The Art Detective

Revealed: The Biggest Consignors to This Week’s Spring Auctions, From a Blue-Chip Artist to a Financier Offloading 19 Works

We bring you the inside scoop on who is selling what.

We bring you the inside scoop on who is selling what.

Katya Kazakina

The Art Detective is a weekly column by Katya Kazakina for Artnet News Pro that lifts the curtain on what’s really going on in the art market.

While Sotheby’s won this auction season’s largest collection—Texas rancher Anne Marion’s $150 million trove—rival Christie’s had to put together its sales more or less lot by lot.

It was difficult. Christie’s had to reel in sellers with aggressive guarantees. One of the its biggest fish was private equity executive Thompson Dean.

In January, Dean, co-C.E.O. of Avista Capital Partners, put his 15-room Park Avenue apartment on the market, priced at $35 million (it’s since been reduced by nine percent). The spread was filled with art, including pieces by Gerhard Richter, Christopher Wool, and Richard Prince.

This week, many of these works are being sold at Christie’s auctions of 20th and 21st century art. Dean pledged 19 pieces to the auction house, according to a regulatory filing with the New York State Department of State.

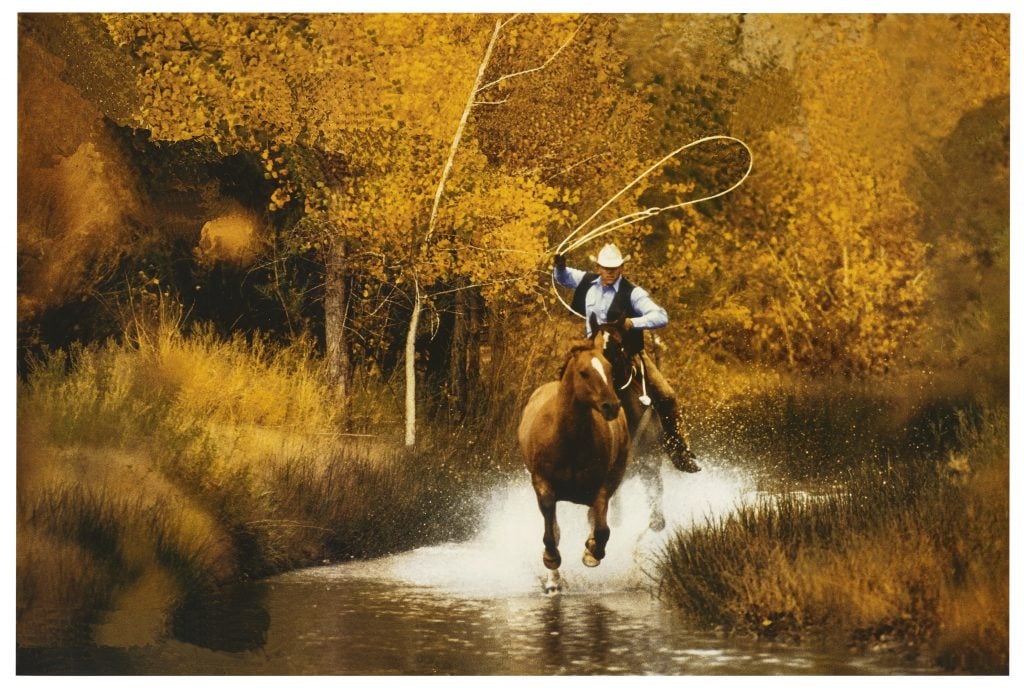

Richard Prince, Untitled (Cowboy) (2000). Courtesy of Christie’s Images, Ltd.

The blue-chip offerings include Warhol’s Marilyns, Richard Prince’s cowboys and nurses, and Christopher Wool’s text paintings. Consigned anonymously, the group is estimated at $38.6 million to $55.7 million, based on published estimates.

Dean is among several prominent unnamed sellers at auction this week. Giancarlo Giammetti, co-founder of Valentino fashion brand, parted with a prized Jean-Michel Basquiat (it soared to $93.1 million with fees, the second highest auction price for the artist). Megadealer Larry Gagosian is selling a massive Roy Lichtenstein. Billionaire Ron Perelman is offloading a Cy Twombly.

The auction houses declined to comment on the sellers’ identities.

These works arrive as the art market emerges from the pandemic, facing pent-up demand from the wealthy around the globe. Sotheby’s and Christie’s have $1 billion worth of art to test it.

“The strong prices really proved to me one thing,” art-industry insider Josh Baer wrote in his newsletter the Baer Faxt on Tuesday. “COVID made many wealthy people even wealthier over the past year and they are plunging deeper into the art market.”

Italian fashion designer Valentino Garavani (L) and Italian business man Giancarlo Giammetti (R) in Paris, 2019. Photo: Christophe Archambault/AFP via Getty Images.

So far, however, Dean’s collection hasn’t fared as well as Christie’s might have hoped.

Seven works included in Christie’s 21st century auction hammered for $14.8 million, under the combined low estimate of $26.7 million. Christie’s secured third-party backers for most of the works ahead of the sale; all but one ended up selling to these investors. Without substantial upside, Christie’s—which had shelled out a hefty sum to Dean in order to secure the consignment—may find itself in the red on the group.

The biggest disappointment was Wool’s painting spelling “OH OH” in signature bold text. Estimated at $8 million to $12 million, it didn’t draw a single bid.

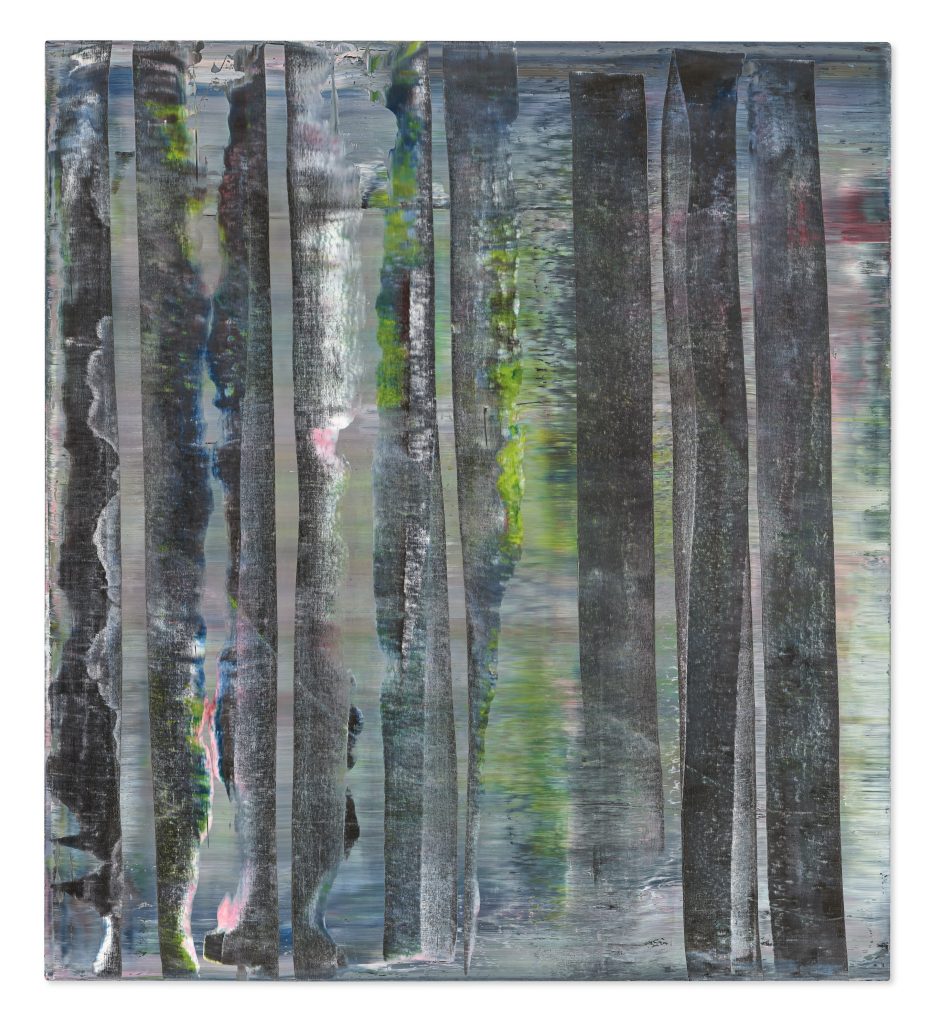

Richter’s Abstraktes Bild, estimated at $9 million to $12 million, ended up hammering for $5.8 million on a single bid by the third-party backer represented by evening sale head Ana Maria Celis. Lake Resort Nurse by Prince hammered at $3.3 million, below the low estimate of $4 million. John Currin’s Girl on a Hill fell short of its $500,000 low target.

Most of these artists have been market darlings before the pandemic. What changed?

Gerhard Richter, Abstraktes Bild (1992). Courtesy of Christie’s Images, Ltd.

“It symbolizes in many ways what’s happening in the market,” said Brett Gorvy, co-founder of Lévy Gorvy gallery and a former Christie’s executive. “Fashion has moved on. The focus is elsewhere.”

The works have been on the market for a while, Gorvy said, and weren’t the best examples by the artists. Buyers want “fresh material, exciting names, works that haven’t been seen in a long time.”

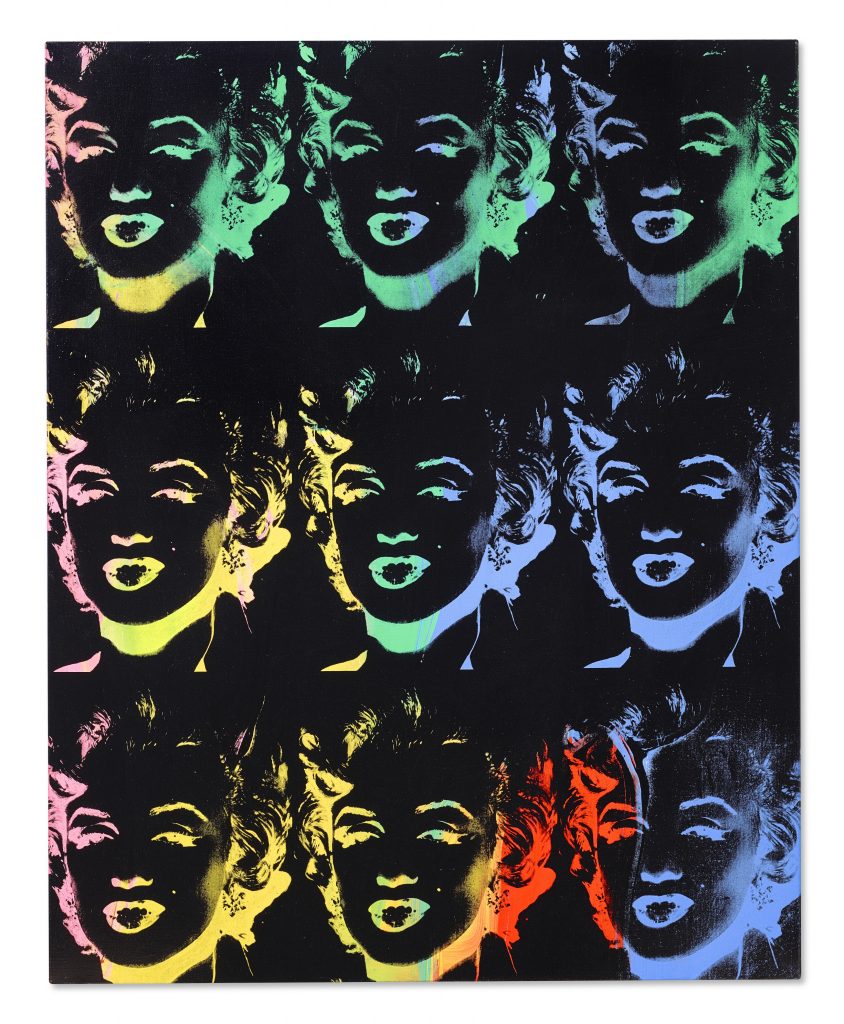

Andy Warhol, Nine Multicolored Marilyns (Reversal Series) (1979–86). Courtesy of Christie’s Images, Ltd.

On Thursday evening, Christie’s will offer two of Dean’s works in its 20th century sale: Warhol’s Nine Multicolored Marilyns (Reversal Series), estimated at $6.5 million to $8.5 million, and White on White Mona Lisas (Reversal Series), estimated at $3 million to $5 million.

Who else is offloading valuable art this week? Read on for details.

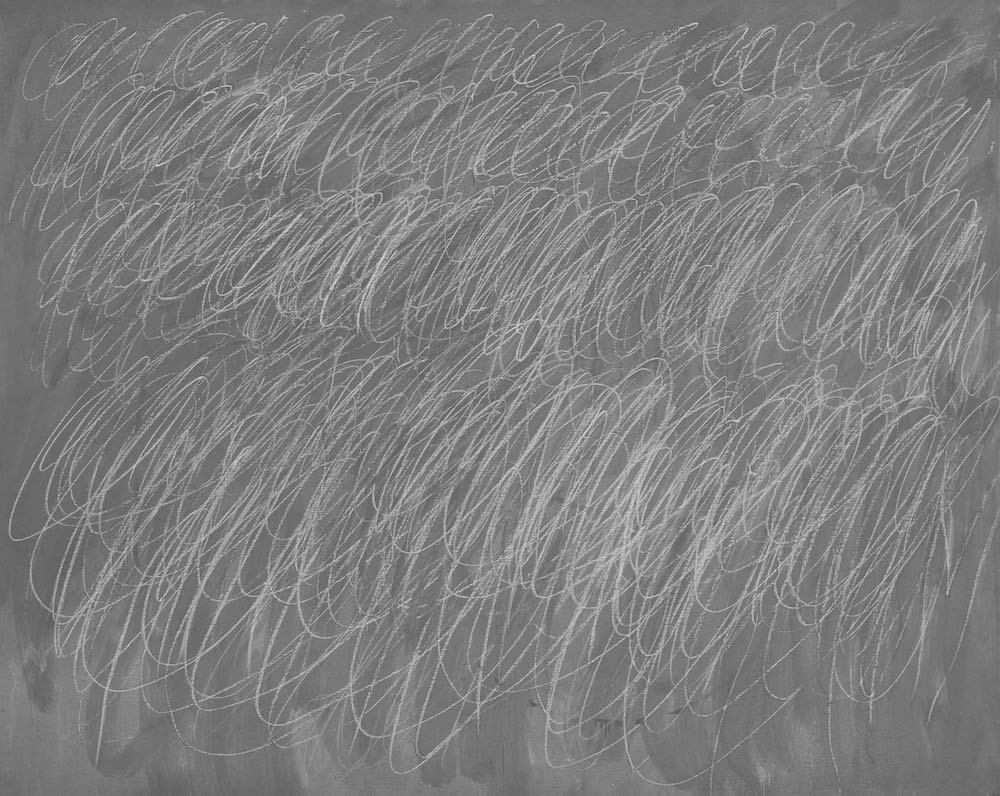

Cy Twombly Rome (1972). Image courtesy Sotheby’s.

Billionaire investor Ron Perelman still has some art selling to do—even after his house cleaning efforts at Sotheby’s and Christie’s last year, which raked in almost half a billion dollars. (He’s not done selling houses either, and has one listed for $60 million in Manhattan.)

On Wednesday, Perelman parted with Twombly’s canvas Untitled (Rome) (1972), one of the late artist’s celebrated “Blackboard” paintings. Estimated at $35 million to $45 million, it sold for $41.6 million with fees on a single bid. The Revlon owner bought it from Gagosian in 1992 for an undisclosed price, according to the provenance, which didn’t mention Perelman by name. His spokesman declined to comment.

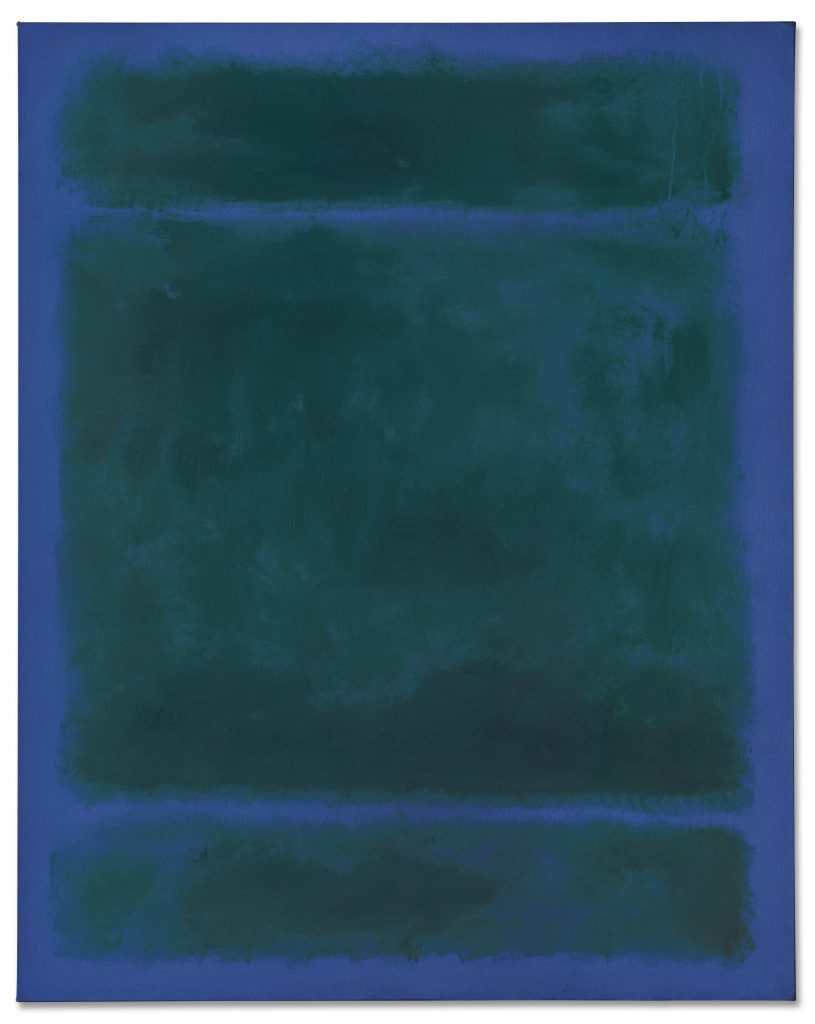

Mark Rothko, Untitled (1970). Courtesy of Christie’s Images, Ltd.

Sasan and Yassmin Ghandehari, London-based collectors of Impressionist, Modern and contemporary art, are said to be the sellers of Mark Rothko’s painting at Christie’s on Thursday evening. Estimated at $40 million, it’s the Ab Ex master’s penultimate work, which spent years in the collection of Paul and Bunny Mellon. In 2014, Sotheby’s sold it as part of Bunny Mellon’s estate for $39.9 million. It’s remained in the same collection ever since, according to the provenance, which doesn’t mention the couple.

In 2020, the Ghandeharis landed on list of Top 200 Collectors published by ARTnews, which said that Sasan “runs the venture-capital side of a real-estate empire started by his property tycoon mother, Hourieh Peramaa.” Yassmin is an interior designer, according to the publication. The couple could not be reached for comment.

Roy Lichtenstein, Interior: Perfect Pitcher (1994). Courtesy of Christie’s Images Ltd. 2021.

The megadealer had sold a number of the top lots on offer this week before they found their way to the auction block—but he is also selling art of his own, sources say. Gagosian is believed to be the seller of Lichtenstein’s 10-foot-tall, 16-foot-wide Interior: Perfect Pitcher (1994), estimated at $20 million to $30 million at Christie’s 20th century sale on Thursday.

The work is guaranteed and has been backed by a third party, ensuring it will sell. Painted toward the end of Lichtenstein’s life (he died in 1997), the epic canvas depicts a living room with paintings representing many of the Pop artist’s famous series and styles, from 1960s nudes to Cubist compositions and classic still lifes. It was acquired directly from the artist’s estate in 2002 and has remained in the same collection ever since. A representative for Gagosian could not be reached, but previously denied the dealer was the consignor.

Urs Fischer, Things (2017). Courtesy of Christie’s Images, Ltd.

Until NFTs came around, we hadn’t heard much about artists selling their own work directly at auction if it wasn’t for charity (Damien Hirst notwithstanding). But Urs Fischer, who joined three other artists to publicly sell work to benefit COVID relief and environmental causes at Christie’s contemporary art evening sale on Tuesday, also offloaded another work at the sale anonymously.

The artist (who, as it happens, recently got into NFTs) consigned Things (2017), a massive sculpture of a rhino bombarded by objects ranging from luxury bags to copy machines. Estimated at $3 million to $6 million, the sculpture—the artist’s proof—sold for $3.6 million on just one bid by the third-party backer.

Fischer’s studio didn’t return emails seeking comment.

Magnifying Glass

Magnifying GlassA closer look at one work making waves in the market this week

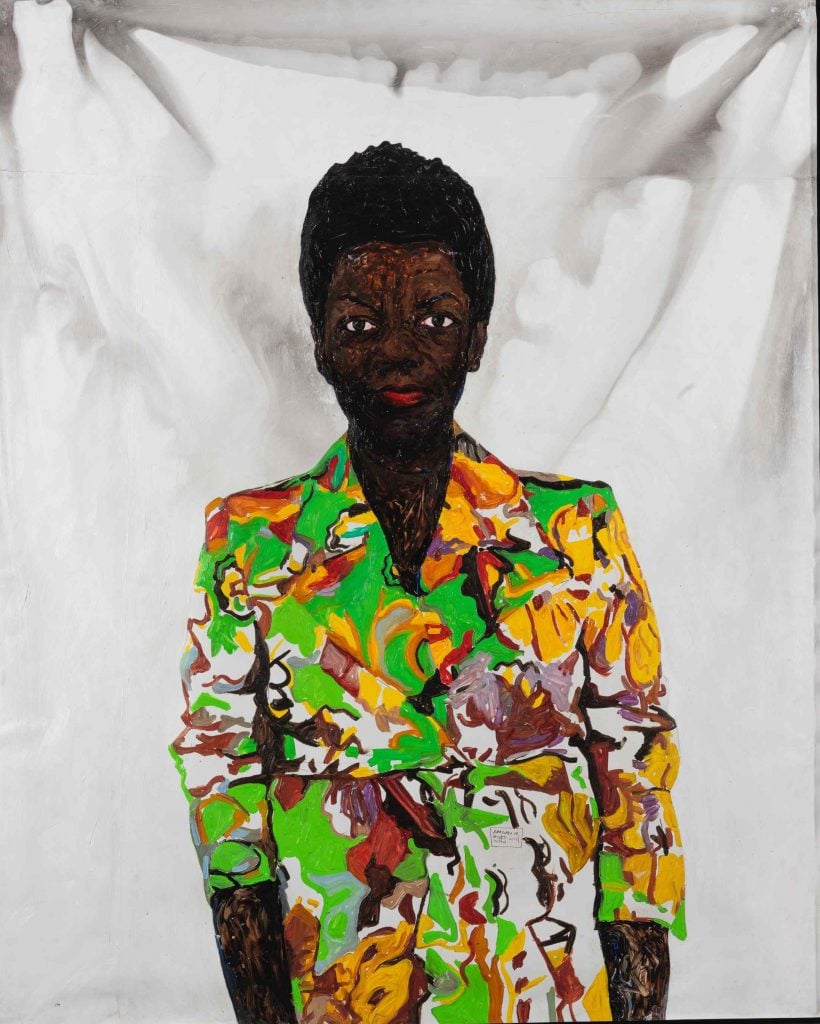

Amoako Boafo, Thelma in Colored Blazer (2018). Courtesy of Sotheby’s.

Two years ago, soon after Amoako Boafo’s sold-out solo debut in Los Angeles, the artist was visiting his native Ghana when he got an alarming call: His studio at the Academy of Fine Arts in Vienna had caught on fire.

It was a shared space and the fire, smoke, and water affected many artists. One of the pieces altered by the elements was Boafo’s portrait of Thelma Golden, director of the Studio Museum in Harlem. Boafo had sold it prior to the fire to “an Austrian guy named Raymond Deininger,” he told us this week via WhatsApp.

The artist said he was willing to clean up the canvas, but the buyer didn’t mind and thought the traces of the calamity added history and depth. “So I never worked around the painting,” Boafo said. This week, Thelma in Colored Blazer (2018) is estimated to fetch between $250,000 and $350,000 at Sotheby’s.

The background, which was originally monochrome white, is now the undulations of gray and white. Sotheby’s doesn’t mention the fire in its catalogue essay or condition report, which notes minor undulation, tears, and scattered areas of dust.

A Sotheby’s spokesperson said the auction house is aware of the fire and has been in touch with the artist. “Technically, it’s not a condition issue,” he said. “The work passed through the artist’s studio. The artist approved that sale. From our perspective, there’s no issue. It’s not like it’s charred.”

The greatest problem was smoke damage, said Bennett Roberts, owner of Roberts Projects in Los Angeles, who gave Boafo his first solo show in the U.S. (At the time, prices for Boafo’s paintings started at $5,000.) Roberts bought one work in a condition similar to that of Thelma in Colored Blazer. “I liked it even more,” he said.