The Big Interview

The Story of artnet, Part 5: How artnet (Barely) Survived the Dot-Com Bust, September 11th, and a Hostile Takeover Bid

In an interview, artnet founder Hans Neuendorf addresses a tumultuous period in the company's history.

In an interview, artnet founder Hans Neuendorf addresses a tumultuous period in the company's history.

Andrew Goldstein

After a decade of hard-fought combat against the glitches of the early internet and opposition from the entrenched art market—a period in which artnet founder Hans Neuendorf regularly had to sell off paintings to keep the business afloat—success came swiftly to the company: In 1999, at the apogee of the first dot-com frenzy, artnet had a sky-high IPO on the Frankfurt stock market.

Just as swiftly, however, another period of calamity reared its head. First, in 2000, the stock-market bubble burst. Then, in 2001, two passenger planes were sent crashing into the World Trade Center, bringing down the twin towers and changing the world—all while Neuendorf watched from the artnet offices, just two blocks away.

For the fifth and penultimate installment of an interview series to mark artnet’s 30th anniversary, artnet News editor-in-chief Andrew Goldstein spoke to Neuendorf about how the company survived the disastrous early years of the millennium, how he built the business back up, and how a very public hostile takeover bid for the company led to his retirement as CEO, passing the reigns of artnet to his son, Jacob Pabst.

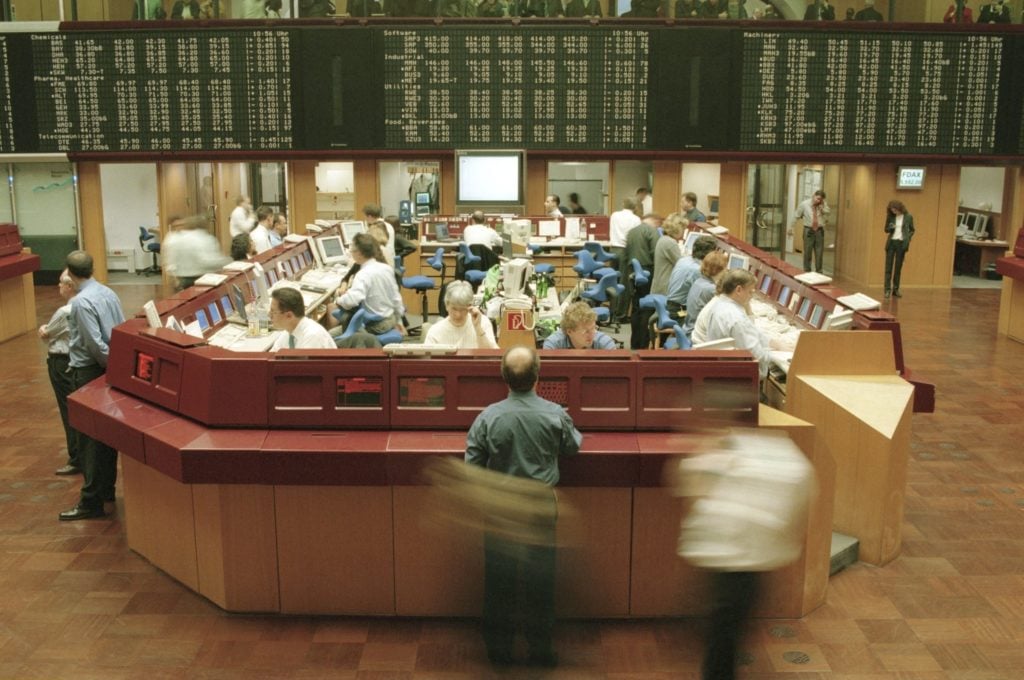

Stock trades in Frankfurt in November 1999. (Photo by Grabowsky/ullstein bild via Getty Images)

Eventually, artnet entered a phase of tremendous success. Tell me about how you took the company public.

I was in New York trying to raise money and [artnet president] Bill Fine had this young sales guy working for him. He was one of those lucky guys—there are people who are just lucky. He said, “I know someone at the Frankfurt Stock Exchange. Can I bring him in?” He brought in this shady character. They were both very young—22 or something—and I thought, “This is not going to come to anything.” But I talked to them anyway and said, “OK, see what you can do.”

Two months later, they came back with these two giants—six-foot-five people—who were investment bankers, and they said that their bank was interested in taking our company public in Germany. We had tried to go public in New York, too, but everybody there wanted big deals, $120 million or something like that, and we were just hoping to get $20 million somehow—completely underestimating what it would cost to build the company.

But those kids came through. The bankers brought their laptops and had a financial model and asked me all these questions about the business. They entered all the information into their laptops and then said, “Okay, this is the business plan now.” They had one for five years out. They did all this work and made a presentation for the stock market.

This was in 1999?

Yeah. We were the 100th company to go public in that segment of the German stock market, which was called the Neuer Markt, or the new market. It’s mostly internet companies and things like that. There was a lot of speculation going on. The little bank we were with had never done a public offering before, and for them it was a career step—we were their guinea pig. And they brought in another bank, Flemings, which was later bought by another bank, which was later bought by yet another bank.

Flemings had a representative in Frankfurt who had no clue what he was doing, and he was very afraid that he would fuck up. So he would constantly ask more and more questions, and then they had another company come in to do more due diligence. All because this representative was inexperienced and afraid he might make a mistake.

This was our biggest stroke of luck, because while he was doing due diligence, the stock prices for companies like eBay and Amazon were going through the roof. And our IPO price was connected to those prices, so when they did the financial model to predict what was going to happen to artnet, they projected a fantastic price—and only because this guy took so much time.

Traders on the floor of the New York Stock Exchange admiring the prices in January 1999 after the the Dow Jones industrial average finished at a record high. (Photo: STAN HONDA/AFP via Getty Images)

You were right on top of the internet bubble.

At that same moment, we started the online auctions. The bank had made it a condition that the auctions were operational and I said, “We can’t do that, we don’t have the money.” They said, “We’ll give you a loan,” and they gave me a $2.5 million loan, just to get onto the starting blocks for the IPO.

We did the auctions because I thought we should help the market do transactions. Transactions were too expensive and inefficient, and I wanted to change that. So we were asking 7 percent commission on the sales. I thought that if we were dramatically less expensive, the public would be won over. That was not at all the case. They didn’t care.

I couldn’t pull it off because there was no way we could advertise. At the time, you couldn’t advertise on the web, you could only advertise in print, which was far too expensive—and also it was somehow perverse for an online product.

That we survived this period is just fantastic. It was very, very difficult. We kept at that for two years, and then the money we got from taking the company public was gone and we had to close the auctions. It’s a total miracle that we survived, period. I was clueless—I didn’t know what I was getting myself into.

This was the same time that Sotheby’s was trying to get into online auctions by partnering with eBay, wasn’t it?

Yeah, they tried to do online auctions at the same time we did—they immediately copied us because they thought this would be so hot. And then they also discovered that it didn’t work. They pretended that they lost $100 million on it because at the time a loss incurred by a venture into online was acceptable in the financial world, but a loss from general operations, as was the case with Sotheby’s, was not acceptable. So they relabeled it. They lost money on online auctions, but it wasn’t $100 million. That was really an operational loss.

After you went public at the height of the dot-com bubble, the bubble burst. What was that like?

We had a lot of problems. There was a lot of hostility from the start against an art company going public—people thought we shouldn’t be a listed company. There were also some people who were starting companies then who were really crooks, making money from investors who didn’t know what they were doing, and when the press would write about these bad guys they always put us in that mix, because they thought that because artnet was an art company there certainly had to be something fishy going on there. This ruined our reputation, and the stock went down to 20 cents or something. It became a penny stock.

But that was not our fault. It was because of the way the stock-market machine handled things. For instance, when we came out, we had a very high price because eBay and others were getting high prices, and the banks who bought the stock in order to distribute it to their customers flipped it. So a day after we went to the stock market, a packet of 50,000 shares came down the pike. You know, bomp. And then the whole price started to unravel.

So our share price also suffered from the behavior of the investment banks. When I had done my roadshow, I had talked to all of them, and they all said, “We’re a serious company, we’re going to keep this stock and make sure that it gets to the right hands.” Bullshit. They sold it right away.

The World Trade Center after being hit by two planes September 11, 2001, in New York City. (Photo by Spencer Platt/Getty Images)

After the dot-com bust, 9/11 followed. Your office was near Ground Zero when that happened. Tell me about that day.

We were at 61 Broadway, just below Trinity Church, and when I stepped out of the subway that morning, people were standing in the middle of the street and they were all looking up. I asked someone, “What’s going on?” And they said, “Look at the tower.” It was burning. They said an airplane had gone into the tower and then another airplane had gone into the other tower, and then I understood it wasn’t an accident. I went into my building and the lobby was full of people. No one was going up, but the elevator was still working, so I went up to go to work.

The office was almost empty. People had gone home. I was thinking, “Well, why is everyone leaving?” You heard police sirens, but I looked out the window to see if it was dangerous, if one of the towers could hit our building, but I didn’t think it was tall enough. While I was looking out the window, the whole thing started to pancake. It came down as I watched and our building shook like an earthquake. Then you couldn’t see anything anymore, because the air was full of the ashes and all that.

So I’m shocked, of course. And the telephones weren’t working anymore because all the telephone lines were damaged. Cell phones weren’t working either. Then, while I was going around closing all the windows, because the ashes were blowing into the office, the building started shaking again, and that was the second tower coming down. One woman who was also in the office was running around with her cell phone, trying frantically to reach her brother, who worked in one of the buildings. But then she left because she had reached him.

I stayed there by myself for quite a long time. I thought: What do I do now? Then the police and firefighters came through and said I had to leave right away, and I couldn’t use the elevator. By that time it was midday, and I walked down the stairs into an empty lobby, and they had boxes there with rags that you could put in your mouth so you wouldn’t breathe in the ashes. There were no subways, no buses, no cars—everything was closed off—and all you could do was walk home. It was a beautiful September day, the sun was coming down, giving me sunburn on my neck. It took me three hours to get home.

How did you manage to keep artnet running through this time?

They put big diesel generator trucks in front of every building to keep the systems running, like water and things, but for two or three weeks we couldn’t get into the office, and we all would meet at the apartments of employees. Our chief tech guy was able to obtain some cell phones, so we could communicate, but there was no business to be done because our server was still in the building and the site was down. It was pretty harrowing. It was terrible. So many people dead.

The rubble of the World Trade Center smoulders following the terrorist attack. (Photo by Porter Gifford/Corbis via Getty Images)

I’ve heard that in the months before the attack, you had invested a million dollars in creating a new African art database, and that it was completely lost after 9/11. The dust somehow erased it from the servers?

Yes. But I think it was stolen. Anyway, we didn’t have the African art database anymore. It had gone back to 1920, and I thought it would be very, very useful because African art is another area that people don’t know too much about. It’s a terrible shame, because it was very good. I had bought boxes full of African art catalogues that were printed in France and Holland from a Frenchman for quite a lot of money, and we shipped them over here and entered it all manually. He had collected this data—it was not available anywhere else. And so when the database was lost, all that data was lost as well. We had good data from all the early sales, and that was important because it allowed you to trace pieces back. I was furious at the time when it happened, but I didn’t see a way of retrieving it.

It seems as if you suffered hardship after hardship in running this company. When did things start to go well for artnet?

It never started to go really well. I was much too early and I mistook the vision for the reality. I always thought success was only around the corner. You have hope that tomorrow it’s going to happen, then tomorrow. So from day to day you continue.

Sergey Skaterschikov. Screenshot from YouTube.

In 2012, you had to fight off a hostile takeover bid of artnet by the Russian businessman Sergey Skaterschikov. Where did he come from, and what did he want?

I don’t know why he put his mind to playing a role in the art world, but that’s what he wanted. What we found out is that he was on the board of a company of one of the big Russian oligarchs, Vladimir Yevtushenko, and he supported Sergey. Yevtushenko was married to the sister of the former mayor of Moscow, and more recently he fell from grace with Putin and I think has not recovered yet, but has retained some of his old privileges.

But he had, among other holdings, a gravel company, and Sergey sat on that board, because apparently he knew something about gravel. That didn’t really qualify him for the art world, but he thought he should be involved in the art world, too. So he approached me and I didn’t trust him, and when I talked to him, I also found out he didn’t have a clue about what he was getting into.

He’s a fishy guy—a windy guy—and I wondered why he wanted it. But he did all kinds of deals. He is an investment banker by profession, and he was only interested in doing mergers and acquisitions and boosting the value of companies by adding another company to it. I didn’t want artnet to be a part of that game—I had worked too hard to get it going.

So he made a hostile takeover bid and offered a serious price. We knew he had the money—he did it with investment banks that were very good, so it was professionally done. But we wrote to our shareholders that we didn’t think it would be a good idea, and we thought the price he was offering was too low, and not enough shareholders accepted his offer. Sergey had to give it up, and the whole thing was a waste.

So you outmaneuvered him.

Yeah.

Is that because you had better relationships with the shareholders?

We had more than 2,000 investors at that time. Now it’s down to about 1,500, but that’s still quite a lot. And many, many of them have 10 shares, or five shares, and those people never show up at the annual general meetings. That’s how I was able to maintain control of the company, because these people never vote.

During this period, Sergey sent out these newsletters with poison-pen screeds about the company, saying, among other things, that artnet Magazine didn’t serve any purpose. You then closed it down. Why?

Its editor, Walter Robinson, was too Chelsea-centered and he wasn’t international, and in the end I couldn’t continue on that basis. We were in midst of a crisis and I thought it would be best to discontinue.

artnet CEO Jacob Pabst standing atop the company’s offices in the Woolworth Building. Courtesy of Jacob Pabst.

You also stepped down as CEO of the company, handing the role to your son, Jacob Pabst. What made it seem the time was right for a generational change?

First of all, during several of the preceding annual meetings I heard shareholders asking how long I was planning to stay as CEO. I was in my 70s and usually retirement age is 65. Some people do it until 70, but once you’re 75 or so, people start saying, “Well, what are you still doing there?” Because Jacob had worked his way up in the company, starting in the tech department, I thought it was a good moment. And I think it was an excellent idea.

This was in 2012, and all of a sudden other businesses like Artsy, Artspace, and Paddle8 started coming into the field. The online art marketplace suddenly became a hot thing. What did you make of that?

Yes, we had the good fortune of Artsy and other competitors who tried to nibble away at the fringes of our business and take part of it. That certainly hurt our business, at least to a degree, even though ultimately they didn’t succeed with it. I don’t mind that much, because I think Artsy raised a lot of money, and the press was all over them, and they claimed that they had invented the whole thing, even though we were right there just doing our business. We’ve done much more business than they ever have. Nevertheless, the press overlooked it and praised them.

But Artsy was very clever in how they did it because they had celebrities on their board, and the celebrities gave money, and that was good. But most of the money they spent on marketing, and I think that helped us a lot, because all of a sudden everybody was talking about the online art business, and that gave us credibility. Ultimately it was to our advantage that they came along. I think it’s a great thing. Had they not arrived, we would have had to invent them. A big competitor with lots of money gives the whole enterprise credibility.

Then, in 2014, artnet restarted its editorial operation under the name artnet News, led by former Louise Blouin Media editorial director Benjamin Genocchio. How did that come about?

Bill Fine brought in Genocchio because they worked together at Louise Blouin Media. I remember it was a very cold day, because he didn’t want to meet me here at the office—he was working for Blouin—so I had to go see him at his apartment in SoHo. He promised me the moon—he said the total cost of the whole thing, including staff, would be $700,000 a year, and we would be able to quickly bring that money in through advertising. Obviously none of this was true, but that’s how it started. And I think launching artnet News worked out well for us. We needed that boost. It turned out to be a good move. It played a big role in getting the reputation of Artsy down a little bit.