The Back Room

The Back Room: Changing the Game

Art whales splash into sports memorabilia, information (and NFTs) don’t want to be free, Dana Schutz’s market conquers all, and much more.

Art whales splash into sports memorabilia, information (and NFTs) don’t want to be free, Dana Schutz’s market conquers all, and much more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: Art whales splash into sports memorabilia, information (and NFTs) don’t want to be free, Dana Schutz’s market conquers all, and much more—all in a 7-minute read (2,027 words).

__________________________________________________________________________________

The famous 1909 Honus Wagner tobacco card, considered the “Holy Grail” of baseball cards. (Photo by Bob Chamberlin/Los Angeles Times via Getty Images)

If you got into the arts partly to avoid the worst excesses of sports culture, I have some very bad news about your escape hatch: some of the planet’s biggest art collectors are “pouring hundreds of millions of dollars into sports collectibles,” Katya Kazakina writes—and their new interest appears to be powering a growing crossover between the two markets.

Sales of trading cards, equipment, and game-worn sneakers and jerseys have exploded from $1 billion to $10 billion “almost overnight,” per sports-focused Goldin Auctions. Prized baseball, basketball, and hockey cards are now trading for as much as works by blue-chip artists like Alexander Calder and George Condo.

Who are the art mega-patrons playing to win in the sports collectibles game? Fellow MoMA trustees and hedge-funders Steven Cohen and Dan Sundheim top the lineup. (Cohen also doubles as majority owner of the New York Mets; Sundheim holds a minority stake in the NBA’s Charlotte Hornets.) Frick Collection trustee and Blackstone Group CEO Stephen Schwarzman is very much in the mix too.

Their firms have all responded to the market surge by snapping up companies that manufacture, sell, and appraise athletic collectibles. (As the old saying goes, the biggest winners in a gold rush are the people hawking the shovels.)

Collectors Holdings, a company formed by Cohen, Sundheim, and entrepreneur Nat Turner, just acquired Goldin for an undisclosed price believed to be around $200 million. The same trio combined to shell out $853 million for PSA, a firm that authenticates and grades memorabilia for sale, earlier in 2021. Only a few days ago, Blackstone agreed to buy Certified Collectibles Group (one of PSA’s competitors) in a deal that led analysts to value the company at $500 million.

Crucially, the same key dynamics are amplifying demand in the markets for sports memorabilia and art, including:

If all of those don’t sound eerily familiar to you, dear Arnet News Pro member, I will stand in the batters box so a Mets pitcher can wind up and throw a stadium hot dog at me. No wonder Heritage Auctions turned over $100 million in sports collectibles last year, and Sotheby’s held a joint sale of memorabilia with Goldin.

Unlike art, however, the value of trading cards depends almost entirely on their authenticity and condition. This is why the few appraisal companies like PSA and Certified Collectibles Group loomed as such desirable acquisitions. Two Honus Wagner tobacco card given the same grade and “slabbed” (permanently encased in clear, hard plastic) are identical in buyers’ eyes. Ralph DeLuca, a major card collector, drew the contrast this way:

“With art, it’s very subjective… You can say, ‘Oh I have an Andy Warhol,’ and it can be the wrong size or the wrong color, the wrong series than the market wants right now.”

__________________________________________________________________________________

Athletic collectibles seem unlikely to merge with the art market at scale soon due to the significant cultural differences separating their respective audiences. Just look at Amy Cappellazzo’s stated intent to “stay in [her] lane” when it comes to this niche, as well as Goldin’s founder saying of the uneven results of the joint sale with Sotheby’s, “Our customers prefer to deal with our platform.”

Still, with vastly more people interested in sports than fine art, titanic art collectors making big investments in the memorabilia market’s infrastructure, and some of the world’s finest auction houses already exploring opportunities in a space worth billions of dollars, the two markets also seem destined for a more sustained team-up than we’ve seen yet.

__________________________________________________________________________________

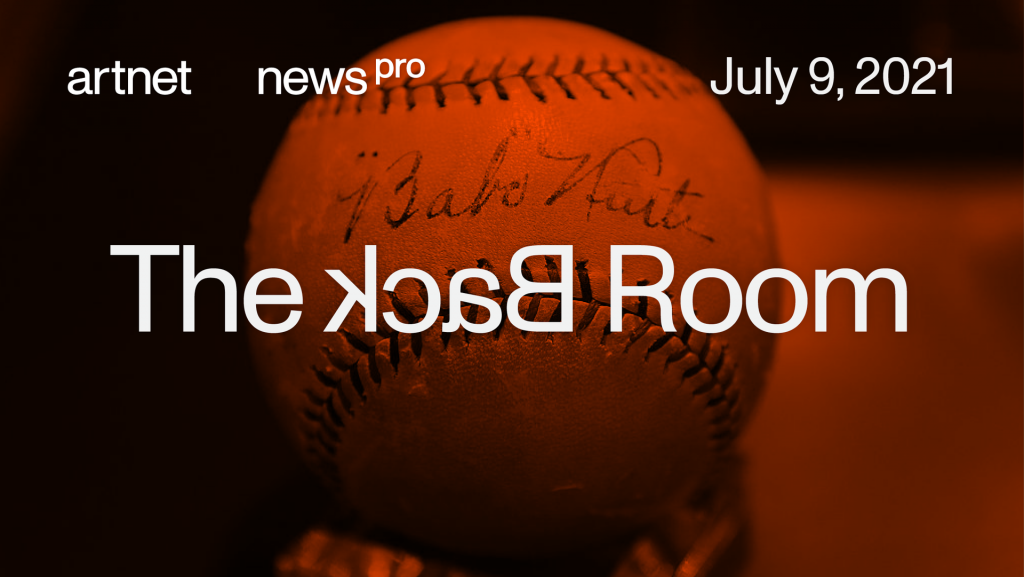

British computer scientist Tim Berners-Lee, who founded the World Wide Web. (Photo by Karjean Levine/Getty Images)

Anyone familiar with the Silicon Valley mantra “information wants to be free” might see irony in last week’s news that Sir Tim Berners-Lee, the man generally credited as the inventor of the internet, sold an NFT of the world wide web’s source code in a package that went for $5.4 million at Sotheby’s.

But that’s a widely held misunderstanding of tech history—and it has major implications for the crypto-art market, I argued this week.

“Information wants to be free” originated in veteran tech journalist Steven Levy’s 1984 book Hackers: Heroes of the Computer Revolution. In it he outlined a so-called Hacker Ethic, which he describes as “the list of unspoken principles shared by” the programmers and developers that were then building what they hoped would be a benevolent new world of technology. Among them was “all information should be free.”

However, at the Hackers Conference, a tech confab held in conjunction with the book’s publication, Apple cofounder Steve Wozniak argued that engineers should be given full rights to products they develop whenever their employers decide not to release them for strictly commercial reasons. Counterculture writer Stewart Brand responded to Woz as follows (emphasis mine):

“On the one hand information wants to be expensive, because it’s so valuable. The right information in the right place just changes your life. On the other hand, information wants to be free, because the cost of getting it out is getting lower and lower all of the time. So you have these two fighting against each other.”

Why has public memory forgotten half of Brand’s perspective? Most citizens in liberal democracies genuinely believe in free information and free markets. Tech giants like Google, Facebook, and Amazon have also aggressively marketed the liberation mantra to camouflage that their “free” services actually involve selling users’ personal data for mind-warping profits.

The same tension is present in Berners-Lee’s world wide web NFT despite that the proceeds are headed to charities. The internet has no rivals when it comes to liberating information for no-cost consumption at scale. Yet a unique digital artifact of its plumbing can also sell for millions of dollars in the right historical and market context. The two forces can coexist because they serve different audiences with different goals.

__________________________________________________________________________________

NFTs are an imperfect solution to many of the worst problems facing artists in the traditional market, including scarcity-driven cultural capitalism. But they don’t block the pursuit of alternative systems by the people who want them most.

So Berners-Lee’s $5.4 million NFT is less a monument to art-tech irony than to a paradox of crypto: its shortcomings and its potential can both be real at the same time. As with the web itself, which of those two sides will win out is a question it may take generations to find out for certain.

__________________________________________________________________________________

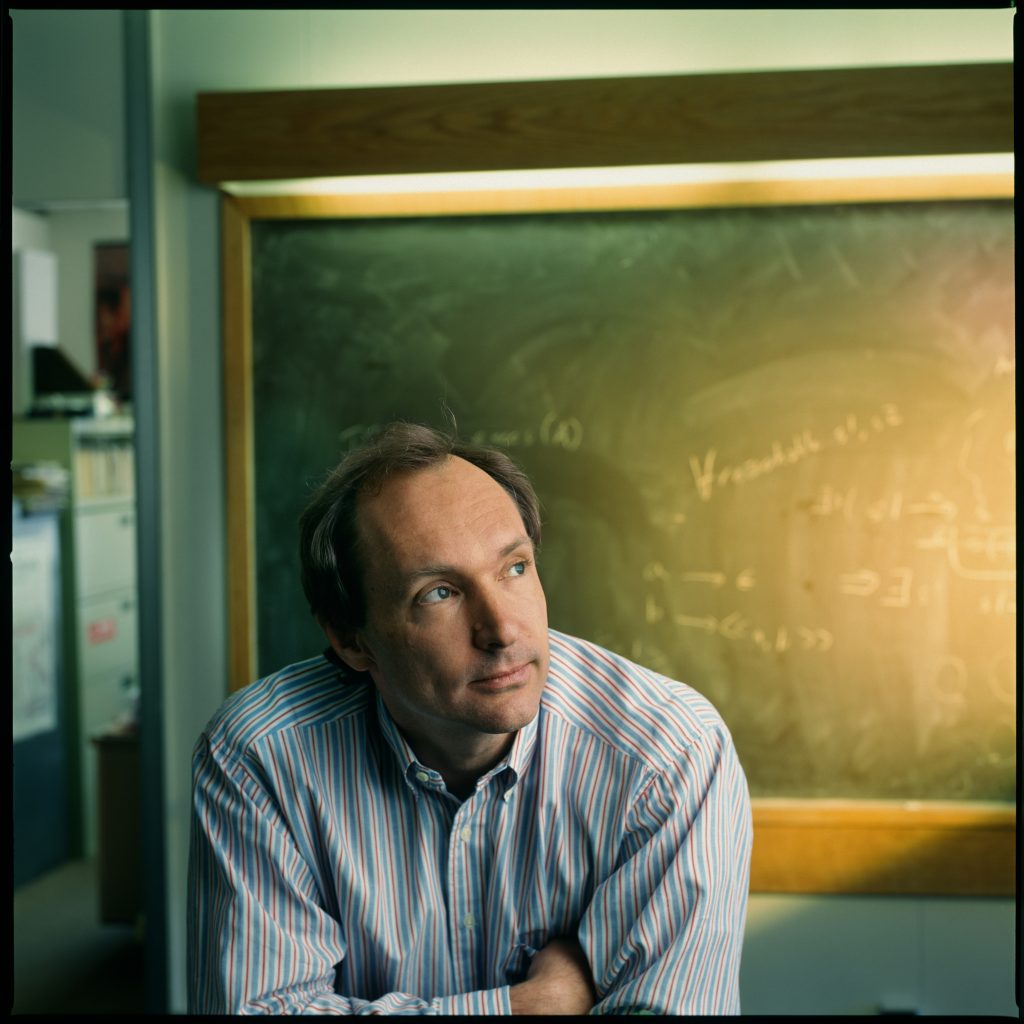

© Artnet Price Database and Artnet Analytics 2021.

If you ever thought Dana Schutz’s career was in jeopardy during the all-consuming controversy over Open Casket, her contribution to the 2017 Whitney Biennial that was pilloried as a “Black Death Spectacle”… well, not so much, it turns out. Although auction results are only ever half the story, they indicate just how fleeting an effect (if any) the uproar ultimately had on Schutz’s market.

As seen in the chart above, the artist’s sales under the hammer tripled year-over-year from 2017 to 2018, then went vertical in 2019. Her 14 highest auction prices have all been set in the past two years, including the record $6.5 million paid for Elevator (2017) at Christie’s Hong Kong last December. Six of her nine paintings to go for more than $1 million at auction only mounted the rostrum in 2021.

For many more details on Schutz’s fascinating career trajectory, check outEileen Kinsella’s deep dive below.

“I think they’re great. They are the urinal of our time.”

—Lucien Smith on NFTs, during a rollicking new interview with foe-turned-friend Kenny Schachter. (Note to the anti-crypto set: He’s referring to the Marcel Duchamp readymade. Or is he?)

Pace Gallery will debut an in-house NFT marketplace in September with tokens minted from the digital archives of Lucas Samaras. (Artnet News)

__________________________________________________________________________________

Chinese staffers are frustrated that senior posts at four of the nation’s major institutions all went to Western white dudes, some of whom aren’t even relocating. (The Art Newspaper)

__________________________________________________________________________________

In a new interview, Museo Jumex founder and fruit-juice scion Eugenio López Alonso says that “art is not the stock market.” (The New York Times)

__________________________________________________________________________________

The opening of Arco Madrid showed the ups and downs of a European art fair in the continent’s not-quite-post-COVID moment. (Artnet News Pro)

Wet Paint is on hiatus this week, but here’s what made a mark around the industry in its absence.

Art Fairs

Auction Houses

The Telegraph confirmed the winning bidders of two major lots in last week’s London auctions:

The Reubens family, Britain’s second-wealthiest clan, bought Lucian Freud’s portrait of David Hockney for £15 million ($20.8 million).

John Caudwell, a U.K. billionaire cell phone retailer, bought Elizabeth Peyton‘s portrait of a young Prince Harry for £886,200 ($1.2 million).

Galleries

Institutions

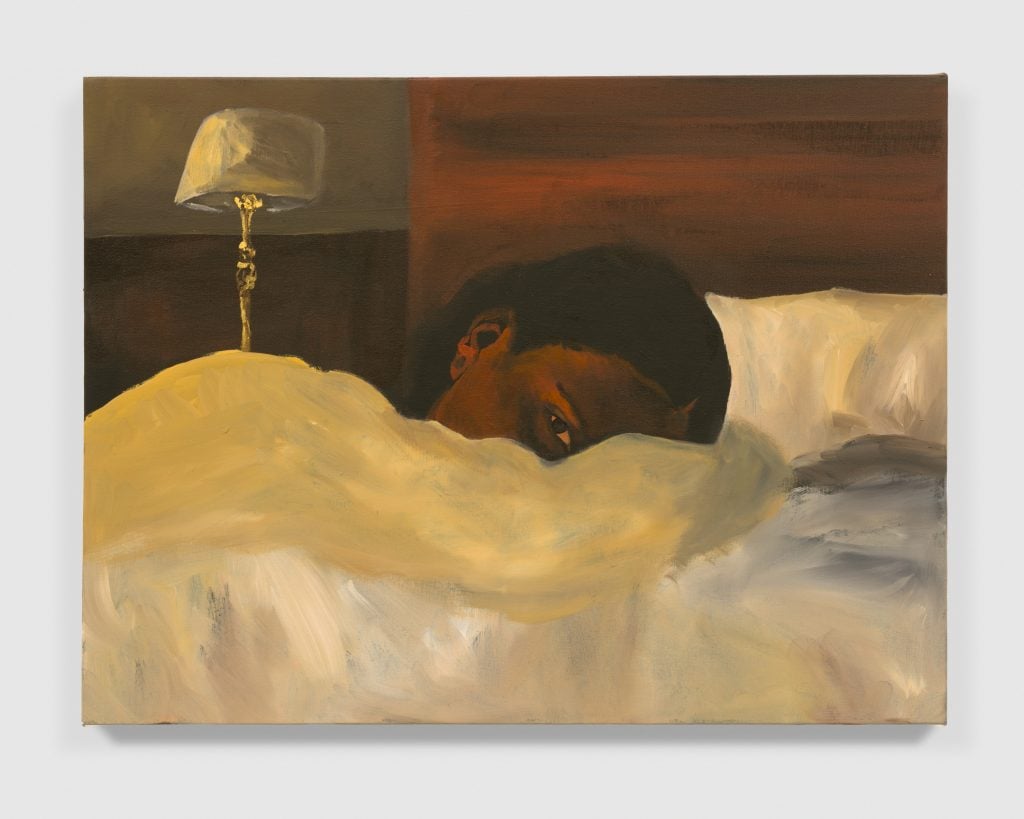

Danielle Mckinney, Reading Room (2021). © Danielle Mckinney. Courtesy of the artist and Marianne Boesky Gallery, New York and Aspen.

__________________________________________________________________________________

Date: 2021

Seller: Marianne Boesky Gallery

Price: $16,000

Exhibition: “Danielle Mckinney: Midnight Oil”

Danielle Mckinney is on one hell of a run through 2021. By mid-April, she had appeared in a Vaughn Spann-curated group show at Half Gallery, debuted a solo exhibition at NYC’s buzzy Fortnight Institute, and snared the inaugural summer residency at Amalia Dayan and Adam Lindemann’s South Etna Montauk Foundation. Before the year’s second quarter closed, her work was included in a multi-artist exhibition at the FLAG Art Foundation, and she had sold out back-to-back one-person shows at Los Angeles tastemaker Night Gallery and Marianne Boesky’s Aspen outpost. Not a bad six months, amirite?

Although she holds an MFA in photography from Parsons School of Design, Mckinney’s success has come from her pivot to psychologically charged paintings. Her darkroom training led her to build up her ethereal subjects from a base of black acrylic, infusing the results with uncommon richness and atmosphere. Boesky describes Mckinney’s Reading Room as “indicative of the intimacy of her imagery. The painting communicates a deeply cerebral life, living each moment at a time.” The piece is still on view in the Aspen show through July 25, but good luck ski-jumping onto the waiting list for new work.

__________________________________________________________________________________