Analysis

At Hong Kong’s Latest Round of Auctions, Work by Western Artists Reached a New High

Sales topped $260 million during the October auction week, with western artists tripling their previous total.

Sales topped $260 million during the October auction week, with western artists tripling their previous total.

Tim Schneider

Although you could be forgiven for thinking otherwise, Banksy’s remote-controlled theatrics at Sotheby’s London weren’t the only auction developments worth tracking this month. A quick look at the data from Sotheby’s and Christie’s most recent fine art sales in Hong Kong suggest that the regional market for Asian and western works alike took a leap compared to Octobers past.

That leap reveals some important lessons about where the region’s market is headed. In short, the market is looking increasingly top heavy (not unlike most major art markets) and increasingly interested in the work of western artists. Work by non-Asian names garnered nearly triple the amount it generated during the equivalent period last year.

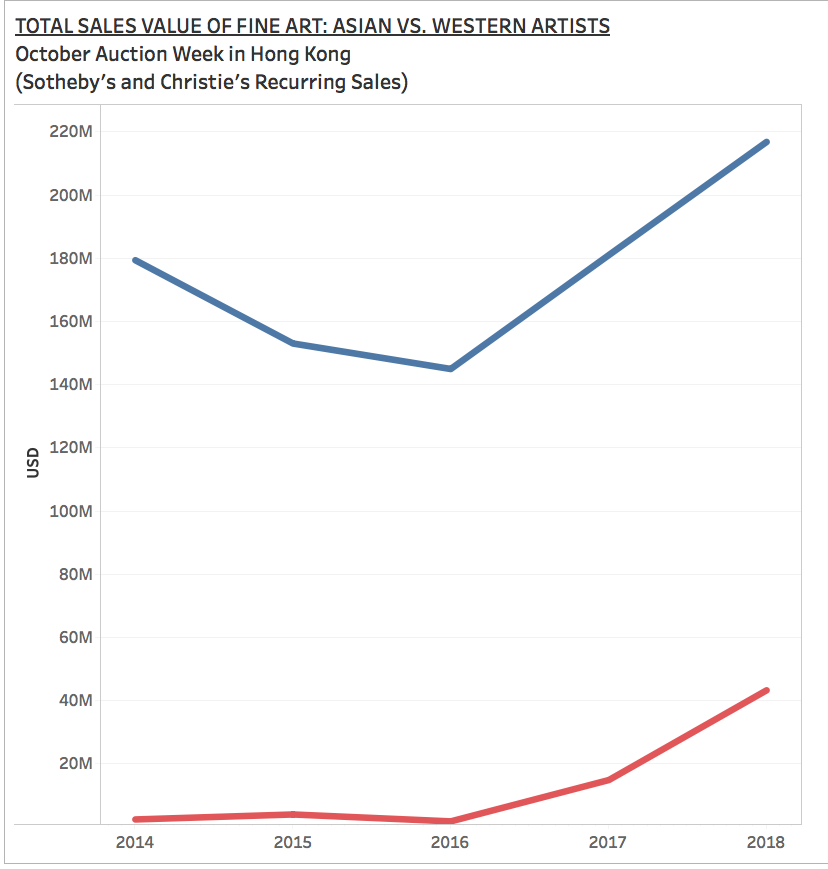

Below is a chart showing the total sales value for fine art lots purchased at Sotheby’s and Christie’s Hong Kong during recurring sales held between September 30 and October 8 over the past five years. (In other words, the data do not include one-off or limited sales, like works from the Speelman Collection at Sotheby’s in October.) This approach does not make the years uniform, but it attempts to minimize variation as much as possible.

As always, numbers come courtesy of the artnet Price Database and include buyers’ premiums unless otherwise noted.

Overall, fine art sales in this period reached a new high of about $260.7 million. The bulk of the activity here belongs to Sotheby’s, which holds a concentrated week of auctions in Hong Kong ending no later than October 8 every year. Christie’s hosts a handful of sales during that time, but it reserves its dedicated week of fall art auctions for late November.

The chart above shows the largest year-on-year jump in the sample period: a roughly $63.5 million increase from what was already a healthy rebound year in 2017. (Remember, the Chinese stock market crashed in the summer of 2015, so sales activity was generally depressed both that year and the following one.) The question, as always, is how much we can or should read into this leap.

Sotheby’s Hong Kong set two notable records during this sales cycle. The house pulled in over $200 million through its modern and contemporary art evening sales on September 30. That figure represents the largest cumulative total for its eastern outpost in a night of fine art auctions, and much of that success owes to the $65 million sale of Zao Wou-Ki’s colossal triptych Juin-Octobre 1985 (1985)—a new record for the artist at auction.

Notably, Zao’s work would single-handedly account for the entire year-to-year difference in total fine art sales value during this period. That isn’t a slight on either Sotheby’s or the health of the market. Quite the contrary. It means that, even if you took away the single heftiest lot sold in this period—the most expensive ever from one of the most consistently sought-after artists in the region—buyers would still have spent just as much on fine art in Hong Kong in 2018 as in the previous cycle.

This performance is particularly notable since stocks on China’s Shanghai composite index have been tumbling since January, and took an even more dramatic fall this week.

And in fact, we find another strong growth indicator if we parse the results between artists of Asian heritage and artists of western heritage.

Asian artists (who generated $216.8 million during this period) still proved dramatically more popular than western artists ($43.3 million) among Hong Kong’s buyers this October (as they were this spring). However, their respective increases in 2018 split relatively evenly, with Asian artists gaining $35.8 million versus western artists’ $28.4 million.

That’s a significant development on the westerners’ side of the ledger. Their collective sales value in the 2018 cycle is the highest ever in this period—again, almost triple their 2017 total. It will be worth watching the November sales at Christie’s Hong Kong to see if similar gains materialize. If so, this particular result will look less like a one-year anomaly and a little more like the first step in sustained progress for western artists in the region.

At the same time, we should keep in mind one number crucial to both of these boisterous charts: 972. That was the total number of lots sold to account for the big-money totals above, and it happens to be the fewest of any single October-centric cycle we surveyed at Sotheby’s and Christie’s Hong Kong.

The trend held for both Asian and western artists, too. The latter group clearly didn’t have any works ascend to the heights of Zao’s record-smashing triptych, but their two top lots—PIcasso’s Buste D’Homme Lauré (1969) for $7.8 million and Joan Mitchell’s Syrtis (1961) for $7.2 million—together brought Sotheby’s more than all western artists in this period last year.

All of which suggests this regional market is climbing on the backs of a handful of high-value artworks rather than growing from a broadening base, just as we’ve seen for years in other regions around the globe. And that should add a subtle note of caution to what is otherwise excellent news for major art sellers in the east.