Opinion

Kenny Schachter Reveals the Mystery Buyer of Jeff Koons’s Bunny—and Blurts Out Other Secrets From Auction Week as Well

artnet News's intrepid columnist found plenty to marvel at in this latest round of New York sales.

artnet News's intrepid columnist found plenty to marvel at in this latest round of New York sales.

Kenny Schachter

Remember Fatal Attraction’s famous bunny-burner? Well, I definitively know the identity of the bunny-buyer, and now you do too: Steve Cohen. Surprise, surprise. In case you’ve been on a silent meditation retreat (or in rehab) and haven’t heard, Jeff Koons’s metallic cast of an inflatable rabbit sold for $91 million, even Roberta Smith weighed in on the subject with a piece entitled “Stop Hating Jeff Koons.” There you have it. Thankfully I located my old source Deep Pockets on the ground when I recently moved from London to New York and loaded up on scoops.

The New York auction numbers from last week have been raked over and rehashed numerous times, so I will skip the obvious and dig deeper. Generally speaking, what we’re seeing is an ongoing march of conservatism, as when there is a flight to quality in a shaky stock market (sound familiar?) or, in the case of art, a beeline toward the obvious names of the historically canonized—or, these days, the previously under-appreciated or overlooked. Everyone is obsessed with the high-wattage evening auctions, yet the day sales are often where trends and anomalies rear their heads in more intriguing and telling ways.

Froth. Does that look like the art market to you? (Photo by Tim Graham/Getty Images)

I’m a fan of the Wall Street Journal’s Kelly Crow, but not when she states, “The art market may be entering its Frothy Period.” In my estimation it’s the opposite—the only froth is in the reportage (and in KAWS’s market; I wasn’t going to mention the K-word, but what choice do I have?). Kelly also sounds off on guarantors, reporting that “their presence and purchasing power is credited with propping up confidence in the market because the works they stake sell rather than flop.” I tried to explain to her that when they “flop” the guarantor still has to pay and take home the art whether they wanted it or not.

Also, most importantly, this is the sign of a healthy market rather than an indication of a dud. If a guarantor gets a finance fee, thereby discounting their purchase price, well, so be it—they deserve it for stepping up to the plate. The Mugrabis and Nahmads are no different from the market-makers on the floor of the New York Stock Exchange, who go a long way to ensure the smooth flow in the balance of trading.

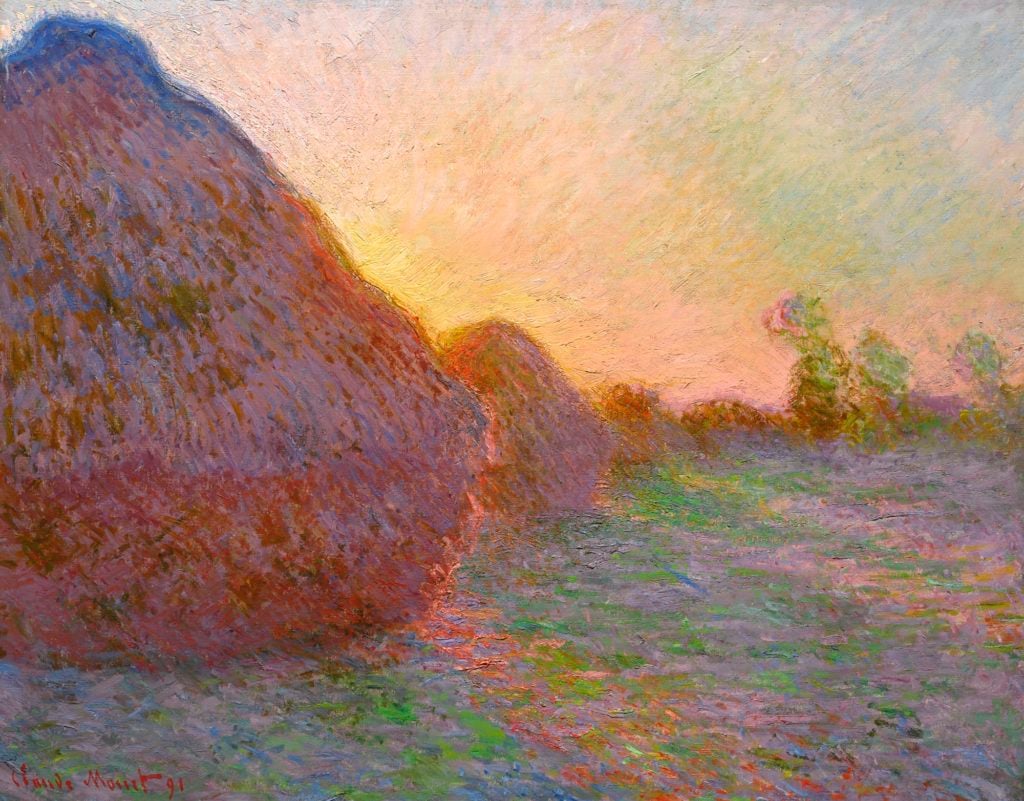

Claude Monet, Meules (1890). Courtesy of Sotheby’s.

Nevertheless, people generally love to talk smack about a strong market, even artnet News’s Tim Schneider, who wrote of the $110 million sale of the Monet (aka Mon-ey) haystacks in Sotheby’s Impressionist and Modern sale that “the high-wattage price somewhat belied the mood in the room and, to some extent, the reality of the bidding.” I was sitting in the same room and saw something very different, even with the flop of William-Adolphe Bouguereau’s 1884 football-field-sized kitsch Old Master-redux painting accompanied by a stupid estimate of $25 million to $35 million, which failed to garner a bid. Bouguereau’s record remains at $3.5 million from a 2000 sale at Christie’s of “Nineteenth-Century European Art,” which is where it belongs—in terms of both context and price.

The only bubble that should burst is the perennial disparagement of the giant in plain sight: the art market. Whether you like it or not, you must appreciate its resilience.

“To be honest” is never a good way to preface a sentence—if you are telling the truth, anyway—but it seems to be de rigueur auction speak, as if lying is their default mode. Hasso Plattner, the German owner of SAP and the Monet haystacks and a few other works from last week’s sales, may want to consider hiring Sotheby’s installation experts for the way they tweaked the lighting to highlight the painting’s fiery hues, a common practice (trick) of auction-house theatrics. The worst instance of this was a faded Warhol screenprint at Christie’s some years back that was lent vivid life through some highly questionable lighting filters, despite the fact the work itself was flat. It was all show, no go.

A few words on condition issues, giving new heft to the notion of buyer beware. A coveted Modern sculpture, also guaranteed (though I can’t say which or where), had apparently once been cracked in half; the consignor had instructed the specialists to keep it on the down-low, and I’m not sure the guarantor checked beforehand. A Warhol Liz (at Christie’s) came with lining on the back of the canvas and varnish on the front. When I queried as to the reason behind what looked like a good shellacking, the expert replied, “I don’t know, for fun?” If the work wasn’t damaged—and it didn’t seem to be—the gaudy primping must have been to foster that just-out-of-the-studio freshness… for eternity. It sold to Larry G. with Jose Mugrabi as the underbidder—and, it’s said, the painting’s last-minute guarantor—for $19.3 million on an estimate of $20 million to $30 million. Warhol is still in the midst of a financial rut, which will surely reverse course sooner or later. It always does.

Billionaire financier David Martinez sold Frank Stella’s black pinstriped abstraction that he had owned for about 15 years and made only a small profit on when it sold for $28 million (including buyer’s premium) against and estimate of $25 million to $35 million. Bloomberg recently reported that in April of 2017, Martinez’s Fintech fund gave Venezuela’s embattled, dictatorial Nicolás Maduro a $300 million loan, and that since then “the distressed-debt veteran has traveled to the Venezuelan capital to pitch Zerpa, El Aissami, and [other government officials] on additional potential financial deals, including oil-related debt-for-equity swaps with the Russian and Chinese governments, three people familiar with the matter said.”

Martinez told Bloomberg that he figured his business competitors would “cry” and complain about his activities in Venezuela “based on inaccurate information from conflicted and uninformed sources.” (Another, longer piece on the matter has since been taken down.)

Oh no, there goes Zozo, down 60 percent since July. Courtesy of Kenny Schachter.

In other financial news, Yusaku Maezawa’s Zozo corp is closing its European and American operations after its “Zozosuit” body stocking failed to persuasively customize clothing fit, contributing to a loss of more than $24.5 million and a stock decline of 60 percent since July 2018. Perhaps that contributed to his selling a Warhol flower painting at Sotheby’s, which fetched $5.6 million on an estimate of $1.5 million to $2 million, and also Ed Ruscha’s Bones in Motion, which didn’t fare as well, hammering for $2 million against a $2 million to $3 million estimate. Too bad he had turned down a guarantee for $3.5 million. So much for the ’80s adage that greed is good.

Is this a harbinger of things to come? Maezawa’s flamboyant $110.5 million Basquiat purchase in 2017 could be seen as no more than an elaborate exercise in marketing—will it be next on the block?

While the market appears to be thrumming for the classics, there was generally weak overall demand for the more contemporary offerings—aside the meteoric rise of females and artists of color. I was hoping to ignore the KAWS juggernaut this auction cycle (it’s certainly been flogged enough). In actuality, 18 lots were offered between Phillips, Christie’s, and Sotheby’s with a gross estimate of $6.5 million to $9.4 million, minting a whopping grand total of $19.9 million. The X’d-out eyes of his cartoon creatures remind that Jesus died for our sins (indeed).

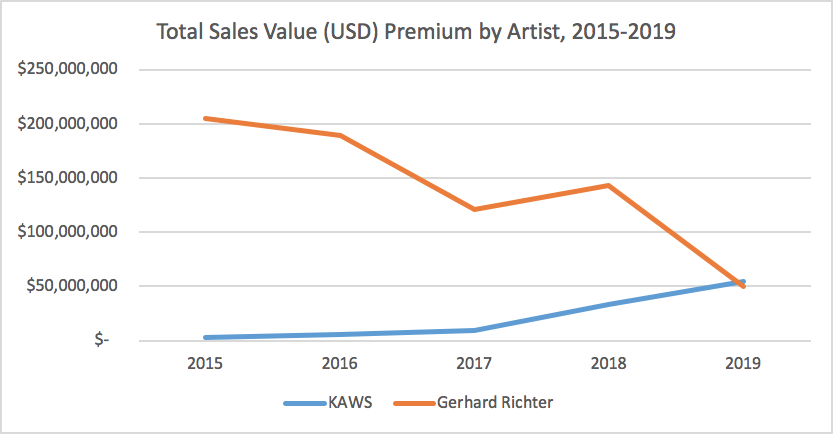

KAWS for celebration, or concern? Graph courtesy of the artnet Price Database.

Contrast the KAWSes with the eight lots on offer among the houses from 87-year-old undisputed master Gerhard Richter, of which three passed and the rest sold for a total of $14.3 million. Why? Chalk it up to a new generation with short attention spans and little to no grasp of art and art history, which for some has morphed into an offshoot of a Supreme-branded limited-edition run.

LA-based wheeler-dealer Stavros Merjos, whose wife Honor Fraser’s gallery represents KAWS, made a three-year exclusive deal with Christie’s to supply KAWS works to its evening sales. (In other words, they can’t take anyone else’s KAWS, just because.) Boy, did Merjos’s investment pay off when you consider the typical dealer discount of 50 percent.

Regarding the $14.8 million painting that sold in Sotheby’s Hong Kong outpost, I can reveal the buyer wasn’t Justin Beiber, but a French Moroccan HK resident who has been sucking up as much inventory as he can get his hands on, paying late and often using trades of additional KAWS works as currency. On this basis was he able to (perversely) overpay at Sotheby’s and buttress his remaining stock in the process.

In Germany, Hells Angels gang members have been found to traffic in the fake Sigmar Polke market, along with other established European artists—I suggest they take a closer look at KAWS, since his artworks would be much easier and way, way more lucrative.

Let’s be very clear here: when you release a helium-filled balloon into the sky, its magical ascent is followed by the inevitable fall—the unavoidable physics of gravity (and the at market). Sooner or later, what goes up will drop with the velocity of lead. (Even something as unstoppable as KAWS’s present prices.) I’m not saying that he won’t find his way into the history books, since I am not one to comment on that. (Well, I could but won’t.)

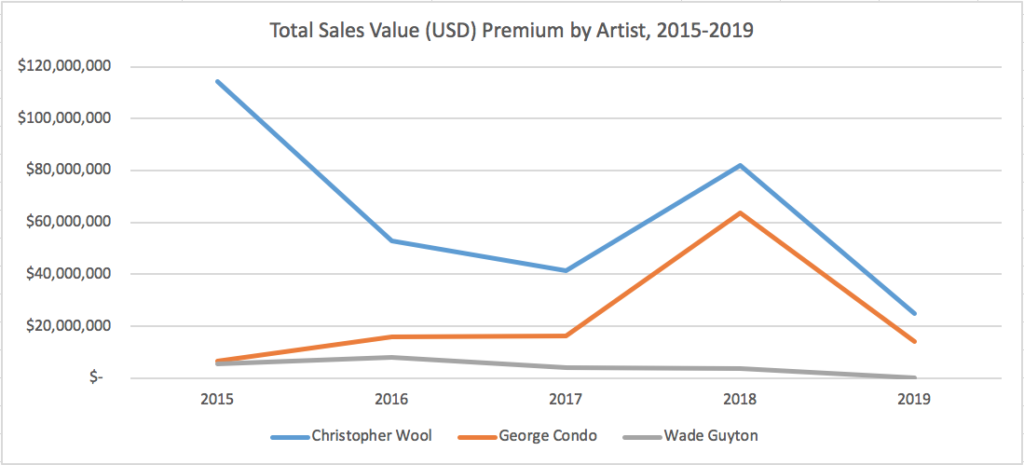

What goes up must come down. Graph courtesy of the artnet Price Database.

The same is happening to his stablemate at Skarstedt Gallery, George Condo, who recently experienced a rapid run-up and is presently stalling a bit. Same with Christopher Wool, whose work I adore but who is suffering from (auction) overexposure and a drifting devaluation. I love his “Fool” painting and own a micro version of it, but John Sayegh-Belchatowski lost on his re-actioning of the large-scale iteration (that work’s third public sale) to cover his guarantee of Basquiat’s Pojo Frito, which went for $25.7 million. That was Basquiat’s 13th-most-expensive auction result, and it proved unlucky for Sayegh and his financial health due to Sotheby’s more stringent financing standards.

Phillips had some good activity with Dubuffet and also with Chamberlain—who’s proving a hard sell these days. (I hear the Chamberlain estate, like many before, are splitting from Gagosian.) The house also had its best day sale ever, bringing in $34.7 million with 325 lots on offer. By way of comparison, Sotheby’s did $105.8 million with 356 lots for sale—a hair’s breadth from the house’s record of $107.8 million, from May 2008—and Christie’s garnered $92.9 million with 255 lots offered. But the discordant mishmash of art that Phillips sells regularly relegates them forever and a day to a distant third place behind the behemoths Sotheby’s and Christie’s.

Phil’s (Phillips’s eponymous cafe) might be a better name for the colloquial atmosphere that is the auction house’s trading floor. Photo courtesy of Kenny Schachter.

Phillips does have excellent cookies and free coffee in its Phil’s café, though. (I couldn’t help myself.) If the auction house rebranded its entire operation as “Phil’s” it might be a better fit for the colloquial atmosphere that is the Phillips trading floor, where the chattering of the crowd is like a low roar—even in the midst of evening-sale bidding—as opposed to the church/synagogue/mosque-like reverence in the other houses. Like Rodney Dangerfield, Phillips gets no respect (not just by me). Um, and I wasn’t the only one who couldn’t get a phone signal in the room—more than once I heard the auctioneer reference phone bidders losing their connections in mid-bid.

By the way, Jennifer Bartlett’s previous record of $176,000 from 1991 was twice quashed in the same Sotheby’s sale last week, with works achieving $200,000 and $262,000 on estimates of $25,000 to $35,000 and $30,000 to $40,000, respectively. And Elizabeth Murray, whose record stood at $132,000 for a nearly 10-foot work, was nearly bested (also at Sotheby’s) for a 30-inch work with the shamefully low estimate of $10,000 to $15,000 that hit $93,750. Get out and get yourself a Bartlett and/or Murray for a quick buck—they are both great and certain to reach higher heights.

Everyone likes to talk about the home runs, but there are inevitably more whiffs than wallops. #MeTooed artist Subodh Gupta’s Vehicle for Seven Seas was estimated at $50,000 to $70,000 and hammered (including fees) for $137,500, which was still oceans away from the $787,352 the very same work achieved in 2008. Not to mention his 2008 record of $1.4 million.

Jeff Elrod’s Ice Age at Phillips, carrying an estimate of $100,000 to $150,000, was sold with no reserve. As a result, the auctioneer backtracked from $50,000 to $25,000 and then to $5,000 before it recovered to $43,750, miles away from Sotheby’s sale of the very sale work in Hong Kong in 2016 for $193,396. His record remains $342,607 from 2015 and will be some time before that tally is tested again. A similar painting also made $43,750 at Christie’s (estimated at $70,000 to $90,000), and another passed at Sotheby’s (est. $120,000 to $180,000).

Oscar Murillo’s recent Turner Prize nomination was not enough to lift his faltering values, which have tumbled far from his record of $401,000 in 2013. His 17 highest prices ranged between the years of 2013 to 2015, the heyday of Zombie Formalism. A work similar to his record-setting painting, estimated at $70,000 to $100,000, fetched $81,250 at Sotheby’s.

Art-price pomp is so off the charts, the market should emulate the pageantry of the Met Gala—wouldn’t it be a laugh if dealers and collectors (and hangers-on) put a little more thought into their outfits? For the most part, things were strong this spate of auctions, but also reflected a society scared and on edge—even sober we are reduced to the mentality of a paranoid addict. With cause unfortunately. Bidders were keeping cards close to their chests, with less and less visibility (save for the revelations of my columns).

We could analyze, prognosticate, and lament until we are Yves Klein blue in the face. The conjecture is endless but the art market prodigiously swallows a healthy chunk of everything before it, and it never ceases to amaze. No one pulls over for firetrucks, police cars, or ambulances (which seem to be hurtling toward emergencies 24/7) in New York City. Nor does the art market. Sure it changes lanes—things go up and down—but it chugs along like a freight train, as if by manifest destiny.

UPDATE: A previous version of this column mentioned that a Louise Bourgeois spider sold at Christie’s had been fitted with a “prosthetic” leg after one of its original eight appendages had gone missing. According to Christie’s, the work that had been done to the sculpture as “repatination and the addition of an internal steel armature”; the auction house additionally provided its condition report, stating “all of the elements are present.”