Analysis

The Venice Biennale Spotlights the Market for Latin American Art

Artists from the region have historically been marginalized. Four case studies highlight some of the area’s intricacies.

Artists from the region have historically been marginalized. Four case studies highlight some of the area’s intricacies.

Artnet News and Morgan Stanley

I. The Big Show

The Venice Biennale is often referred to as “the Olympics of the art world,” and it has been running one year longer than the modern games—since 1895. Every two years, its administrators tap a lucky curator to organize an agenda-setting exhibition in the floating city, while scores of countries curate shows in dedicated national pavilions and other groups present projects all over town. The Biennale shapes the tastes of globetrotting curators, critics, collectors, and dealers, who are on hand during its opening days in April, making deals. (Until 1970, the Biennale had an actual sales office; now business is a bit more discreet.)1

For the Biennale’s first 100 years, only Italian men were asked to organize the big show, but a more diverse cast of luminaries has held the top job since then.2 This year, Adriano Pedrosa, the director of the São Paulo Museum of Art, is in that position—the first South American and the first openly queer individual to do so.3 His show, “Foreigners Everywhere,” is enormous, with more than 330 artists and collectives4 who predominantly hail from the Global South, a contested term that usually encompasses countries in Latin America, the Caribbean, Asia, Africa, and the Pacific region (excluding those that are more developed, like South Korea and Australia).5

II. The State of Play for Latin American Artists

More than 80 artists in “Foreigners Everywhere” have links to Latin America, representing about 24 percent of the show. (In the 2022 Biennale, by contrast, about 11 percent of the artists had Latin American ties.) The show is bringing fresh attention to figures who historically have been marginalized in the mainline art market, and more than 30 percent of the participants have no records in the Artnet Price Database (also referred to throughout as the “Database”).

Per the Database, the current record for a Latin American artwork on the auction block is $34.9 million, for a 1949 painting by the Mexican artist Frida Kahlo that Pedrosa has hung in the Biennale’s Central Pavilion. That sale occurred just three years ago, but its price does not come close to the top of a list of the most expensive works ever sold at auction globally (the number-one slot belongs to Leonardo da Vinci’s $450.3 million Salvator Mundi, ca. 1500).

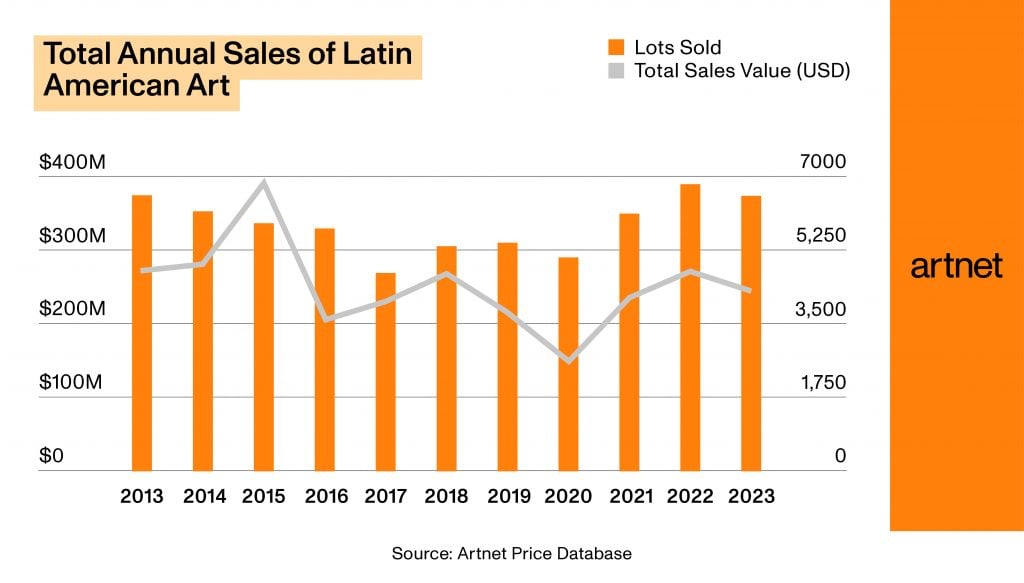

Last year, the total auction volume for Latin American artists was actually lower than it was a decade ago, according to the Artnet Price Database—$245.5 million versus $270 million. That number peaked in 2015, at $388.3 million, then dropped off, and has not broken $267 million since. These results reflect a specialized market that is punctuated by sales of internationally recognized figures.6

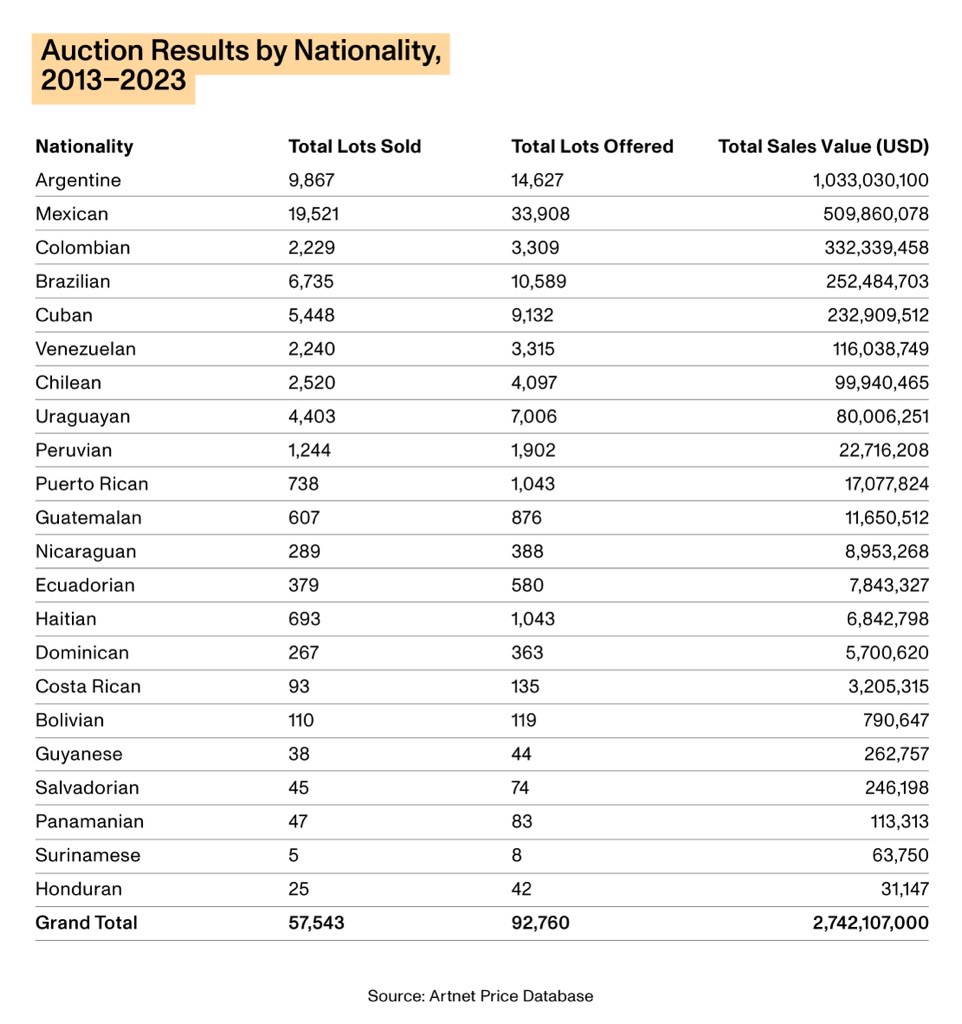

Examining the auction field by nationality in the chart above, Argentinian artists appear to be dominant, with total sales of $1.03 billion between 2013 and 2023, but this comes with an important asterisk: The work of Lucio Fontana, who was born in Argentina, contributed a whopping $932.8 million to the total, but he worked predominantly in Italy. Next, for that 2013–2023 stretch, are artists from Mexico ($509.9 million), Colombia ($332.3 million), and Brazil ($252.4 million), where at least 30 artists in “Foreigners Everywhere” are or were active. (Sixteen have such links with Argentina.)

Interestingly, there is less gender inequality at the upper reaches of the auction market for Latin American artists than there is globally. Looking at total sales in the Database from 2013 through 2023, six of the top 20 performers are women, with Kahlo leading the way at number five. Worldwide, only a single woman makes the cut, with Yayoi Kusama coming in at 16.

To capture some additional intricacies of the market for Latin American art, four case studies follow below on artists with ties to the region—two who are in this year’s Venice Biennale and two who have been in past editions.

Methodology: Morgan Stanley collaborated with Artnet News using the Artnet Price Database to analyze the fine art market for works by artists with Latin American nationalities that were sold at auction from 2013 through 2023, with additional relevant searches going back to 2000. All price data is drawn from the Artnet Price Database and includes the buyer’s premium, unless otherwise expressly noted. The Database includes only lots with a minimum estimate of $500 (for original paintings, sculptures, works on paper, photographs, prints and multiples, and installations with an identified artist). For the purposes of this report, Latin America included the following countries and one territory: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Cuba, Dominican Republic, Ecuador, El Salvador, French Guiana, Guadeloupe, Guatemala, Guyana, Haiti, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Puerto Rico, Suriname, Uruguay, and Venezuela.

For the avoidance of doubt, all sale records come from the Artnet Price Database, as do all other figures cited in this report, unless otherwise noted.

III. Four Case Studies

1. Frida Kahlo (2024 Venice Biennale)

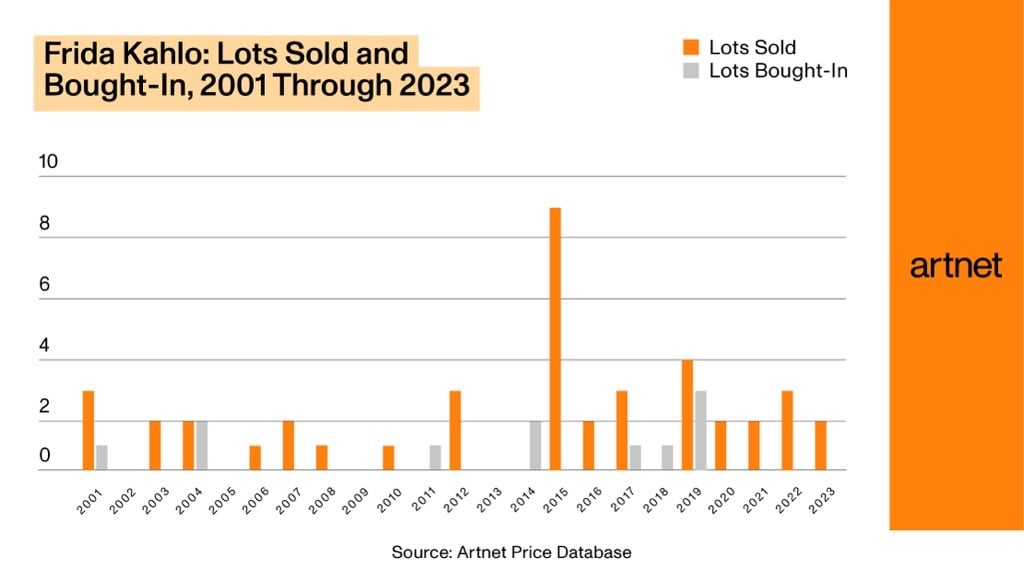

The market for Mexican artist Frida Kahlo, who has achieved near-mythic status since her 1954 death, is marked by an unusual issue. In the mid-1980s, when Mexico’s cultural leaders finally recognized her vast importance, tight export restrictions were put in place. Because Kahlo was also not very prolific, international demand now far outstrips supply. The export rules essentially created two markets—one in Mexico, the other outside of it—and one expert told Artnet in 2015 that a painting that might sell for $500,000 in the country could easily go for twice that outside its borders, if it could get there.7

When major works have become available at New York auctions, they have soared. Kahlo’s current record was set in 2021 at Sotheby’s, when a 1949 self-portrait, Diego y yo, went for $34.9 million and became the most ever paid for a work by a Latin American artist at auction, as mentioned above. (Its title refers to the artist’s husband, artist Diego Rivera, who appears on her forehead, and whose fame and auction records long overshadowed her own.) In 2022, Self-Portrait (Very Ugly), from 1933, sold at Christie’s for $8.6 million. And last year, Portrait of Cristina, My Sister (1928) went at Christie’s for $8.2 million.

There was a roughly five-year stretch, between 2016 and 2021, when not a single Kahlo hit the market above the $8 million level, a stark example of the limited supply of major works by the artist in private hands. During this period, her auction high stayed at the $8 million mark, which was achieved at Christie’s in 2016 for Dos Desnudos en el Bosque (La Tierra Misma), from 1939.

To give some idea of how far the Kahlo market has come: Before Diego y yo landed at auction in 2021, it was previously sold at Sotheby’s in 1990, when it made just $1.4 million—about $3.45 million adjusted for inflation.

2. Leonora Carrington (2022 Venice Biennale)

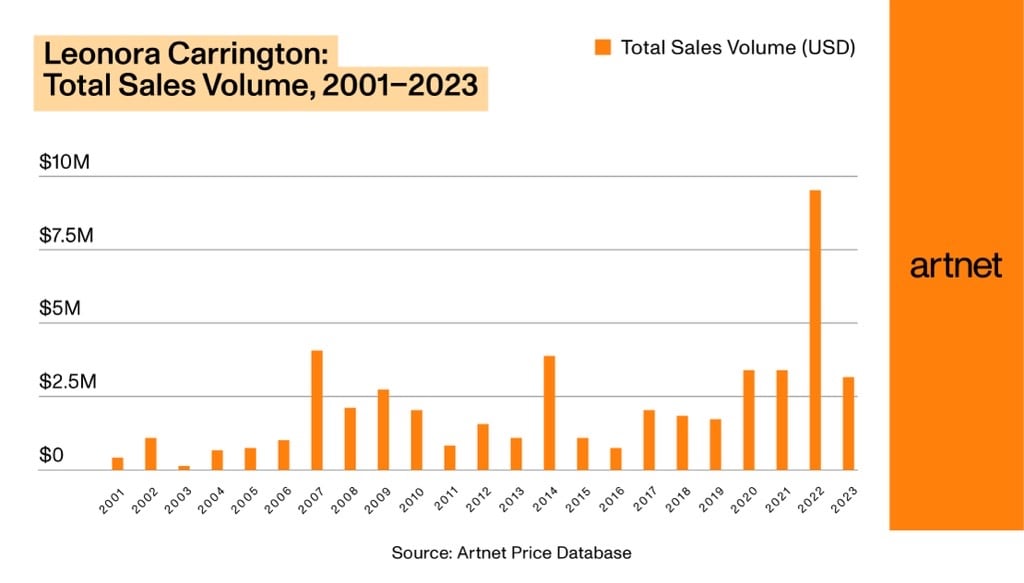

At Sotheby’s Modern evening sale in New York in May 2024, the British-born Leonora Carrington, who lived most of her life in Mexico, stole the show, when her Distractions de Dagobert (1945) went for a record $28.5 million.8 This also made it the third-most-expensive Latin American work ever sold on the block, after the first-place Kahlo and a $29.2 million work by the Argentine-Italian Lucio Fontana.

Carrington’s previous auction record was just $3.26 million, set two years ago at Sotheby’s in London. Her market is ascendant: All but two of her top ten auction prices have been achieved since June 2020. Interest in her was boosted by curator Cecilia Alemani’s inclusion of her work in the 2022 Venice Biennale. (Alemani, who directs the High Line’s art program in New York, named the exhibition after the title of one of Carrington’s short stories, “The Milk of Dreams.”) The same year, her work also appeared in the Metropolitan Museum of Art’s exhibition “Surrealism Without Borders.”

Carrington’s auction total between 2013 and 2023, about $31.2 million, puts her in 11th place on the list of biggest-selling Latin American artists during that stretch. After her May result, she is likely to move up a few places when that list is compiled next year.

3. Beatriz Milhazes (2003 Venice Biennale)

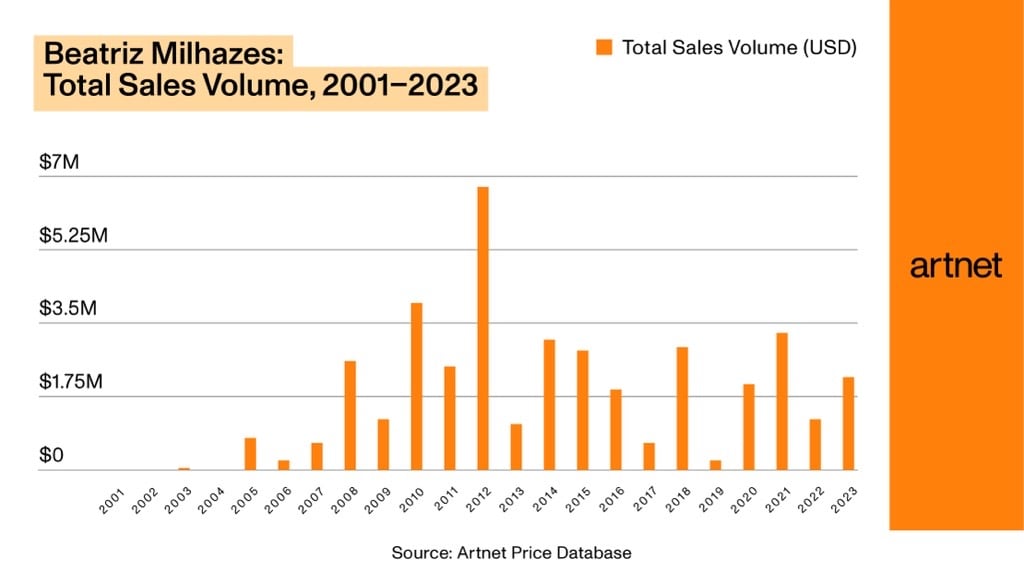

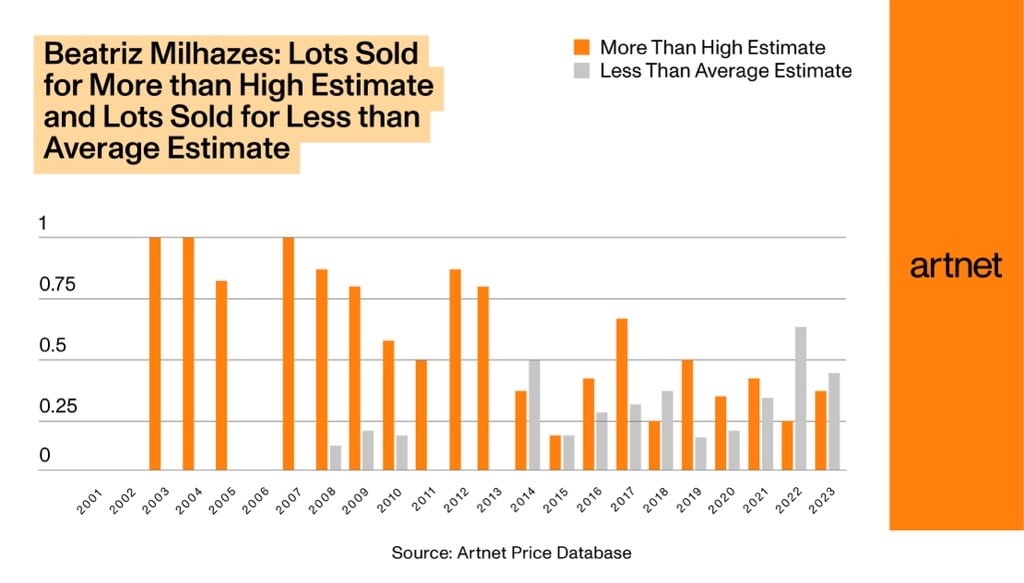

Brazilian artist Beatriz Milhazes is known for her exuberant, large-scale abstract paintings and collages that bridge Brazilian and Western modernism. Milhazes represented her native country at the Venice Biennale in 2003, and this year has a show in its Pavilion of Applied Arts. There was a time when her works were red-hot, but in recent years, her primary prices have outpaced secondary ones. In the first decade of the 2000s, the artist became very popular with Brazilian collectors, with prices for new works multiplying to as much as $1.5 million by 2019, when one of them sold for that heady price at Art Basel through the powerhouse international gallery White Cube.9

Per the Database, Milhazes’s annual auction total reached $6.9 million in 2012, when a single piece, 2000’s Meu Limão, fetched $2.1 million at Sotheby’s. That remains her record. In the ensuing years, Milhazes’s annual totals have declined dramatically, falling to just $235,899 in 2019. That year, the artist left her longtime New York rep, James Cohan, for the global Pace empire. In 2021, White Cube, which also represents the artist, sold a 2014 painting, Little Tree, for a reported $200,000 at Art Basel Hong Kong.10 Her secondary market has remained fairly tepid over the past decade. Last year, 16 artworks at auction generated $2.2 million But while her total annual volume has never reached even half of her 2012 high, her work has averaged a respectable annual sell-through rate of 77 percent since 2013.

4. Fernando Botero (1958 and 1992 Venice Biennales)

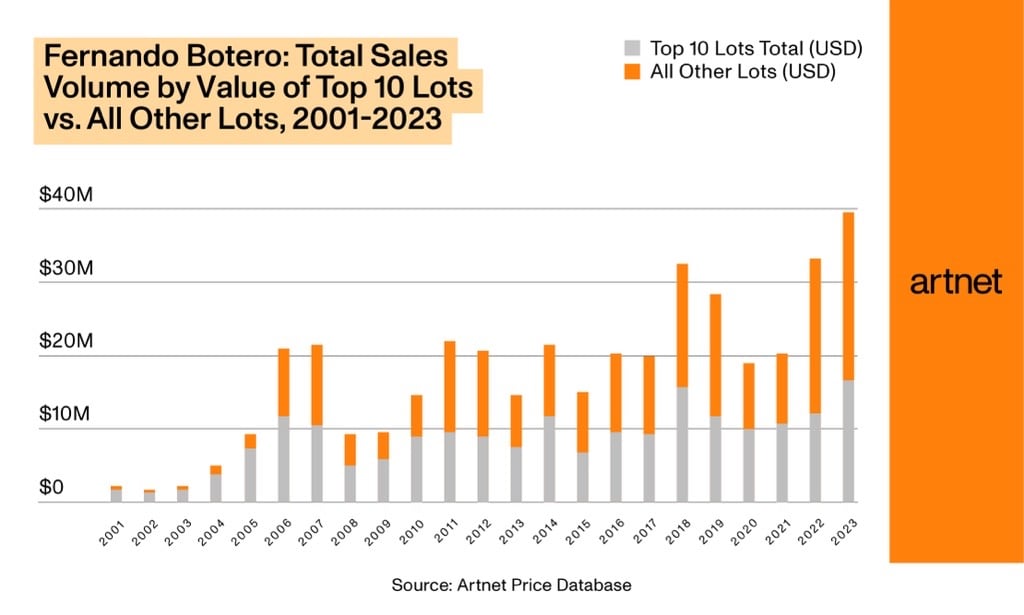

The legacy of the Colombian artist Fernando Botero is remarkable from both a critical and a market perspective. Though his voluptuous figures have fallen in and out of favor with critics and curators over the years, he has been a commanding presence in the market, generating $262.9 million in auction sales over the past decade, which puts him behind only Fontana on a list of bestselling Latin American artists.

Botero got his start at 14, when he sold a drawing for two pesos to a man hawking bullfight tickets. One month after his death in September 2023, at 91, Christie’s New York set a record for his work at auction, selling his 1979 painting The Musicians for $5.13 million. In the intervening 77 years, he appeared in the Venice Biennale’s main exhibition twice, in 1958 and 1992, and steadily developed a devoted following that made him a deep-pocketed collector in his own right.11

After hovering in the low seven digits at the start of this century, Botero’s total auction sales spiked to $8.9 million in 2005, then jumped to a whopping $21.6 million the following year. Setting aside a dip during the 2008 financial crisis, that figure held relatively steady, around the $20 million mark, for the next two decades. Last year, though, it soared again, to $39.3 million. His death in September appeared to bring renewed interest in his work. Another indicator of the strength and maturity of the artist’s market is that only about 20 percent of the lots offered over the past three years have sold for below their average estimates, while more than half have exceeded their high estimates.

One distinctive aspect of Botero’s market success is that he has managed to build an audience across mediums, which is something of a rarity in the selective (read: fickle) art field. Looking at his top ten works on the auction block, four are paintings and six are sculptures. His top-performing sculpture comes in at number two: the 11-foot-tall Man on a Horse (1999), which sold for an above-estimate $4.32 at Christie’s New York in 2022. The man is stoic, gazing into the distance, seemingly prepared for a long journey.

IV. Looking Forward

The roster of artists in the current Biennale who have had little to no market exposure is long and varied. They include María Aranís (1903–66), a Chilean painter about whom little is known, and who has zero entries in the Artnet Price Database, and the Colombian painter and graphic designer Marco Ospina (1912–83), who has had just a single work come to the block. (It sold for under $8,000.) “Foreigners Everywhere” could very well boost both figures, and many more. Will their markets prove to be enduring, like Fernando Botero’s, or more precarious, like Beatriz Milhazes’s? Could this year’s Biennale bring fresh energy to the Latin American art field as a whole? Only time will tell. Watch this space.

Endnotes

Artnet Price Database: From Michelangelo drawings to Warhol paintings, Le Corbusier chairs to Banksy prints, you will find over 14 million color-illustrated art auction records dating back to 1985. Artnet covers more than 1,800 auction houses and 385,000 artists, and every lot is vetted by Artnet’s team of multilingual specialists. Whether you are appraising a collection, researching an artist’s market history, or pricing an artwork for sale, the Price Database will help you determine the value of art.

Disclosures: This material was published in June 2024 and has been prepared for informational purposes only. The information and data in the material has been obtained from sources outside of Morgan Stanley Smith Barney LLC (“Morgan Stanley”). Morgan Stanley makes no representations or guarantees as to the accuracy or completeness of the information or data from sources outside of Morgan Stanley.

This material is not investment advice, nor does it constitute a recommendation, offer or advice regarding the purchase and/or sale of any artwork. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. It is not a recommendation to purchase or sell artwork nor is it to be used to value any artwork. Investors must independently evaluate particular artwork, artwork investments and strategies, and should seek the advice of an appropriate third-party advisor for assistance in that regard as Morgan Stanley Smith Barney LLC, its affiliates, employees and Morgan Stanley Financial Advisors and Private Wealth Advisors (“Morgan Stanley”) do not provide advice on artwork nor provide tax or legal advice. Tax laws are complex and subject to change. Investors should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts and estate planning, charitable giving, philanthropic planning and other legal matters. Morgan Stanley does not assist with buying or selling art in any way and merely provides information to investors interested in learning more about the different types of art markets at a high level. Any investor interested in buying or selling art should consult with their own independent art advisor.

This material may contain forward-looking statements and there can be no guarantee that they will come to pass.

Past performance is not a guarantee or indicative of future results.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Diversification does not guarantee a profit or protect against loss in a declining financial market.

By providing links to third party websites or online publication(s) or article(s), Morgan Stanley Smith Barney LLC (“Morgan Stanley” or “we”) is not implying an affiliation, sponsorship, endorsement, approval, investigation, verification with the third parties or that any monitoring is being done by Morgan Stanley of any information contained within the articles or websites. Morgan Stanley is not responsible for the information contained on the third party websites or your use of or inability to use such site, nor do we guarantee their accuracy and completeness. The terms, conditions, and privacy policy of any third party website may be different from those applicable to your use of any Morgan Stanley website. The information and data provided by the third party websites or publications are as of the date when they were written and subject to change without notice.

This material may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm has not reviewed the linked site. Equally, except to the extent to which the material refers to website material of Morgan Stanley Wealth Management, the firm takes no responsibility for, and makes no representations or warranties whatsoever as to, the data and information contained therein. Such address or hyperlink (including addresses or hyperlinks to website material of Morgan Stanley Wealth Management) is provided solely for your convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through the material or the website of the firm shall be at your own risk and we shall have no liability arising out of, or in connection with, any such referenced website. Morgan Stanley Wealth Management is a business of Morgan Stanley Smith Barney LLC.

© 2024 Morgan Stanley Smith Barney LLC. Member SIPC. CRC 3639331 06/2024