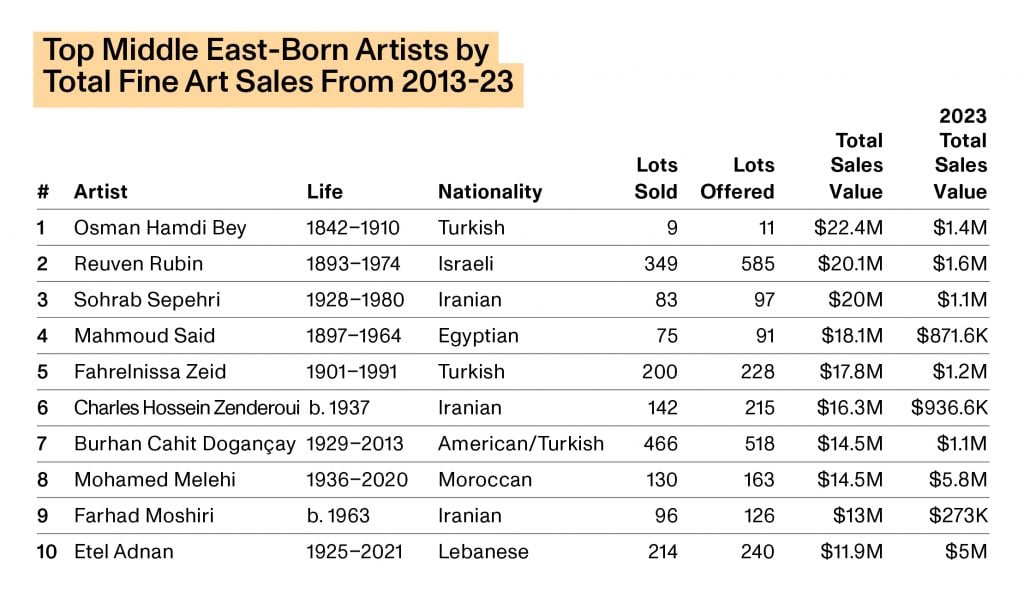

Sales of work by Middle East-born artists were relatively steady over the period, while the number of lots sold crept up. Excluding 2020, total annual sales ranged from $67 million to $101 million, with the latter achieved in 2013, making it the smallest region we examined by sales value after Africa.

However, while the global art market surged in 2017 and 2018, Middle East-born artists saw no such bump. Sales of work by artists born in other regions all ticked higher in those years.

The Postwar and Contemporary and Impressionist and Modern genres commanded the bulk of the market, with Postwar and Contemporary enjoying a hefty lead over its elder in all years during the sample period except for 2019, when the gap narrowed. In 2023, sales in the Ultra-Contemporary genre outperformed the low estimate by 79 percent, the largest delta between expectations and performance in the region that year.18

Source: Artnet Price Database and Artnet Analytics.

Source: Artnet Price Database and Artnet Analytics.

The previous decade saw another “boom” in demand for Postwar and Contemporary art by Middle East-born artists driven by social upheaval, as the market for Arab art burgeoned before cresting in 2011 during the Arab Spring.19 Recently, the volume of Ultra-Contemporary works by Middle East-born artists has begun to ascend. The quite modest but growing segment accounted for $8.2 million in sales in 2021 and rose to $10.2 million by 2023. Notably, Middle East-born artists were the only regional group that saw Ultra-Contemporary sales increase in 2023. This upward trajectory may be due in part to the introduction of the Iraqi-born artist Mohammed Sami to the auction market; his work generated $3.1 million in 2023.20

Part Two: A Global Look Ahead

Hardly a day passes without an announcement of a new museum, cultural district, biennial, or auction sale. Below, we examine what we believe to be the most consequential developments coming up in 2024, from regionally focused art fairs to major museum openings. We focused our survey on the same regions for which we examined performance of artists at auction. What results is a global look ahead, broken down by region and category.

North America

Museum Openings and Expansions

- New York: The Grey Art Gallery, New York University’s art museum, will move out of its longtime home and reopen in a purpose-designed, expanded space at 18 Cooper Square on March 2.21

- Alabama: The Freedom Monument Sculpture Park will open on the 17- acre campus of the Legacy Museum and the National Memorial for Peace and Justice in Montgomery, Alabama, in March. The project involves major works and new commissions by artists including Wangechi Mutu, Kehinde Wiley, and Vinnie Bagwell alongside historical artifacts like original dwellings collected from Alabama plantations.22

- Pennsylvania: Penn State will open its new Palmer Museum of Art building on June 1. The 73,000-square-foot facility in University Park, Pennsylvania, includes 20 galleries, education and event spaces, and outdoor terraces.23

- New York: The Frick Collection, the jewel-box New York museum that houses the collection of Henry Clay Frick, will return to its historic home on Fifth Avenue after almost two years and $290 million worth of renovations in late 2024. The Breuer building, which the Frick occupied during construction, will become the new headquarters of Sotheby’s auction house in 2025.24

Key Biennials and Exhibitions

- Harlem Renaissance: One of the most anticipated exhibitions of the winter season is “The Harlem Renaissance and Transatlantic Modernism” at the Metropolitan Museum of Art in New York (February 25–July 28). It marks the city’s first major survey of the Harlem Renaissance since 1987, according to the museum.25

- Female Artists in the Spotlight: A critical mass of shows seeks to reexamine the legacies of important female artists. These include “Janet Sobel: All-Over” (February 23–August 11) at the Menil Collection in Houston; “Christina Ramberg: A Retrospective” (April 20–August 11) at the Art Institute of Chicago; “Käthe Kollwitz” at the Museum of Modern Art in New York (March 31–July 20); and “Mary Cassatt at Work” at the Philadelphia Museum of Art (May 18–September 8).26

- PST in LA: In September, the greater Los Angeles area will host PST ART, the sprawling Getty-sponsored bonanza of themed exhibitions. This year’s organizing principle is art and science, with related shows at more than 60 institutions.27

Art Market Developments

- Art Fairs: All eyes are likely to be on Expo Chicago and the Armory Show. The two fairs were acquired by the London-based art fair conglomerate Frieze in 2023, and experts have wondered how the new ownership will affect the Midwestern fair (April 11–14) and the New York event (September 5–8), especially considering that Frieze operates its own branded fair in the city (Frieze New York, May 1–5).28 There has been speculation as to whether Frieze might merge the two New York fairs, or adjust the dates so the Armory Show does not clash with Frieze Seoul. But at the time of the sale last fall, Frieze maintained that both the Armory Show and Expo Chicago would retain their management structures and staff.29

- Art Fairs: Atlanta, Georgia, an emerging art hub, will hold its first international art fair this fall at the entertainment venue Pullman Yards (October 3–6).30

- Galleries: Tribeca continues to attract high-profile galleries, emerging as a commercial hub to rival Chelsea. Among the galleries opening storefronts in the neighborhood in 2024 are Jack Shainman, Marian Goodman, and Blum.31

- Auctions: Chicago’s Hindman auction house announced plans to merge with Freeman’s, the Philadelphia-based firm, becoming the largest mid-tier auction house focusing on American art. The newly named Freeman’s | Hindman opened a New York office in January.32

Europe

Museum Openings and Expansions

- Scotland: The Perth Museum, converted by Dutch architects Mecanoo, will open inside the Scottish city’s former city hall in March.33

- Norway: Kunstsilo, a former grain silo in Kristiansand, a small city in the south of Norway, will open as an art museum on May 11. The $66 million, 35,000-square-foot facility will show Nordic art from the collections of the local government and hedge fund manager Nicolai Tangen.34

- France: Former commodities trader Christian Levett closed his antiquities museum in the south of France, the Mougins Museum of Classical Art, in 2023 and plans to reopen it in June under a new name, Femmes Artistes du Musée de Mougins, with a new focus—art by women.35

- Germany: The manufacturing magnate Reinhard Ernst will open a museum dedicated to his collection of abstract paintings and sculptures in Wiesbaden, Germany, at an unspecified date this year.36

Key Biennials and Exhibitions

- Caspar David Friedrich: Germany is celebrating the painter’s 250th birthday with exhibitions in three different cities: “Caspar David Friedrich: Art for a New Era” at the Kunsthalle Hamburg (through April 1); “Caspar David Friedrich: Infinite Landscapes” at the Alte Nationalgalerie, Berlin, (April 19–August 4), and “Caspar David Friedrich: Where It All Started” at the Albertinum and Kupferstich-Kabinett, Dresden, August 24–January 5, 2025).37

- Michelangelo: London is getting a Michelangelo doubleheader. The British Museum is presenting “Michelangelo: the Last Decades,” which focuses on the artist’s final 30 years (May 2–July 28), while the Royal Academy of Arts is mounting “Michelangelo, Leonardo, Raphael,” which explores the Renaissance artists’ influence on one another (November 9–February 16, 2025).38

- The Venice Biennale: The world’s attention will be on Italy for the Venice Biennale as well as its many high-profile collateral exhibitions and events (April 20–November 24). The Golden Lions for Lifetime Achievement will be awarded to Italian-born Brazilian artist Anna Maria Maiolino and the Paris- based Turkish artist Nil Yalter.39

- Other Key Biennials: Other notable biennials on the European schedule include Manifesta 15, the roving art show that will touch down in Barcelona, Spain (September 8–November 24), and Malta’s first ever biennial (March 11–end of May).40

Art Market Developments

- Art Fairs: Paris+, Art Basel’s newest fair, will make its much-anticipated move to the Grand Palais for its third edition after the monumental glass structure reopens following a four-year renovation. The new space will offer exhibitors larger booths and accommodate 25 percent more galleries (October 18–20).41

- Galleries: American galleries are continuing to open in Paris. Those on deck for this year include the design specialist Friedman Benda and the Contemporary art space Brigitte Mulholland.42

- Auctions: Artcurial, the French auction house, is planning to develop and expand in Switzerland over the next two years following its 2023 acquisition of the Swiss auctioneer Beurret Bailly Widmer Auktionen, which is now Artcurial Beurret Bailly Widmer.43

- VAT Rates: Art dealers in the European Union are petitioning to lower the value-added tax (VAT) rates for art. Before a new E.U.-wide VAT directive goes into effect at the end of 2024, national governments have the opportunity to reconsider the VAT on art. The change is likely to have the largest impact on art dealers in Germany, where the VAT is currently highest, and France, where the closure of a loophole under the new E.U.-wide system may raise the VAT on art substantially.44

Asia-Pacific

Museum Openings and Expansions

- Japan: TeamLab, the wildly popular Japanese collective specializing in immersive digital art, opened a new permanent space in Azabudai, Tokyo, on February 9.45

- Bali: The five-star resort Ayana Bali is launching its own cultural center in the coastal town of Jimbaran. The institution, which is scheduled to open in early 2024 by appointment, is dedicated to Balinese history and culture.46

- Uzbekistan: As part of a broader push to fashion itself as an art destination, Uzbekistan is restoring the Center for Contemporary Art in Tashkent. The institution, housed in a former diesel station, will reopen sometime this year after a redesign by the firm Studio KO.47

Key Biennials and Exhibitions

- The Biennale of Sydney: The Australian biennial returns for its 50th •birthday edition, led by Cosmin Costinaș and Inti Guerrero (March 9–June 10). “Ten Thousand Suns” will be on view at venues across the city, from the newly reopened Art Gallery of New South Wales to the recently restored White Bay Power Station.48

- Other Key Biennials: Other important biennials in the Asia-Pacific region include the 8th Yokohama Triennale in Japan (March 15–June 9) and the 15th Gwangju Biennale in South Korea (September 7–December 1).

- M. Pei: The first major retrospective of the celebrated late architect I.M. Pei will open at the M+ Museum in Hong Kong on June 29. The exhibition will present a variety of archival documentation, photographs, and models to the public for the first time.49

- Versailles in Beijing: In a high-profile collaboration delayed by the pandemic, the French and Chinese governments are teaming up to bring an exhibition on the relationship between their two nations in the 18th century to the Forbidden City’s Palace Museum (April 1–June 30). The show is an expanded version of one held at the Palace of Versailles in 2014 to mark the 50th anniversary of diplomatic relations between the two countries.50

Art Market Developments

- Art Fairs: The African art fair 1-54 will make its Asia debut with a selling exhibition at Christie’s scheduled to run alongside Art Basel Hong Kong from March 26 through 30.51

- Galleries: Betting on the growing Japanese art market, Pace is scheduled to open a new gallery in the Azabudai Hills development in central Tokyo in spring 2024.52

- Auctions: Christie’s and Sotheby’s are putting down roots in Hong Kong. After almost two decades of holding sales twice a year in rented spaces, Christie’s and Sotheby’s are opening permanent headquarters in the city, with plans to conduct auctions year-round, as they do in London and New York.53

- Tariffs: Trade of art and antiques between the United States and China has reportedly been dampened by tariffs in both directions. The U.S. implemented tariffs on Chinese art, among other goods from the country, in 2018; China enacted reciprocal tariffs the following year.54

Africa

Museum Openings and Expansions

- Nigeria: The Edo Museum of West African Art in Benin City, Nigeria, is due to open in stages beginning this year. The exact dates have not been announced. Designed by the British architect David Adjaye, the space will house West African art and art from the diaspora.55

Key Biennials and Exhibitions

- The Lagos Biennial: The Lagos Biennial was held at the historic Tafawa Balewa Square, the site of Nigeria’s independence celebration, from February 3 through 10.56

- Africa in Venice: Three African countries—Ethiopia, Tanzania, and Benin— will present pavilions at the Venice Biennale for the first time this spring. Ethiopia will show paintings by Tesfaye Urgessa. Tanzania will present a group exhibition of work by Happy Robert, Naby, Haji Chilonga, and Lute Mwakisopile. Benin will feature Ishola Akpo, Moufouli Bello, Romuald Hazoumè, and Chloé Quenum.57

- Artist-Led Spaces: Dynamic programming continues at exhibition spaces and residencies established in recent years by African artists across the continent, including, among many others, the Savannah Centre for Contemporary Art (SCCA) in Tamale, Ghana, founded by Ibrahim Mahama; Guest Artists Space Foundation (G.A.S.) in Lagos, Nigeria, founded by Yinka Shonibare; Black Rock Senegal in Dakar, Senegal, founded by Kehinde Wiley; and dot.ateliers in Accra, Ghana, founded by Amoako Boafo.58

- Black Figuration: This spring, Black figuration is back in the spotlight. The exhibition “When We See Us: A Century of Black Figuration in Painting,” which examines the style over the past 100 years with a focus on African artists and artists of the African diaspora, travels to the Kunstmuseum Basel from Zeitz MOCAA in Cape Town (May 25–October 27).59

Art Market Developments

- Art Fairs: Also Known As Africa (AKAA), an art fair specializing in African art and design, will hold its first event in the United States, at the Beehive in Los Angeles (May 2–May 12).60

- Auctions: Work by the 28 finalists for the Norval Sovereign African Art Prize, which benefits Contemporary artists working in Africa and the African diaspora, will be on view at the Norval Foundation in Cape Town, South Africa, through May 15. The majority of the works from the show were auctioned off at Sotheby’s in February to raise funds for the artists and the Norval Foundation’s learning center.61

- Outlook: The world’s most rapidly growing population of millionaires is in Africa, where the number is estimated to double to 768,000 by 2027.62

Latin America and the Caribbean

Museum Openings and Expansions

- Brazil: In late 2024, Brazil’s most prominent museum—the Museu de Arte de São Paulo Assis Chateaubriand (MASP)—will open an expansion that will increase its size by 66 percent. A new tower will be connected to the original Lina Bo Bardi-designed building via an underground tunnel.63 The exact opening date has not been confirmed.

- Brazil: Inhotim Institute, the sprawling center for art, architecture, and nature in Brumadinho, Minas Gerais, will open its first on-site hotel in September. The 45-bungalow development will be supplemented by a separate 150-room hotel in 2029.64

Key Biennials and Exhibitions

- Latin America in Venice: The influence of Latin American art will extend far beyond the region’s borders in 2024, as the Venice Biennale hosts its first Latin American artistic director. On April 20, Adriano Pedrosa, the director of MASP, will open “Foreigners Everywhere,” his central exhibition, which will focus on queer, outsider, Indigenous, and folk artists.65

- Mercosur Biennial: The 14th edition of the Mercosur Biennial will open in Porto Alegre, Brazil (September 13–November 17). The exhibition, which will spread across several institutions in the city, is organized by Raphael Fonseca, the curator of Modern and Contemporary Latin American art at the Denver Art Museum.66

- Latin American Design: The Museum of Modern Art in New York will present its first major exhibition on Latin American design. “Crafting Modernity: Design in Latin America, 1940–1980” (March 8–September 22) will examine Modern domestic design from six countries in the Postwar period.67

- Conference: The German Center for Art History, the Max Planck Institute for Art History in Rome, and the Museo de Arte de Lima will organize the 5th Transregional Academy on Art and Culture in Latin America, a gathering of scholars coming together to discuss the latest in Latin American art history, at the Lima art museum (May 4–May 12).

Art Market Developments

- Art Fairs: April is a big month for Latin American art fairs in 2024: SP-Arte will return to São Paulo’s Oscar Niemeyer-designed Bienal Pavilion (April 3–7), and Pinta PArC will operate in Lima’s Casa Prado (April 17–21).68

- Art Fairs: A new art fair dedicated to Latin American art is popping up in Paris this fall. MIRA will feature around 20 exhibitors at the Maison de l’Amérique Latine (September 18–22).69

- Galleries: Following the news of Mariane Ibrahim’s opening in Mexico City last year, another international dealer, König Galerie, with headquarters in Germany, opened an outpost in the city in February.70

- Auctions: Christie’s and Sotheby’s take different approaches to the sale of Latin American art. Sotheby’s announced plans to dissolve standalone sales for the category in 2017, while Christie’s retains specialized live and online sales of Latin American art, scheduled to be held in March in New York.71

Middle East

Museum Openings and Expansions

- United Arab Emirates: The first Hindu temple in Abu Dhabi, the capital of the United Arab Emirates, opened in February. Construction cost an estimated $84 million.72

- United Arab Emirates: Dubai will host the 2024 World Cities Culture Summit, the first time the annual gathering of members of the World Cities Culture Forum will be held in the Middle East (October 30–November 1). The event is dedicated to sharing best practices in cultural policy.73

- Egypt: After multiple years of delays, the Grand Egyptian Museum, which overlooks the pyramids of Giza, is scheduled to open in May. The $1 billion institution is home to more than 100,000 objects, including treasures from Tutankhamun’s tomb.74

Key Biennials and Exhibitions

- Saudi Arabia Invests: Saudi Arabia is investing deeply in cultural events and exhibitions, including the 2nd Diriyah Contemporary Art Biennale, held in Riyadh and organized by the German curator Ute Meta Bauer (February 20–May 24).75

- Desert X AlUla: The third edition of the outdoor sculpture biennial returns to the ancient Saudi oasis city with a wide variety of installations (February 9–March 23). The project aims to pave the way for Wadi AlFann, a 25-square-mile site that will host site-specific, permanent land art in 2026.76

- Istanbul Biennial: The Istanbul Biennial, which was originally scheduled to take place in September 2024, was postponed until 2025. Its curator, Iwona Blazwick, stepped down amid backlash over her appointment, which went against the recommendation of the biennial’s advisory board.77

Art Market Developments

- Art Fairs: The UAE has heartily embraced digital art, and Art Dubai will offer an expanded section dedicated to the category, including augmented reality, robotic art, and NFTs from 20 international galleries (March 1–3).78

- Auctions: After taking a break for the pandemic, Christie’s resumed its live evening sales of Middle Eastern Modern and Contemporary art in London last fall and delivered solid results.79 The sale is due to return this November.

- Outlook: The Middle Eastern country with the highest number of ultra- high-net-worth individuals (UHNWIs), according to a report from Knight Frank, is Saudi Arabia. The number of people in the country with a net worth of $30 million or more rose by 17 percent in 2022 and is projected to rise an additional 10.4 percent this year.80

Conclusion

The art world and market are undeniably global. Asian buyers regularly acquire work by international and Western artists from regional auction houses, art fairs bring galleries from dozens of countries together under one roof, and artists are collected and exhibited by museums far beyond their region of origin. (Consider that the Bass Museum is presenting an exhibition of work by the Beirut-born artist Etel Adnan through March 2024, and American artists such as Amy Sherald and Jacob Lawrence are included in “When We See Us: A Century of Black Figuration in Painting,” which travels to the Kunstmuseum Basel from Zeitz MOCAA in spring 2024.) Nevertheless, clear regional trajectories and trends remain. The most heavily publicized and anticipated exhibitions in Europe, for example, are more focused on Old Master artists than in North America, where more emphasis is placed on Postwar and Contemporary art. The market for Ultra-Contemporary Middle East-born artists, though small, is the only one that grew in 2023 amid a broader contraction in the Ultra-Contemporary market. The market for the work of African-born artists, meanwhile, has been more volatile than those for artists from most other regions. Taken together, these facts can help us better understand how artists born into different regional contexts, with a range of cultural and market infrastructures, take distinct paths to the global art world.

Endnotes

- Velthuis and S. Baia Curioni, eds: Cosmopolitan Canvases. The Globalization of Markets for Contemporary Art (Oxford, 2015).

- Methodology: All price data is drawn from the Artnet Price Database and includes the buyer’s premium unless otherwise expressly noted. The Database includes only lots with a minimum estimate of $500 (for original paintings, sculptures, works on paper, photographs, prints and multiples, and installations with an identified artist).

- https://www.nytimes.com/2015/07/21/business/international/impressionist-and-modern-art-lifts-christies-first-half.html

- https://www.reuters.com/article/us-art-auction/christies-ny-has-its-best-impressionist-modern-sale-since-2010-idUSKBN0DN03F20140507/

- https://www.cnn.com/style/article/paul-allen-collection-christies-auction-record/index.html

- Barboza, David. “At Christie’s auction, new records for Chinese art.” The New York Times. November 29, 2006.

- “China Set to Overtake U.S. as Biggest Economy in PPP Measure.” Bloomberg News. April 30, 2014.

- Reyburn, Scott and Balfour, Frederik. “Sotheby’s Agrees Joint Venture for Auction House in China.” Bloomberg News. September 21, 2012.

- This term is typically applied to Western, not Asian, art, but we are using it here for the sake of comparison and consistency.

- https://news.artnet.com/market/Ultra-Contemporary-african-art-detective-2060089

- https://news.artnet.com/market/intelligence-report-art-dealers-1956758

- Artnet Price Database and Artnet Analytics

- https://www.artnews.com/list/art-news/artists/most-important-shows-okwui-enwezor-1234588006/johannesburg-biennale-1997-okwui-enwezor/

- https://ocula.com/magazine/features/a-century-of-black-figuration/

- https://news.artnet.com/market/auction-records-julie-mehretu-jenny-saville-2398187

- https://news.artnet.com/market/top-artists-at-auction-2015-434054

- https://www.theartnewspaper.com/2018/11/15/latin-american-art-gets-a-boost-on-the-auction-block

- Artnet Price Database and Artnet Analytics

- https://www.artforum.com/features/trading-places-the-new-middle-east-market-187887/

- Artnet Price Database and Artnet Analytics

- https://greyartgallery.nyu.edu/wp-content/uploads/2023/09/Grey_announce_2023_09_15-FINAL-.pdf

- Sheets, Hilarie. “Alabama Sculpture Park Aims to Look at Slavery Without Flinching.” The New York Times, October 11, 2023.

- https://www.psu.edu/news/palmer-museum-art/story/palmer-museum-art-open-new-building-june-1-2024/

- Pogrebin, Robin. “Whitney Museum Sells Breuer Building to Sotheby’s for About $100 Million.” The New York Times, June 1, 2023.

- Small, Zachary. “The Met Announces Harlem Renaissance Exhibition for 2024.” The New York Times, August 22, 2023.

- https://news.artnet.com/art-world/museum-shows-2024-2406702

- https://www.getty.edu/projects/pacific-standard-time-2024/

- https://www.theartnewspaper.com/2023/12/21/a-new-home-for-paris-and-a-bright-future-for-expo-chicago-art-fairs-in-2024

- https://www.artnews.com/art-news/news/questions-are-swirling-around-the-armory-show-opening-after-frieze-acquisition-1234678928/

- https://theatlantaartfair.com/

- https://www.artnews.com/art-news/news/as-mid-size-galleries-close-and-blue-chips-open-tribeca-reaches-its-final-state-as-an-art-destination-chelsea-1234683941/

- https://www.artnews.com/art-news/news/freemans-hindman-merger-1234692344/

- https://www.museumsassociation.org/museums-journal/news/2023/10/perth-museum-reveals-opening-date/

- https://www.theartnewspaper.com/2023/12/21/the-big-museum-openings-and-expansions-of-2024

- https://www.theartnewspaper.com/2023/08/16/first-museum-dedicated-to-women-artists-to-open-in-the-south-of-france

- https://www.theartnewspaper.com/2023/12/21/the-big-museum-openings-and-expansions-of-2024

- https://www.theartnewspaper.com/2023/12/21/the-must-see-exhibitions-in-2024-from-two-michelangelo-shows-in-london-to-the-mets-most-expensive-painting

- https://www.theartnewspaper.com/2023/12/21/the-must-see-exhibitions-in-2024-from-two-michelangelo-shows-in-london-to-the-mets-most-expensive-painting

- https://www.labiennale.org/en/news/anna-maria-maiolino-and-nil-yalter-golden-lions-lifetime-achievement-biennale-arte-2024

- https://www.theguardian.com/travel/2024/jan/02/from-arctic-art-to-the-disgusting-food-museum-europes-top-10-culture-destinations-for-2024

- https://parisplus.artbasel.com/

- https://www.wallpaper.com/design-interiors/friedman-benda-gallery-opening-marais-paris

- https://www.artcurial.com/en/artcurial-switzerland

- https://www.theartnewspaper.com/2023/07/26/dealers-lobby-states-to-slash-vat-rates-on-eu-art-sales

- https://www.teamlab.art/e/borderless-azabudai/

- https://www.nowbali.co.id/ayana-unveils-saka-museum-a-bali-focused-cultural-centre/

- https://www.theartnewspaper.com/2023/10/20/uzbekistan-culture-push-contemporary-art-museum-tashkent

- https://www.timeout.com/sydney/news/the-biennale-of-sydney-2024-everything-we-know-072523

- https://www.mplus.org.hk/en/exhibitions/i-m-pei-life-is-architecture/

- https://en.chateauversailles.fr/press/expositions-hors-les-murs/palace-versailles-heads-china-exhibition-forbidden-city-2024#:~:text=The%20Palace%20of%20Versailles%20is,April%20to%2030%20June%202024

- https://www.theartnewspaper.com/2023/10/20/1-54-contemporary-african-art-fair-expands-its-reach-into-hong-kong

- https://www.pacegallery.com/journal/pace-tokyo-spring-2024/

- Tsui, Enid. “How auction houses Christie’s, Sotheby’s and Phillips in Hong Kong are expanding, and what it means for buyers.” South China Morning Post, March 18, 2023.

- https://www.theartnewspaper.com/2023/12/26/tariffs-on-art-are-worsening-frayed-china-us-relations-deepening-ongoing-trade-war

- Emelife, Aindrea. “West Africa’s art scene: uncovering a long legacy of creativity.” Financial Times. March 11 2023.

- https://lagos-biennial.org/

- https://artreview.com/2024-venice-biennale-pavilions-your-go-to-list/

- https://news.artnet.com/art-world/artist-led-spaces-are-proliferating-around-the-world-filling-a-gap-caused-by-dwindling-public-funding-and-market-pressures-2232925

- https://kunstmuseumbasel.ch/en/exhibitions/2024/when-we-see-us

- https://www.happening.media/category/magazine/en/news/651fcf3053160d13ef22b485/the-also-known-as-africa-fair-expands-to-los-angeles

- https://www.sothebys.com/en/buy/auction/2024/the-norval-sovereign-african-art-prize-2024-benefit-auction-hosted-by-sothebys

- Walsh, Declan. “The World Is Becoming More African.” The New York Times. October 28, 2023.

- https://www.theartnewspaper.com/2023/12/21/the-big-museum-openings-and-expansions-of-2024

- https://www.theartnewspaper.com/2023/11/24/on-site-hotel-nearing-completion-at-brazils-inhotim-museum-and-botanical-garden

- https://www.apollo-magazine.com/art-market-predictions-2024/

- https://contemporaryand.com/magazines/14th-edition-of-the-mercosur-biennial/

- https://press.moma.org/exhibition/crafting-modernity/#:~:text=On%20view%20from%20March%208,domestic%20design%20in%20Latin%20America

- https://www.theartnewspaper.com/2023/12/21/the-full-list-of-major-art-fairs-in-2024-from-austin-to-zurich

- https://www.theartnewspaper.com/2023/12/15/paris-to-get-new-fair-for-latin-american-art-next-september

- https://news.artnet.com/market/konig-galerie-new-mexico-2417721

- https://issuu.com/christiesstudio/docs/christie_s_latin_american_spring_2023_market_repor

- https://www.cnbctv18.com/photos/travel/culture/13-things-you-must-know-about-the-700-crore-hindu-temple-being-built-in-abu-dhabi-18527561.htm

- https://www.businesswire.com/news/home/20231105788458/en/Dubai-to-Host-2024-World-Cities-Culture-Summit#:~:text=DUBAI%2C%20United%20Arab%20Emirates%2D%2D

- https://www.theartnewspaper.com/2023/12/21/the-big-museum-openings-and-expansions-of-2024

- https://www.theartnewspaper.com/2023/12/21/venice-and-more-the-most-interesting-biennials-to-visit-this-year

- https://desertx.org/learn/news/desert-x-alula-2024

- https://news.artnet.com/art-world/istanbul-biennial-2024-postponed-2420767

- https://www.artdubai.ae/wp-content/uploads/2023/11/AD-2024-Gallery-List-Digital.pdf

- https://www.theartnewspaper.com/2023/12/07/londons-middle-eastern-art-sales-have-defied-tensions

- https://www.arabianbusiness.com/money/wealth/saudi-arabia-to-lead-middle-east-in-ultra-high-net-worth-individual-growth

Morgan Stanley Disclosures: This material was published in February 2024 and has been prepared for informational purposes only. Charts and graphs were published by Artnet News in the 2024 Artnet Intelligence Report. The information and data in the material has been obtained from sources outside of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley makes no representations or guarantees as to the accuracy or completeness of the information or data from sources outside of Morgan Stanley.

The information and data provided by the third-party websites or publications are as of the date when they were written and subject to change without notice.

This material may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm has not reviewed the linked site. Equally, except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm takes no responsibility for, and makes no representations or warranties whatsoever as to, the data and information contained therein. Such address or hyperlink (including addresses or hyperlinks to website material of Morgan Stanley Wealth Management) is provided solely for your convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through the material or the website of the firm shall be at your own risk and we shall have no liability arising out of, or in connection with, any such referenced website. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

Artnet Price Database: From Michelangelo drawings to Warhol paintings, Le Corbusier chairs to Banksy prints, there are more than 14 million color-illustrated art auction records dating back to 1985 in the Artnet Price Database. The Artnet Price Database covers more than 1,800 auction houses and 385,000 artists, and every lot is vetted by Artnet’s team of multilingual specialists.

Artnet Disclosures: This Artnet Intelligence Report The Year Ahead 2024 (“the Report”) was published by Artnet Worldwide Corporation (“Artnet”) in February 2024 and has been prepared for informational purposes only. Portions of the information and data in the Report have been obtained from sources outside of Artnet. Artnet makes no representations or guarantees as to the accuracy or completeness of the information or data in the Report, including from the sources outside of Artnet.

This material is not investment advice, nor does it constitute a recommendation, offer or advice regarding the purchase and/or sale of any artwork. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. It is not a recommendation to purchase or sell artwork nor is it to be used to value any artwork. Investors must independently evaluate particular artwork, artwork investments and strategies, and should seek the advice of an appropriate third-party advisor for assistance in that regard as the Report does not provide advice on artwork nor provide tax or legal advice. Tax laws are complex and subject to change. Investors should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts and estate planning, charitable giving, philanthropic planning and other legal matters. The Report does not assist with buying or selling art in any way and merely provides information to parties interested in learning more about the different types of art markets at a high level. Any investor interested in buying or selling art should consult with their own independent art advisor.

This material may contain forward-looking statements and there can be no guarantee that they will come to pass. Past performance is not a guarantee or indicative of future results.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Diversification does not guarantee a profit or protect against loss in a declining financial market.

Morgan Stanley Smith Barney LLC. Member SIPC.

CRC #6307273 02/2024