The Gray Market

Why Art Businesses Are Once Again Drunk on Growth and Racing to Scale Up (and Other Insights)

Our columnist susses out what to make of the nearly 30 art businesses that have been expanding during the pandemic.

Our columnist susses out what to make of the nearly 30 art businesses that have been expanding during the pandemic.

Tim Schneider

Every Wednesday morning, Artnet News brings you The Gray Market. The column decodes important stories from the previous week—and offers unparalleled insight into the inner workings of the art industry in the process.

This week, cranking up the machine again…

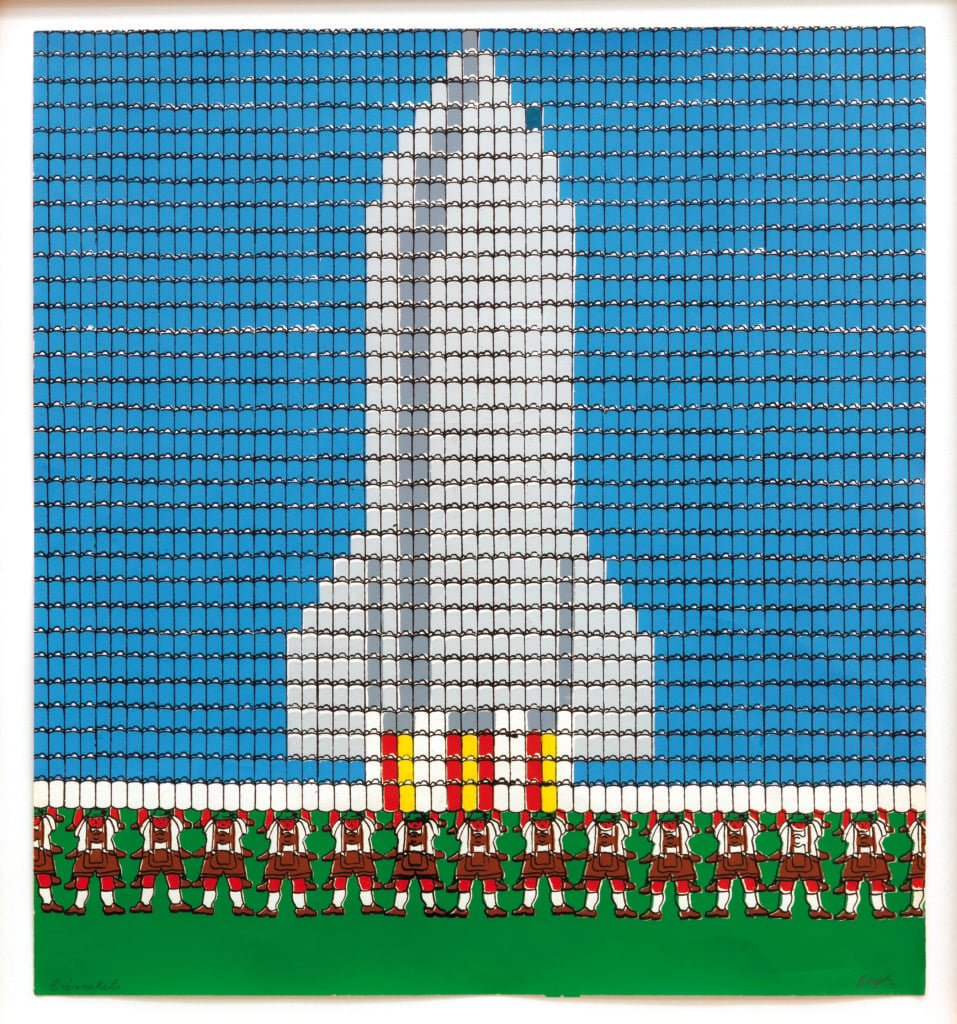

For too long in the pre-pandemic era, the default solution to the most pressing problem in the art business was to scale up. This most often meant making your operation physically larger. So, ambitious art-fair organizers staged more and more annual events; ambitious dealers opened up more and more permanent bricks-and-mortar galleries; and ambitious auction houses offered more and more sales and services in more and more places. If you weren’t building an empire, the logic went, you were probably on the cusp of extinction.

Many observers predicted that COVID would finally cure the trade of this delusion. It could usher in a more considered, sustainable version of exhibiting and selling art. The enlightenment would be driven by the widely held understanding that permanent growth is at least inadvisable, if not outright impossible. Instead of multiplying the number of art fairs or proliferating the number of salesrooms, then, art sellers would be incentivized to develop an array of nimbler, more creative unlocks for the business’s many long-standing challenges.

One month into our third year of COVID, however, I’ve seen enough to declare these hopes and dreams dead on arrival. After combing back through the past several months of industry news, I’m here to report that the art market is drunk on growth again, and the binge may only be getting started.

By my count, at least 26 different for-profit art companies have announced or completed significant physical expansions since the start of the fall 2021 art season. That’s more than five new augmentation projects a month between last September and this column’s publication date. Crucially, the growth spurt transcends the wealthiest players with the most spare calories to burn. The companies scaling up during this stretch hail from various sectors of the trade and various tiers of the commercial hierarchy.

In the aggregate, they also comprise a jolt of expansionary energy we have not seen in years. Especially as global art sales remain sturdy amid declining Omicron caseloads in key markets, the resurgent trend signals good and bad news about the market’s trajectory in the years ahead.

Le Grand Palais Éphémère, Champs de mars, Paris. Wilmotte & Associés Architectes. Photo ©Patrick Tourneboeuf/RMN_GP/Tendance Floue.

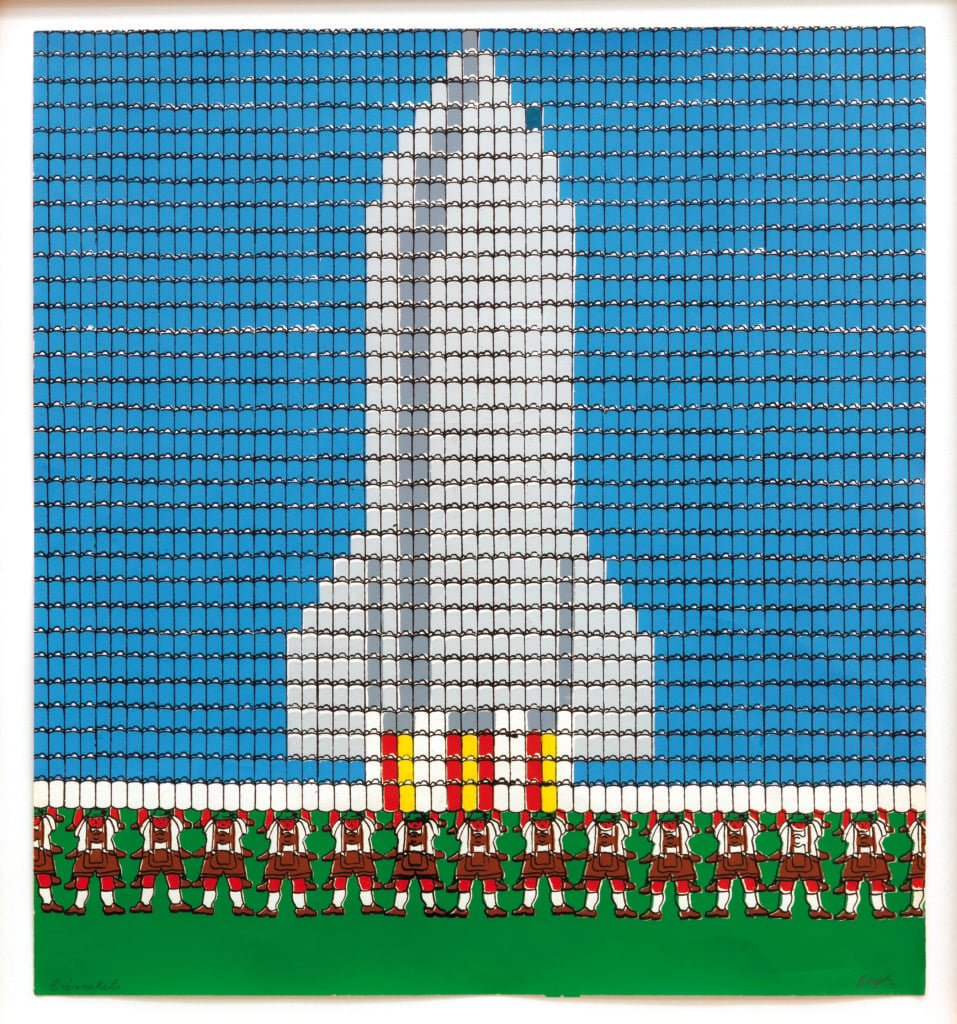

What started me down this path was, of course, last week’s bombshell announcement that Art Basel will add a Paris fair to its annual slate of events. The back story is juicy, with the Swiss firm covertly managing to dislodge FIAC from its decades-long October spot at the Grand Palais in a twisty drama that began just over two months ago. But the end result is blunt and direct: Art Basel will now match chief rival Frieze (more on them in a minute) by staging major trade fairs in four global art cities starting this fall.

Yet Art Basel’s sashay into Paris wasn’t the only scale-focused move announced in the fair sector last week. Art Basel’s parent company, MCH Group, also publicized that it had secured a minority stake in Art Events Singapore, the company behind the long-delayed expo Art SG. My colleague Vivienne Chow relayed that MCH will have a “board-level presence” at Art Events Singapore and “will lend professional support to [Art SG] behind the scenes” in the lead-up to the fair’s January 2023 bow.

Together, these extensions into Paris and Singapore mark a turning point for Art Basel and MCH Group. After roughly four years of turmoil that included the unwinding of planned or finalized investments in a trio of regional fairs (Art SG, Art Düsseldorf, the India Art Fair), arguably the biggest expo brand in the world is back on the growth trajectory. Weirdly, the message may be even stronger in the context of the (somewhat awkward) news that Art Basel will push back this year’s Hong Kong fair to late May due to COVID complications: even without absolute clarity that the art world has restabilized on its axis, the Swiss are once again marching into new territories.

Pull out to the widescreen view, however, and the more important point is that they’ve had plenty of like-minded company since September, both inside and outside their own sector.

Frieze signed a long-term lease with London’s Cork Street Galleries in Mayfair. Photo courtesy of Cork Street Galleries.

Aside from the looming premiere of its Seoul fair this fall, Frieze also opened its new gallery-hosting hub in London at No. 9 Cork Street. There, out-of-town dealers have been able to pop up for four weeks at a time since last September, giving the brand a year-round anchor for new collaborative adventures.

On the auction side, Phillips announced in December that it will expand to a new 48,000-square-foot Asia headquarters in Hong Kong’s West Kowloon Cultural District, with plans to have the operation up and running in 2023. Bonhams, meanwhile, paid an undisclosed amount to acquire Swedish auction house Bukowskis, which extends Bonhams’s reach to footholds in Stockholm and Helsinki.

And then there are the galleries, led (no surprise) by the four megas.

Gagosian opened a third permanent space in Paris in October and, just last week, announced the imminent debut of another in Gstaad—the gallery’s 19th overall. Hauser and Wirth acquired what will become its new flagship space in December: a 15,000-square-foot Grade II listed Victorian building at 19 South Audley Street, in London’s Mayfair. Arne Glimcher is launching a project space in Tribeca, called Gallery 125 Newbury, that will “operate in association with Pace,” according to the official press release. And David (and Monica) Zwirner went slightly to the left with a plan to transform 17 cottages and a large house on Lake Montauk into a subsidized artist’s retreat (though some locals are resisting).

(Update: Hours after this column’s publication, Pace announced the acquisition of Los Angeles’s Kayne Griffin gallery, which will become a fully staffed Pace L.A. in April.)

Several dealers, ranging from other blue-chip brands to ascendant regional outfits, have looked to scale up their international footprints during this span, too. Lehmann Maupin will upgrade to a new two-floor, 2,600-square-foot space in Seoul this spring; the South Korean capital will also soon welcome its second Peres Projects location, and its first from Gladstone Gallery.

Eva Presenhuber and König Galerie each expanded to Vienna since last fall. Mitchell-Innes and Nash will christen a new seasonal space in Mexico City later this month. Swiss gallery Von Bartha launched its first location across borders this winter, in Copenhagen, while London’s Tiwani Contemporary is currently putting the finishing touches on a new spot in the West African cultural capital of Lagos.

Sean Kelly L.A. Courtesy Sean Kelly.

Three U.S.-headquartered dealers confirmed expansions to new states, with each location set to open this spring. Los Angeles’s David Kordansky confirmed it will debut its first New York gallery, New York’s Sean Kelly announced it will inaugurate its first Los Angeles gallery, and Various Small Fires (established in L.A. and previously expanded to Seoul) just revealed it will launch its third space in Dallas, Texas, in April.

Finally, a quick scan of the fall-to-winter news cycle turned up at least seven galleries scaling up on their home turf. New York is the epicenter here. Last week, Andrew Kreps announced the broadening of its Tribeca footprint with a new storefront property at 394 Broadway. Queer Thoughts just doubled its square footage only a few doors down from Kreps, while Lower East Side dealers Jack Barrett and Lauren Marinaro told Wet Paint in December that they are each upgrading to larger digs in Tribeca/Noho soon. A short J train ride away, Half Gallery also recently bought the neighboring lot to its East Village location for conversion into a project space that will launch this fall.

Europe got in on the local expansions, as well. Paris’s Nathalie Obadia opened a new project space in the city’s eighth district in September. The same month, Belgian galleries DMW and Base-Alpha (both in Antwerp) teamed up to launch a new joint venture in Brussels called Ballroom Gallery.

Are you exhausted yet? I certainly am! Which really says something, since I’ve no doubt missed a few more scale-ups announced or executed in the past five months. Even still, the smorgasboard above provides plenty of food for thought about what the trade learned (or ignored) during the pandemic’s darkest days.

Assembling this roundup was not my way of suggesting that all of these expansions are ill-advised. Each of them deserves to be evaluated on its own merits. I’m sure many, if not most of them, are justified now, and will prove successful long term.

But the ultimate results of these moves are irrelevant to me today. Instead, what matters most is that the art business has not experienced such a pronounced, cross-sector, multi-tier burst of physical expansions since COVID started sweeping the globe roughly two years ago. To me, it reads as an industrywide inflection point with two main consequences.

First, to build on what I wrote about MCH Group and Art Basel a few days ago, the surge signifies that much of the art market is past the pandemic even if the pandemic isn’t fully past the art market. Yes, select fairs and other art events are still being rescheduled or cancelled as a result of the virus and its logistical complications, but plenty of others are forging ahead as planned—and being rewarded for it. The consensus seems to be this: enough sellers have done enough business for a long enough stretch of time amid substandard market conditions to alleviate the fears of market stasis, let alone market contraction. The result? Scaling up is once again a sound strategy.

That said, I suspect some of this activity also stems from real-estate price pressures. If you wait to make a move until everyone is completely comfortable with the public health situation, you’ll likely lose out on any remaining chances at securing even a mildly favorable lease or mortgage. Plus, at least here in the U.S., waiting to pounce will only mean paying more to borrow money in the future, since Federal Reserve officials have now telegraphed an interest-rate increase in March, with the possibility of further hikes later in 2022.

The online viewing room for Tennis Elbow, made to look like the gallery’s sidewalk-facing window at the gallery in Tribeca. Photo courtesy The Journal Gallery.

The second takeaway from the growth spurt is more uncomfortable. Back in August 2021, I argued that the art industry at large was being overly self-congratulatory about the changes made in response to lockdown measures, especially when it came to embracing tech upgrades and new business models. The main problem, I felt at the time, was that “the most significant change across the for-profit art trade has been simply to hold more sales of more stuff more often, via technology that has basically been available for at least five to 10 years,” meaning the online viewing room. (The amount of progress made looks even less impressive if you reduce the OVR to its underlying identity: a website, which has been around since the 1990s.)

In this sense, the online viewing room boom was only a digitization of the default strategy that art sellers of all stripes had been flogging for years leading up to COVID: more is more. Most often, the “more” in question meant more and larger, physical sales spaces. When the pandemic endangered in-person sales, the circumstances provoked plenty of bold talk about the need for structural change and generational innovation. Instead, the paradigm only shifted the bare-minimum amount; “more” came to mean more, and larger, online sales spaces.

The good news is that the adjustment has been enough to defy expectations and prevent scores and scores of galleries from closing during the crisis. The bad news is that we now have five months’ worth of data suggesting that the most appealing idea the trade could conjure during 18 months of crises was to double down on scaling up.

That’s fine in many cases. Plenty of artists and dealers deserve more space to work with, and growing your sales force in new regions has served merchants well for centuries. But if you were hoping COVID would spark a large-scale revolution in the art trade, it’s time to recognize that the old thinking simply kept working too well during the rupture to make abandoning it later seem like a good idea. Now, even as entrepreneurs in every sector set out to aggressively redraw the art-market map, we mostly find ourselves right back where we were before.

That’s all for this week. ‘Til next time, remember: change doesn’t come easy, especially if you can get what you want by staying the same.