Analysis

JJ Charlesworth on Why the Art Market Is a Bubble That’s Not Going to Burst

Why the art market is a bubble that's not going to burst.

Why the art market is a bubble that's not going to burst.

JJ Charlesworth

After a reportedly lively and lucrative Art Basel last month, London’s auction sales showed that the secondary market for twentieth century art is firing on most, but not all, cylinders: while Sotheby’s Impressionist and Modern art sale netted £178.6 million or $282 million—the second highest total for any auction held in London—Christie’s less inspiring sale still managed to pull in £71.5 million, or $112.9 million.

And yet these were modest by comparison with the staggering Christie’s sale in New York in May where record prices were paid—$179.4 million or £114.23 million for Pablo Picasso’s Les Femmes d’Alger and $141.3 million or £89.97 million for Alberto Giacometti’s l’Homme au Doigt.

The art market’s apparently unstoppable upward spiral has become an almost normal phenomenon, and many commentators have all but given up speculating on whether or when it might come crashing down. It’s easy to get tangled in the impenetrable intrigue of the secondary market—with its buy-ins, third party guarantees, buyers premiums, and the rest of the bizarre lore and shadiness of the business—while the old notion of the art market “bubble” seems no longer to offer a reliable dose of periodic schadenfreude for those who like to see the very rich lose their shirts.

But in reality there’s little reason to believe that the art market will see the same crashes it has experienced over the last thirty years, and last week’s London auctions hold some of the clues to why.

Sotheby’s headquarters in New York.

Photo: Courtesy of Sotheby’s.

First off, we’re seeing the steady establishment of high modernist art into the accepted canon of what’s desirable at auction, particularly with previously “difficult” abstract art such as Kazimir Malevich’s Suprematism, 18th Construction at Sotheby’s London.

Those kinds of sales show that the first half of the 20th century is now increasingly seen as culturally and intellectually serious and lasting in its reputation as important art—the big touring Malevich retrospective at the Tate, Stedelijk, and Bonn’s Bundeskunsthalle last year didn’t hurt in cementing Malevich’s reputation, after all. Modernism is now completely uncontroversial, and collectors are keen on the strength of its brand.

But as illustrated by the contrast between the mega-sale of Picasso’s Les Femmes d’Alger in New York and the stuttering sale of a late Picasso portrait in London, even in an established name in an established field, buyers discriminate between the merely rare and the truly, seriously, excruciatingly rare.

Of course, when you’re billionaire hedge fund manager Steve Cohen, having the most sought-after Alberto Giacometti for your collection is worth the $141.3 million. But while such prices are all about an artist’s reputation, about the quality of the work and so on, in reality reputation means nothing without scarcity, and scarcity does one important thing in the art market, against which everything else is incidental. Scarcity guarantees the “store of value” effect, and “store of value,” in a world of increasing global prosperity is what the increasingly global super-rich are really after.

You might be about to download some of the greatest movies in the history of the world for the price of a beer, but great art is different. Scarcity counts.

Kazimir Malevich Suprematism, 18th Construction (1915).

Photo: Courtesy of Sotheby’s

Unlike two or three decades ago, we live in a world where economic growth has really taken hold outside the West—in Latin America, in China, India, Southeast Asia—not to mention the rise of petrodollar economies such as the gulf states and Russia.

But alongside global prosperity has come a lot more political instability, and it’s in the interests of the social elite to keep their options open as to where they relocate—the fractious debate in Britain over “non-dom” status has highlighted how many of the very wealthy choose to live elsewhere than their countries of origin, exploiting favorable taxation environments, but also an escape from the risks of running afoul of more authoritarian regimes at home. The Chinese and Russian upper classes are sending their kids to public school in Britain in increasing numbers and coming to live here too.

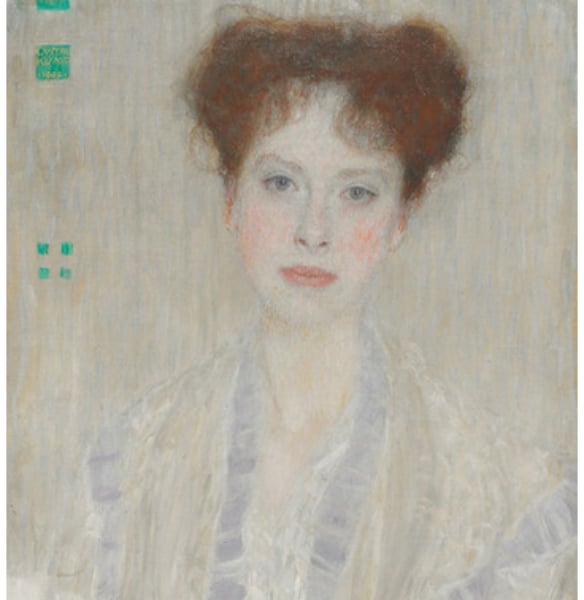

Detail of Gustav Klimt, Portrait of Gertud Lowe (1902), fetched $39 million at Sotheby’s.

Photo: Courtesy of Sotheby’s.

And hey, if you want to get some of your wealth out of crumbling roubles and into some other form of asset, why not try art? Not just a few thousand pounds worth, but millions of pounds worth, all concentrated into a handy bit of wood and canvas with some colors on it. And the best guarantee of its value is its rarity and the security of its reputation. Which is why, as Giovanni Gasparini, director of the MA in Art, Law and Business at Christie’s Education in London, recently pointed out, “art is more appealing as an asset to park liquidity into as it does not naturally depreciate as, say, boats, which can rapidly become obsolete due to technological innovation.” That’s right, your yacht costs money to run, and in the end you need to buy another one. Your Malevich, however, holds its value. Plus it’s easier to clean.

Diversifying your assets in this way also means buying outside of your home market—as the Art Newspaper reported, many of the works in the Christie’s Picasso auction went to buyers in Asia. It means that classic, ultra-rare modernist art is now seen in many ways as the top of a cultural hierarchy, transcending all national cultural boundaries, and big non-Western collectors are happy to buy into Western modern art, as the Qataris did when they bought a Cezanne for $250 million in 2012. An asset that keeps its value, that is in permanent short supply, what’s not to like? Even Bitcoin, that supposed Holy Grail of scarcity assets, is in trouble. And bitcoins are boring to look at.

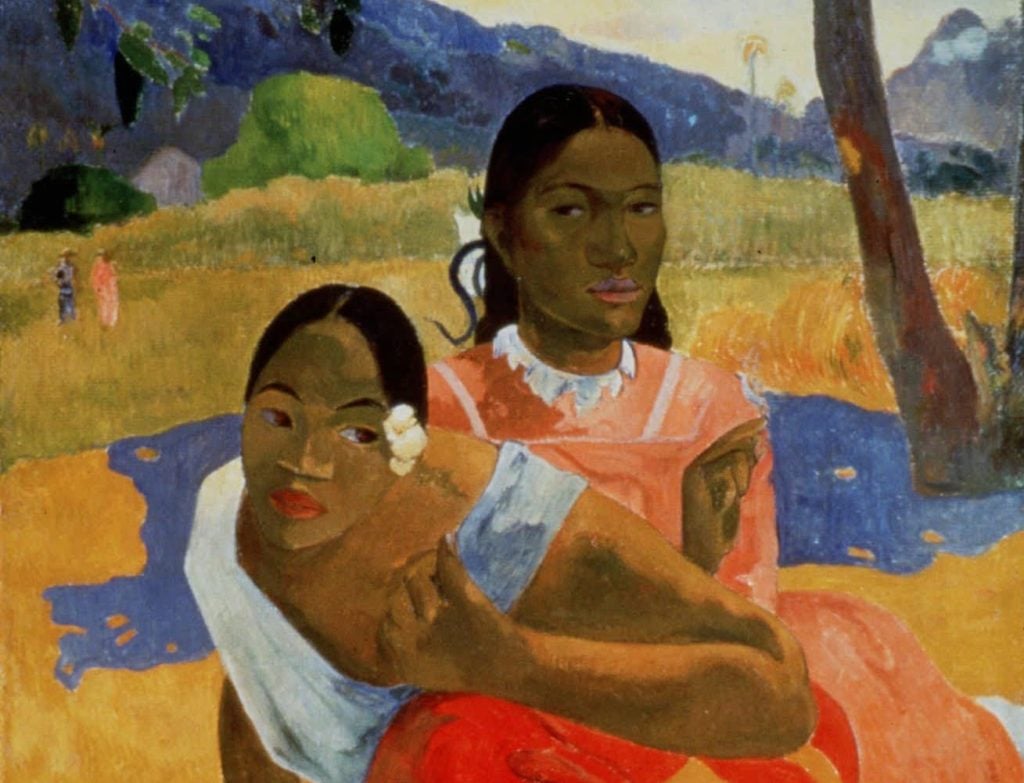

Paul Gauguin, Nafea Faa Ipoipo (When Will You Marry?) 1892. The painting sold for $300 million.

The art market reflects the fact that the world is getting richer—it’s economic growth, in India, in China and elsewhere, that makes the super-rich rich, after all—but at the same time, it highlights that the Western economies are lagging behind while the rest of the world catches up. Classic Western modern art will be heading east and south with ever increasing regularity.

The transfer of wealth from the West to the East and South is a global phenomenon, and for the art market it means that unlike bubbles in the past, which were closely tied to a particular national economy, it’s a rise distributed across many economic centers of activity, regions experiencing economic growth that puts the Western economies in the shade. Now, the Western world doesn’t make much anymore—iPhones may be “designed in California” but they’re made in China—but the one thing the West did make a lot of—modern art—is in greater demand than ever.

As long as the world economy keeps growing, the art market bubble isn’t set to burst anytime soon. So if you’re a Gurlitt, or preferably the lucky inheritor of a restituted work of early 20th-century modern art, it’s time to sell.