Market

How Are Emerging Art Dealers Dealing With the Gallery Crisis? We Asked a Dozen of Them at NADA

Sales were fast and furious on opening day of NADA Miami Beach. So why are dealers still so nervous?

Sales were fast and furious on opening day of NADA Miami Beach. So why are dealers still so nervous?

Julia Halperin &

Tim Schneider

It’s undeniable that the gallery sector is a different place in December 2018 than it was in January. Throughout this year, galleries worldwide have shuttered, dealers have vocalized their mounting discontent with the hamster-wheel art-fair system, and a small number of top-tier galleries have continued to hoover up a growing number of prominent artists and estates.

Art Basel Miami Beach’s heavy hitters ended the year with a largely status-quo vibe—but then they also happen to represent the extreme top end of the market. Do their emerging-market counterparts at NADA Miami share the general sense of stability? Day one of the fair was a natural opportunity to find out.

At first blush, the stresses of the so-called “gallery crisis” seemed remote during NADA Miami’s opening hours. The aisles were packed with fairgoers, and early sales came in at a fast clip for many of the 106 dealers.

By the end of the day, for example, Chicago gallery Shane Campbell had sold six drawings by Elliott Hundley ($2,700 each) and a sleek blue abstract painting by Anthony Pearson ($30,000), among other works. New York dealer Rachel Uffner sold a number of charming, unvarnished ceramics by Joanne Greenbaum priced between $5,000 and $8,000, as well as several photo-on-glass works by Sara Greenberger Rafferty for $7,000 each.

But after consulting with about a dozen dealers at the fair, it became clear that the veneer of positivity inside the booths came either despite, or perhaps because, the shifting sands of the industry had compelled several sellers to make major changes to their business models in the preceding 12 months.

Those changes took a variety of forms. Yet individually and collectively, the actions speak to the fact that many smaller dealers have given up on the idea that art fairs and short-term gallery-share initiatives like Condo would be enough to keep them ahead of the hurricane for much longer. Something bigger is afoot.

And since one of the primary factors separating NADA members from their blue-chip cousins is simply the size of their prices (and associated profit margins), it’s possible that we can use NADA Miami to apply sci-fi author William Gibson’s famous adage to the gallery sector as a whole: The future is already here—it’s just not evenly distributed. If so, then you can find some of the key business trends of that future below.

Asked to articulate how his business had changed in the past year, dealer Simon Preston barely missed a beat. “Well, I don’t have a space anymore,” the British-born, New York-based dealer replied. After 10 years on the Lower East Side, Preston opted not to renew his lease when it ended in May. Instead, he rented a small office and viewing room month-to-month.

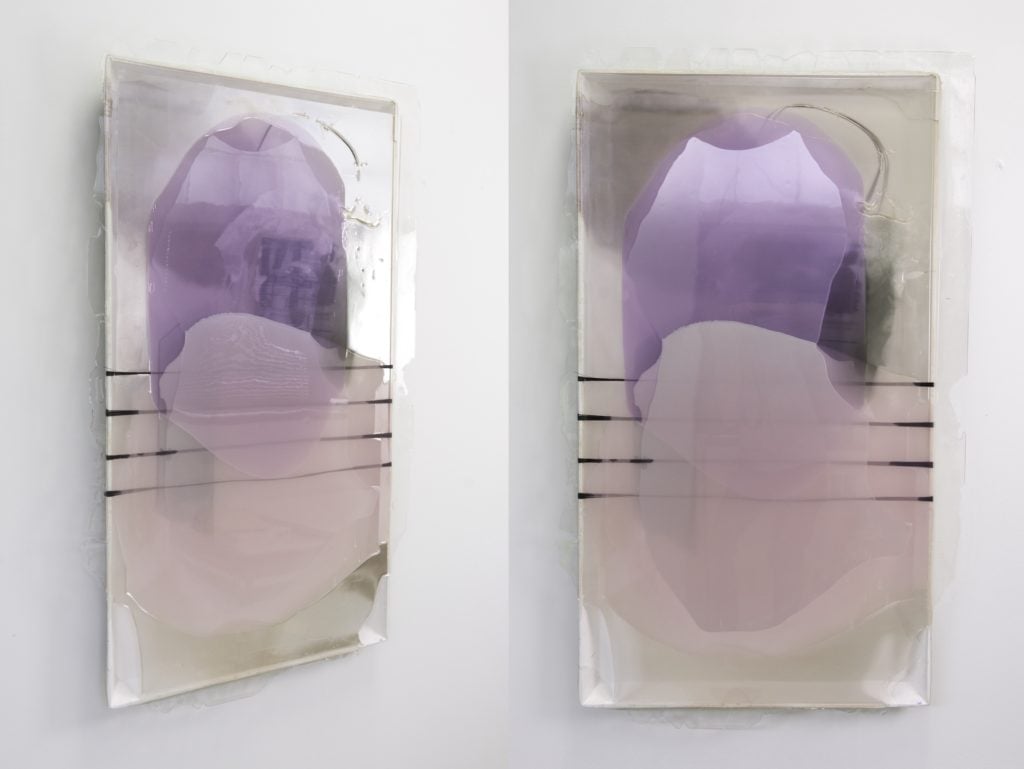

Josh Tonsfeldt, Untitled (2018). Courtesy of the artist and Simon Preston Gallery.

One factor, he says, was the precipitous drop in foot traffic to the gallery, which dovetailed with a desire to reduce overhead. “I thought, ‘This is my way to take my woes and turn them into opportunities.’” Preston has since begun to collaborate with other dealers to present shows of work by artists he represents while searching—at a less than frantic pace—for a new space.

During NADA’s opening day, Preston sold two painted flat-screen television screens by Josh Tonsfeldt for $22,000 and a Matisse-inspired painting by Nick Goss for $40,000.

The stigma attached to being without a space is steadily evaporating, he notes. “If I said I was closing the gallery a year ago, people would have gasped. Now, no one blinks.”

In a year characterized by a proliferation of short-term gallery-share initiatives, it is unsurprising that a growing number of dealers at NADA opted to share booths in order to maximize exposure while cutting costs.

“The market has to find some ways to cooperate to survive,” says the Polish dealer Dawid Radziszewski, who participated in two Condo events and a new Warsaw-based gallery share program called Friend of a Friend this year. At NADA, Radziszewski presented witty sculptures of faces made out of shells, clams, and coral by the Polish artist Katarzyna Przezwańska ($1,700–4,000) in a booth he shared with fellow Polish dealer Wschód.

Installation view of Katarzyna Przezwanska at Galeria Dawid Radziszewski.

A similar spirit of collaboration is behind the partnership between the New York galleries Sargent’s Daughters and Shrine, whose shared booth at NADA was only an offshoot of their grander decision to permanently share a brick-and-mortar gallery space as of this past summer.

Scott Ogden, the founder of Shrine, was looking for something bigger than his closet-size 240-square-foot space on Henry Street in New York, while Allegra LaViola of Sargent’s Daughters was considering giving up her spacious gallery on the Lower East Side. After first meeting at the opening for the Met’s “Souls Grown Deep” exhibition in May—a show that crystallized their mutual interest in works by self-taught artists—the duo decided to split the lease, renovated, and reopened as a two-gallery shop in early August.

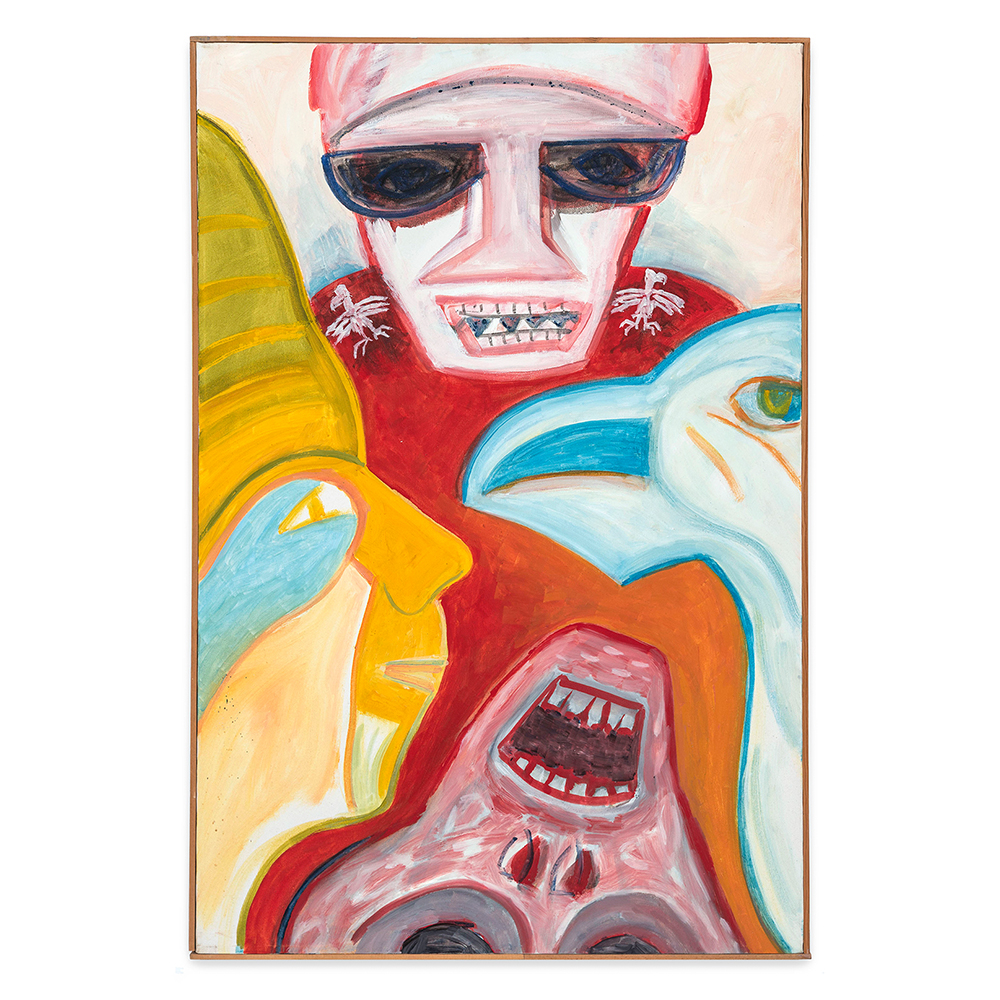

At NADA, the duo is presenting a multi-artist group of work anchored by the late painter, ’60s-era East Village expat, and ahead-of-his-time social-justice thinker Hak Vogrin (priced between $4,000 and $10,000), whose estate they began working with after a family friend of the artist walked into the gallery unannounced with images of the works. A joint exhibition of paintings by Vogrin is on view at the gallery as, in Ogden’s words, “a full-building retrospective,” through January 6.

Hak Vogrin, Death Officer with Auk (ca. 1980s). Courtesy of Shrine NYC and Sargent’s Daughters.

For both dealers, the collaboration has felt reinvigorating. “I really wish all the headlines lately weren’t so doom and gloom. Obviously there’s pressure just like always,” LaViola says. But people are figuring things out. “Not to sound like a hippie on a commune, but a lot of it is just about being open to community”—though perhaps, she admits, in a longer-term or more full-bodied way than in years past.

For at least one dealer, the best way to stay in the game was to move away from the action.

After running an eponymous gallery in Los Angeles for four years, Tif Sigfrids decided to do something dramatic: She picked up and moved her gallery to Athens, Georgia earlier this year. She now operates a shared gallery space with close friend, artist, and Athens prodigal son Ridley Howard inside a former retail shop in the legendary music city and college town’s main district. Sigfrieds says their rent for the year is less than the cost of participating in one art fair.

A less frequently-recognized bonus of the move outside a major art-market hub: Sigfrids is able to continue to work with emerging artists as they become more established and move onto larger galleries, because she is not competing with anyone for representation in the same city. At NADA, for example, she presented work by rising star and pastel painter Mimi Lauter, who recently joined Blum & Poe in Los Angeles. (The blue-chip gallery sold a massive yellow pastel painting by Lauter at Art Basel in Miami Beach for around $40,000.)

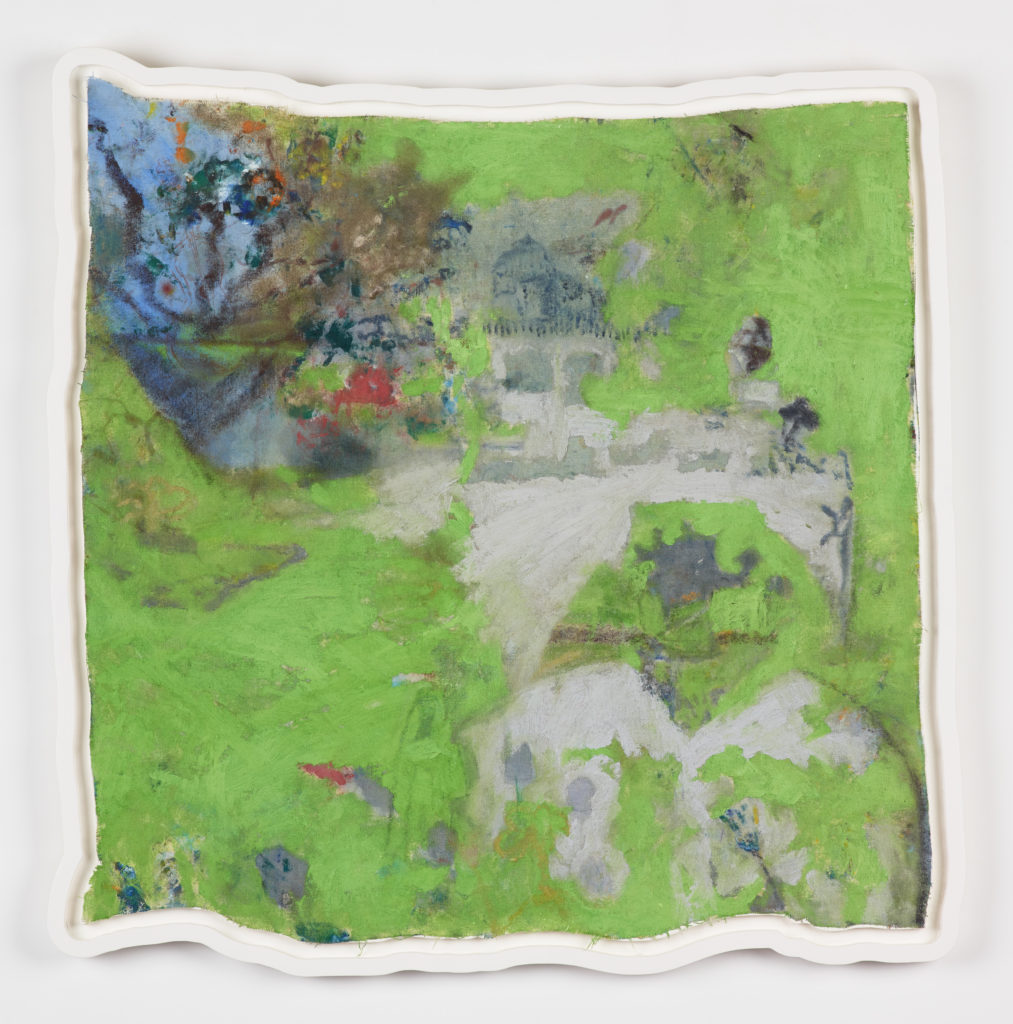

Gracie DeVito, Zigzag Wanderer (2018). Courtesy of Tif Sigfrids.

“Moving the gallery to a small Southern town sounded like an absurd storyline, but I went with it anyhow,” Sigfrids says. The low overhead in Athens “makes the whole thing seem more flexible…. Having new sets of challenges and a new context for looking at art has made the whole project more interesting.” Whether her geographical transition will inspire others to abandon the coasts will be a question worth watching.

Several dealers said the biggest change they’ve witnessed over the past year has been the growing centrality of Instagram. Although collectors and dealers have been buying, selling, and discovering art on the platform for years, some say it has become a bigger and bigger part of their business’s identity—for better or worse. “People were saying, ‘I loved that show—that I saw on Instagram,’” recalled Simon Preston.

The New York dealer Jack Hanley, who sold a number of Cubist-inspired paintings by Danielle Orchard for $8,000, among other works, said more people now pay more attention to his gallery’s Instagram than its emails or newsletters. “A year ago we didn’t pay too much attention to it,” he said. “Now we’ve found a couple artists on Instagram, and made a few sales.”

Similarly, Francesco Lecchi, director of Milan gallery Clima, noted that the photo-sharing app has become “fundamental” to his business. By providing an unmediated, simple, and ever-present line of communication with collectors, Instagram has even allowed the gallery to propel conversations begun with wary collectors at fairs into finalized sales back inside the gallery at a later date, showing how technology may actually be best at building bridges between sales channels rather than replacing them outright.

A number of dealers are also fundamentally altering their business models in order to ensure longevity.

Los Angeles gallery the Landing announced in October that it would transition from being a project space to representing artists and estates. Founder Gerard O’Brien says the main motivation for the shift was the excitement of constructing a team to help build entire careers for special talents they were lucky enough to work with (like artist to watch Yevgeniya Baras).

But the dealer says he primarily sees himself as a storyteller. Growing a gallery means growing the number of stories you can tell, and in the art market, good storytelling is good business.

Meanwhile, Damîen Bertelle-Rogier of the Brussels gallery Super Dakota, which specializes in emerging artists, opted to begin incorporating established artists and secondary market material into his program. “The emerging market has slowed down a lot compared to top tier,” Bertelle-Rogier said.

Installation view of Super Dakota’s booth at NADA.

The shift wasn’t easy: Bertelle-Rogier had to raise capital in order to build up secondary market inventory and hire additional staff members to maintain relationships with the gallery’s younger artists. But he is confident that hedging his bets was the right decision. At NADA, he sold a painting by the more established artist Julia Wachtel, with whom the gallery began working earlier this year.

Bertelle-Rogier isn’t the only one who is noticing a more judicious pace among emerging art collectors. “People are taking longer and being more deliberate—which is fine with me,” says Julia Fischbach of Chicago’s Patron Gallery.

Installation view of PATRON Gallery’s booth at NADA in Miami.

The gallery is re-evaluating its strategy in order to match the market’s new pace. After participating in 13 art fairs in two years, it plans to think outside the booth in 2019. In lieu of a number of fairs, Patron plans to rent out pop-up spaces for shows in New York and Los Angeles around three times a year.

The first of these—a presentation of work by Greg Breda and Myra Greene—will take place in New York in March 2019 to coincide with the Armory Show. These projects are “a fraction of the cost of an art fair,” Fischbach says, and allow her artists to have exhibitions in hub cities without the gallery having to open new brick-and-mortar spaces.

(Whatever the case about a new and more deliberate pace among the gallery’s collectors, they aren’t all being that slow: By the afternoon of the VIP preview, Patron had sold multiple works by every artist it brought to NADA.)

Dealers are not unified in their outlook on 2019. Some are convinced the market is headed for contraction: “We’re all stuck on a train that is going really really fast and there is a wall coming at us,” says Damîen Bertelle-Rogier. Others are more sanguine. But everyone seems to be in agreement that the traditional gallery model is no longer viable.

“Generally speaking, it’s not business as usual,” noted the New York dealer James Fuentes, who sold more than 10 works by the outsider artist Purvis Young at prices ranging from $1,000 to $30,000. “What I’m fighting for is the right to have a mom-and-pop shop in New York City.”

Nevertheless, he still feels more hopeful now than he did at this time last year. “Maybe,” Fuentes said, “it’s because I got through another year.”