The Back Room

The Back Room: Auction Action Returns to New York

This week: a marquee auction overview, a big year of bounce-back on the block, another eight-figure Beeple, and much more.

This week: a marquee auction overview, a big year of bounce-back on the block, another eight-figure Beeple, and much more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: a marquee auction overview, a big year of bounce-back on the block, another eight-figure Beeple, and much more—all in a 7-minute read (2,026 words).

____________________________________________________________________________

Jean-Michel Basquiat, The Guilt of Gold Teeth (1982). Image courtesy Christie’s.

The Big Three auction houses are once again holding major fall evening sales in front of large crowds in New York, but a lot has changed in the nearly two years since COVID-19 forced the sector to mothball its old standards and practices.

Aside from the mask mandates and hybrid sales formats that now dominate salesrooms, departmental restructurings and a dedicated evening sale for the Macklowe collection have stretched New York’s usual fall auction cycle to two weeks. Although the shift has saved us from the resurrection of the term “gigaweek” (which always made me feel like we were gearing up to test a nuke), it has also made for an overwhelming kind of re-immersion.

To avoid lapsing into pure dollar-value scorekeeping, I’ve tailored a primer around what has asserted itself as the most important post-pandemic question in the auction market: Is a critical mass of buyers deserting Modern and even postwar artists for talent that has emerged in the last 40 years?

It’s too early to know much at the November slate’s midpoint, so we’ll return to this question with more color next week. For now, I’ll try to address it by recapping two major auctions held by Christie’s this week, and by looking ahead to two major upcoming sales from Sotheby’s and Phillips, with a huge assist from Eileen Kinsella’s indispensable auction-week preview.

(As usual, final prices listed below include buyer’s premium, but presale estimates do not. Guarantees and the number of lots to be offered also both remain subject to change until the opening gavel of each sale.)

21st Century (Held Tuesday, November 9)

Takeaway: Managed to comfortable success. Katya Kazakina reported in her sales recap that 80 percent of the auction’s presale low estimate value was covered by guarantees. Nevertheless, Christie’s specialists found healthy demand by dollar figures, and they sold every lot consigned. Both are indications of the growing hunger for works largely made since the 1980s.

The Cox Collection (Held Thursday, November 11)

Takeaway: Don’t count out the Modernists yet. Buyers put megabucks’ worth of support behind Christie’s contention that the Cox trove was one of the all-time great U.S. collections. Combined with the flawless sell-through rate, the works’ landing nearly 25 percent above their collective high estimate (after fees) shows continued appeal for strong examples by artists of the 19th century.

The Macklowe Collection (Monday, November 15 at 7 p.m. EST)

Presale Takeaway: The Macklowe Collection is full of postwar and “classic contemporary” masterpieces, but are they being offered too late to go stratospheric?

Though the Cox Collection results suggest otherwise, industry chatter and auction data suggest it’s not an irresponsible question. With Sotheby’s laying out an undisclosed but undoubtedly hefty guarantee for the 165-work collection (the next batch will be offered in spring 2022), big sales numbers for this first group would go a long way toward justifying the belief in the continued market power of (largely) canonical white men born in the 20th century’s first half.

20th Century and Contemporary (Wednesday, November 17)

Presale Takeaway: Phillips’s consignments reflect its competitors’ encroachment on the ultra-contemporary artists that had long characterized an important part of its marquee sales. The house found a thinner-than-usual supply of works by hot recent talent (like Jadé Fadojutimi and the late Matthew Wong) partly because Christie’s and especially Sotheby’s (with its new Thursday-set evening sale “The Now”) wanted more of the same.

____________________________________________________________________________

In terms of both sales and consignments, New York’s premier November auctions so far show that a nucleus of plutocrats still goes bonkers for grade-A works by the old guard of artists, even as the larger market takes an incremental step closer to present-day talent. Still, let’s see how the rest of the slate plays out. Middling bids at the Macklowe sale and rabid interest in Phillips’s and Sotheby’s young guns could torque the narrative in a hurry.

____________________________________________________________________________

Artist Peter Max attends a party for Gotham Magazine on June 25, 2014 in New York City. (Photo by Ben Gabbe/Getty Images for Gotham Magazine)

In the latest Wet Paint, a look inside the controversial conservatorship of Alzheimer’s-stricken Pop art legend Peter Max. His daughter, Libra Max, recently filed Senate testimony alleging that her father’s “court-appointed guardians have isolated [him] like a prisoner”—just one small piece of the explosive claims that Phillips Nizer LLP, the firm of Peter Max’s conservator, called “demonstrably false and defamatory” before demonstrators converged outside its midtown offices last week.

In lighter news, Christophe van de Weghe has returned to staging shows in the historic Chelsea building (521 West 23rd Street) he has been renting to others since 2010. In a role reversal, the dealer framed the decision as part of a larger strategy to more fully embrace the primary market, a move more and more blue-chip resale specialists are turning to for stability in the current market cycle.

Here’s what else made a mark around the industry since last Friday morning…

Art Fairs

Galleries

Institutions

… and More

____________________________________________________________________________

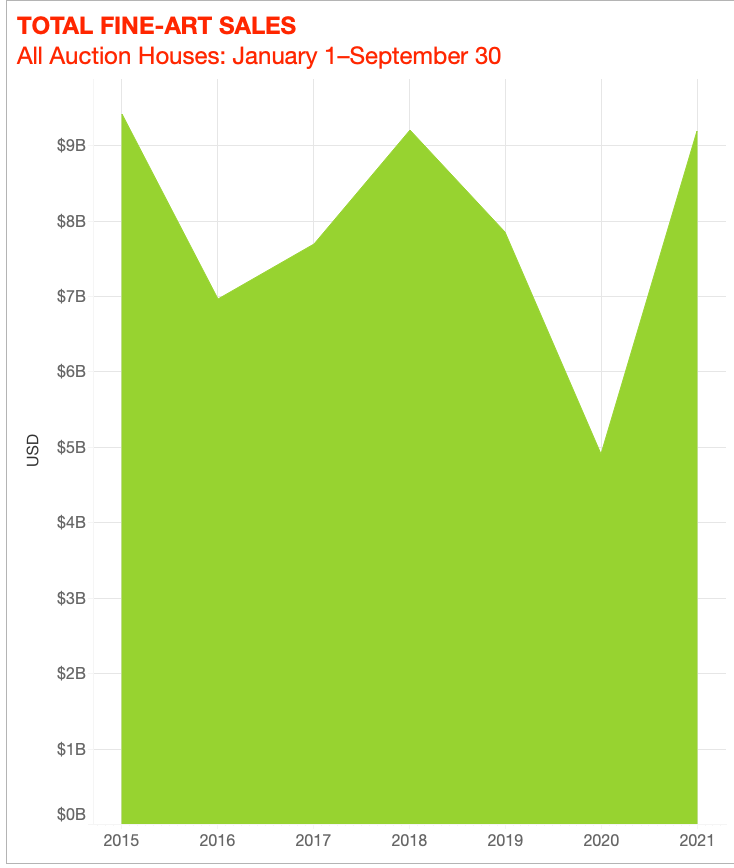

© 2021 Artnet Price Database and Artnet Analytics.

While most gavel-watchers are focused on the marquee sales cycle still playing out now, results show that the first three quarters of this year were among the strongest since 2015, the last hurrah of the most recent multiyear auction-market boom.

From January through September 2021, $9.2 billion worth of fine art was sold at auction, according to the Artnet Price Database. That figure exceeds the 2019 equivalent by a hefty $1.3 billion. It also runs nearly even with the same period in 2018, which included the highest-earning single-owner sale in history, the Peggy and David Rockefeller collection.

In fact, the opening three quarters of 2021 are within about $200 million of the equivalent period in 2015, the only year in this sample to meaningfully outperform the one we’re living through now. That’s less than the individual estimates for most of this November’s New York evening sales. Not bad for a bounce back from our pandemic-haunted 2020, eh?

Click through below for Julia Halperin’s deeper analysis, or simply pocket her widescreen takeaway for later use: “today’s market is bigger—and broader—than it’s been in a long, long time.”

____________________________________________________________________________

“I look at my life as pre-Beeple and post-Beeple… The same way the world thinks about before Jesus Christ and after. Beeple is kind of my Jesus.”

—Noah Davis, Christie’s head of digital sales and resident NFT evangelist, looking back on his involvement in the house’s $69.3 million sale of Beeple’s Everydays: the First 5,000 Days. (The Guardian)

____________________________________________________________________________

Beeple, HUMAN ONE (2021). Courtesy of Christie’s.

____________________________________________________________________________

Sale Price: $29 million

Estimate: $15 million

Sold at: Christie’s 21st century art evening sale, November 9

There aren’t many artists who have ascended from being placed in one of the Big Three auction house’s online-only sales to being included in the same house’s premier New York evening sale within eight months. And I’m pretty sure that Beeple (AKA Mike Winkelmann) is the only one who has ever managed to make that jump with his first-ever physical piece, to say nothing of securing a trophy-lot estimate and a house guarantee for it. Welcome to the HUMAN ONE saga.

Beeple’s mixed-media sculpture resembles a rotating chrome phone booth embedded with human-sized LED screens that continuously loop randomized animated renderings of a single astronaut trekking through worlds that bridge the familiar and the surreal, sometimes incorporating art-historical reference points. (The lot also includes an NFT for the physical work.) The most novel aspect of the piece, however, is that Beeple will be able to remotely edit or augment the video as he sees fit forevermore.

The work ultimately sold for nearly twice its estimate to an online bidder willing to outspend rivals in Hong Kong and in the salesroom. After the auction, the buyer unmasked himself on Twitter as Switzerland-based Ryan Zurrer, a vocal booster of NFTs who now runs alternative-asset firm Dialectic AG and psychedelics-focused investment fund Vine Ventures.

ARTnews relayed that his collection includes works by Refik Anadol and a host of other digital artists more familiar to the crypto space than the gallery world, such as Maxim Zhestkov, Federico Clapis, and WLOP. Given that we could have said the same about Beeple last winter, who knows where these other artists’ careers could lead by the time Christie’s November 2022 evening sales arrive?

____________________________________________________________________________

Additional reporting and writing by Naomi Rea.