Analysis

The Gray Market: Could Auction Houses Really Help Save Struggling Galleries? (and Other Insights)

Our columnist follows the bread crumbs left by the rumor that Art Agency, Partners will offer gallery advisory services for a hefty fee.

Our columnist follows the bread crumbs left by the rumor that Art Agency, Partners will offer gallery advisory services for a hefty fee.

Tim Schneider

Every Monday morning, artnet News brings you The Gray Market. The column decodes important stories from the previous week—and offers unparalleled insight into the inner workings of the art industry in the process.

This week, a Gray Market special report…

It’s not exactly an analytical breakthrough if I tell you that the art industry is deeply troubled and, in many cases, deeply paranoid right now. A lot of people in the trade feel vulnerable. And the more vulnerable you feel, the more likely you are to lash out at any shadow that looks even vaguely threatening.

That’s why it was treated as a minor bombshell when, about two weeks ago, my colleague Kenny Schachter tossed out a few lines stating that Art Agency, Partners (AAP), the prominent art consulting firm and Sotheby’s subsidiary, “will offer up gallery advisory services” to sellers in the market’s battered middle tier. Schachter also whispered that said services would come in exchange for a fee “in the neighborhood of $250,000,” which he assessed would “bankrupt the companies that need support the most.”

The perceived scandal in this chatter stemmed from the not-uncommon belief that auction houses have been encroaching further and further into galleries’ and dealers’ territory for years now. The first flash point was the houses’ increased focus on private sales over roughly the past decade. More recently, Sotheby’s in particular has drawn scorn for acquiring AAP in the first place, before AAP attracted even more critics by providing advisory services directly to living artists and estates in 2017.

For its part, AAP has been adamant throughout these developments that its operations are meaningfully separated from Sotheby’s, and that it can work in collaborative and complementary ways with the gallery sector. AAP’s deal to co-represent the estate of Vito Acconci with Pace served as a marquee example of this possibility. (It has been reported that Pace will take sole control of the project after the recent departure of Christy MacLear, the former head of AAP’s estate management division.)

Since I’m always keen to dig into the shifting sands of the industry, I decided to follow up on the rumor with AAP co-founder Allan Schwartzman a few days after Schachter’s story went live.

Now, Schwartzman and I have no prior relationship. I just emailed him out of the blue to ask whether there was any truth at all to this incendiary nugget dropped into a volatile landscape like a tarantula into a crowded grade school classroom.

So I can’t really blame him for responding in polite yet enigmatic fashion with the following statement last Saturday:

Many vital galleries and artists in the mid-market are suffering greatly, and it looks as though survival for them is getting even harder. And while contemporary art could benefit from some focused editing, it is dangerous in general if the market becomes so ‘efficient’ that it kills off the system that nurtures and sustains living artists who are not yet, or may never be, financially dependable ‘commodities.’ Remember what Einstein said about bees? All of us who believe in the power and potential of art should feel responsible to help keep the enterprise fertile and healthy.

I think it’s fair to say that those four sentences leave a lot of room for interpretation (especially if you, like me, didn’t know what Einstein said about bees). But they definitely don’t amount to an outright denial.

As a result, Schwartzman equipped me with the primary ingredient I needed to serve up a type of art media clickbait that we’re all familiar with.

Activation of Michael Rakowitz’s Enemy Kitchen (2012–ongoing), with the artist at left, on the MCA’s plaza, October 1, 2017. Photo by Nathan Keay, © MCA Chicago.

The recipe is simple:

This is not a particularly hard thing to pull off. Practically any smart kid at a college newspaper could do a decent job of it. Hell, you could probably feed the raw material into an algorithm and get 80 percent of the way to publication.

So I did that reporting. I have those quotes. I could have written that story.

But I’m not really into executions without trial. So I went back to Schwartzman a few days ago with a set of follow-up questions informed by the commentary I’d gotten back from sources in other sectors of the industry—all of them forced to operate from only the specter of top-down havoc conjured by Schachter’s rumor, Schwartzman’s lyrical non-denial, and my own curiosity.

What resulted was a long conversation about the perils of the 21st-century art market, its deep-seated (and potentially self-harming) fear of change, and a couple of low-key revelations that meaningfully alter the context of both the original rumor and AAP’s intentions for the gallery sector.

Allan Schwartzman at the FAIR VALUE panel discussion at the 2014 Armory Show. ©Patrick McMullan. Photography by J Grassi/Patrickmcmullan.com.

This time, Schwartzman did not half-step on the central issue. “We are not offering advisory services to galleries for a fee or not for a fee,” he told me, “though when colleagues and friends in the gallery business informally seek my advice, I give, just as I always have.”

He also offered a few facts that brought the roots of the gossip into better focus. According to Schwartzman, AAP was not attempting to impose influence on the primary market of its own volition. Instead, two separate galleries asked AAP to make advisory proposals for their own businesses.

“One was a healthy gallery in the middle market,” he explained. “I didn’t feel that AAP could fulfill their needs, and so we did not move forward with a consultancy.” As for the second proposal, Schwartzman said he was “not at liberty to discuss” the details. “But both parties concluded it was not feasible to move forward with what AAP had been asked to propose,” he said.

This whole story would be much simpler to write if AAP, a subsidiary of one of the two dominant auction houses, voluntarily decided to offer paid advice to struggling galleries. Then I could just dress up Schwartzman’s firm in a werewolf suit and treat them as a nightmare predator stalking the increasingly winner-take-all art market for the wails of the injured.

And the story would get even more sinister (and potentially more viral within the trade) if I were to assume that no legitimate barricades separate AAP from its parent company—a common and, as Schwartzman insisted, inaccurate portrayal. “There is an operational separation, contractually based, between the two [companies],” he emphasized. “Only a few people from the legal and compliance departments have access to AAP’s data and that of our clients. I have responsibilities both running AAP and within Sotheby’s.”

But what do we do with the apparent fact that multiple galleries—one of which Schwartzman judged to be in fine shape—instead approached AAP looking for answers?

On one hand, this sequence of events speaks to the split personality of the 21st-century art market. Schwartzman readily acknowledges as much, in terms that sound like they could just as easily come from the wariest midlevel gallerist. “While large parts of the market are challenged,” he says, “others are not only doing well but growing rapidly. In the process, we are facing the likelihood of a kind of Darwinian genocide.”

On the other hand, it’s also a testament to the newfound fluidity of the market that galleries have sought solutions—seemingly, to very different questions—from an advisory firm owned by a major auction house. The old boundary lines have been blurring for some time now, and it’s telling that the players coming away with their hands smeared in chalk are not always just the biggest names.

Which leads us back to the operative question: Based on the demonstrated demand, as well as Schwartzman’s assessment of the overall ecosystem, is AAP at least considering getting involved in the gallery sector somehow, someday?

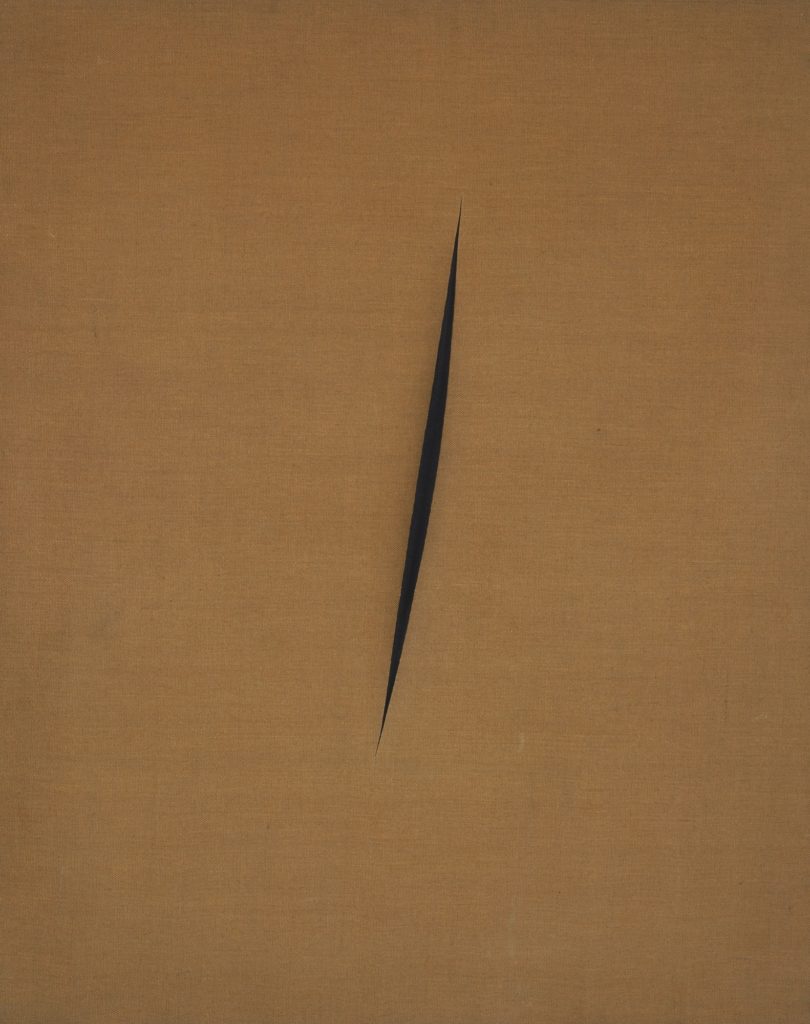

Lucio Fontana, Spatial Concept: Expectations, 1960. Courtesy of MoMA.

When asked to elaborate on the firm’s plans in this regard, Schwartzman emphasized that much more work needs to be done—and that he was effectively only talking about this subject at all because the rumor mill had forced his tongue.

“Since I come from a background of incubation and development for artists and the market that supports them, I’m at a very early stage of trying to think through a new model that can help support some sections of the middle market that are currently highly challenged,” Schwartzman said. “It is premature to discuss at this stage. But what I am attempting to do is not what was reported.”

Schwartzman went on to say that he thinks of what he is now trying to develop at AAP as a “laboratory” with the capacity to “offer fresh models for the field that hope to address imbalances and needs for the system.” He projected that the firm would be prepared to speak publicly about these initiatives in the next six to eight months.

“This in-development effort is not about growth for growth’s sake,” noted Schwartzman. Nor do he and his colleagues see their “exploration of new services” as tainted by their relationship with an auction powerhouse like Sotheby’s.

“It is a natural knee-jerk reaction for people to say, ‘You can’t do that. It is a conflict of interest,’” he says. “But, honestly, that response is becoming pat and tiresome.” Besides, where traditionalists see heresy, Schwartzman sees opportunity.

Allan Schwartzman, Jill Kraus, Sean Kelly at the FAIR VALUE panel discussion at the 2014 Armory Show. ©Patrick McMullan. Photography by J Grassi/Patrickmcmullan.com.

The grand irony of this situation is that many, if not most, of AAP’s critics could hardly agree more with the assessment driving Schwartzman down these still-foggy alternative roads.

“In the process of becoming an industry,” he says, “the [art] business forgot that it is not simply another business, but a place where the parts of the system that nurture artistic development sometimes need to be supported.” In other words, in a manic pursuit of growth and professionalization, too many people tried to treat art as just another product market, where the few best providers can annihilate the rest of the field with no ill effects.

In this environment, Schwartzman says, “You can either let the magnetic pull of the market in its current concentrating state play out a kind of brutal sorting system that seems to be happening, or you can try to nurture and sustain the markets for some of the artists and the galleries that serve them.”

To me, this is the same sentiment as the one motivating proposals for everything from art-fair “taxes” to more holistic market-wide cooperation. Rather than the “haves” of the art industry raiding the henhouses of the “have-nots”—or at least turning a blind eye to the brutality playing out there—those in favorable positions have the option, if not the responsibility, to play guardian for the good of the overall ecosystem.

Obviously, it’s impossible to know how AAP’s campaigns into the primary market—no matter how well-intentioned—might reverberate through other portions of the market at this stage. And the day I stop counseling people to ask hard questions about what’s ahead will be the day I start styling my hair with leftover cooking grease.

But in these troubled times, the question we sometimes have to ask is what matters more: a potential solution, or the identity of its source?

For my part, I think we in the art world should adopt the same goal that investor and philanthropist Ray Dalio developed to guide his firm: establishing “a meritocracy of ideas in the pursuit of meaningful work and meaningful relationships, accomplished through radical honesty and radical transparency.” In short, best idea wins, regardless of who voiced it.

Dalio would be the first to tell you that every meritocracy of ideas is built on a graveyard of flawed suggestions and fragile egos. Maybe AAP’s still-gestating gallery initiatives will deserve a plot inside that same cemetery. I promise I’ll keep my shovel nearby when the time comes, just in case.

But if we’re genuinely concerned about the big picture, it’s only fair to reserve judgment until the firm’s concepts are actually ready for review. Until then, we’d just be taking up arms against ghost stories—and possibly killing positive change in the crib at the time we most need new perspectives to flourish.

That’s all for this week. ‘Til next time, give peace a chance—but don’t let your guard down, either.