The Back Room

The Back Room: Go Figure

The flagging(?) market for figurative art, Hunter Biden as artist’s rights case study, Christie’s private-sales surge, and much more.

The flagging(?) market for figurative art, Hunter Biden as artist’s rights case study, Christie’s private-sales surge, and much more.

by

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: The flagging(?) market for figurative art, Hunter Biden as artist’s rights case study, Christie’s private-sales surge, and much more—all in an 8-minute read (2,133 words).

__________________________________________________________________________________

Emily Mae Smith, Revenge of the Flowers (2020). Courtesy of the artist and Simone Subal Gallery, Perrotin Gallery, Galerie Rodolphe Janssen, and Contemporary Fine Arts Berlin.

During the mid-2010s dominance of Zombie Formalism, more than a few art-world citizens would have descended into the underworld like mythical heroes for the chance to bring back figurative painting.

But the two genres have fully swapped positions in the years since—and now some market players are asking whether the industry has nearly burnt itself out on figuration, writes Katya Kazakina.

All sectors of the industry were already saturated with imagery of the body before the pandemic, yet the genre’s presence has only become harder to escape since March 2020. Human figures appeared in all but three of the top 30 contemporary and ultra-contemporary artworks sold at auction in the first half of 2021, according to Artnet Analytics, as Asian collectors chased works by artists like Amoako Boafo, Emily Mae Smith, Dana Schutz, and Amy Sherald.

What Caused the Figurative Flare-up?

But now there are signs that at least two non-figurative genres are on the rise as in-person exhibition-hopping returns—and major galleries in Chelsea are championing both via works by artists of color.

__________________________________________________________________________________

Installation Work

Major must-see-IRL installations can currently be found at…

__________________________________________________________________________________

Landscape

While pure abstraction still mostly remains out of fashion, landscape could be a natural bridge between it and the figurative works the market has been flocking to, as can be seen in…

__________________________________________________________________________________

Figuration won’t fade out overnight, experts agree. There is simply still too much demand on the buy side, as results from Phillips’s New Now sale in London reminded us this week.

But whether the change is led by the return of live viewing, a hunger among audiences for deeper (or at least different) discourse, or artists’ inevitable attraction to other means of communicating, nothing lasts forever… no matter how much it sometimes feels like it.

__________________________________________________________________________________

Hunter Biden (duh). (Kris Connor/WireImage)

The only thing in the art market less avoidable than figuration this week was news of the ethics agreement finalized between the White House and Georges Bergès Gallery, the dealership managing Hunter Biden’s blossoming art career.

But while the conversation so far has fixated on how the pact could harm the Biden administration politically, it also raises questions about artist’s rights that every studio should consider.

Here are the two key dynamics relayed by the Washington Post‘s Matt Viser, who spoke to two officials familiar with the agreement.

__________________________________________________________________________________1. “Purchases of Hunter Biden’s artwork… will be kept confidential from even the artist himself,” and the gallery “will withhold all records” from him, “including potential bidders and final buyers.”

The Idea:

What Hunter doesn’t know about his collectors can’t hurt his family. No one can buy influence through the artwork if the Bidens stay blind, deaf, and dumb to who is doing the buying—and for how much.

The Problems:

Setting aside the bizarre verbiage (“potential bidders” in a gallery-sector context?)…

So the gallery must only be blockading the identities of buyers and of parties who make sales inquiries (the latter being those “potential bidders”). But even if so…

__________________________________________________________________________________

2. Bergès has “agreed to reject any offer that he deems suspicious or that comes in over the asking price.”

The Idea:

The gallery will short-circuit any attempts at impropriety by sticking to a clear price list, from $75,000 for works on paper to $500,000 for large paintings.

The Problems:

Forget coming in over the asking price. By traditional industry standards, those prices are so high for a first show that market players and ethics watchdogs alike have suggested it would be “suspicious” for buyers just to meet them as listed. However…

Instead, my worry is the gallery-sector standard that an artist’s prices must rise at every subsequent show of new works. Even if Hunter can secure half a million dollars for a large painting this fall, will he be able to get, say, $700,000 in 2024 or $1 million in 2028, especially when his father is just another ex-president?

Maybe so… but lofty initial prices create major pressure that most rising talent fails to overcome.

__________________________________________________________________________________

Much of the pandemonium around Hunter’s ethics agreement hinges on the assumption that the art market is uniquely susceptible to grifters and dark dealings. As you know all too well, dear Pro reader, artwork has no fundamentals and thus no quantitative basis for its pricing, and the industry built around it is notoriously arcane to outsiders.

Yet any good or service is ultimately worth whatever a buyer will pay for it. Even fundamentals are only ever a guide—and one that is often disregarded. This means every business can be gamed by bad actors seeking financial gain or presidential influence, from finance and tech, to food and beverage, to (ahem) real estate and apparel.

What the art world should focus on in Hunter Biden’s ethics agreement is the way it disadvantages an aspiring artist within an industry that is unforgiving at even the best of times. No matter what happens with his career, we can learn from its strange beginning.

__________________________________________________________________________________

© Artnet News.

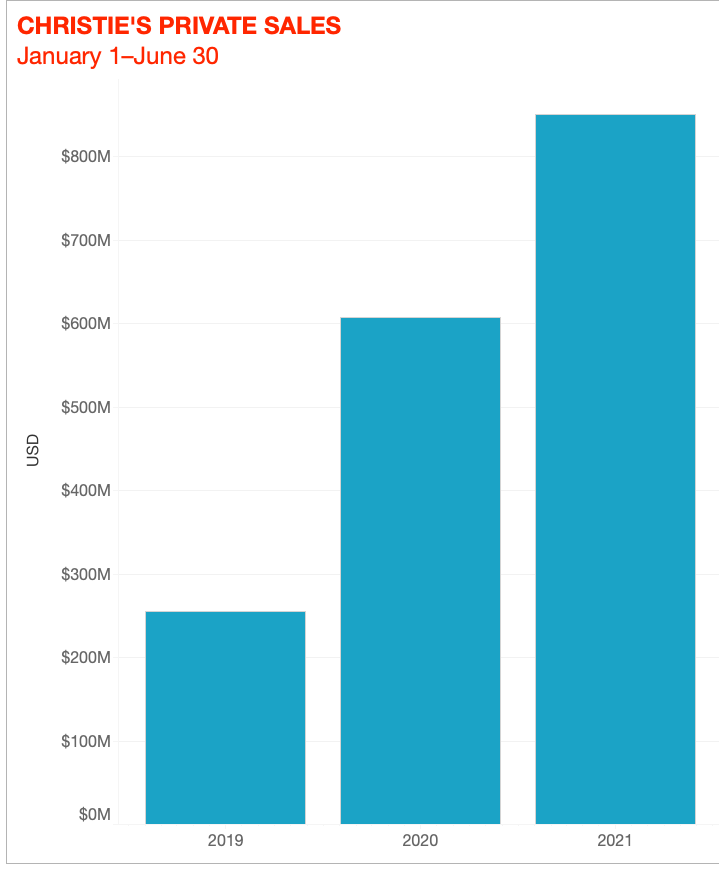

Amid the selection of first half results Christie’s reported this week, one of the standouts was the continued, propulsive growth of private transactions. The house raked in more than $850 million in private sales in the opening six months of the year—a 41 percent increase on the equivalent period in 2020, and an almost 240 percent gain compared to the first half of 2019.

The chart above reverse-engineers the gains into U.S. dollars. (Christie’s declined to confirm my calculations, but I got straight A’s in algebra so I think we’re good.)

It shouldn’t be much of a surprise that H1 private sales at the house last year walloped their predecessors in 2019. After all, public selling events across the auction sector had to be put on ice from mid-March through June of 2020 due to, you know, that whole epochal plague situation.

The real news is that between January 1 and June 30 of this year, Christie’s stacked roughly another $243 million in private deals on top of the $607+ million worth it generated during the six months when private sales were the only game in town.That’s an impressive feat regardless of the circumstances.

Click through below for Eileen Kinsella’s full rundown of the earnings call.

__________________________________________________________________________________

“As an art dealer, I was never aware of the diversity. There are collectors in Korea, Taiwan, Hong Kong, Tokyo. It’s coming from so many places that it’s hard to make a comparison to New York in the ‘80s or whatever. It’s its own thing, and maybe it’s a new paradigm that is going to drive the global market. But again, what do I know?”

—Joel Mesler on what he’s learned about the Asian collecting circuit since becoming a full-time artist, during an expansive interview with Henri Neuendorf.

Rumors are that the next gig for outgoing Art Basel director of the Americas Noah Horowitz will be at an auction house, according to Melanie Gerlis. (Financial Times)

__________________________________________________________________________________

Lehmann Maupin signed an exclusive partnership allowing it to accept 40+ cryptocurrencies via Gemini, the crypto exchange founded by Cameron and Tyler Winklevoss. (Artnet News Pro)

__________________________________________________________________________________

When Jeff Koons, Maurizio Cattelan, or Vanessa Beecroft wants a sculpture honed from Carrara marble, they now call an Italian robot. (The New York Times)

__________________________________________________________________________________

Here’s why Friedrich Petzel, whose expansion simply swaps one Chelsea space for a larger, more versatile one, “[doesn’t] need to have a global empire.” (ARTnews)

Here’s what else made a mark in the latest Wet Paint (and elsewhere).

Art Fairs

Auction Houses

Galleries

Institutions

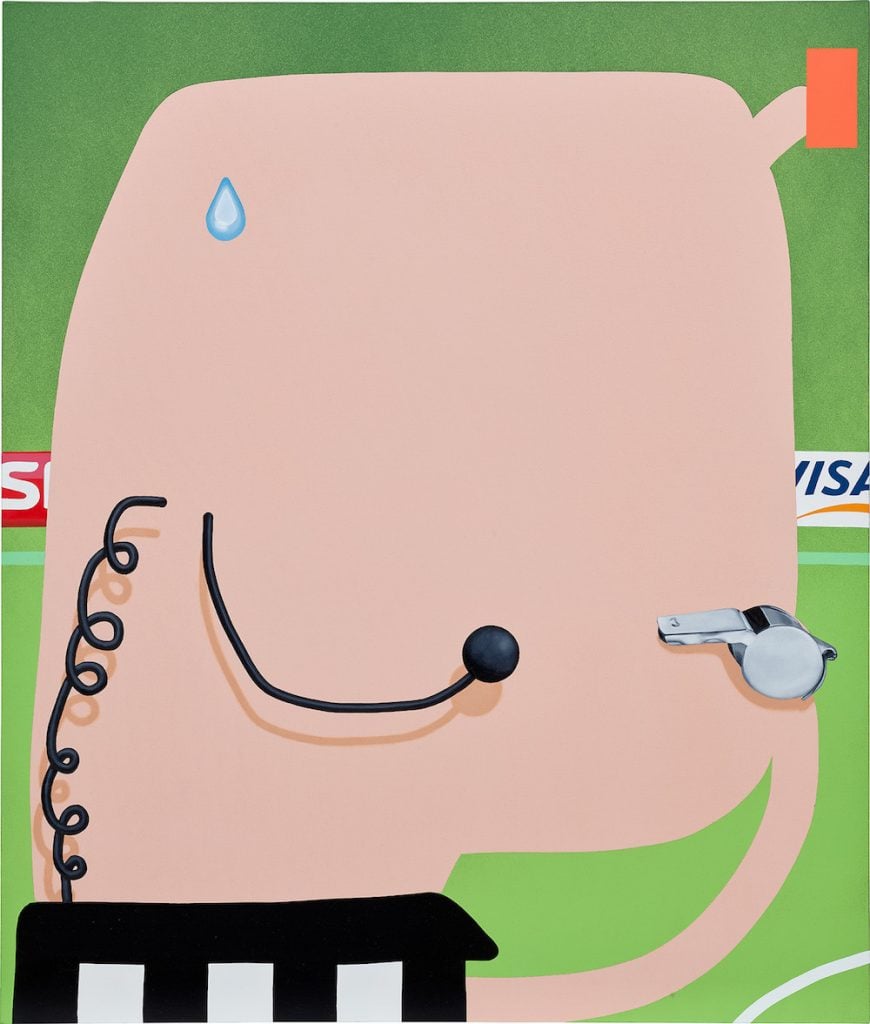

Oli Epp Whistleblower (2017). Image courtesy Phillips.

__________________________________________________________________________________

Date: 2017

Seller: Private Collection

Estimate: £10,000 to 15,000 ($13,900 to $20,800)

Sale Price: £144,900 ($200,800)

Sold at: Phillips’s New Now (London)

Prior to this spring, the only works by 27-years-young Oli Epp to reach the auction block were 41 separate prints that each sold for under $4,500 with fees. Then his painting The Magician (2018) more than quintupled its high estimate at Christie’s Hong Kong on May 25, selling for a premium-inclusive HK $1,000,000 (roughly $129,000).

That record lasted all of about seven weeks. When bidding closed on Whistleblower—a canvas fielding another of Epp’s blobby, faux-naive human figures (this time, a referee)—it had surpassed the most optimistic estimate roughly 10 times over, resetting the artist’s hammer high at £144,900 ($200,800).

Simon Tovey, head of Phillips’s New Now in London, said of the competition for the piece, “There has been strong demand on the primary gallery level for Oli Epp’s work, and clearly the subject of Whistleblower chimed with recent football fever,” a nod to the Euro 2021 tournament that ended Sunday with Italy triumphing over England on penalty kicks. Hopefully the painting’s breakaway success helped soothe the sports heartbreak surely suffered by at least a few of the house’s homegrown footie fans just a few days earlier.

__________________________________________________________________________________