Auctions

Christie’s Pulled In $202 Million at Its 20th/21st-Century Sales in London—But Not Many Buyers Went Big

Two back-to-back evening sales set the tone for the market year ahead—resilient if not spectacular.

Two back-to-back evening sales set the tone for the market year ahead—resilient if not spectacular.

Naomi Rea

Despite a tumultuous economic environment and the onset of yet another winter flu taking many people out of commission, Christie’s energetically kicked off London’s auction week today with two back-to-back evening sales bringing in £167.8 million ($202.2 million).

The sales total falls within the house’s presale expectations of £128–190.3 million ($154.3–229.3 million), though not quite as handily when you account for the fact that final sales figures reported by the house are inflated by auction house fees, whereas the presale estimates are not. The final hammer price of the night, £137.9 million ($166.2 million), conveys a more accurate picture of how things went—an unspectacular but still not entirely discouraging result. (We will stick with hammer prices tonight, unless otherwise noted.)

To offer a direct sale-to-sale comparison, Christie’s equivalent sale last year—a 20th and 21st-century relay sale between Shanghai and London, also with its The Art of the Surreal sale as a coda—brought in just over £249 million ($334 million) after fees. This year’s takings are down 32.6 percent on that.

The sale room at Christie’s 20th/21st century evening sale on February 28. Photo courtesy Christie’s Images Limited 2023.

As is now fairly typical, the “evening” sale was timed at 2 p.m. in order to take advantage of London’s situation as a central nexus of timezones, and be convenient for buyers in New York and Asia. As is now commonplace as well, there were plenty of cameras conveying the action to those unable to be in the room.

The atmosphere going into the sale was a little manic, as specialists crowded around the phone banks on both sides, though the sale room was also buzzing and fuller than we have seen in London for a while. One of the attendees smirked at the theater of it all, remarking “it all happens on the phones anyway,” but was swiftly proven wrong as there was bidding action from the auction house floor throughout the sales (and indeed the final lot of both sales landed to bidders present in the room).

The attendance was not surprising as this week in London represents the first public market test of the year in an increasingly rocky financial environment. The war in Ukraine has now passed the one-year mark and China’s Covid policies are still wreaking havoc further east. It feels longer than ever since the New York auctions last fall, and while the $1.5 billion sale of the collection of the late Microsoft cofounder Paul Allen in November left specialists in a mood of tentative optimism that the event would inspire confidence in the market, many market watchers anticipated that the Allen sale would be a sort of final hurrah. Meanwhile, London has so far managed to stave off a recession, but the consensus is that it, along with the rest of the global economy, is still sputtering towards one.

All told, 106 lots were offered across both sales after three lots were withdrawn, wiping between £4.6 million and £7.8 million ($5.5 million and $9.4 million) off the slate. Specialists grafted extra hard ahead of the sale to secure a whopping 27 guarantees, three of which were made by the house, 24 by third parties. Six records were set; 12 works failed to find buyers, of which 10 were within the main sale, two in the Surrealist portion of the evening, making for a sell-through rate of 89 percent by lot, 91 percent by value across both sales.

Alberto Giacometti, Chandelier for Peter Watson. Photo courtesy of Christie’s Images Ltd 2023.

It was fairly obvious that material had been a challenge heading into the 20th/21st century sale, despite the fact that the house worked hard to find fresh-to-market works that would excite-to-buy; 66 percent of the 20th/21st century evening sale had never been offered for public sale before. Speaking to Artnet News ahead of the sale, one London art advisor remarked that the material the house was able to cobble together was a reflection of the recession climate the market is navigating: “It’s all very safe and just exciting enough,” she said, adding snarkily that she expected it will “do well with the interior designers!”

To wit, there was an unusual amount of sculpture in this sale (nine lots), including a remarkable Giacometti chandelier being sold by relatives of the artist John Craxton, whose eyes nearly popped out of his head when he spotted it for sale for just £250 ($700) in an antiques shop in Marylebone during the 1960s. The lot paid dividends for the house, bringing in a whopping £2.4 million.

Another notable sculpture was a primitive Baseltiz carving from the Hess Art Collection in Switzerland, the 1994 Frau Paganismus (Mrs Paganism). It was likely consigned in response to the market, as another Baselitz sculpture achieved the $11.2 million record price for the artist at Sotheby’s New York last May. This one came in below its £4 million ($4.8 million) low estimate to hammer at £3.8 million ($4.5 million).

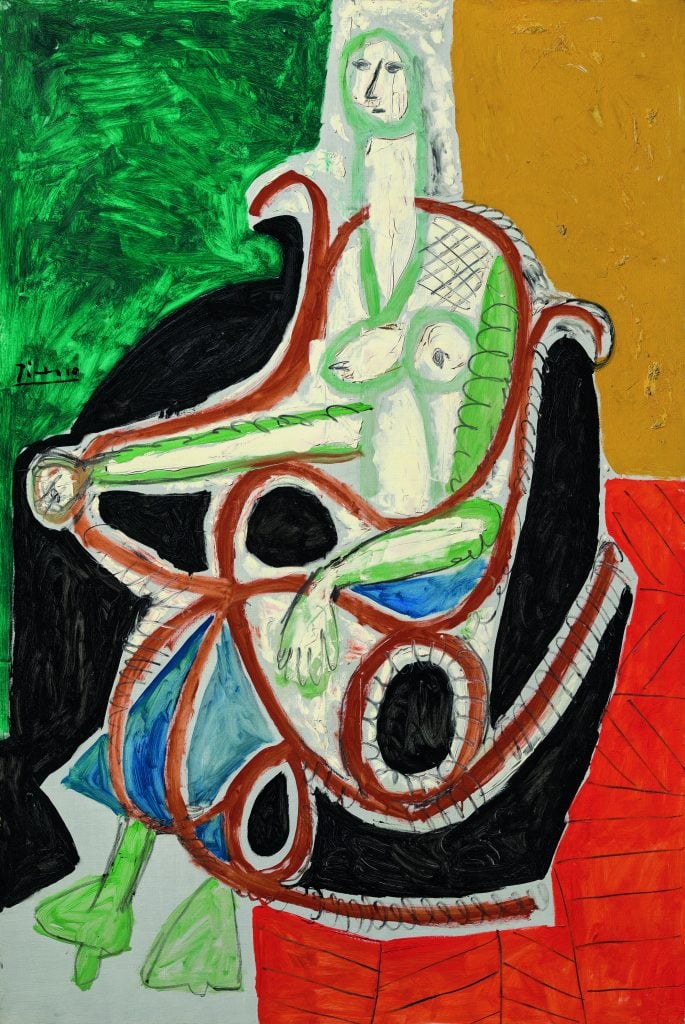

Pablo Picasso, Femme dans un rocking-chair (Jacqueline) (1956). Photo courtesy of Christie’s Images Ltd 2023.

Marking the 50th anniversary of Pablo Picasso’s death, the top lot of the evening was the artist’s large-format late portrait Femme dans un rocking-chair (Jacqueline) (1956, estimate: £15–20 million, $18–24 million). In a sign of the times, it hammered below estimate at £14.5 million ($17.4 million) on just one bid to Impressionist and Modern specialist Giovanna Bertazzoni, who was very possibly bidding on behalf of its third-party guarantor.

Those watching London for insights on what’s to come as the season progresses to Hong Kong and New York might be curious to see if the market for ultra-contemporary artists has withstood the economic downturn. The speculative segment has been cooling down as buyers fly to artists whose markets are more tried and tested. After rocketing 500 percent in sales in five years, the category’s growth slowed and by the end of last year, total sales had declined 10 percent year-over-year, per data from the Artnet Price Database.

The sale was front-loaded with ultra-contemporary lots, opening on Michaela Yearwood Dan’s Love me nots (2021, estimate: £40,000–60,000, $48,092–$72,138). The artist’s prices soared to $388,798 at Phillips in December, and a new record was set in the sale room today when the work hammered at £580,000 ($753,800)—buoyed with fees to £730,800 ($879,956), and landing with a bidder on the phone with Tessa Lord.

Continued frenzy was also exhibited for Caroline Walker, whose works are hitting the block at all three of the main houses this week, with 10 telephone bidders chomping at the bit and a cluster of bids raising the hammer price to £550,000 ($661,265), easily beating her £200,000 ($240,460) high estimate.

But erstwhile market stars whose estimates have caught up with their hammer prices didn’t do as astonishingly well as they have in the past couple of years. A Louise Bonnet and Robert Nava hammered within estimate without fireworks. An Adrian Ghenie “pie fight” study hammered below the £280,000 ($336,644) estimate, on a single bid.

NFTs were represented in the sale with the auction debut of Tyler Hobbs, who was a breakout in the NFT mania in 2021, and whose market has also survived the crash (he is opening a solo exhibition at Unit London next week before a solo outing at Pace in New York next month). Hobbs was represented by one of his best known “Fidenza” works, a series of 999 algorithmically produced and randomized grids of color that find predecessors in Mondrian and Agnes Martin as much as in the early computer-plotter art of generative pioneers such as Vera Molnár. The floor price for “Fidenza” works this morning was 72 ETH, or £96,587 ($116,752), and the lot hammered well above that, though still within estimate at £290,000 ($348,667).

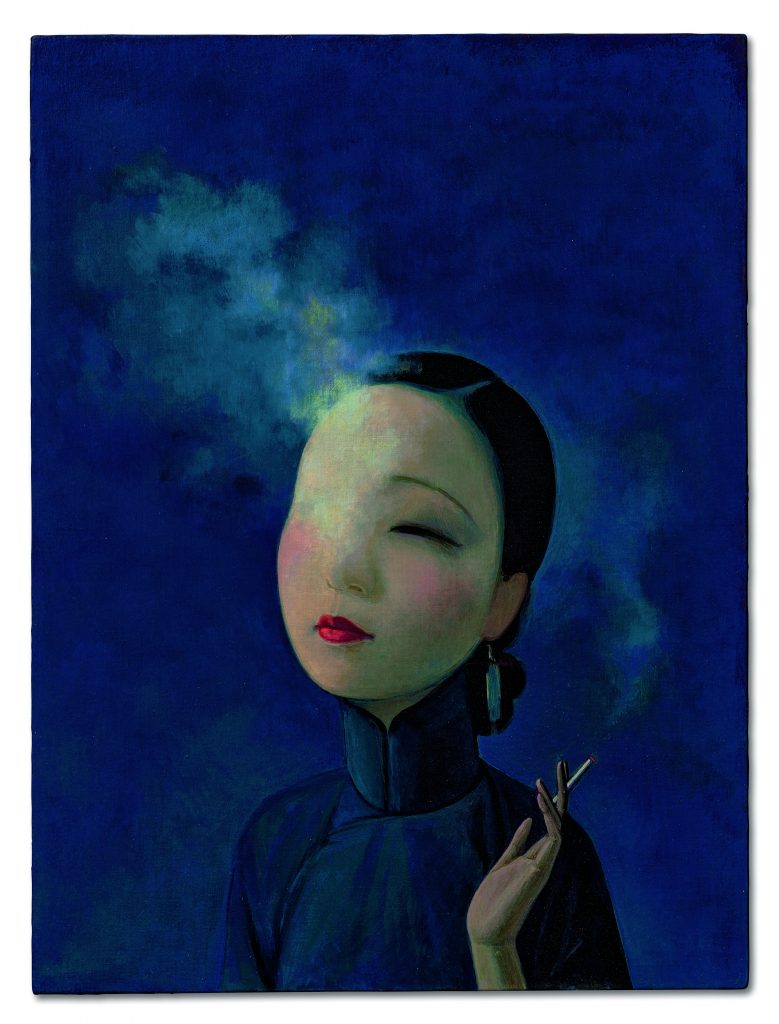

Liu Ye, The Goddess (2018). Photo courtesy of Christie’s Images Limited 2023.

Choruses of applause came a few times during the sale: First, when a flurry of interest, mostly from Asia-Pacific region specialists, ignited a protracted bidding war for Liu Ye’s 2018 painting, Goddess. When one bidder failed to secure it against Hong Kong-based specialist Elaine Holt’s £2.6 million ($3.1 million) winning hammer bid, he was heard sulkingly consoling himself with the fact that he may soon have another opportunity when David Zwirner (he heard) brings one to Frieze.

More claps erupted on the sale of an early Van Gogh painting of one of his few named sitters, Gordina de Groot, which has been in the same collection for 120 years. The work attracted some fiery competition and ended up hammering at at £4 million ($4.8 million), double its high estimate, to an irascible bidder in the room who we can identify as London collector and dealer Danny Katz. He implored auctioneer Jussi Pylkkänen, who was milking the sale, to “put the bloody hammer down!”

Mixed results came in for German Modern and Impressionists. Two Ernst Ludwig Kirchner paintings with a combined low estimate of £4 million ($4.8 million) failed to find buyers, as did an Erich Heckel painting, and Edgar Degas’s Trois Danseuses (est. £3–5 million, $3.6–6 million).

Someone scored a deal on a provocative Otto Dix watercolor, which hammered at £200,000 ($240,460), less than half its £500,000 ($601,150) low estimate. It was sad day, too, for Chaim Soutine, whose Expressionist painting, Femme assise dans un fauteil, was also a pass, eaten up by the house, which had guaranteed it.

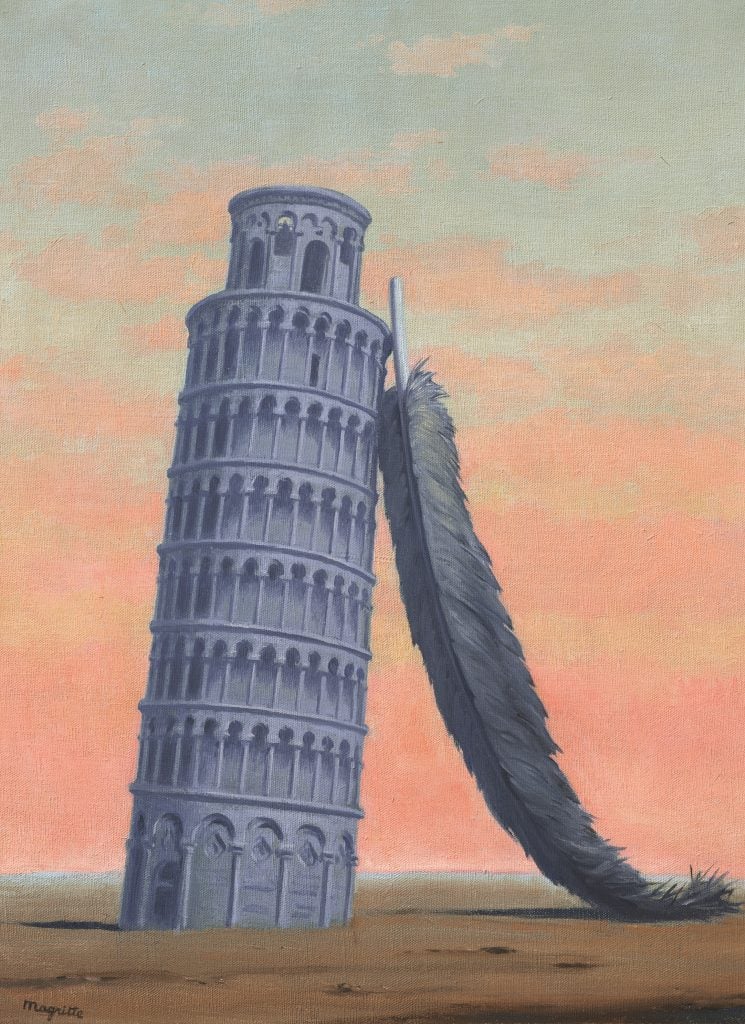

René Magritte, Souvenir de voyage (1958). Photo courtesy of Christie’s Images Limited 2023.

After a short break, the main evening sale was succeeded by the house’s Art of the Surreal evening sale. Of the 32 lots, everything sold except for a Dalí painting on board and a Hans Arp sculpture, which carried a combined low estimate of £2.8 million ($3.3 million). The higher, 94 percent sell-through rate is unsurprising given Surrealism is riding off the interest rekindled by its role in the 2022 Venice Biennale.

Strong results came in for works by René Magritte. His Souvenir de voyage, part of a grouping of 25 works anonymously consigned by collectors Gary and Kathie Heidenreich (who were identified by Artnet News). Their Surrealist collection focused on exiled and women artists began after having lunch with Leonora Carrington in Mexico with their advisor Wendi Norris. The work, which last sold publicly in 2009 for $1 million at Sotheby’s, blew past its £3.5 million ($4.2 million) upper bound to hammer at £4.6 million ($5.5 million).

London has proven itself to be a good place to bring a Magritte—not least since Sotheby’s decamped its own Surrealism sale to Paris. This time last year, the rival house netted a £59.4 million ($79.8 million) record for a Magritte masterpiece. To wit, another Magritte—not part of the Heidenreich consignment but a dreamy skybird motif backed by a third-party guarantee—hammered within estimate at £5.1 million ($6.1 million).

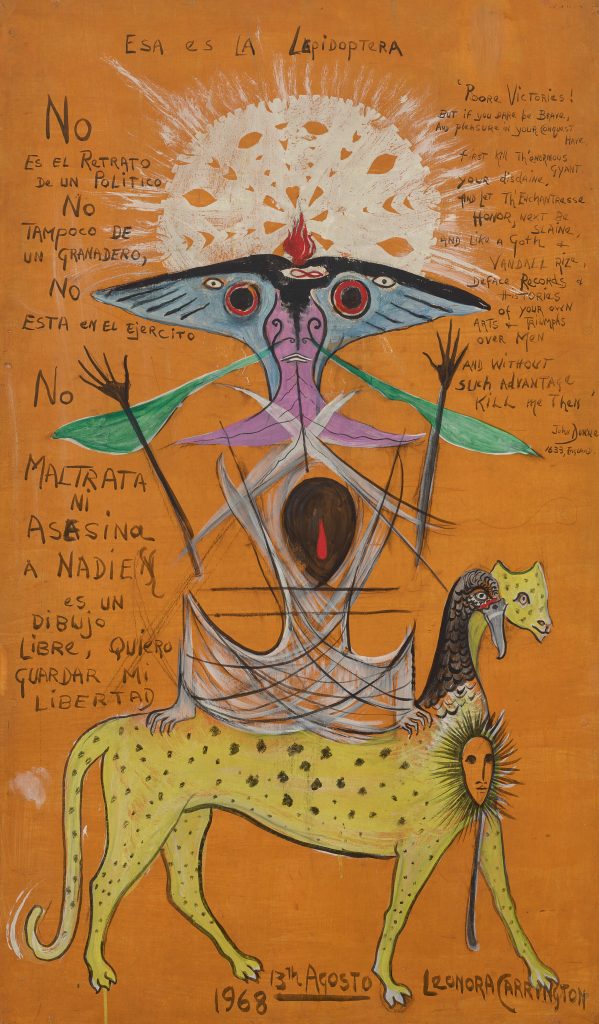

Leonora Carrington, Lepidoptera (1968). Photo courtesy of Christie’s Images Limited 2023.

A flurry of bids came too for Leonora Carrington’s colorful orange Lepidoptera, one of her few overtly political works, driving it to £460,000 ($553,058), nearly double its high estimate. Carrington’s market has been on the rise, riding off the 2022 Venice Biennale and a new $3.25 million auction record set in Sotheby’s last May.

Anyone who sat through to the end of this 4.5-hour sale marathon was rewarded with a bit of light entertainment, as the second auctioneer, Impressionist and Modern art specialist Veronica Scarpati, desperately worked to secure a £560,000 ($673,288) bid from billionaire collector David Nahmad, sat in the front row, for an Yves Tanguy painting that had been estimated to fetch £900,000–1.5 million ($1–1.2 million), but had failed to excite the room.

The sale closed on a £280,000 ($336,644) Joan Miró painting, which hammered to a bidder in the room, and auctioneer Pylkkänen’s proclamation that “the art market is alive and well.” If this sale is anything to go by, he’s not wrong. While the market may be sputtering a little, no one is turning their engines off just yet.