Artnet News Pro

The Art Market at a Glance: 5 Charts That Map the Biggest Changes in the Industry This Year

From the rise of Asian buyers to the dominance of ultra-contemporary art, these graphs show, rather than tell, what happened.

From the rise of Asian buyers to the dominance of ultra-contemporary art, these graphs show, rather than tell, what happened.

Julia Halperin

If a picture speaks 1,000 words, then a chart must speak at least 3,000.

Here at Artnet News Pro, we’ve worked to make sense of the wild, frequently obscure art market. Often, the clearest way to do that is to track shifts and trends through data. Below, we’ve gathered five of our most revealing charts to demonstrate some of the biggest changes in the market this year. Let the graphs tell you the story of how the business of art is evolving.

All data © Artnet Analytics.

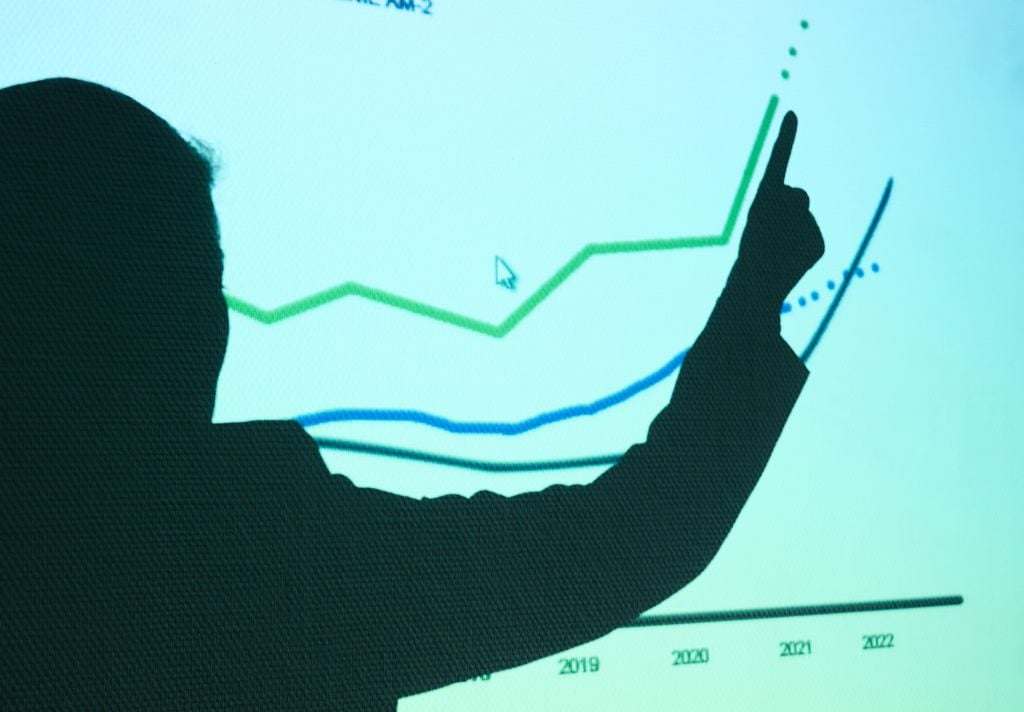

The turnaround in the art market was immediately evident in March of this year. As this chart shows, global fine-art sales at auction that month ($1.1 billion) were more than one-fifth higher than in March 2019 ($940 million)—a full year before shutdown—according to the Artnet Price Database. The biggest difference came at the top end of the market. Fifteen lots sold for $10 million or more this March, against only seven in March 2019. The success in the year’s first quarter assuaged any lingering fears from jittery consignors, laying the groundwork for nine months of megawatt sales to come.

© Artnet Analytics.

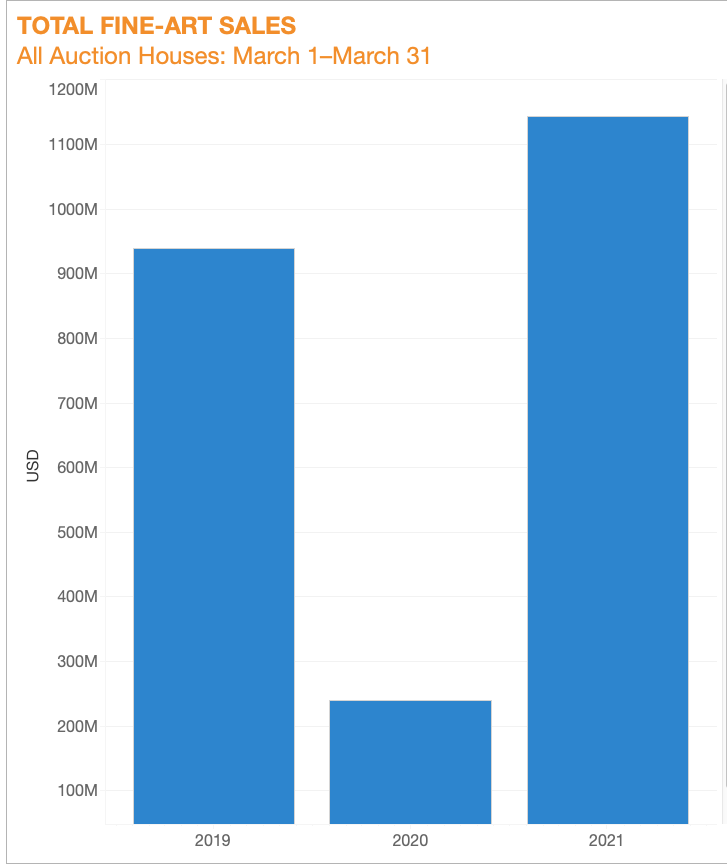

The shifting tastes and growing influence of young Asian collectors in 2021 was undeniable. This chart—mapping total sales of work by Asian and non-Asian artists at Hong Kong auction houses—helps explain why. Over the past 20 years, China and East Asia’s art buyers have evolved, from nonparticipants in the global trade to students of Western trends, to global consumers and tastemakers in their own right. A new generation of young Asian buyers—often educated abroad and tapped into the zeitgeist through social media, the internet, and international travel—is now setting the agenda by paying big prices for international artists in Hong Kong salesrooms, and paying less attention to the historic Asian figures their parents prized.

© Artnet News 2021.

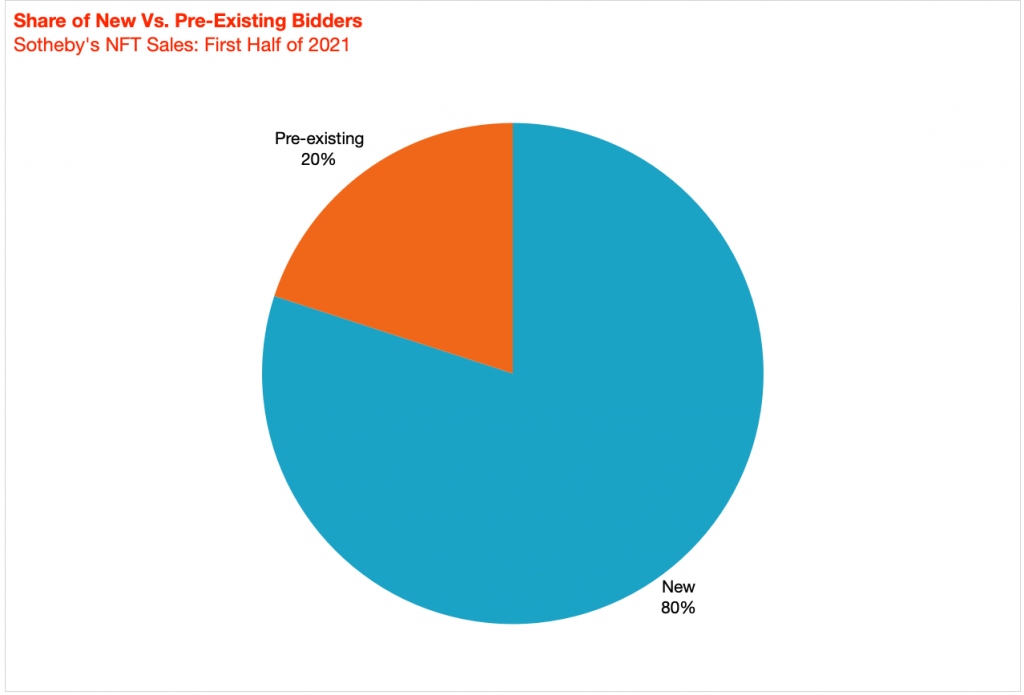

This chart offers some stark evidence of why auction houses and galleries alike became so enthralled with crypto in 2021: in its mid-year results, Sotheby’s reported that roughly 80 percent of bidders in its NFT auctions were new to the house. While the business did not offer any data about the overall number of participants in these sales, the distribution of paddle-wielders was so slanted that the question of quantity almost becomes secondary. At 80 percent fresh faces, even a modestly sized pool of bidders would serve up a tremendously rich set of new relationships to try to build on. Whether the crypto crowd will actually transition to buying other assets, including fine art, is a question that may be answered in 2022.

© 2021 Artnet Price Database and Artnet Analytics.

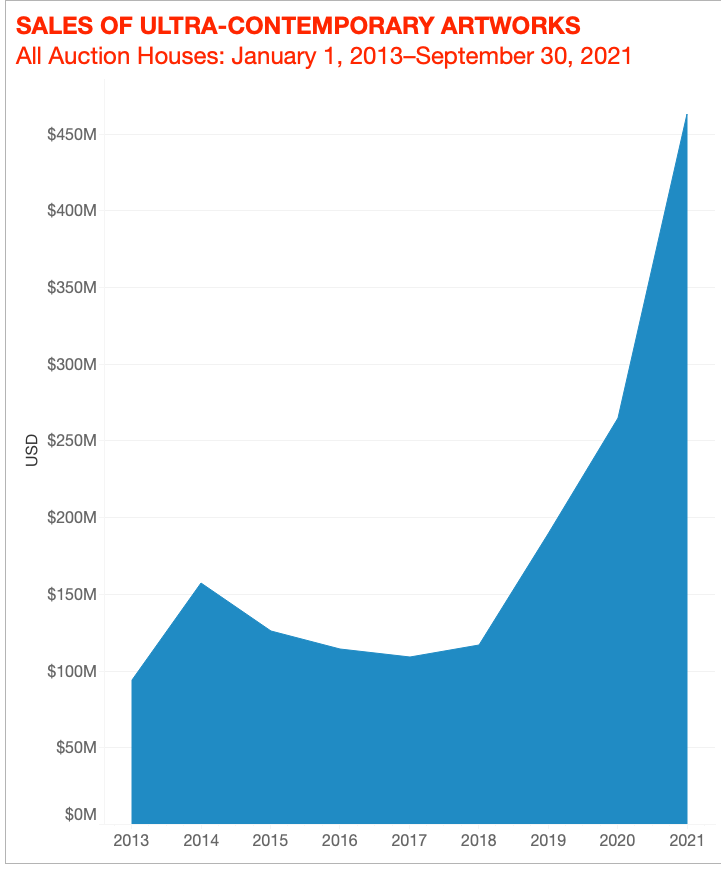

As anyone who has witnessed bidding wars for works by artists such as Matthew Wong, Avery Singer, and Emily Mae Smith this year knows, the market for ultra-contemporary art (our term for work made by artists born after 1974) is pretty much on fire. And its momentum has only picked up during the pandemic, as this chart demonstrates. In the first nine months of 2021, $462.5 million worth of art from this category was sold at auction. That’s up 75 percent from the full year of 2020 and 145 percent from 2019. Remarkably, the size of the market for ultra-contemporary art now rivals that for Old Masters—even though the former genre covers art made over the course of fewer than 50 years and the latter, more than six centuries.

© Artnet Price Database and Artnet Analytics 2021.

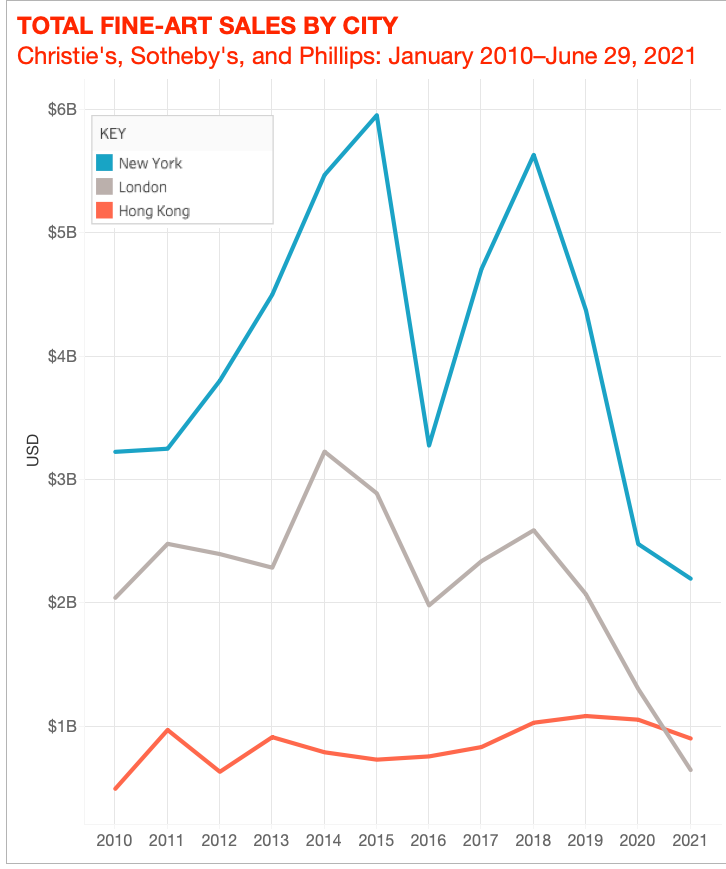

Asian collectors aren’t just driving the conversation when it comes to contemporary art. As this chart tracking auction sales at Christie’s, Sotheby’s, and Phillips over the past decade makes clear, they are fundamentally altering the auction landscape. Total Hong Kong sales fell just three percent in 2020, to $1.05 billion, compared with a 43 percent drop in New York and a 38 percent decline in London. This year is expected to be a record for the Asian hub. Our own Tim Schneider noted that you should have one takeaway from looking at this graph: If you want to get a job at an auction house sometime in the next decade, it would be wise for you to learn Cantonese.