The Back Room

The Back Room: Nature vs. Nurture

This week: the Almine Rech method, Marlene Dumas defies speculators, Vera Molnár’s market paradox, and much more.

This week: the Almine Rech method, Marlene Dumas defies speculators, Vera Molnár’s market paradox, and much more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: the Almine Rech method, Marlene Dumas defies speculators, Vera Molnár’s market paradox, and much more—all in a 6-minute read (1,580 words).

__________________________________________________________________________

Almine Rech and Paul de Froment. Portrait by Bec Lorrimer. Courtesy of Almine Rech.

Among artists who have rapidly morphed from virtual unknowns into auction sensations, one gallery has appeared on their CVs with stunning frequency in recent years: Almine Rech. So what accounts for the dealer’s uncanny success rate in a business where misses far outnumber hits?

Today, the roughly 60 artists represented by Rech include several of “the most sought-after new names, with an emphasis on artists of color and voguish figurative styles,” Katya wrote. The list features Genesis Tramaine, Otis Kwame Kye Quaicoe, Vaughn Spann, Chloe Wise, Ewa Juszkiewicz, and Claire Tabouret, among others.

Works by some of Rech’s upstarts now regularly buzz the $1 million threshold at auction; their gallery shows routinely sell out at prices well into the six figures. She now owns seven spaces in five countries across three continents, with a downtown Manhattan gallery on the way.

What’s the secret? While causes and effects are muddy, Rech’s approach clearly embodies four major themes that increasingly define the larger market…

When Rech founded her namesake gallery in Paris in 1997, she focused on conceptual and minimalist headliners, including James Turrell, Joseph Kosuth, and John McCracken. At that point, elite galleries seldom scouted emerging talent.

But in the 2010s the gallery also began working with popular up-and-comers like Joe Bradley and Alex Israel. The youth movement accelerated in 2016 when Rech opened a New York space led by her son Paul de Froment.

Rech said the gallery’s willingness to mix canonical greats with unproven youngsters confounded art-fair selection committees early on. Yet it has become the norm today.

Lisson and Pace have championed more and more rising talent as the founders’ sons became chief decision makers. Even Gagosian, now under a new leadership structure, has embraced earlier-stage artists such as Jennifer Guidi and Nathaniel Mary Quinn (both also repped by Rech).

Rather than poaching artists from smaller galleries, Rech has partnered with them so they benefit as the artists level up—a sign of the growing collaborative spirit among dealers since the pandemic.

Rech has elevated three artists discovered by Richard Beavers Gallery in Brooklyn, including Genesis Tramaine. All works in Tramaine’s first two solos with Rech were consigned from Beavers. (Her third just closed in New York, with all works sold for prices from $80,000 to $165,000.)

Rech also worked with Half Gallery to transfer Genieve Figgis and Justin Adian onto its roster. Half owner Bill Powers said he gets a cut of sales from the first two shows Rech does with his artists; he has also curated five group shows at Rech’s spaces since 2018.

More than most international galleries, Rech has been quick to sign artists experiencing outsize success among East Asian buyers, even when they still mean little in the West.

Consider Spanish-based figurative painter Javier Calleja. In 2019 he debuted at auction, with 11 sales totaling $262,000. Two years later, after teaming with Rech, 153 of his works generated $14.4 million under the hammer. Nearly all of those results have been at Asian houses.

Last year the gallerist featured Calleja in a New York group show and a Shanghai solo. “Everything sold like hotcakes,” Katya wrote, including to the Long Museum and seven other Chinese institutions.

Now the action is shifting stateside; a Calleja canvas went for $1.2 million at Sotheby’s New York last month.

Rech denied that the gallery props up its artists’ prices at auction, but her team does notify its clients about upcoming lots by gallery artists they have been waiting to buy.

She largely credits her roster’s sterling performance under the hammer to historic rates of wealth creation and the globalization of taste. Basically, so many top buyers are now so rich that it makes no material difference whether they pay $200,000 or $1 million for an in-demand asset.

__________________________________________________________________________

Rech questions whether the good times will roll forever, but for now, she’s leaning into the momentum. Next up is a New York solo show by landscape painter Scott Kahn, with prices from $290,000 to $1 million… just three years after not a single buyer bit on Kahn works that topped out at $12,000 in a small Connecticut gallery.

Whether Rech is more the cause or the effect in this equation is debatable. But the gallery is undeniably a variable—and we should expect more dealers in this follow-the-leader market to try aping its moves going forward.

____________________________________________________________________________

The latest Wet Paint was still being applied when this newsletter closed, but here’s what else made a mark around the industry since last Friday morning…

Art Fairs

Auction Houses

Galleries

Institutions

NFTs and More

____________________________________________________________________________

© 2022 Artnet Worldwide Corporation.

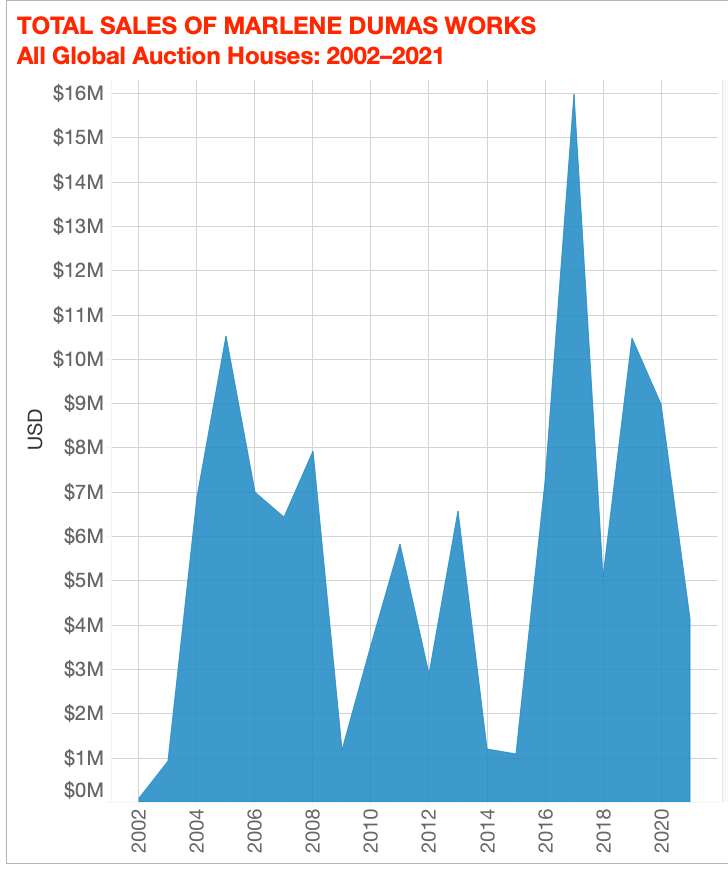

Marlene Dumas‘s breathtaking exhibition at François Pinault’s Palazzo Grassi in Venice reaffirms her place in the pantheon of art history. Yet her auction data proves that, even amid the continuing market frenzy for figurative painting, few speculators have capitalized on her rise.

For details on Dumas’s primary-market prices, power-broker collector base, and robust editions market, click through below.

____________________________________________________________________________

“Don’t do this unless you have no choice. There are easier ways to make a living.”

—Marilyn Minter’s advice to young artists considering turning their passion into their profession. (T: The New York Times Style Magazine)

____________________________________________________________________________

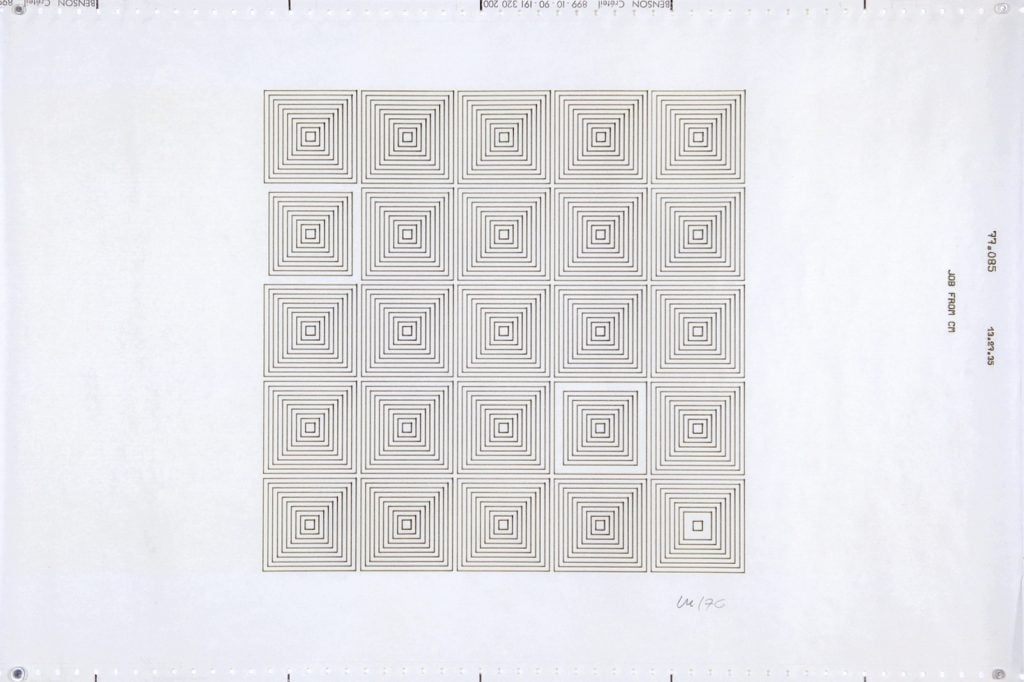

Vera Molnar, 1% de désordre (1976). Courtesy of Sotheby’s.

____________________________________________________________________________

Estimate: $15,000 to $20,000

Sale Price: $25,200

Sold at: Sotheby’s “Natively Digital 1.3: Generative Art”

Art-tech trailblazer Vera Molnár emerged as one of the stars of Cecelia Alemani’s central exhibition at the Venice Biennale, where a full wall of her computer-based works from the 1970s and ‘80s drew rave reviews. Included were several plotter drawings that Molnár created by programming the interface to randomly disrupt otherwise uniform grids of concentric squares.

Her 1976 drawing 1% de désordre, offered in the latest Sotheby’s “Natively Digital” sale, follows the same method. From a pattern of 250 interlocking squares, three were omitted at random because of Molnár’s programmatic intervention.

Artist Marcelo Soria-Rodriguez, who is showing in the (unaffiliated) Decentral Art Pavilion during the biennale, bought the work as a gesture of “homage,” he told us, to a pioneer of generative art.

But contrary to the typical market dynamic for work by acknowledged greats, he got a bargain by choosing history over novelty. The $25,200 he paid was less than one-fifth of the final price for the Molnár NFT that opened the auction; that work, 2% of disorder in co-operation #01, sold for an artist-record $138,600.

____________________________________________________________________________