The Art Detective is a weekly column by Katya Kazakina for Artnet News Pro that lifts the curtain on what’s really going on in the art market.

As Frieze London greeted well-heeled VIPs in Regent’s Park this week, a young couple dropped by the new Mark Rothko exhibition at Pace gallery three miles away in Mayfair. Stopping next to a sensual, pink-and-red abstract painting, the man turned to his girlfriend, reached into his pocket, pulled out a ring, and asked her to marry him. She said yes on the spot.

The joyful happenstance was just the kind of a moment Pace was hoping for when it decided to christen its swanky new flagship on Hanover Square with a solo exhibition by the Abstract Expressionist. The goal was to telegraph the gallery’s commitment to London, highlight its longtime connection to the estate of one of the major artists of the 20th century, and do a show people would be drawn to.

“That opening in London with Rothko was a signature of the Pace gallery,” said Arne Glimcher, a cofounder of Pace. “It’s a revelation, the show. The gallery has been mobbed since we opened the door.”

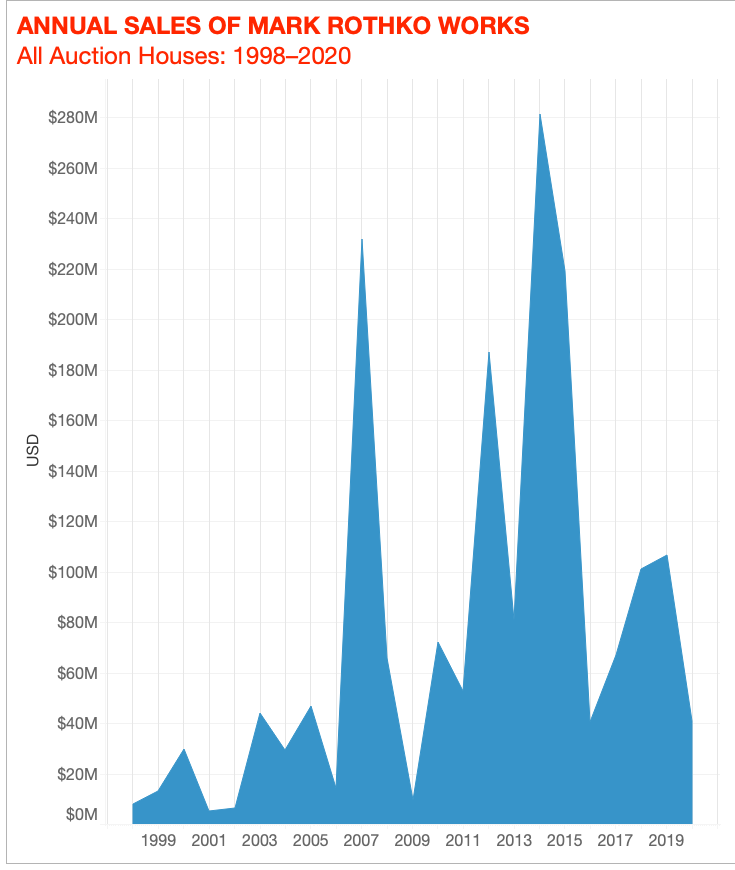

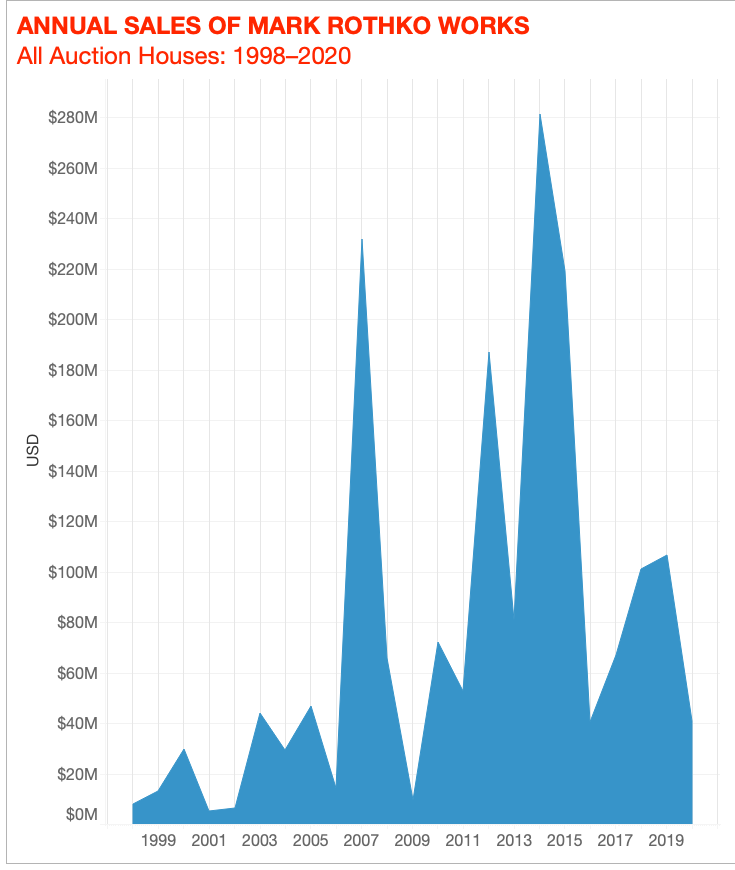

The Rothko market could use some love. The artist’s annual auction sales peaked at $281 million in 2014, the market’s most recent high point and a period when his paintings were coveted by Qatari royals, Russian oligarchs, and billionaire hedge-fund managers.

Since then, things have been rocky. Last year, just $40 million worth of Rothko’s art sold at auction, an 85 percent decline in six years, according to Artnet Analytics. Most significant Rothkos of the past five years have been sold privately—with “several” transactions above $100 million, Glimcher said—and the artist’s auction record has remained unchallenged for almost a decade.

Installation View, “Mark Rothko, 1968: Clearing Away,” Pace Gallery, London © 2020 by Kate Rothko Prizel and Christopher Rothko

Tastes have changed since the radiant Rothko from the estate of collector David Pincus surged to $86.9 million in 2012. Figuration has replaced abstraction as the style du jour. A new generation of buyers entering the market wants to make their mark and crown their own heroes, lifting prices for artists who have been excluded from the art-historical canon.

“It’s not so sexy anymore to buy AbEx art,” an auction executive told me, unless it’s an “A+” work that would attract trophy hunters.

That’s why all eyes are on Sotheby’s, which will offer Rothko’s No. 7 from the collection of divorcing couple Harry and Linda Macklowe next month. Estimated at $70 million to $90 million, it could potentially surpass the artist’s current auction record and set the stage for the second Macklowe Rothko, Untitled (1960), in May. That work—dark and melancholy—is estimated at $35 million to $50 million. The couple acquired both paintings from Pace in the 1980s, according to the provenance.

© 2021 Artnet Price Database and Artnet Analytics.

Glimcher, who as a young man became Rothko’s friend and has been representing the estate for 43 years, isn’t concerned with changes in fashion as far as Rothko and his AbEx peers are concerned.

“You think that Pollock and Rothko and de Kooning and Newman and Still are out of fashion?” he said this week. “Do you know what fashion is? Fashion is something that is hot one year and cold the next year because the next year, the hem lines are shorter. Real art is eternal.”

(The gallery later pointed out that Jay-Z and Frank Ocean had both stopped by to see the Rothko show—though the initial draw may have in fact been a performance by the more of-the-moment Torkwase Dyson.)

New generations of collectors and art lovers will keep rediscovering Rothko, Glimcher said. “They’ll also keep rediscovering Rembrandt and Vermeer and Titian. And that’s what Rothko was. Rothko was Titian. In greatness. In creating a new way of seeing.”

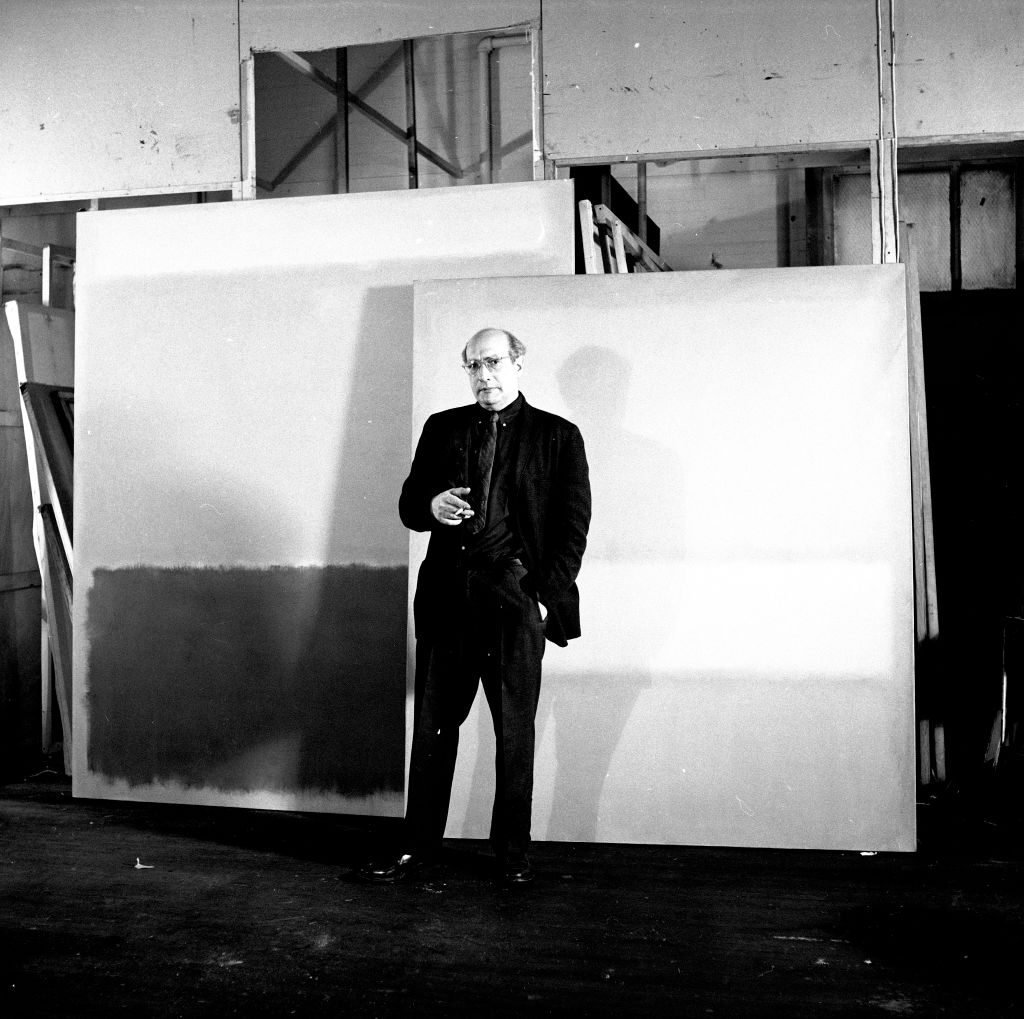

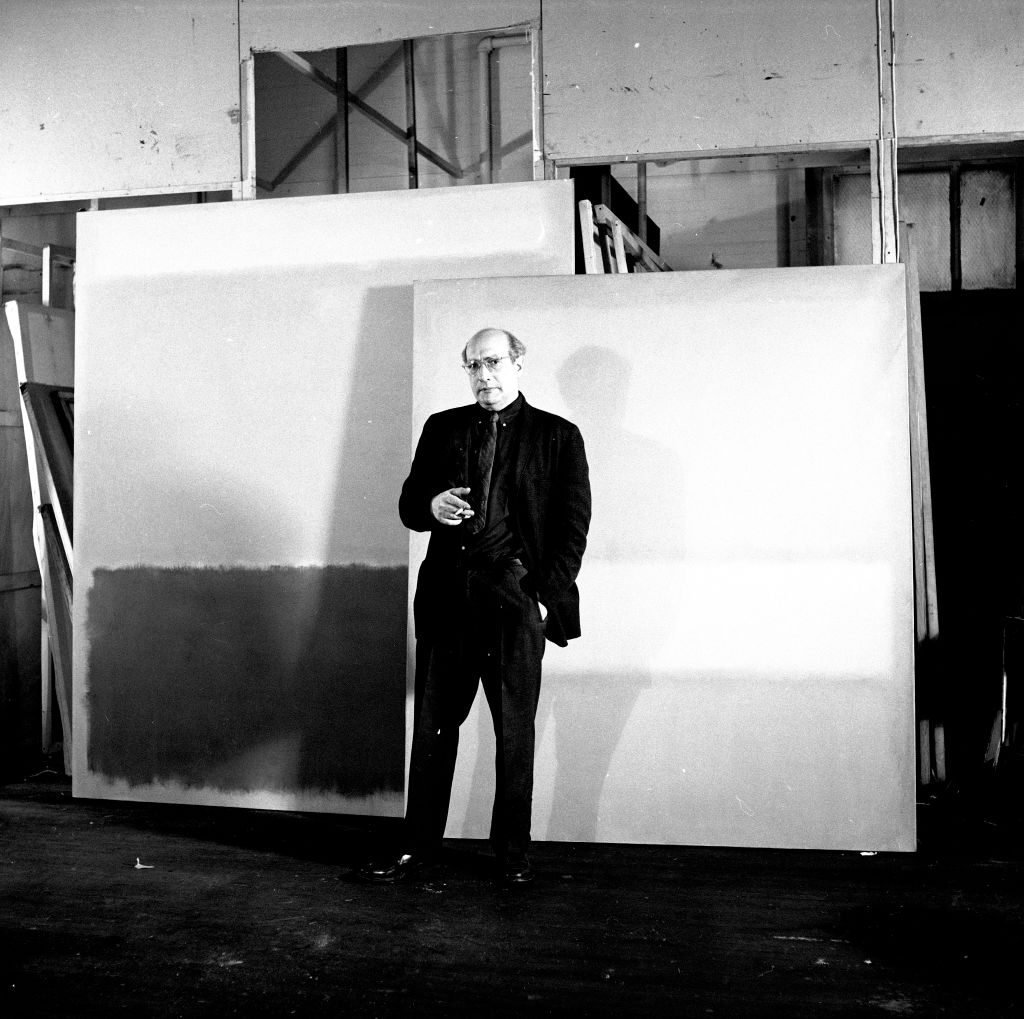

Abstract Expressionist artist Mark Rothko (1903-1970), during his MoMA exhibition, New York City, March 1961. Photo by Ben Martin/Getty Images.

Rediscovery is what Pace’s “Mark Rothko 1968: Clearing Away” exhibition is all about. “You think you know what Rothko is,” he said. “But my job has been for 43 years to show you the various layers of Rothko that you didn’t even know existed.”

The show includes 16 paintings on paper that have never been exhibited together before. The artist, who died in 1970, created them in his final three years, when health issues forced him to reduce his scale from monumental to intimate. That was when he discovered acrylic paint and began to explore its unique potential for coloration.

“The Pace show explores the darkness and radiance near the end of Rothko’s creative span,” said David Anfam, the author of the catalogue raisonné of Rothko’s paintings, which is now in its sixth printing.

Most works are loans from the artist’s two children, Kate Rothko Prizel and Christopher Rothko, who collaborated with the gallery to put the show together. Other named lenders are architect Peter Marino, advisor Alex Brottman, and collector Steven Croman, once described by the New York Post as “Bernie Madoff of Landlords.”

Only two works were available for sale, with prices starting at $6 million. Both found buyers, according to Glimcher. Rothko’s paintings on paper, which are typically mounted on canvas, have sold for as much as $18 million at auction. In May, a 1968 painting on paper comparable in size to the works at Pace fetched $5.5 million at Sotheby’s. Another, from 1969, sold for $3.7 million at Phillips in June.

Mark Rothko, No. 7 (1951). Photo courtesy of Sotheby’s.

The Macklowe paintings at Sotheby’s, of course, are of a different caliber—with a larger scale and potential price point to match. Experts say the most sought-after Rothkos are those from 1950 to 1954 that show off the artist’s ability to render deep feeling in simple, hovering forms.

The one hitting the block in November, No. 7 (1951)—an eight-foot-tall abstract canvas with a central yellow square framed by pink and orange rectangles—“comes from one of the finest years in his entire output,” Anfam said. “It’s bright, brilliantly measured and sensuous. Furthermore, it’s among the last A+ list paintings from private collections that have not been auctioned before.”

We hear that Sotheby’s secured an irrevocable bid for the work, so it’s as good as sold. Now the question is whether it will soar.