The Back Room

The Back Room: Crypto Ain’t Dead Yet

This week: An NFT market correction, Kenny Schachter radios in from the crypto frontier, mega-galleries jostle for supremacy, and more.

This week: An NFT market correction, Kenny Schachter radios in from the crypto frontier, mega-galleries jostle for supremacy, and more.

Tim Schneider

Every Friday, Artnet News Pro members get exclusive access to the Back Room, our lively recap funneling only the week’s must-know intel into a nimble read you’ll actually enjoy.

This week in the Back Room: An NFT market correction, Kenny Schachter radios in from the crypto frontier, mega-galleries jostle for supremacy, and much more—all in a 7-minute read (1,825 words).

__________________________________________________________________________________

Screenshot of the “Bids” section of LarvaLabs’s Meebits site.

The death of the NFT market has been greatly exaggerated. That’s the takeaway from ace crypto journalist Amy Castor’s dig into an apocalyptic report from blockchain-media site Protos, which claimed the trade “imploded” in May based on data from Nonfungible.com.

The reality, Amy argues, is more complex—and makes last month’s events look more like a market correction than a collapse.

__________________________________________________________________________________

Doomsday Claim No. 1: NFT sales slid 90 percent, from $170 million to just $19.4 million, between May 3 and month’s end.

The Counter: May 3 was a historic outlier in the market created by the release of Meebits, a ravenously anticipated new line of crypto-collectibles from LarvaLabs (the makers of CryptoPunks).

Dating back to mid-2017, the other two highest single days of NFT sales were March 11 ($26 million) and April 11 ($24 million), each about 6.5x lower than Meebits Day.

Nonfungible.com’s data also only tracks on-chain NFT sales, meaning it excludes…

All artworks hammered down by an analog auction house, from the $69.3 million paid for Beeple at Christie’s to the $17 million paid for Pak works at Sotheby’s.

All sales on the popular NFT exchange Nifty Gateway, which conducts primary and secondary market transactions on its website rather than the blockchain.

__________________________________________________________________________________

Doomsday Claim No. 2: The number of active NFT wallets (basically, accounts that register a purchase or sale on a given day) dropped 70 percent, from an apex of 12,000 to 3,900 at the end of May.

The Counter: Protos is distorting history again. The number of daily active wallets declined only about 39 percent during the recent NFT wave that began building in October 2020.

Since last fall, the largest number of daily active wallets was just 5,700, less than half as many as during that long-ago boom.

__________________________________________________________________________________

Details for Nerds and Completists

__________________________________________________________________________________

Amy said it best: NFT sales “are slumping, though they haven’t become a dried up riverbed of the damned either.” The change mainly stems from a spring swoon in the prices of cryptocurrencies: ether was down from $4,300 on May 12 to $2,600 at month’s end, and bitcoin plummeted from $64,000 on April 14 to $35,000 at the close of May.

Those declines left crypto-whales with far less discretionary income to blow on NFTs, but they didn’t wipe out the species. With so much activity bubbling up in the off-chain art market, too, rest assured that the blockchain isn’t about to release us anytime soon.

__________________________________________________________________________________

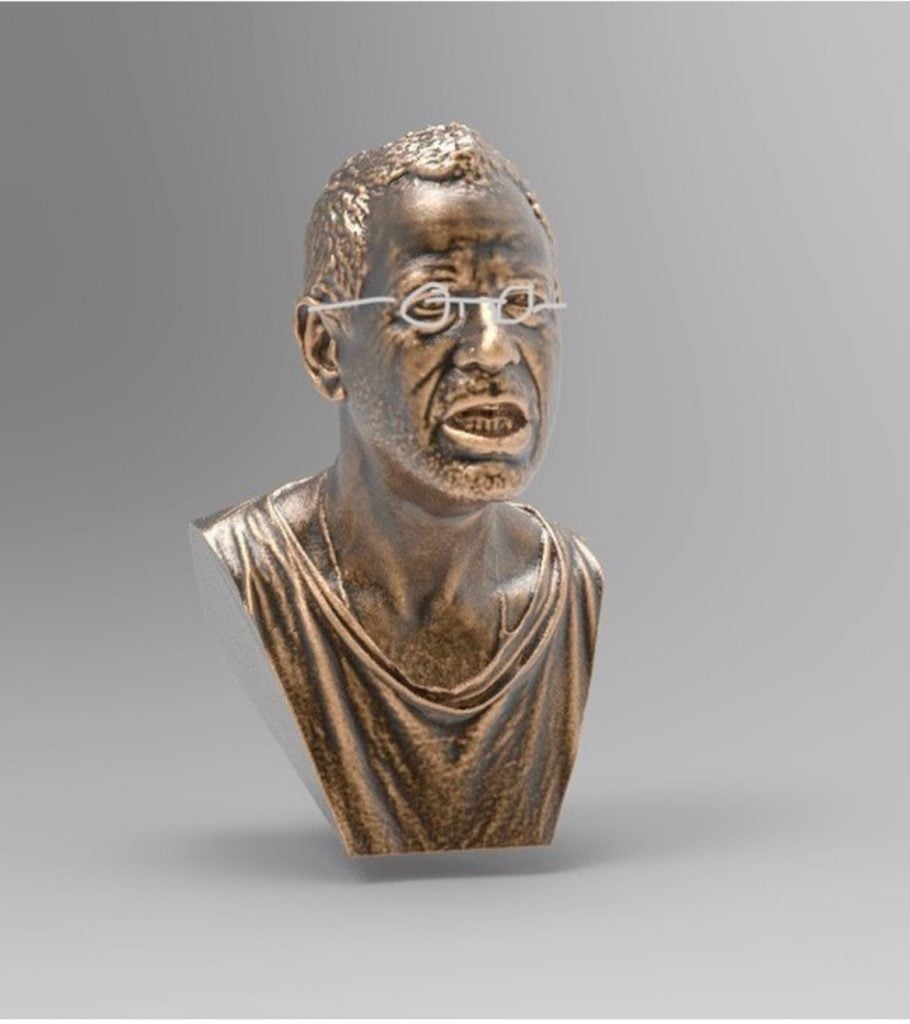

Living death mask after Franz Xaver Messerschmidt (real pair of glasses included) NFT redeemable as 3D printed bronze—coming soon to Super Chief Gallery. Courtesy of Kenny Schachter.

The one and only Kenny Schachter beamed back in this week toting his signature bundle of hard reporting and hot gossip from the nexus between the traditional art world and the NFT galaxy. Skip his lively firsthand telling if you dare, but here’s a (comparatively dry) cheat sheet of what he’s seen, heard, and done.

__________________________________________________________________________________

Damien Hirst’s NFT Business Plan

“The Currency,” Hirst’s forthcoming series of 10,000 NFTs backed by unique works on paper, will be split up and priced out as follows:

The first 10 works will be auctioned off to capitalize on the premium crypto-collectors place on the earliest-numbered editions of any NFT run.

The rest will be “released in tranches” with individual works starting around $2,000 each.

Clusters will be parceled out to specific exchanges like Uniswap and Sushiswap.

The target value for the entire array of 10,000 pieces is $500 million.

Kenny’s Take: “Gone are the days when art was discussed as a substitute for money—now art is money.”

__________________________________________________________________________________

One NFT Step Forward, Two Steps Back

Kenny relays two ways crypto-artists and distributors are increasingly harking back to the traditional art market.

But there are exciting signs of evolution for NFTs as an artistic medium, too.

__________________________________________________________________________________

Digital Gossip

Analog Gossip

And Finally, the Week in Kenny

__________________________________________________________________________________

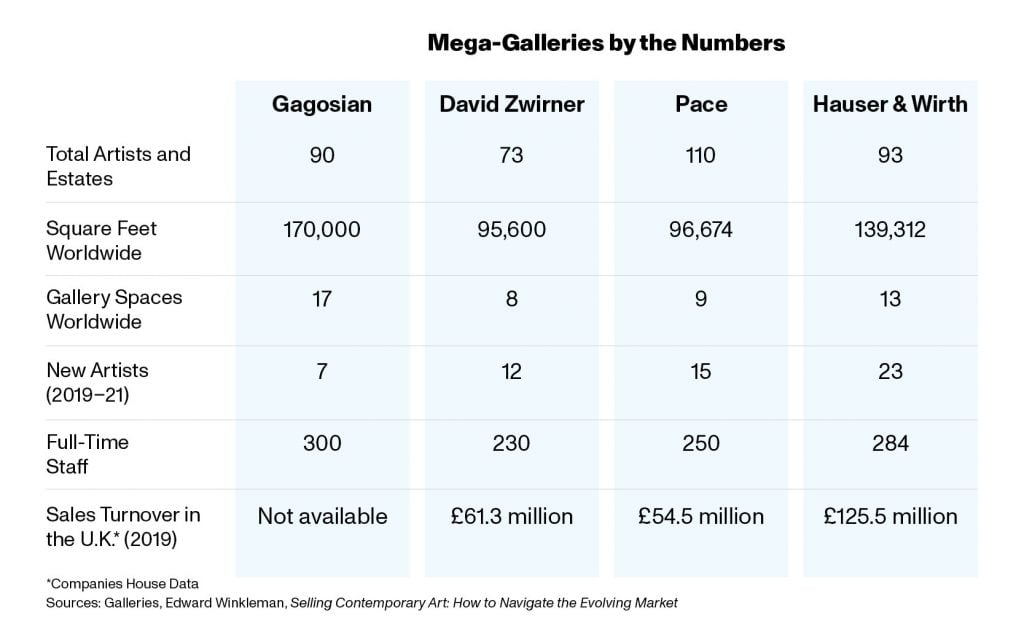

Table by Artnet News.

In 2014, Gagosian was the gallery sector’s undisputed apex predator. It boasted 15 permanent locations and 128 artists on its roster. Pace Gallery ranked a distant second with eight galleries and 84 artists. Everyone else basically ducked for cover and chose their battles.

But the gap has been closing, as Katya Kazakina details in the latest edition of the Art Detective—and the art world is being remade by the shift.

Today, Gagosian still holds the edge in the number of gallery spaces, total square footage, and permanent staff size. Yet Pace and Hauser & Wirth each now represent more artists than Larry. Among the Big Four mega-galleries (David Zwirner rounds out the set), Gagosian has also been the least aggressive at adding new talent recently, signing just seven new artists since 2019.

Yet these metrics mask that each of the four horsemen is charting a distinct route to art-market domination, from luxury-lifestyle branding to experiential-art entrepreneurship. Click through for Katya’s full view of where the top private players are heading next.

__________________________________________________________________________________

“Woo-hoo!”

—Phillips Asia chairman Jonathan Crockett as he hammered down the final lot of his house’s white-glove hybrid sale in association with Poly Auction this Tuesday. The evening and day sales took in a combined $90 million (HK$701.5 million), far north of the $66 million (HK$512 million) presale high estimate.

__________________________________________________________________________________

Hauser & Wirth will open a second Los Angeles gallery with 5,000 square feet of exhibition space in West Hollywood in fall 2022; chef selection for the on-site restaurant “has not yet been finalized,” you nosy gourmands. (The Los Angeles Times)

__________________________________________________________________________________

Japan is reshaping its tax, philanthropy, and inheritance laws in hopes of reclaiming its 1980s status as a premier East Asian art market. (The Art Newspaper)

__________________________________________________________________________________

The organizers of JingArt in Beijing (which opened this week, fyi) and Art021 in Shanghai announced they will launch a new fair called Shenzhen DnA (that’s “Design and Art”) in its namesake city September 30. (The Art Newspaper)

__________________________________________________________________________________

… and here’s your weekly plateful of market snacks:

__________________________________________________________________________________

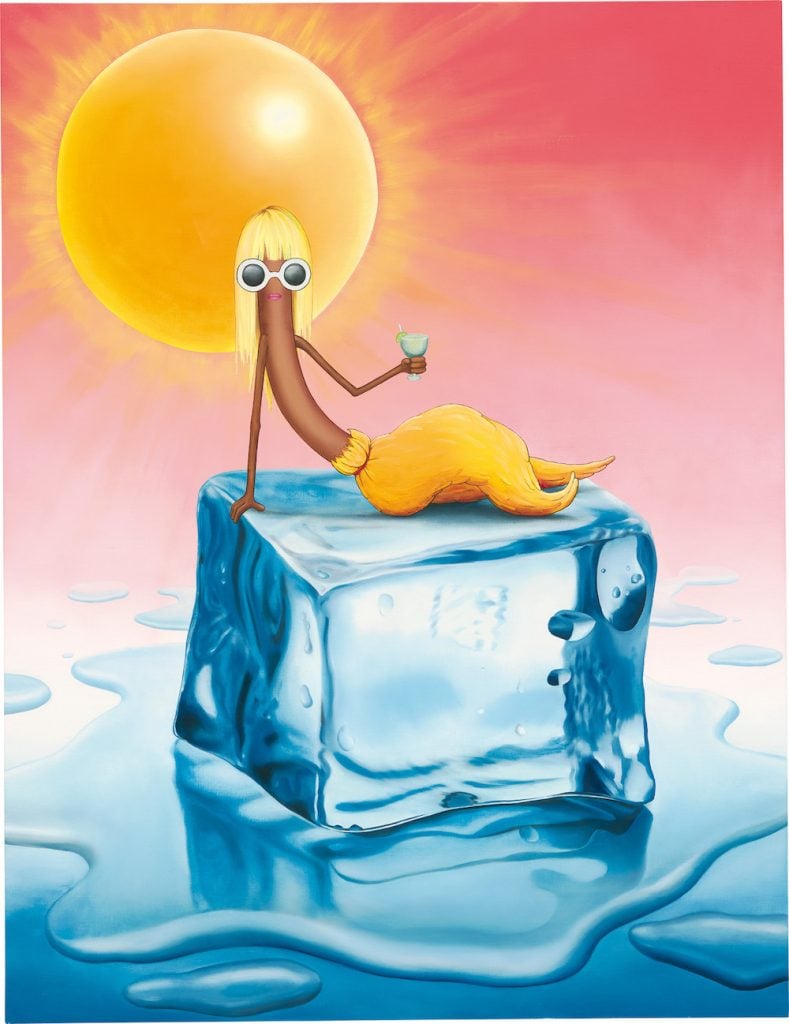

Emily Mae Smith, Broom Life.(2014) Image courtesy Phillips and Poly Auction.

__________________________________________________________________________________

Date: 2014

Seller: Private Collection

Estimate: $51,300–76,900 (HK$400,000–600,000)

Sales Price: $1.6 million (HK$12,350,000)

Sold At: Phillips Hong Kong’s 20th Century Art & Design Day Sale in Association With Poly Auction

Sale Date: Tuesday, June 8

__________________________________________________________________________________

Prior to this Tuesday, Brooklyn-based figurative painter Emily Mae Smith carried an auction record of just under $360,000. Then a good ol’ fashioned bidding war broke out in Hong Kong. When the dust settled, her hammer high had soared almost 450 percent to almost $1.6 million. The buyer who refused to take no for an answer was YiXiao Ding, a young Shanghai-based collector backed by vast family wealth, according to Nate Freeman’s latest coat of Wet Paint.

The day prior to the sale, Xiao (as he prefers to be called) “posted a now-deleted Instagram sharing an image of Broom Life, saying ‘Plz don’t fight with me tmr for this EMS. We are in LOVE,’ followed by three crying-laughing-squinting emojis.” No one cleaned up from Xiao’s infatuation quite like the anonymous consignor, who enjoyed a 53,000 percent return on a painting purchased for $3,000 from Laurel Gitlin’s booth at NADA Miami Beach in 2014. (Xiao did not reply to an IG DM, and Phillips declined to comment.)

__________________________________________________________________________________